One Invoice, One E-way Bill policy makes tax automation critical

During the past 21 months since the implementation of the Goods and Services Tax (GST) in India, many business owners have been on a roller coaster ride trying to evolve and adapt to this new and dynamic indirect taxation system. GST has long been a procedure-driven arrangement that demands accurate and timely compliance in order to avoid inefficiencies such as supply chain disruption and government penalties. However, now, with the most recent announcement by the Finance Ministry of rule changes to e-way bill system, businesses will find GST compliance more demanding than ever. It will now become critical for businesses to change from manually filing returns and generating e-way bills, to automating all their accounting and invoice management systems.

How will tax automation ensure successful GST compliance?

E-way bills are mandatory for interstate movement of goods when the value of goods exceed Rs. 50,000 in motorized conveyance. However, India’s logistics sector is highly unorganised. Transporters are frequently unable to access all the required e-way bill documentation in a timely manner, and this may account for the discovery that transporters sometimes make multiple trips using a single e-way bill. In order to curb this type of tax evasion, the government will no longer permit generation of multiple e-way bills based on one invoice. If an e-way bill is generated once with a specific invoice number, then none of the parties — consignor, consignee, or transporter — can generate another e-way bill with the same invoice number.

Transporters of goods worth over Rs 50,000 who fail to produce proper e-way bill documentation to a GST inspector during transit will receive either a penalty of Rs 10,000, or the amount of tax the transporter sought to evade, whichever is higher.

To enforce these new measures, the government will integrate GST’s e-way bill system with the National Highway Authority of India (NHAI)’s FASTag tool. This tool will trace the location of vehicles, as well as the number of times each transporter crosses NHAI’s toll plazas, thereby exposing transporters to increased risk of penalties if they should attempt to move goods interstate without the appropriate e-way bill documentation.

Once optional, businesses will now find they must integrate automated accounting and invoice management systems, e-way bill generation software, and GST return filing systems with their current processes — from sales transactions to return filing. Businesses will no longer be able to afford the risk of manually or separately managing these processes, since the monetary impact of even a small mistake will be substantial.

Tax automation software helps businesses efficiently comply with GST requirements in other ways as well. Businesses have a very short span of time to reconcile invoice data with actual transactions and file monthly GST returns. Furthermore, companies must file multiple returns for each state in which they conduct business. Beyond monthly reconciliations and return filing, GST often also requires daily compliances, making it nearly impossible for most businesses to comply manually.

Smart, automated solutions like Avalara’s cloud-based Avalara India GST will play a crucial role in successful GST compliance with reconciliation intelligence and advanced analytics and will make it possible for companies to reconcile data quickly and accurately.

