Uncovering the complexities of the e-way bill system

What is the e-way bill?

The Electronic Way Bill (e-way bill) is a mechanism developed by the government to track the movement of goods, ensure that the transportation of goods complies with the Goods and Services Tax (GST) law, and check tax evasion.

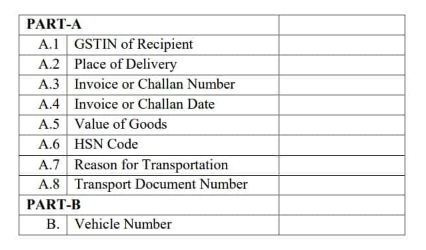

Registered taxpayers are required to generate an e-way bill on the GST Network (GSTN) before transporting goods with consignment values of more than Rs. 50,000/-. Taxpayers must furnish this information electronically in part A of form GST EWB-01 before commencing to move any goods.

When will the e-way bill system be implemented?

At the 24th GST Council meeting on 16th Dec 2017, members rolled out a roadmap for implementing the e-way bill system:

a) A trial implementation started on 16 Jan, 2018.

b) The nationwide e-way bill system will become compulsory for interstate supply transportation on 1 Feb, 2018.

c) States may choose their own start date prior to 1 June, 2018 to implement the e-way system for intrastate goods

Who is required to generate an e-way bill?

Every registered person causing the movement of goods with consignment values exceeding Rs. 50,000 in relation to the supply of goods.

Exceptions

a) If for reasons other than the supply of goods (including job work or removal for testing purpose), send on approval basis

b) In relation to inward supplies of goods from unregistered persons, if the unregistered person does not voluntarily generate an e-way bill, the movement of goods is deemed to be caused by the consignee; the consignee will be required to generate an e-way bill

c) Handicraft goods transported interstate where the consignee is expected to make a turnover below Rs. 20/10 lakhs (as applicable)

Registered persons may not be required to generate an e-way bill if they have instead obtained invoice reference numbers from the common portal by uploading a tax invoice issued in form GST INV-1. Invoice reference numbers are auto-populated by the GSTN on the basis of information furnished in form GST INV-1.

Generating e-way bills using the online portal

Registered persons shall generate e-way bills by furnishing information in part B of form GST EWB-01 on the e-way bill portal.

a. If the registered person does not generate the e-way bill as above, the transporter may use information previously furnished in part A of form GST EWB-01

b. In cases where the movement of goods is caused by unregistered persons, either they or the transporter must generate the e-way bill

How to use the e-way bill portal system

Users must first register on the e-way bill portal of the respective state. Upon registration, users fill in relevant details for either outward movements (consignors) or inward movements (consignees).

Once the details have been submitted and validated, the portal will generate an e-way bill. An online e-way bill looks something like this:

Generating e-way bills by SMS

Users will first register their mobile numbers on the e-way bill portal. Once a mobile number has been registered, e-way bills can be generated, cancelled, and managed through SMS text message using the registered mobile number.

A set of SMS codes has been defined for the generation and cancellation of e-way bills. It is of utmost importance to keep the correct key sequence in mind to avoid any errors.

Example

An outward supply of goods is sent to receiver Mr. B with the following information: GSTIN 29AAAPK1234P1Z1 whose address has PIN Code 550011 against Invoice No. 0001 dt. 01/01/2018 of Rs. 1,000/-.

In this instance, goods having HSN 711234 through vehicle number KA 34 AB 1234 covering a distance of 100 km will have the following key sequence:

EWBG OSUP 29AAAPK1234P1Z1 550011 0001 01/01/2018 1000 711234 KA34AB 1234

E-way bill number (EBN)

Once an e-way bill is generated, a unique e-way bill number (EBN) will be made available to the supplier, recipient, and transporter. The recipient of the goods must communicate his acceptance or rejection of the consignment. If there is no communication within 72 hours, it will be deemed accepted.

Responsibility of the transporter

In the case of multiple consignments in one, the transporter must prepare a consolidated e-way bill by indicating the serial number of each e-way bill on the GSTN in form GST EWB-02.

If multiple vehicles are used for the same consignment, the original transporter (before transfer of goods into separate vehicles) shall update the details of the method of conveyance in form GST EWB-01.

Responsibility of the person in charge of conveyance

The transporter in charge of the shipment of goods shall carry:

- A copy of the e-way bill or EBN either physically or mapped to a radio frequency identification device (RFID)

- The invoice, bill of supply, or delivery challan, as applicable

The commissioner may require a class of transporters to obtain a unique RFID, embed the RFID onto the conveyance, and map every e-way bill to the RFID before moving the goods.

Cancellation of e-way bill

If the goods are not transported as per the details furnished, the e-way bill must be canceled within 24 hours of its generation. An e-way bill cannot be canceled if it has been verified in transit.

Verifying documents and inspecting goods

The authority, approval, or permission of the commissioner must be obtained before any conveyance can be intercepted or physically verified, or before an e-way bill or EBN in physical form is verified. Physical verification can only occur once during the entire transit period unless specific information is received indicating the need for another inspection.

A summary of the inspection must be recorded online in part A of form GST EWB-03 by the proper officer within 24 hours of the inspection. The final report must be submitted in part B within three days of inspection.

If a vehicle is intercepted and detained for more than 30 minutes, the transporter may note the delay in form GST EWB-04.

Validity of e-way bill

The validity of the bill shall depend on the time and distance of goods to be transported. Once the e-way bill is generated, the system will automatically reflect its validity.

Avalara is an experienced application service provider (ASP) and partner of authorized GST Suvidha Providers (GSPs). To understand how our cloud-based application, Avalara India GST, can help you with GST compliance automation, contact us through https://www1.avalara.com/in/en/products/gst-returns-filing.html

Prepare your business for e-invoicing under GST

Discover how to meet all compliance requirements while integrating e-invoicing into your tax function.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.