GST and place of supply: Complexities when a transaction involves 3 parties

Getting place of supply right under the Goods and Services Tax (GST), a destination-based consumption tax, matters. Typically, the state to where the goods are destined will get the GST revenue.

When the location of the supplier and the place of supply are in two different states, the tax charged by the supplier would be Integrated GST (IGST). When they are in the same state, it’s Central GST (CGST) and State GST (SGST). But this becomes more complex when the transaction involves three parties.

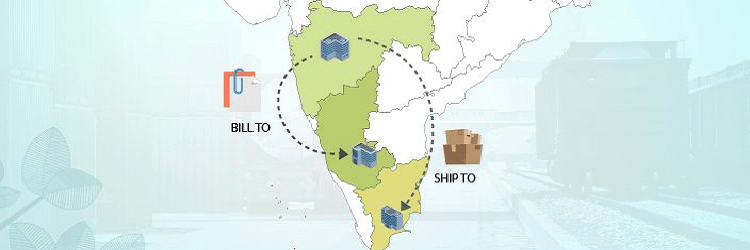

For example, if person A in Maharashtra ships goods to Person C in Tamil Nadu on the instructions of Person B in Maharashtra, the place of supply is difficult to determine. The transaction looks something like below:

While goods are billed to B in Maharashtra, they are shipped by supplier A, as per B’s instructions, to C in Tamil Nadu. Since goods are moving from one state to another, ordinarily IGST would apply, i.e., Tamil Nadu would get the tax revenue. But the presence of B complicates the transaction, as his state (Maharashtra) also wants tax revenue. Section 10(1)(b) of the IGST Act brings clarity to the issue

Where the goods are delivered by the supplier to a recipient or any other person on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods, either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person.

The law therefore determines that when supplier A delivers goods to recipient C at the direction of third person B, the goods will be deemed to have been received by B, and the place of supply shall be the place of B. Therefore, even if the goods were moved by A in Maharashtra to C in Tamil Nadu, they would be deemed to be received by B in Maharashtra and therefore CGST+SGST would be charged by A.

The reason for this determination is that tax should follow the commercial transaction to avoid any loss of credits. In the commercial world, there would be a second sales transaction between B and C, which would attract IGST so that both B and C can claim GST credit and keep the GST chain unbroken.

There of course are some issues with this well-intentioned provision.

Who is the recipient?

While, in our example, we call C the recipient, the law defines the recipient as someone “who is liable to pay consideration” (Section 2(93) of the CGST Act). In our example, B is the person who pays the consideration to A and therefore would be the recipient, as per this definition. If B is the recipient, who is the “third person” mentioned in the provision, at whose instructions goods are dispatched to C? The provision suddenly stops making sense unless we interpret the word recipient as the “receiver of the goods” and accept C as the recipient instead of B.

Can one deviate from the definition given in the act? Perhaps if one uses this passage from Section 2 of the CGST Act to one’s advantage: “in this act unless the context otherwise requires”. Many court judgements have held such reading valid provided it can be proved that the context required a different interpretation of the word “recipient”. Maybe the legal mandarins will examine this and possibly make an amendment to the act at a later stage. This interpretation is also supported by Section 16(2), which allows credit to B even when goods are never received by him, while using the word recipient in reference to C as below.

For the purposes of this clause, it shall be deemed that the registered person (in our example B) has received the goods where the goods are delivered by the supplier (in our example A) to a recipient (in our example C) or any other person on the direction of such registered person (in our example B). (Section 16(b))

The provision also raises many other questions that will no doubt be debated in due course:

- Does this provision apply only in the case of sales transactions or can it also apply in a situation where C is only a branch of B? In this case, there would be no second sales transaction between B and C. How then would the state of C get its revenue? Is it necessary that an invoice is raised by B to C to transfer the credit? Or is it a good idea for C to make payment directly to A even if the order is placed by headquarter B specifically mentioning that the goods are to be delivered to C and payment will be released by C? Should we change the way transactions are done if it can reduce the possibility of future disputes?

- Would this provision apply if one of the parties is not in India? Say B in the US orders its subsidiary A in India to supply goods to C in India. Though the section starts with the words “the place of supply of goods, other than supply of goods imported into or exported from India, shall be as under…” there is no export transaction in this case as export requires physical movement of goods out of India (Section 2(5) of the IGST Act). Can we apply this provision in such a case, and if we can, how do we apply CGST+SGST and IGST in various situations?

- Can this provision be invoked when an importer in Delhi imports goods in Mumbai and requires goods to be directly shipped from the Mumbai port to a customer in Maharashtra, while he raises a commercial invoice from his Delhi office to his Mumbai customer?

Law cannot make provisions for all possible transactions in real life. Instead, businesses must endeavor to fit all transactions into the five situations mentioned in the Place of Supply provisions for goods under Section 10. The law therefore becomes intriguing and interesting at the same time. It has the potential to keep industry, consultants, and courts busy for years to come.

Avalara is an experienced application service provider (ASP) partnering with licensed GST Suvidha Providers (GSPs). To understand how Avalara India GST can help you with GST compliance automation, contact us through https://www.avalara.com/in/products/gst-returns-filing