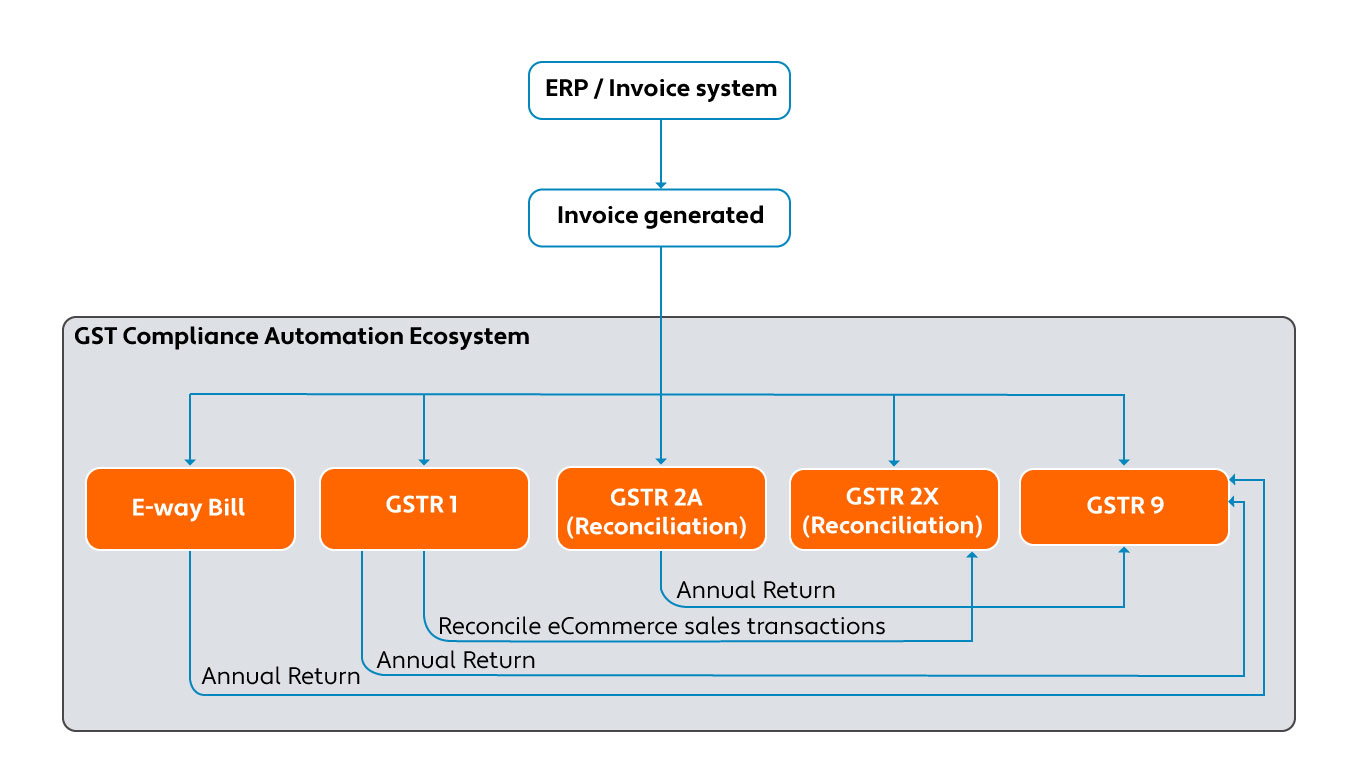

Let's look at how GST compliance automation works:

As purchases or sales transactions are entered into any ERP, billing, or accounting system,GST automation software triggers compliance actions for any or all the following:

- E-way bill generation (each transaction)

- GSTR-1 (monthly)

- GSTR-3B (monthly / quarterly)

- GSTR-2A (monthly)

- GSTR-9, 9B, 9C (annually)

There are other GST return forms which are included in the system like GSTR 2x, GSTR 8,

Businesses therefore have two options, they can:

- Attempt to manually calculate and file every return; or

- Use automated calculation and return filing software

Practically speaking, bigger businesses don’t have the option to manually reconcile, calculate, finalise, and file every return within the very narrow window of time that the GST process allows, especially with even tougher rules. It simply would not be feasible. Cloud-based applications, such as Avalara India GST, will make it possible for larger companies to stay on top of their compliance requirements.

Businesses with complex transactions often benefit from additional compliance management services, such as Avalara’s ASP service, to help them carry out day-to-day automated return processing.

Small and medium-sized businesses benefit from cloud-based tax automation software too

Big businesses aren’t the only ones benefiting from automated GST compliance solutions. Small- and medium-sized businesses find that cloud-based applications prove to be cost-effective by reducing their need to employ additional resources to ensure compliance in a timely manner, not to mention by eliminating errors.

These services help businesses of all sizes meet tedious compliance requirements and eliminate risk of penalties from late or incorrect return filing, allowing them more time to focus on strategic opportunities and growth.

Automated solutions come with an additional bonus: they bring visibility into the input tax credit process. Input tax credit tracking and reporting with Avalara India GST, for instance, gives businesses a clear picture of exactly how the input tax credit is being utilised and whether any unused input tax credit has accumulated. These insights are pivotal for allowing businesses to make informed decisions.

With its cloud-based software and ASP services, Avalara along with its GSP partners successfully act as a bridge between businesses in India and India’s GST network, ensuring that businesses pay the appropriate fees so the government can collect the appropriate amount of tax revenue.

Avalara is an experienced application service provider (ASP) and partner of authorized GST Suvidha Providers (GSPs). To understand how our cloud-based application, Avalara India GST, can help you with GSTR-1 to -9, contact us through https://www.avalara.com/in/en/products/gst-returns-filing.html.

Prepare your business for e-invoicing under GST

Discover how to meet all compliance requirements while integrating e-invoicing into your tax function.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.