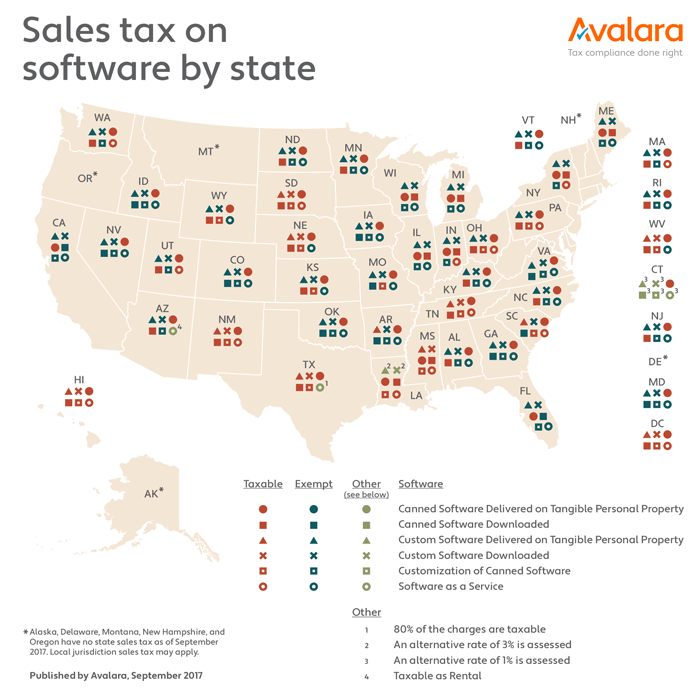

Sales tax on software: a visual guide by state

Update 11.13.2018: The taxability of software is always in flux. Learn about some recent changes in Taxing sales of SaaS in the post Wayfair world.

Like the lines and lines of code that power a smartphone app, the world of software taxability is highly complex. Your finance team likely already grapples with rules so nuanced they seem to spring from another language entirely, especially if your company handles sales tax manually.

Is your business getting it right across all the states where you sell?

In the U.S., there are numerous different ways to tax software based on a host of distinct categories. No state or district, at least among those with an established sales tax, exempts all software sales, making tax compliance increasingly complex for growing software companies.

To complicate matters further, lawmakers tend to root software taxability rules in old legal codes written long before something like software as a service (SaaS) even existed. So to say that many of the rules governing software taxation lack clarity is a bit of an understatement. In fact, they can get quite muddy.

Some states or districts, such as Tennessee, South Dakota, and Washington, D.C. tax all software sales. But, in most, it’s a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property — an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

This map offers a complete picture of software sales tax rules for all 50 states and Washington, D.C. Use it as an initial check to determine if your compliance strategy has any potential gaps.

The what (type of product), the how (delivery method), and the where (in which state or district) all factor into the way your products are categorized in terms of software taxability.

It can be a real eye-opener to discover that your accounting platform needs to apply tax accordingly when software is downloaded versus delivered on a disc. Some states tax the former, and some don’t. As for the latter, it’s taxable countrywide, and it all comes down to that disc. A disc is tangible personal property, something (or some thing) on which all states and Washington, D.C. levy sales tax. Therefore software sold on a disc is taxable, assuming you have nexus — the obligation to collect and remit sales tax — in the state.

Taxing downloadable or SaaS software is likely to become more widespread, too, with states feeling the squeeze of the digital age. The more consumers gravitate to streaming or downloadable purchases, the less tangible personal property there is to tax. For that reason, this map could change tomorrow, or anytime in the future as states hunt for more ways to secure sales tax revenue. And why wouldn’t they look to the growing, billion-dollar software industry as a source of additional tax dollars?

It all adds up to an ongoing complication for your business, as you endeavor to apply the right tax to the right transaction at the right time, amid changing regulations. Of course, keeping up with software taxability rules is only one piece of the puzzle. It’s imperative for best-in-class software businesses to have a sales tax strategy that enables — rather than slows — growth.

Interested in learning more about sales tax rules for software? Check out this map in Part 1 of The Software Executive’s Guide to Sales Tax.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.