Wyoming changes sales tax rules for remote sellers

Add Wyoming to the list of states that have new sales tax requirements.

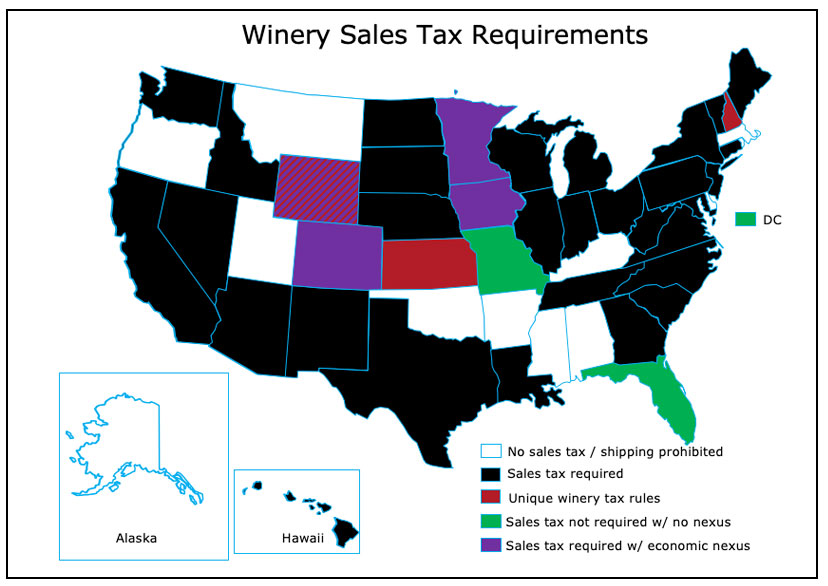

As a result of the Wayfair Supreme Court decision, Wyoming will require some remote and on-line sellers, including wineries that hold a Wine Shipment Permit, to collect and remit Wyoming sales tax effective February 1, 2019. Under the new rules, a winery that has gross revenue from sales into Wyoming exceeding $100,000 or 200 or more transactions into Wyoming the preceding calendar year must pay both sales (up to 6%) and excise (12% “markup” on wine) taxes on direct-to-consumer wine shipments into the state.

Note that wineries meeting the thresholds for sales tax collection may obtain an exemption from collecting sales tax for wine shipped directly to a licensed retailer in Wyoming because the retailer will then collect the sales. Wineries looking to obtain the sales tax exemption should contact the Wyoming Department of Revenue Excise (Sales & Use) Tax department.

The Department of Revenue mailed out personalized notices in late December to wineries that neared the thresholds in 2018. The notification provided the historical timeline of Wyoming’s Wayfair rules (Act 41 and the associated W.S. 39-15-501 in which a consent judgement ruling on November 2, 2018). The letter also details specific actions required of all recipients regardless of whether they meet the Wayfair economic nexus thresholds. Those that received the letter should take one of the following actions.

- If you believe your company does not meet the statutory thresholds; send a written notice that you are not subject to this Act must be mailed/emailed no later than January 21, 2019 to:

Written Notification:

Wyoming Department of Revenue

Attn: Terri Lucero, Administrator, Excise Tax Division

122 West 25th Street

Cheyenne, Wy 82002

Email Notification:

Terri.lucero@wyo.gov

- By January 21, 2019 complete the Wyoming Sales Tax License to begin collecting sales taxes payments on February 1, 2019.

If those that were notified fail to respond as requested above by January 21, 2019 the Department of Revenue will assume they do not intend to comply with the Act. A similar notification has been posted on Wyoming Department of Revenue website.

If at some point in the future if the nexus thresholds are met, the company would be required to complete the Wyoming sales tax license and begin collecting and remitting tax at that time. No back taxes for completed sales earlier in the calendar year or under the threshold requirement.

Learn more about Avalara's Beverage Alcohol solution here.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.