Wayfair turns 2, but survey shows many businesses still unaware of economic nexus

It’s coming up on two years since the Supreme Court of the United States issued its decision on South Dakota v. Wayfair, Inc. (June 21, 2018), granting states the authority to tax remote sales. Most states responded to the ruling by creating new sales tax collection obligations for out-of-state sellers. Yet according to a recent survey, many retailers remain unaware of the Wayfair ruling or its possible impact on their business.

Before diving into the data, a quick recap of the decision is in order.

South Dakota v. Wayfair, Inc. and the rise of economic nexus

South Dakota v. Wayfair, Inc. represents a turning point for sales tax: Prior to the decision, a state could require a business to register with the tax authority and collect and remit sales tax only if the business had a physical presence in the state. States defined physical presence differently, some rather broadly, but the connection had to be physical in nature.

Wayfair overturned the physical presence rule. A physical presence in a state is no longer the only requisite for sales tax nexus, the connection between a business and taxing authority that creates a sales tax collection obligation. Physical presence in a state still establishes nexus, but it’s no longer the sole trigger for nexus.

The Supreme Court determined the economic and virtual ties between Wayfair, Inc. (and the other respondents) and South Dakota were sufficient to establish sales tax nexus. As a result, states can now base a sales tax collection obligation solely on a remote seller’s economic activity in the state. This is economic nexus.

Within days of the Wayfair decision, Hawaii, Maine, and Vermont began enforcing economic nexus laws that had been waiting in the wings. Other states quickly followed suit, and today, 43 of the 45 states that have a general sales tax (plus Washington, D.C.) have economic nexus. Florida and Missouri are working on adopting it.

South Dakota v. Wayfair, Inc. was a game changer for states. It enables the state to tax online sales that couldn’t be taxed prior to the decision because the seller was out of state.

Is the same true for businesses? Have they been irrevocably impacted by the Supreme Court decision on South Dakota v. Wayfair, Inc.?

Survey examines awareness and impact of Wayfair decision

To determine the awareness and impact of Wayfair on businesses, Potentiate surveyed hundreds of U.S. businesses that collect and remit sales tax and make retail sales into at least one state other than their home state. The survey respondent for each business was the business owner or a decision maker (e.g., executive director, finance manager, accounting director, or IT manager).

The survey sought to:

- Gauge the impact of Wayfair on attitudes and behaviors related to selling activities

- Understand specific challenges introduced by Wayfair

- Measure perceptions and differences across companies of different sizes

- Monitor results over time

Methodology

Respondents ranged in size and included extremely small businesses (ESB), small to medium-sized businesses (SMB), and medium and large enterprises (UMM/ENT):

- 25% were ESB (extremely small businesses, less than 20 employees)

- 50% were SMB (small to medium-sized businesses, 20–499 employees)

- 25% were UMM/ENT (enterprise-level businesses, 500 or more employees)

Data was gathered from approximately 250 different respondents in three separate waves (for a total of 750+/- respondents):

- December 19–December 24, 2019

- January 29–February 7, 2020

- March 27–April 17, 2020

The survey didn’t reference “nexus” or “economic nexus.”

Unaided awareness vs. aided awareness

Respondents were asked if they had heard of the South Dakota v. Wayfair, Inc. Supreme Court decision and whether they were familiar with its implications for sales tax. They were categorized as having “unaided awareness” of Wayfair if they had heard of the case and were familiar with its effect on sales tax.

All respondents were provided the following brief overview of the Wayfair decision: “On June 21, 2018, the Supreme Court of the United States ruled in favor of the state in South Dakota v. Wayfair, Inc. The decision allows states to require remote sellers to collect and remit sales tax.” Respondents unfamiliar with Wayfair prior to reading the overview were categorized as having “aided awareness.”

Results

Overall awareness of Wayfair rules

Both aided awareness and unaided awareness respondents were asked about their awareness of the Wayfair decision.

Overall, unaided awareness of Wayfair remained relatively consistent from one measurement period to the next:

- 54% in December 2019

- 58% in January 2020

- 57% in March 2020

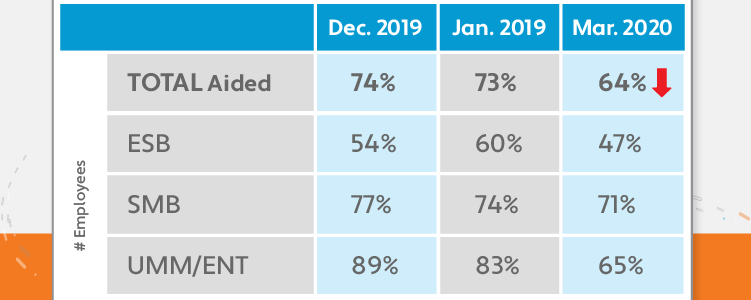

Aided awareness of Wayfair decreased:

- 74% in December 2019

- 73% in January 2020

- 64% in March 2020

Awareness by business size

The size of the business surveyed seemed to impact awareness. During the first two waves, both unaided awareness and aided awareness enterprise-level businesses were the most aware of Wayfair, and extremely small businesses were the least aware. In March 2020, unaided awareness and aided awareness small to medium-sized businesses overtook enterprise-level businesses for most aware.

