50 years on, VAT continues to create confusion for UK businesses

VAT is one of the top sources of government revenue and April 1 marks 50 years since its introduction in the UK by Chancellor of the Exchequer Anthony Barber, who dubbed it ‘a simple tax.’

However, for years, VAT has been at the heart of media fury, national debate, and business headaches. Some of the most famous blunders spurred on by the goods and services tax range from pasties to prawn crackers and debate whether tampons should be considered a luxury or necessary item.

Since 1973, both ministerial criticism and public uproar have surrounded these VAT points of contention, raising the question: is VAT really a simple tax? Post-Brexit, and with the ongoing digitisation of the tax administration system in the UK, the rules and regulations around how to effectively calculate and submit a VAT return have become layered with complexity, increasing the risk of non-compliance for businesses.

Survey gauges the impact of VAT on UK businesses

To understand how UK businesses think about and are impacted by VAT, Avalara commissioned Censuswide to survey over 1,000 business decision-makers in the UK from varying business sizes and industries. The research was specifically designed to:

- Measure the sentiment around VAT complexity

- Gauge the time spent cost of managing VAT compliance

- Understand the impact of inaccurate/late VAT return filings

- Gauge confidence in understanding VAT

- Measure support for VAT simplification

- Understand investments in technology to address VAT compliance

The data is broken up in three ways:

- Percentages based on responses from all respondents

- Percentages based on specific business sizes by employee count — small business, midsize business, and enterprise business

- Small businesses are defined as sole traders to 49 employees

- Midsize businesses are defined as businesses with 50 to 500 employees

- Enterprise businesses are defined as businesses with more than 500 employees

- Percentages based on responses by industry

- Industries include architecture, engineering, and building; arts and culture; education; finance; healthcare; HR; IT and telecoms; legal; manufacturing; retail, catering, and leisure; sales, marketing, and media; travel and transport; and other

Below is a summary of the key findings from the survey.

Complexity leads to significant time spent for businesses

Overall, most UK businesses (71%) agree that VAT requirements and processes are too complex and confusing. From VAT registrations to calculations to returns and reporting, UK businesses find the entire VAT process to be challenging and layered with complexity. Furthermore, only half (51%) of businesses said they would be confident in their ability to explain some elements of their VAT obligations.

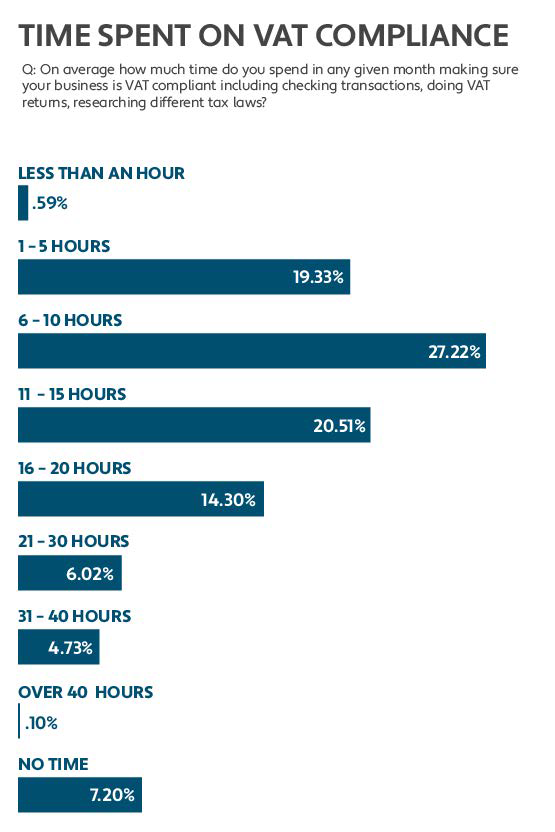

Because of this perceived complexity, it probably comes as no surprise that 46% of businesses are spending anywhere from 10 to 40 hours per month managing VAT compliance, including checking transactions, doing VAT returns, and researching different tax laws.

When looking at specific business sizes, it’s midsize businesses that spend the most time on VAT compliance with 72% spending six to 20 hours per month managing VAT. Similarly, the same percentage of businesses in the finance industry reported spending six to 20 hours per month on VAT management. Sixty-nine percent of IT and telecoms businesses and 68% of HR businesses also spend six to 20 hours per month.

