New report takes a swipe at how states tax software sales

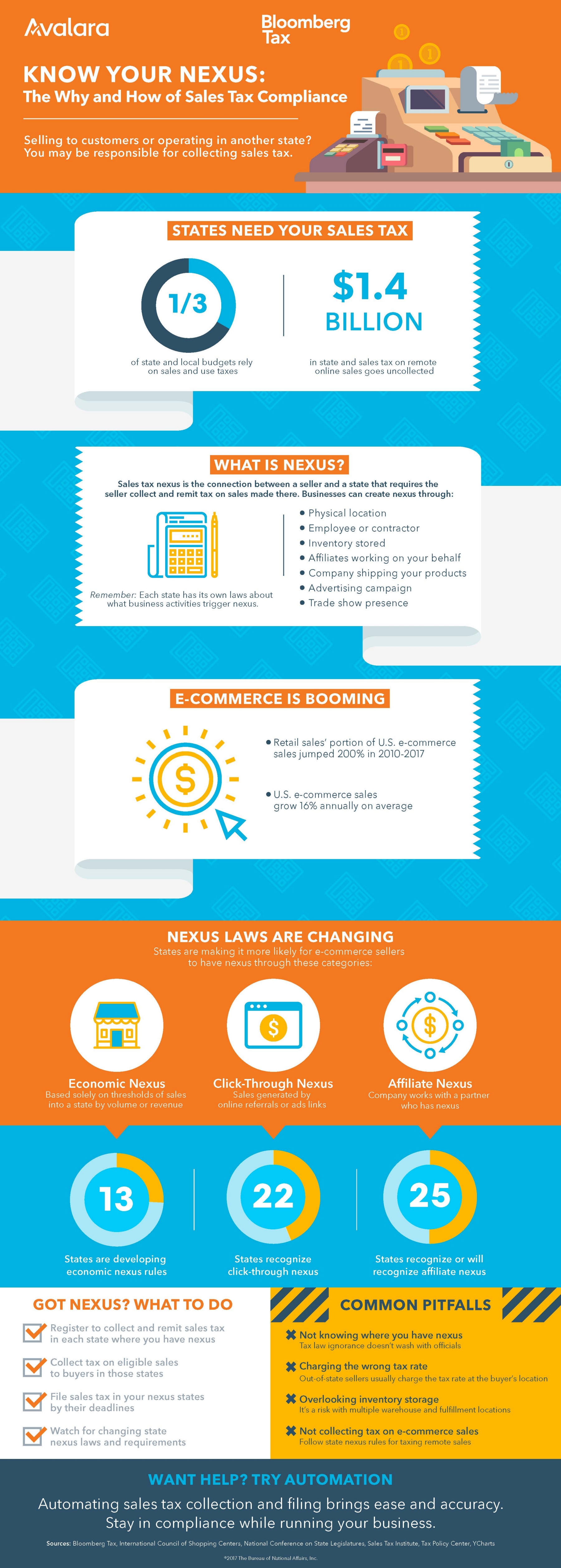

The days of courtship are over for sales tax nexus. What used to be a fairly buttoned-up relationship between sellers and states is now much more casual. Lost revenue from remote sales and laissez-faire federal laws have states more interested in playing the field than playing by the rules.

A survey of all 50 state tax departments in the U.S. published last year by Bloomberg BNA shows that there are now more than 120 different ways in which businesses can create a taxable connection to a state requiring them to collect and remit sales tax in that state. Read the report on nexus and multistate taxes for software companies and get a good look at nexus’s evolution below:

Keeping on top of nexus is difficult for any growing company. But it goes a step beyond for sellers of software and software-related services. Sales tax used to apply only to physical goods. A more services-centric economy and a surge in digital commerce challenged this assumption, forcing states to reexamine tax policies. But rather than clarifying the issue, lack of continuity from state to state creates more confusion, resulting in a square-peg-round-hole problem for software companies attempting to retrofit tangible property taxability rules and nexus to intangible products and services.

These challenges and more are addressed in detail in Nexus and Multistate Taxes: A Brave New World for Software Firms.

Avoid falling out with state taxing authorities over sales tax nexus with Avalara. Our tax automation software marries easily with your existing financial systems and matches up sales data with nexus obligations.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.