“Working with both Avalara and Sage, Set Solutions has saved more than $300,000 annually and 30 hours per week on tax compliance tasks.”

Trusted by companies in every industry

Let’s solve your tax compliances together. Fill out this form to speak with an Avalara tax expert.

You can expect the following once you submit:

- We’ll review your business needs

- One of our experts will contact you to discuss tailored solutions

- You’ll get insights into how Avalara can help streamline your compliance.

We’re excited to speak with you! Already a customer? Get technical support

Overview video

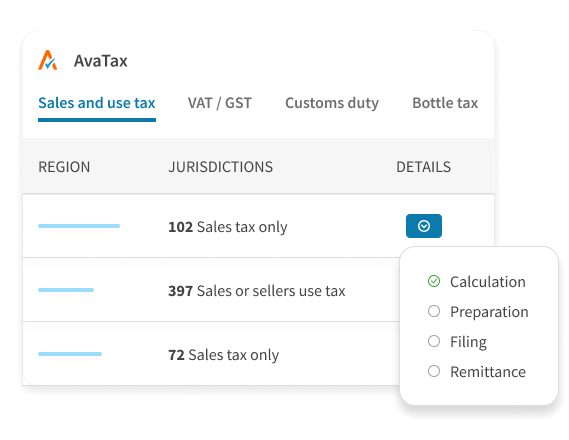

AvaTax automatically calculates rates for:

BENEFITS

Simplify tax calculation across industries, borders, and tax types

Increase accuracy

AvaTax automates tax calculations for sales and purchases, so you can have greater confidence that you’re charging and being charged the correct tax.

Integrate with ease

Avalara has more than 1,400 signed partner integrations and a robust API, so you can connect AvaTax with the business systems you already use or plan on buying.

Scale for growth

AvaTax provides calculation or estimation of customs duties and import taxes during checkout, so you can expand your business across borders while improving VAT and GST compliance.

Go live faster

Avalara offers self-serve setup, contextual information display, clear usage data, and an intuitive user interface for easier onboarding.

Enhance security

AvaTax protects the security, availability, and confidentiality of your data.

Drive reliability

Avalara cloud architecture can build redundancies, address bottlenecks, and replicate data across regions.

How it works

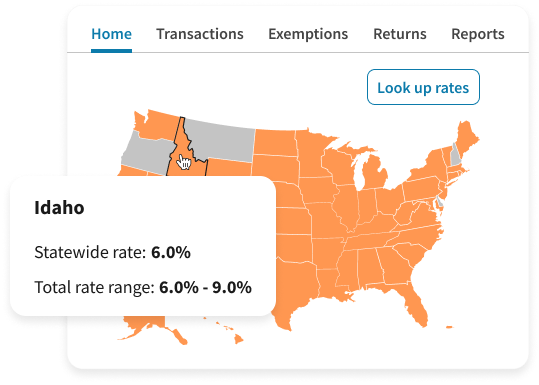

AvaTax calculates tax rates based on item, location, legislation, and regulations

Maintain full visibility and control

Automate tax calculation

Manage tax compliance from a centralised platform while reducing sales and use tax compliance risks.

FEATURES

Discover AvaTax’s unique capabilities

CUSTOMER STORIES

See what our customers have to say

—Missy Basone

CFO, Set Solutions

“Avalara is a game changer. With Avalara’s wide range of product offerings, they take the everyday pain points of doing business and make them simplified, streamlined, and most importantly, manageable.”

—Jacob Swager

Tax Director, Sweetwater

“Avalara has significantly reduced manual tasks, errors, and custom, complex regulations for us, minimising the time our team spends maintaining data workflows.”

—Ricardo Rodriguez

Senior Manager of Indirect Tax, Snowflake

“Incorporating Avalara AvaTax with our ERP has proven to be a truly monumental achievement, as it empowers us to seamlessly and effortlessly obtain sales tax information, ensuring multi-jurisdictional compliance with remarkable efficiency.”

—Andre Johnson

Business Analyst, NEFCO

Related products

Automate the assessment and accrual of consumer use tax.

Offload the hassle of returns preparation, filing, remittance, and notice management.

Process, collect, and access exemption documents.

Get comprehensive, easy-to-understand tax insights relevant to your business.

Calculate or estimate real-time customs duties and import taxes at checkout.

Automate the assessment and accrual of consumer use tax.

Dive deeper

Have questions about tax compliance? Here are some resources to get you started.

EXPLORE

IMPLEMENT

USE

Awards

Frequently asked questions

What is Avalara AvaTax and how does it work?

Avalara AvaTax is a cloud-based tax compliance solution that automates the calculation of sales and use tax, VAT, GST, excise tax, communications tax, lodging tax, and other indirect tax types. It works by integrating with your business systems (such as ERP, accounting, and ecommerce platforms) to calculate taxes in real time based on regularly updated tax rules and rates. This helps promote more accurate and compliant tax calculations for every transaction.

Can Avalara AvaTax integrate with my existing accounting or ecommerce system?

Yes. Avalara AvaTax has more than 1,400 signed partner integrations and custom APIs for a wide range of accounting, ERP, and ecommerce systems. This integration allows for automatic tax calculations within your existing workflows, reducing manual data entry and enabling more accurate tax compliance.

How does Avalara AvaTax keep up with changes to tax rates and regulations?

Avalara AvaTax is regularly updated with the latest tax rates and rules for thousands of tax jurisdictions. The cloud-based platform applies updates in real time, so you always have highly accurate tax information, helping you to stay compliant with changing tax laws without manual intervention.

What features does Avalara AvaTax offer for managing exemption certificates?

Avalara AvaTax includes exemption certificate management features that collect, validate, and store exemption certificates digitally. The system automatically validates certificates during transactions, ensuring only valid exemptions are applied. It also provides a centralised repository for easy access and audit readiness, as well as automated reminders for certificate renewals.

Does Avalara AvaTax support international tax calculations?

Yes. Avalara AvaTax supports international tax calculations, including VAT, GST, and other transaction taxes. AvaTax VAT determination capabilities more accurately calculate VAT and GST based on regularly updated tax data for sales and purchases, for compliance with VAT and GST laws in over 190 countries. This makes it an ideal solution for businesses operating globally, as it helps them manage tax compliance across different jurisdictions with varying tax rules and regulations.

Can Avalara AvaTax integrate with Avalara Tariff Code Classification?

Yes. Avalara AvaTax can integrate with Avalara Tariff Code Classification. The integration allows businesses to automatically classify products with the mandatory 6-digit Harmonised System (HS) codes or country-specific 10-digit tariff codes and Harmonised Tariff Schedule (HTS) codes that are essential for determining accurate duties and taxes for cross-border transactions. With this integration, AvaTax unifies customs duty, import tax, and sales and use tax calculations in a single platform, creating a transparent and frictionless online shopping experience for international customers.

How does Avalara AvaTax help businesses prepare for tax audits?

Avalara AvaTax helps businesses prepare for tax audits by maintaining detailed records of all transactions and their corresponding tax calculations. The system generates comprehensive reports that can be used to demonstrate compliance during audits. Additionally, Avalara Exemption Certificate Management helps ensure all certificates are valid and easily accessible, further supporting audit readiness.