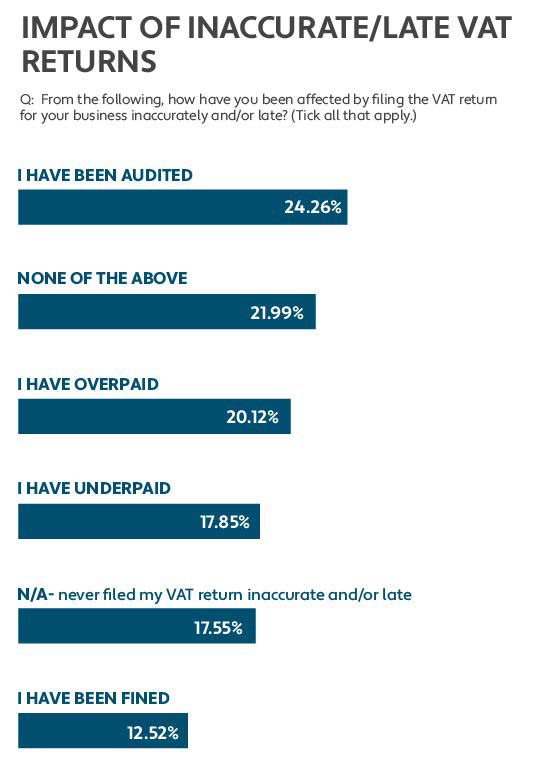

Another result of complexity is evident in the impact on businesses that have filed inaccurate or late VAT returns. VAT returns detail a business’s transactions and applicable taxes, and calculate what they owe or what will be refunded. Filing VAT can be a tedious endeavor. It requires you to keep meticulous records that include receipts of all your purchases and invoices that contain VAT. As such, nearly a quarter (24%) of UK businesses have been audited for filing their VAT return inaccurately or late, and 20% have accidentally overpaid on their VAT return.

According to the survey, one of the most common impacts of filing inaccurate or late VAT returns is an audit. From sales, marketing, and media, 35% of businesses reported being audited and from the HR industry, 33% of businesses reported being audited.

Businesses are turning to technology to combat complexity

Nearly three-quarters (71%) of respondents indicated that they have invested in technology to streamline VAT calculations and reporting. When asked about which part of the VAT management process businesses have invested in technology to address, respondents answered as follows:

- 46% and 43% have invested in technology for the filing and preparation of VAT returns, respectively

- 42% have invested in technology to address real-time reporting requirements

- 40% have invested in technology for data validation

- 23% have invested in technology for VAT determination

The need for technology to manage VAT in the UK has never been greater. Under His Majesty’s Revenue & Customs’ (HMRC) Making Tax Digital (MTD) initiative, which went into effect in November 2022, businesses must comply with digital record requirements, prepare VAT returns using digital links and file VAT returns using software via an API link.

Avalara helps businesses across the UK and around the world manage VAT compliance. Learn more about our VAT solutions here.

Survey methodology

Research was conducted by Censuswide with 1,014 business decision-makers in UK businesses (aged 18+) between 17 March and 20 March 2023. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

**According to the Institute of Chartered Accountants in England and Wales, in late October 2022, approximately 10% of businesses above the VAT threshold and 55% of businesses below it needed to sign up to MTD VAT. Avalara analysed this data, and using HMRC’s Annual VAT data statistics from 2020/21, Avalara found that the 1,297,250 UK VAT registered businesses with £0 VAT registration threshold equals 713,487 businesses that are yet to register.

Avalara found that 1,184,080 UK VAT registered businesses above VAT registration threshold equals 118,408 businesses that are yet to register, meaning there is a total of approximately 831,895 businesses as of August 2022 that need to sign up for MTD and at minimum need a way of filing UK VAT return by API.

Avalara used the reported figures and applied these percentages to the latest available data (HMRC Annual VAT data statistics from 2020/21) on the number of VAT registered businesses split by below or above threshold, coming to a 33% figure. 1,297,250 UK VAT registered businesses with £0 VAT registration threshold equals 713,487 businesses. 1,184,080 UK VAT registered businesses above VAT registration threshold equals 118,408 businesses, meaning there is a total of 2,481,330 VAT registrations. With the 831,895 businesses that are yet to switch, this gave Avalara the percentage figure of 33%.

Ecommerce Tax Trends Report 2022

Get a comprehensive look at the latest developments in the ecommerce industry.

Stay up to date

Sign up today for our free newsletter and receive the latest indirect tax updates impacting businesses selling internationally straight to your inbox.