Amazon to share third-party seller information with Rhode Island

Rhode Island’s Non-Collecting Retailers, Referrers, and Retail Sale Facilitators Act took effect August 17, 2017, but until yesterday, it’s barely caused a blip in the news. Now Amazon says it will disclose the names and addresses of its third-party sellers to the Rhode Island tax authority — and sellers are taking note.

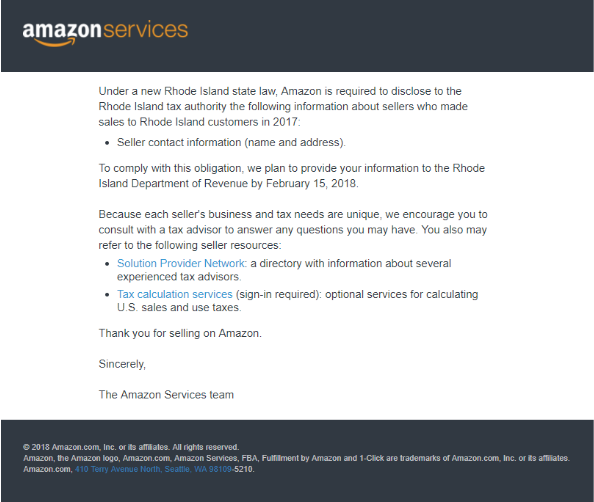

As Amazon explained in its notice to sellers, “Under a new Rhode Island state law, Amazon is required to disclose to the Rhode Island tax authority the following information about sellers who made sales to Rhode Island customers in 2017: Seller contact information (name and address). To comply with this obligation, we plan to provide your information to the Rhode Island Department of Revenue by February 15, 2018.”

Fulfillment by Amazon (FBA) and other third-party sellers are trying to sort out what this means. Why does Rhode Island want this information? Is Rhode Island going to come after them for tax on their 2017 sales? Why doesn’t Amazon collect and remit Rhode Island sales tax for its sellers like it now does in Washington? Does this have anything to do with the South Dakota online sales tax bill pending review by the Supreme Court of the United States?

These are valid questions.

Why is Amazon giving Rhode Island this information now?

Under Rhode Island’s Non-Collecting Retailers, Referrers, and Retail Sale Facilitators Act, a retail sale facilitator must annually provide the Rhode Island Division of Taxation with:

- A list of names and addresses of retailers for whom it collected Rhode Island sales tax, and

- A list of names and addresses of retailers that used its services but for whom it did not collect Rhode Island sales tax.

According to the Rhode Island Division of Taxation, this reporting requirement applies to retail sales facilitators (e.g., Amazon) that:

- Use in-state software to make retail sales in Rhode Island, or

- Contract or agree with a retailer to list and/or advertise taxable goods/services in Rhode Island, and directly or indirectly collect payments from in-state customers and transmit payments to a retailer.

We don’t know why Amazon is complying with this law, which is unusual in that it has nothing to do with fulfilment centers or warehouses. Laws in Massachusetts and Ohio that base a tax collection obligation on the presence of in-state software are being challenged. But Rhode Island isn’t asking Amazon to collect tax on its third-party sales — it’s just asking Amazon to share the identities of its third-party sellers. And Amazon doesn’t only use in-state software to make retail sales in Rhode Island. It also lists/advertises taxable goods for retailers and collects payments from their in-state customers.

Check out Rhode Island to tax out-of-state retailers, referrers, and sale facilitators for more detailed information about the law. Additional information is also available from the Rhode Island Division of Taxation.

What is Rhode Island going to do with this information?

Rhode Island’s new law also imposes tax collection or notice and reporting requirements on non-collecting retailers that, in the immediate preceding calendar year, earned either $100,000 in gross revenue from the sale of taxable goods or services in Rhode Island, or made 200 or more separate sales transactions in the state. The Division of Taxation defines “non-collecting retailers” here. Rhode Island could use the information it obtains from Amazon to confirm that its third-party sellers are meeting these requirements.

According to Scott Peterson, Vice President of U.S. Tax Policy and Government Relations at Avalara, states are legally entitled to obtain data that confirms companies doing business in the state are collecting the proper tax: “Rightly or wrongly, in just about every state, and perhaps in every state, the ability to engage in business is conditioned upon compliance with the law. One of those laws is the ability for the government to evaluate (audit) compliance with the law.”

How does Rhode Island’s action compare to what’s happening in other states?

Rhode Island isn’t the only state seeking information about Amazon’s third-party sellers. As one seller noted yesterday in a Seller Central forum, Amazon sent a similar notice to FBA sellers that make sales in Massachusetts. At the end of January, Amazon complied with what it called a “valid and binding legal demand” to provide even more detailed information to the Massachusetts Department of Revenue: names, addresses, federal tax ID numbers, and phone numbers.

However, Amazon took a slightly different approach in Washington. Instead of complying with the state’s onerous new use tax notice and reporting requirements, it opted to collect and remit tax on its marketplace sales starting January 1, 2018. Learn more about that here.

In the coming months, Amazon will be faced with how to respond to a new Pennsylvania law that holds marketplace facilitators liable for tax on third-party sales. The law requires remote sellers, referrers, and marketplace sellers with at least $10,000 in annual taxable retail sales in Pennsylvania to register to collect and remit Pennsylvania tax by March 1, 2018, or to comply with non-collecting seller notice and reporting requirements. Notice and reporting requirements can be burdensome; learn more about them here.

Does this have anything to do with South Dakota’s online sales tax law?

The Supreme Court of the United States has agreed to hear a challenge to South Dakota’s online sales tax law that requires businesses that make more than 200 separate sales of taxable goods or services in South Dakota in a year, or at least $100,000 from sales of the same, to collect and remit South Dakota sales and use tax.

South Dakota is directly challenging the physical presence precedent upheld by the Supreme Court in Quill Corp. v. North Dakota, 504 U.S. 298 (1992), which has prevented all states from taxing retailers that don’t have a physical presence in the state. Non-collecting remote vendors have become legion thanks to the explosion of ecommerce, which occurred after the Quill decision. The fact that the court has agreed to take the case suggests it’s willing to reconsider the physical presence standard. If the Supreme Court reverses its decision in Quill, FBA sellers could face new reporting requirements nationwide.

While some states are taking a wait-and-see-what-the-court-does approach, others are moving forward with their own efforts to increase remote sales and use tax collections. Notice and reporting requirements, which the Supreme Court let stand in Colorado, seem to be effective: Amazon, Etsy, and Walmart are all complying with Washington’s law; Massachusetts now has FBA sellers’ information in hand; and Rhode Island will soon know the identities of all of Amazon’s third-party sellers.

What’s the next step for non-collecting third-party and FBA sellers?

In its notice, Amazon encourages sellers to consult with a tax advisor. This is sound advice. It also suggests sellers look into tax calculation services, such as those provided by Avalara. These greatly facilitate sales and use tax compliance, particularly for businesses making sales in multiple states.

Learn more about automating tax calculation services at Avalara TrustFile.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.