State legislation for online sales tax is all over the map

As the push to tax internet sales intensifies across the United States, online retailers should keep a watchful eye on where they’re obligated to register and collect sales tax. The day may soon come when most ecommerce sellers are required to collect and remit in all sales tax states. Are you ready?

Right now, precedence holds that a state cannot tax a business unless it has nexus with (i.e., a physical presence in) the state. But numerous states have long challenged this limitation, last upheld by the Supreme Court of the United States in Quill Corp. v. North Dakota, 504 U.S. 298 (1992). Indeed, many have already enacted laws that stretch the definition of nexus to tax more out-of-state sellers, while others are considering such legislation in 2018.

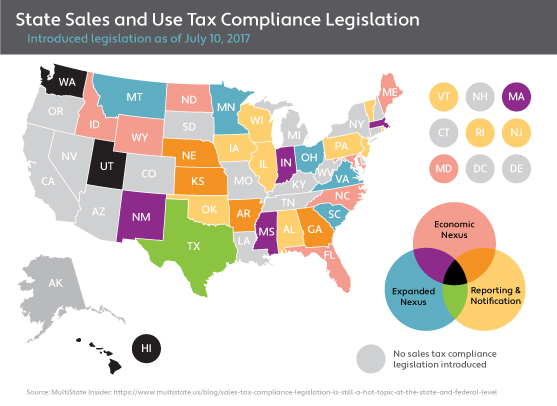

To increase tax collections from remote sales, states generally propose one or more of the following:

- Economic nexus: doing a certain amount of business in a state triggers a tax obligation

- Expanded nexus: a tax obligation is triggered by a relationship with an in-state affiliate (affiliate nexus), referrals from in-state persons (click-through nexus), or even the placement of web cookies or other software on in-state computers

- Non-collecting seller use tax notice and reporting: certain non-collecting sellers are required to 1) notify consumers that sales tax isn’t being collected and may be due; 2) provide annual purchase reports to customers; and 3) provide annual customer information reports to the state

As evidenced by this map from MultiState Insider (July 2017), this creates a dizzying array of state sales and use tax laws and makes sales and use tax compliance extremely challenging for ecommerce sellers. It isn’t enough to know what you’re doing that could trigger a tax collection obligation; you need to stay on top of what the states are doing — and planning to do — to increase their remote sales tax revenue.

Given the mercurial nature of legislation, no such map is evergreen. Since July 2017, some of the proposed measures shown on the map were enacted, others were killed. And since the start of 2018, some type of remote sales tax legislation has been introduced in several states, including Hawaii, Idaho, Iowa, Missouri, and New York. You get the point.

Supreme Court to reconsider what constitutes nexus

Individual states may well strive to find a solution that works best for them, but they remain constricted by the physical presence standard. Quill gives businesses an avenue to challenge state laws that tax out-of-state sellers, and many have. Yet until recently, none of these challenges threatened the status quo.

That changed on January 12, when the Supreme Court agreed to hear a case that directly challenges the physical presence standard upheld in Quill (South Dakota v. Wayfair, Inc.). The court will hear arguments on April 17 and is expected to issue a decision in June. If it overturns Quill, states could have more freedom to tax sales by out-of-state sellers. This could result in more economic nexus laws like South Dakota’s.

Getting sales tax right is essential for all retailers. For ecommerce businesses making sales in multiple jurisdictions, sales tax compliance can consume a great deal of time and resources: You can’t simply set it once and forget it. However, automating sales tax calculation and remittance facilitates compliance for businessses of all sizes in all states.

Learn more about Quill and why it matters in this on-demand webinar.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.