Unaided awareness

Aided awareness

Wayfair’s impact on business

In March, 59% of respondents with unaided awareness said the Wayfair decision had impacted their business. Broken down by business size, the results vary as follows:

- ESB — 68%

- SMB — 57%

- UMM/ENT — 58%

Respondents were also asked how Wayfair and subsequent state tax-related laws had impacted their business. They were given 10 choices, including “None of the above.” In March, the top three impacts on businesses were:

- Increased number of states where registered to collect/file sales tax — 45%

- Increased complexity for sales tax calculation/filing activity — 42%

- Increased need for additional tools/technology — 40%

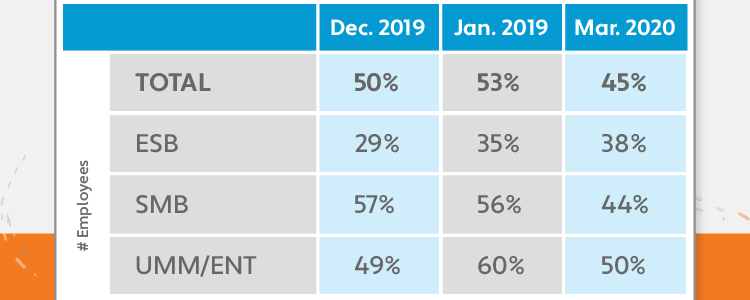

Compliance with Wayfair laws

Overall, between 45% and 53% of businesses surveyed claimed to have implemented all changes required by various state laws created in response to South Dakota v. Wayfair, Inc. (i.e., economic nexus laws).

Again, responses varied by business size, with the smallest businesses as least compliant.

100% compliance with tax-related laws resulting from Wayfair

Managing compliance with Wayfair-related laws

Roughly four in 10 respondents are using some sort of automated solution to address sales tax compliance challenges brought on by Wayfair and subsequent state laws.

The top three tools used to manage compliance are:

- Accounting software — 68%

- Automated solution (Avalara) — 43%

- Functionality built into POS system — 40%

The survey found 31% of respondents still rely on manual sales tax calculation and filing tools, such as tax rate tables and spreadsheets.

Takeaways

One key takeaway is that size matters. Over time, Wayfair-related laws are having a greater impact on ESBs: In December 2019, 44% of respondents representing ESBs said tax-related laws resulting from Wayfair impacted their business; by March 2020, that number had jumped to 69%. During the same period, the impact of Wayfair-related laws on the more-aware SMB and MM/ENT sectors decreased.

ESBs also had the lowest awareness of Wayfair-related laws. Not knowing about Wayfair or resulting economic nexus laws could lead to a lack of compliance in one or more states, and thus create a greater impact if new obligations are discovered. Manual compliance could also be a contributing factor. Very small businesses typically have fewer resources to devote to sales tax compliance and are more likely to handle it manually. This is a hassle under the best of circumstances; for businesses required to collect and remit in multiple states, it can quickly become extremely burdensome.

Most state economic nexus laws do provide an exception for small retailers whose sales are below a certain threshold: In South Dakota, the threshold is $100,000 in sales or 200 transactions in the current or previous calendar year; in New York, it’s $500,000 in sales during the previous four sales tax quarters. Because thresholds in each state vary, businesses must constantly monitor their sales into all states. And because a threshold can be as low as $100,000 or 200 transactions, economic nexus can affect even very small businesses.

Another key takeaway is that automated sales tax solutions can help ease the pain of compliance.

Simplifying registration/licensing. 45% of businesses surveyed have new registration requirements as a result of South Dakota v. Wayfair, Inc. and resulting state laws. A business cannot start collecting sales tax in a new state without first registering with the tax authority and paying any fees needed to obtain a sales tax permit and/or business license. The more states where registration is required, the more of a hassle this is because every state has a different application and process.

Off-loading registration and licensing saves both time and effort, especially for companies that sell throughout the U.S. Avalara State Sales Tax Registration offers a solution.

Simplifying sales tax compliance. Many respondents use an automated solution, like Avalara, to help manage sales tax obligations sparked by the Wayfair decision.

In addition to offering registration services, Avalara automates sales tax rate calculation, filing and remittance, and exemption or resale certificate management. With more than 700 prebuilt integrations, the platform connects to the most widely used business management applications, from accounting software and ecommerce platforms to point-of-sale and mobile commerce solutions. And it combines technology and tax expertise to help businesses of all sizes manage sales and use tax and other transaction taxes.

Avalara serves businesses across the United States and around the world. Additional resources for businesses to help understand and navigate the Wayfair decision and economic nexus laws can be found at our South Dakota v. Wayfair, Inc. resource center.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.