Managing Compliance Documents in Avalara CertCapture Just Got Better

If you were excited when we announced the addition of Single Sign-On and advanced reporting, you’re going to love CertCapture 6.5. The latest release of our compliance document management platform includes a host of improvements to help companies more seamlessly manage sales tax exemption certificates, excise licenses, and Forms W-8 and W-9.

What’s New in CertCapture 6.5?

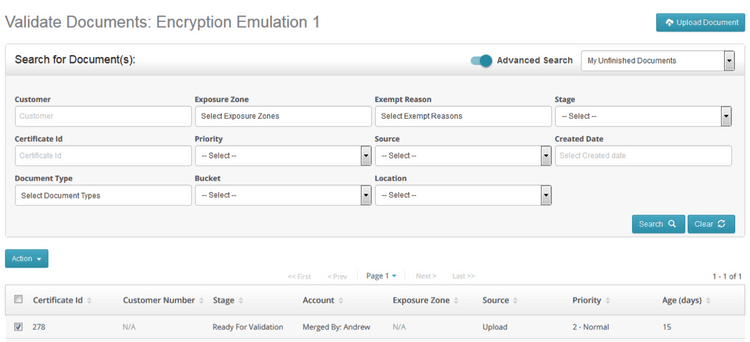

Instant access to compliance documents — With an advanced tagging and categorization structure, you can now access and update individual documents instantly. Whether you need to validate a federal withholding form or verify a customer’s tax-exempt status to complete a retail transaction, CertCapture 6.5 makes it easy to locate, extract, review, approve, and validate the correct document within seconds.

Track Excise Licenses — We redesigned the platform to support excise license numbers in addition to resale exemption certificates and federal excise forms. Now, you can store those ID numbers right within customer accounts according to exposure zones—no more maintaining complex spreadsheets!

Improve the customer experience — When a renewal request is sent from CertCapture, your customer will now see precisely which compliance documents need to be updated. There’s no confusion as to how many forms require immediate attention; customers can quickly update the ones that are highlighted at the top of the list and then move on with their days.

Future-date documents — When saving and validating documents, you can now set the effective date to a past or future date and control when the document is active. Post-dated forms are placed in a staging area until the effective date, at which time the compliance document will be immediately activated and added to the account.

These are the highlights of our latest enhancements to CertCapture, although there are many others. For example, new design features make it easier than ever to interact with the platform on mobile devices. We’ve also made it easier to manage multiple document types, such as excise licenses and exemption certificates within the same account, and added new widgets to enhance graphical reporting so you can analyze your tax compliance documentation data in many different ways. In addition, we are rolling out a host of advanced security policies and procedures and will be taking part in a voluntary Service Organization Control (SOC) 2 audit to maintain the highest level of protection possible for sensitive data stored in CertCapture.

We're committed to making CertCapture the best place to manage all your sales tax compliance documentation. Request a demo to see these new features in action, or let us know what you think about the changes in the comments below.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.