Why does changing the definition of MSMEs matter?

In her address to the nation in May, Union Finance Minister, Nirmala Sitharaman announced several provisions and plans under the Atmanirbhar Bharat Abhiyan (Covid-19 relief package) - one of these provisions was the change in the definition of Micro, Small and Medium Enterprises (MSMEs).

What has changed?

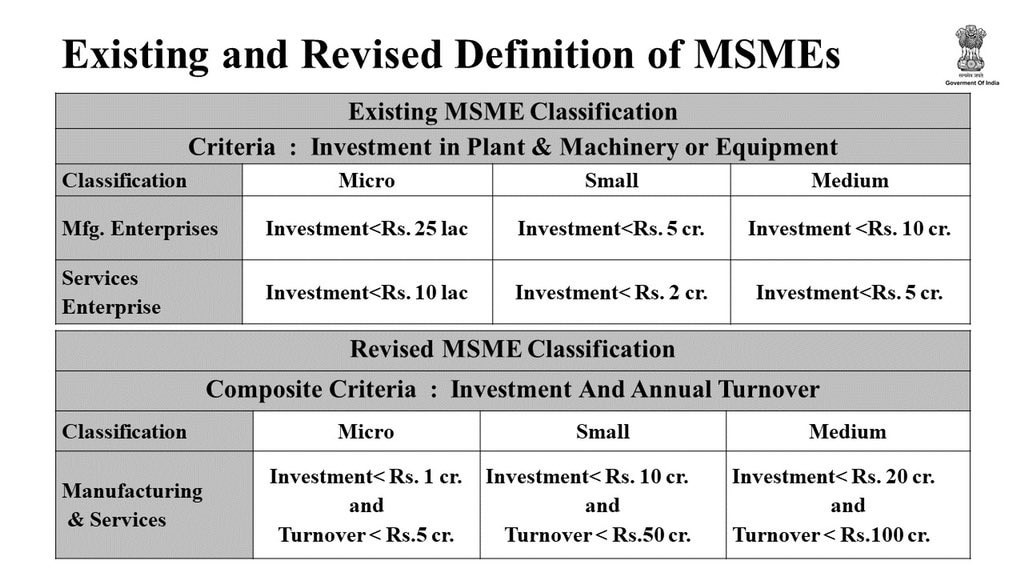

Earlier, MSMEs were categorised on the basis of the amount of investment in the plant and machinery. Under this classification, manufacturing enterprises with an investment under ₹25 lakh and service enterprises with an investment under ₹10 lakh would fall under the category of Micro enterprises. Similarly, the investment for small scale manufacturing enterprises was capped at ₹5 crore and services enterprises at ₹2 crore. Any investments above this cap would fall under the category of medium scale enterprises.

The Centre has decided to remove the difference between the definition of manufacture and service based MSMEs and moving forward will factor in turnover to categorise MSMEs.

To redefine the definition of MSMEs, the Centre has undertaken the following reform measures -

- Increased Investment Limit

- Introduced additional criteria of turnover

- Eliminated difference between Manufacturing & Service sector

- Amendments to law will be made

What is the new definition?

As per the new definition of MSMEs, the limits for investment will be revised and MSMEs will now be categorised on the basis of their turnover. As per the new guidelines, these are the following categories for MSMEs.

- Businesses with investment upto ₹ 1 crore and turnover up to ₹5 crore will be classified as a micro business.

- Businesses with investment up to ₹10 crore, and turnover up to ₹50 crore will be classified as a small business.

- Businesses with investment up to ₹20 crore, and turnover up to ₹100 crore will be classified as a medium sized business.

Why does this change matter?

As per the announcement made by Union Finance Minister, Nirmala Sitaraman, the decision to change the definition of MSMEs was made mainly because of the low threshold limit under the old definition of MSMEs. This threshold has instilled a fear among MSMEs entrepreneurs that any growth or expansion could lead them to lose MSME benefits provided by the Centre. Because the current definition was ‘killing the urge to grow’, there had been a long pending demand from the MSME sector to expand the threshold limit.

Additionally, the finance minister announced other reform measures that will benefit MSMEs. These include -

- Rs 3 lakh crores worth of collateral free automatic loans

- Rs 20,000 crore worth of subordinate debts for MSMEs

- Rs 50,000 crore worth of equity infusion through MSME Fund of Funds

- Global tenders capped - to be disallowed up to Rs 200 crores

Prepare your business for e-invoicing under GST

Discover how to meet all compliance requirements while integrating e-invoicing into your tax function.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.