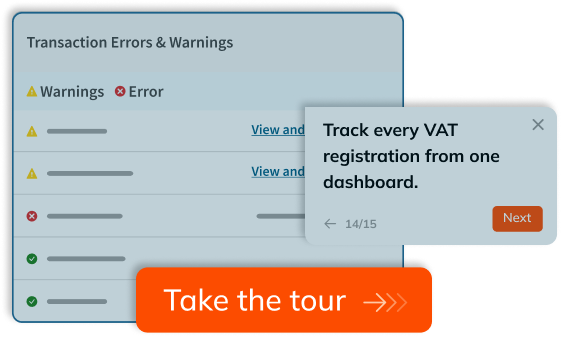

Take a self-guided demo to see how Avalara makes VAT registration simple and reliable. No sales pitch, no commitments.

Simplify VAT compliance with Avalara VAT Returns and Reporting

Automate VAT returns filing to generate more accurate and timely filings. Our cloud-based solutions take the complexity out of global VAT reporting.

Trusted by companies in every industry

Let’s solve your tax compliance challenges together

Fill out this short form to connect with an Avalara tax solution specialist.

You can expect the following once you submit:

- We’ll review your business needs.

- One of our specialists will contact you to discuss tailored solutions.

- You’ll get insights into how Avalara can help streamline your compliance.

Connect with us now — we’re excited to speak with you! Already a customer? Get technical support.

BENEFITS

Solve global compliance challenges while growing your business

Improve accuracy

More than 150 automated validation checks ensure more accurate VAT reporting while audit-ready logs provide greater visibility and control.

File on time

Avalara VAT Reporting connects with the most commonly used accounting systems to generate and prepare VAT returns, accelerating the submission process.

Save time and reduce costs

Avalara keeps more accurate and up-to-date records in a central location, so you can quickly prepare for audits and avoid the cost of hiring third-party auditors.

Generate submission-ready returns

Direct filing is easier with digital formats and human-readable submissions in both English and local languages.

Scale your business for growth

Ease global expansion by automating VAT returns, Intrastat, EC sales lists, OSS/IOSS, SAF-T, and more across 45+ countries.

Streamline global operations

Centralized VAT management makes it easier to monitor sales, purchases, and VAT positions across the Americas, EMEA, and APAC.

How it works

End-to-end VAT compliance on one platform

Product comparison table

Choose the right product for your business

CUSTOMER STORIES

See what our customers have to say

“[Avalara Managed VAT Reporting] eases our ability to manage tax returns for eight countries, which means we can focus on growing the business.”

—Josie Stephens

Assistant Accountant, Nodor International

“Filing VAT returns in multiple jurisdictions would be quite time consuming. My time is much better spent doing more strategic work than on keeping track of our VAT submissions.”

—Metka Koskas

(former) Financial Controller, Missoma Ltd

“Using [Avalara VAT Reporting] gives us the reassurance that all our VAT returns will be filed on time. We don’t need to worry about the different deadlines, different attitudes of local tax offices, different languages or requirements in each country, or translating tax notices, to ensure we are compliant.”

—Mag. Mitat Gürkan

International Accounting Manager, Glamira

“One of the reasons we chose [Avalara VAT Reporting] over its competition was that it allowed us to develop much more innovative and useful automations that can be integrated into our normal workflow.”

—Posky Idnani

EMEA Tax Manager, Acer

Related products

Apply more accurate, regularly updated tax rates based on location, taxability, legislation, and more.

Comply with global e-invoicing requirements and automate your finance and tax reporting processes.

Register for VAT in over 53 countries so you can maintain compliance as your business grows.

Get comprehensive content, data, and insights for confident, compliant expansion.

Offload the hassle of returns preparation, filing, remittance, and notice management.

Dive deeper

Want to learn more about global VAT requirements? We have resources to get you started.

EXPLORE

IMPLEMENT

USE

Awards

Frequently asked questions

How is Avalara using AI to improve VAT compliance?

We’ve introduced AI-powered document review in Managed VAT Reporting to simplify VAT registration. This tool automatically validates uploaded documents, flags missing or incomplete information, and reduces onboarding delays.

What should I look for when choosing a VAT reporting solution?

Key features to look for include automated data extraction, integration with existing systems, compliance with global VAT regulations, and robust reporting capabilities.

What are the main functions of VAT Reporting?

VAT Reporting automates data extraction, validation, and submission of VAT returns, while offering detailed reporting and audit readiness.

How does VAT Reporting integrate with existing systems?

VAT Reporting seamlessly integrates with common ERP and accounting systems, simplifying data uploads and consolidations.

How does Avalara VAT Reporting help businesses prepare for tax audits?

Avalara VAT Reporting centralizes VAT-related data, provides detailed audit trails, and highlights potential discrepancies, ensuring businesses are more audit-ready.

Can VAT Reporting integrate with a VAT determination engine?

Yes. Avalara’s AvaTax Extractor now integrates directly with Managed VAT Reporting, automating the import of VAT calculation data—starting with digital services transactions and expanding to more use cases soon. This connection eliminates manual uploads and spreadsheets, enabling faster, more accurate VAT return preparation. Managed VAT Reporting is Avalara’s fully managed solution for preparing and filing VAT returns, helping ensure compliance across jurisdictions with minimal effort.

Watch the demo to see how it works.

What is Making Tax Digital (MTD) and how does Avalara support it?

Making Tax Digital is a U.K. government initiative aimed at making it easier for businesses to keep their tax records digitally and submit their VAT returns online. Avalara helps businesses reduce the risk of errors, file on time, and maintain compliance with MTD regulations.