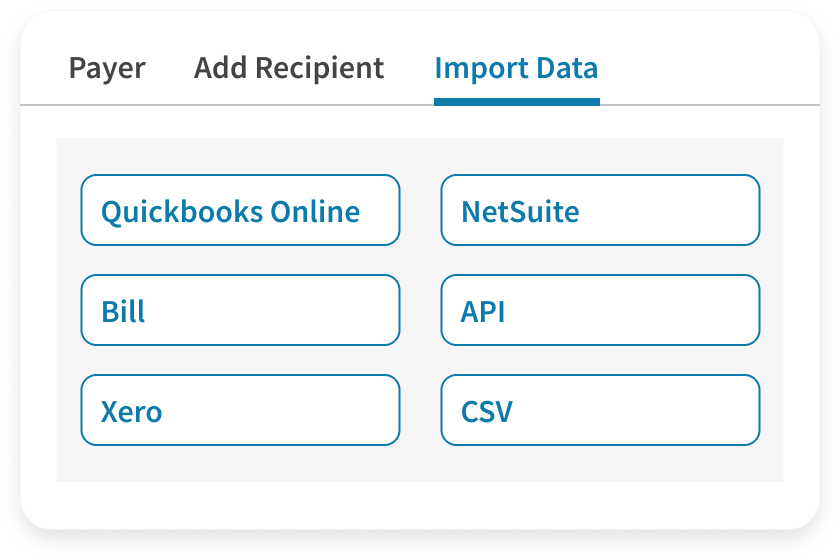

- Import 1099 payee data via CSV, API, or data transfers from common accounting systems

- Transfer vendor details from your W-9 forms for quick e-filing to the IRS

- E-file to individual states that require extra filing

- E-deliver 1099 copies back to your vendors ahead of strict IRS deadlines or use postal mail if desired

- Automatically check for errors at every step

Collect, manage, and e‑file IRS forms with Avalara 1099 & W‑9

Simplify the way you manage forms 1099, W-9, W-2, 1095, and more to improve compliance.

Trusted by companies in every industry

Let’s solve your tax compliance challenges together

Fill out this short form to connect with an Avalara tax solution specialist.

You can expect the following once you submit:

We’ll review your business needs.

One of our specialists will contact you to discuss tailored solutions.

- You’ll get insights into how Avalara can help streamline your compliance.

Connect with us now — we’re excited to speak with you!

Already a customer? Get technical support.

BENEFITS

A complete solution for your 1099 tax compliance needs

Take the stress out of tax season

Avalara helps you e-file with both the IRS and states that require extra filing, automatically e-deliver 1099 copies to recipients, and save and transfer data from year to year.

Reduce the risk of IRS penalties

Avalara flags errors before e-filing your documents with the IRS, validates your recipients’ taxpayer identification numbers (TIN) to reduce B-notices, rechecks previously failed TINs at no additional charge, and verifies the addresses of all your filings.

Simplify IRS e-filing

Avalara automatically imports 1099 payee data and transfers vendor details from your W-9s so you can reduce manual workflows and file faster.

Streamline vendor information collection

Avalara lets you manage IRS forms in a central and secure location, easily access files for an IRS audit, and automatically check for errors during collection.

How it works

Collect, manage, and e-file your IRS forms

There’s more to 1099 compliance than just filing

TIN matching

Automatically compare legal name, TIN type, and TIN against the IRS database to catch errors before they make their way into your filings and trigger pesky B-notices.

APIs and integrations

Populate your 1099 forms with payee data from common accounting systems.

State e-filing

Get alerted when state e-filing is necessary, so you can handle both federal and state 1099 compliance simultaneously.

CUSTOMER STORIES

See what our customers have to say

“Avalara 1099 & W-9 was easy to follow with uploads, scheduling, payments, and corrections. If I needed assistance, their support was quick to respond.”

—Becky Whitmore,

Corporate Controller, Polarity

“Processing 1099s used to take at least a day, but now I am done in less than an hour. And I don’t have to buy materials or worry about mailing.”

—Deborah Turner,

Financial Clerk, Jofit

“I loved how easy it was to do our filing that I recommended you guys to my colleague last year.”

—Evelyn Bufalini,

Accounts Payable Manager, World Insurance Associates

Related products

Automate the assessment and accrual of consumer use tax.

Collect, store, and manage vendor exemption certificates efficiently while improving accuracy.

Satisfy your business license and tax registration requirements with solutions tailored to your business.

Dive deeper

Have questions about 1099 and W-9 compliance? Here are some resources to get you started.

EXPLORE

USE

Frequently asked questions

What IRS form types does Avalara support?

Avalara 1099 & W-9 supports a wide variety of IRS forms related to payee reporting. The full list includes:

1042-S

1094-B, 1094-C

1095-B, 1095-C

1097-BTC

1098, 1098-C, 1098-E, 1098-Q, 1098-T

1099-A, 1099-B, 1099-C, 1099-CAP, 1099-DIV, 1099-G, 1099-INT, 1099-K, 1099-LS, 1099-LTC, 1099-MISC, 1099-NEC, 1099-OID, 1099-PATR, 1099-Q, 1099-R, 1099-S, 1099-SA

3921, 3922

5498, 5498-ESA, 5498-SA

W-2, W-2C, W-2G, W-9, W-4, W-8BEN, W-8BEN-E

Avalara 1099 & W-9 also supports Canada Revenue Agency slip T4A.

How do I know if a TIN is accurate before I e-file to the IRS?

Avalara 1099 & W-9 will automatically check name, TIN type, and TIN against the IRS database. All three must match to get a “pass” or you’re alerted of the error. Avalara allows you to recheck a previously failed TIN at no additional charge.

Can the vendor info in my W-9s be used to populate my 1099s?

Yes. Avalara 1099 & W-9 will save you time and effort by automatically transferring information from the W-9s stored in your account to your 1099s when it comes time to e-file with the IRS.

How do I deliver copies of 1099s to my vendors?

Every vendor for whom you have an email address will automatically receive an e-copy of their 1099 when you e-file to the IRS. For an additional fee, Avalara will send postal mail to vendors.

Can I e-file and e-deliver for previous years?

Yes, you can file original IRS returns for previous years. If you need to make a correction, you may only electronically correct prior years if you e-filed the original with Avalara that year.

What are the IRS penalties if I have missing W-9s during an IRS audit?

IRS fines for missing W-9s can range from $60 to $630 per missing form. It’s a smart practice to collect them early and keep them in a secure location, especially since they contain sensitive information such as your vendors’ social security numbers.

What additional support does Avalara offer specifically for marketplace merchants?

Avalara can help smooth the process of collecting W-9s directly from a marketplace website. With our ecommerce plugin, sellers won’t need to leave the marketplace’s controlled environment, giving them enhanced confidence that their personal data is safe.

Can Avalara connect directly to ERP, accounting, marketplace, and ecommerce platforms with an API?

Yes. Avalara offers a robust API that allows businesses to integrate directly with leading ERP, accounting, marketplace, and ecommerce platforms to automate IRS 1099 and W-9 compliance processes. With this integration, your platform can initiate W-9 requests, transmit payee data with specific processing instructions, validate TINs and postal addresses, and trigger IRS and state e-filing — all from within your existing system. Real-time updates can flow back to your ERP or accounting system, allowing you to streamline compliance workflows and reduce manual effort, risk, and costs.

Connect with Avalara

Simplify the process of collecting, managing, and e-filing forms 1099, W-9, 1095, W-2, and more.