The crazy-making states - Will's Whiteboard

When it comes to sales tax, some states are naughty and some are nice. If your business sells in Oregon, for instance, you don't have any state sales tax to deal with. But sell into New York and you might have to deal with state and local tax, click-through nexus, tax thresholds and more.

Then there are the home rule states.

These states, like Alabama, Colorado and Arizona, add entire layers of complexity you don't get anywhere else. Watch the video to learn more.

Transcript

Hi. Welcome to Will’s Whiteboard. I’m Will. At Avalara, we get a lot of questions about tax compliance. Here’s a recent one. John writes in and he says, “I’ve been in sales tax compliance arena for years. And I’ve heard the term home rule sales tax or home rule states quite a bit. But I’ve got to tell you I actually don’t know what it means.” John, you’re not alone. A lot of people don’t know what home rule means, but it’s a really vital concept for sales tax compliance. So let’s talk about it today.

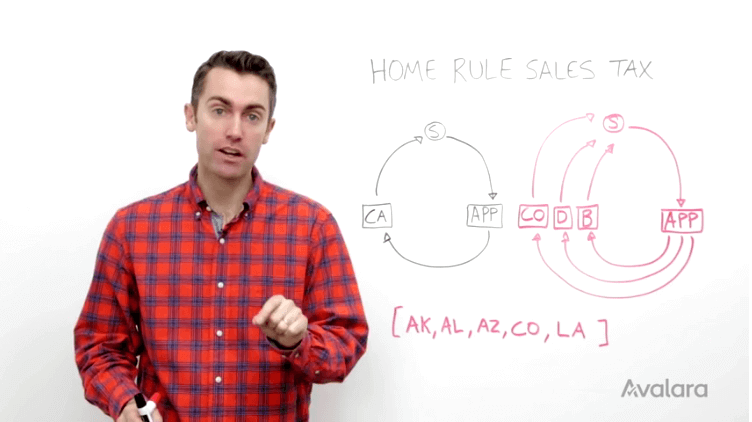

Okay, let’s talk home rule. Now, we’re going to talk about home rule by contrasting a non-home rule state, California, with a home rule state of Colorado. And by the way, there are five home rule states, where you currently really have to watch out for sales tax complexity. Those are Alaska, Alabama, Louisiana, Colorado, and Arizona. But let’s talk Colorado.

First California. Now, California’s not exactly easy when it comes to sales tax compliance. But at least in California, your business is dealing generally with one state entity, Board of Equalization. So you’re staff comes and gets sales tax rules and rates from the Board of Equalization. They import those into your financial transaction. If you have a manual tax process, maybe they’re putting tax tables in there. And then when the time comes, you’re getting data out of that application in order to file with the state. And sometimes, the state is going to come check up on you. They might audit you to make sure you’re getting this process right.

Let’s look at Colorado, a home rule state. Now, you’ve got the same process happening here at the state level. But here’s where it gets complex. Home rule means that the state has granted certain localities, in this case, cities, the right to administer and set their own sales tax rules and rates. Let’s see how this works. If your a business and you’re doing transactions in Denver and you’ve got to manage sales tax there, not only do you have to collect and file state sales tax, you have to get rules and rates from the city of Denver, your staff does, put in your financial application. And when the time comes, you’ve also got to file with Denver. So you’re dealing with two entities now.

So let’s say you’re doing business in Denver and Boulder, whether you’re retail outfit and you’ve got physical locations in each city or you’re doing e-commerce, but you have a tax obligation in both places. Now, you’ve got three entities where you have to go and get rules and rates, and you have to file with these three entities when the time comes. By the way, the cities can also audit you for sales and use tax. So in just one state, you can be dealing with multiple audits. There are 70, currently, 70 cities in Colorado that have this home rule status and are administering their own sales tax rules and rates.

But think about this. In the entire U.S. there are 46 states that have a state sales tax. So on a state level, you’re dealing with 46 entities. But in just one home rule state, there are 70 localities that you have to deal with. And you can think of these as mini-states, because you got to deal with the same stuff, rates, filing, and audits. So you can see why home rule states are real multipliers when it comes to compliance complexity. You’ve got to watch out, because it can suck a lot of time from your staff and make them less efficient. And it can also increase your risk of error because you’re dealing with so much manual effort if that’s your sales tax process.

So if you’re doing business in home rule states and have a tax obligation, this is one area where sales tax automation really makes sense. Outsource all of that to the cloud. With something like Avalara’s AvaTax, the software will keep up on all the rules and rates in each place where you’re doing business, state and city and across the U.S. so you don’t have to spend time doing that. In addition, with Avalara Returns, it will automatically file for you with the correct state agency on time. So you’re going to save massive amounts of time here, making your staff more efficient and decreasing your risk of manual human error so that, when you get audited, you’re more likely to have a clean bill of health.

I hope this helps explain home rule, John. And if you’re doing business in a home rule state, watch out. We really recommend compliance here– and sales tax software.

Thanks very much. I’ll see you next time.