What are the penalties for submitting a late UK VAT return?

At the start of 2023, the United Kingdom changed the way penalties and interest apply to late value-added tax (VAT) returns and payments. Businesses now get a penalty point when they submit a VAT return late, and perhaps financial penalties. Here’s what you need to know about the point penalty system — and how to avoid penalties.

For VAT accounting periods before December 31, 2022, late VAT returns and payments were subject to a VAT default surcharge.

As of January 1, 2023, HM Revenue & Customs (HMRC) is using a penalty points-based system that simplifies and separates penalties and interest. It’s designed to be more lenient on taxpayers who make the occasional slipup while still penalizing those who repeatedly fail to meet their obligations.

How does the points-based system for late VAT returns work?

If you don’t send a VAT return as required by the deadline of your accounting period (e.g., monthly, quarterly, or annually), you’ll be subject to penalties points and financial penalties.

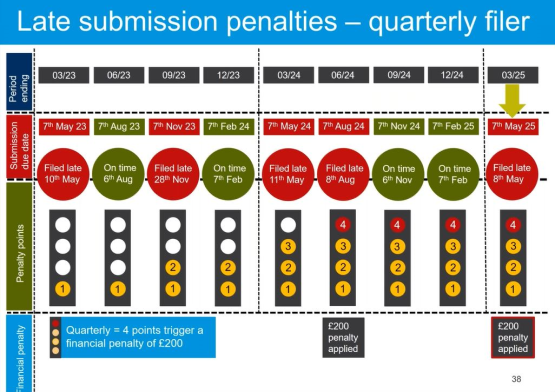

You’ll receive 1 penalty point each time you submit a return late. If you reach the penalty points threshold for your accounting period — 2 for annual returns, 4 for quarterly returns, or 5 for monthly returns — you’ll receive a £200 penalty each time you submit a late return.

Here’s an example of how it would work for a company filing VAT returns monthly:

- The company files the January 2023 VAT return late and gets 1 penalty point.

- It files the February 2023 VAT return on time, so no penalty points are assessed, but it still has 1 penalty point.

- It files a late VAT return in March and gets another penalty point, for a total of 2 points.

- It files the April VAT return on time but still has 2 penalty points.

- It’s late to file its monthly VAT returns for May and June and earns 1 penalty point for each. It now has a total of 4 penalty points.

- It gets another penalty when it files its July VAT return late and reaches 5 penalty points, the penalty points threshold for monthly filers. At this point, the company must pay a £200 penalty.

- If the company has another late VAT return, it won’t get another point because it’s already at the threshold, but it will have to pay another £200 penalty.

This chart from and HMRC webinar shows how late submission penalties would work for a quarterly filer.

Changes to your business can also affect penalties points. HMRC may adjust your threshold and penalty points if you’ve arranged to change how often you submit returns. Penalties points may be increased or decreased, depending on your new accounting period. No adjustments will be made if you have zero points.

Can I get my penalty points removed?

Yes. There are two ways to remove your late VAT return penalty points: The first applies to taxpayers who met their penalty points threshold; the second to taxpayers who accrued some penalty points but did not meet the threshold.

1. If you met your penalty points threshold, your penalty points total can be reset to zero only if you meet the two following conditions:

- Condition A: You submit all VAT returns on or before the due date for a set period, which varies by reporting frequency:

- Annually: 24 months of returns (2 VAT returns)

- Quarterly: 12 months of returns (4 VAT returns)

- Monthly: 6 months of returns (6 VAT returns)

- Condition B: HMRC has received all VAT returns that were due the previous 24 months.

2. If you accrued some penalty points but did not reach your penalty points threshold, your individual points will automatically expire once you’ve filed VAT returns and paid the VAT due on or before the due date for 24 consecutive months.

Read more about removing penalty points you’ve received.

Do penalties apply to late nil returns?

Yes, you must file a VAT return on time even if you have no VAT to report (i.e., a nil VAT return).

What are the penalties for paying VAT late?

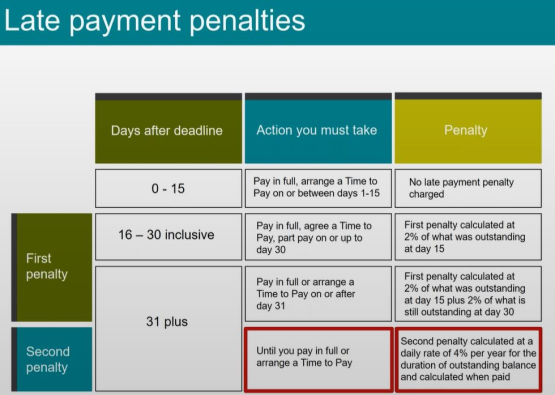

The VAT late payment penalty is on top of the £200 penalty assessed for filing a return late. These penalties vary depending on the action you take: The sooner you remit your VAT late payment, the lower the penalty rate will be.

VAT late payment penalties are assessed in two different ways:

- The first VAT late payment penalty is calculated on outstanding amounts on day 15 and day 30.

- The second VAT late payment penalty is calculated on outstanding amounts from day 31 until you pay in full.

This chart from an HMRC webinar spells it out:

Late payment interest will be due from the day your VAT payment is overdue until the day the late payment is paid in full. Click on the link for more details.

Can I appeal the penalty points and late payment penalty?

You or your registered agent may appeal against late filing points or financial penalties. See the HMRC for more information, including a helpful on-demand webinar.

How can I avoid VAT penalties?

The most effective way to avoid accumulating penalty points and a VAT late payment penalty is to file VAT returns and remit VAT payments on time.

Avalara helps businesses of all sizes file VAT returns and pay VAT on time. Contact us to learn more.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.