Connecticut to tax digital products, plastic bags, and more

He didn’t get everything he wanted, but mere months after taking office, Connecticut Governor Ned Lamont has managed to push through some substantial sales tax changes. That’s no mean feat.

As of July 1, 2019, more remote sellers are required to collect and remit sales tax on Connecticut sales. Admissions taxes to a variety of events venues are lower, and they’ll drop further starting July 1, 2020. The per-ride fee imposed on transportation network companies like Lyft and Uber is higher. The real estate conveyance tax no longer applies to certain sales.

Retailers in Connecticut don’t have to deal with a tax on sweetened beverages, which was proposed but didn’t make the final cut. However, they will have to collect a single-use plastic bag fee come August 1, 2019.

Starting October 1, 2019, taxes on digital goods and services as well on taxes on prepared meals will increase in Connecticut. There will be higher taxes on alcoholic beverages — except beer — and lower taxes on beer sold to-go by craft breweries. Vaping products will be subject to tax for the first time, and short-term home rental facilitators like Airbnb and HomeAway will be required to collect and remit occupancy taxes on behalf of hosts.

More specifics are provided below.

New requirements for remote sellers. As of July 1, 2019, remote sellers with $100,000 in sales and at least 200 transactions in a 12-month period must collect and remit Connecticut sales tax. Prior to that date, the threshold was at least $250,000 in sales and 200 or more retail sales and systematic solicitation in the state in a 12-month period.

Lower tax on admissions. Admissions to many events venues in the Constitution State were taxed at 10 percent prior to July 1, 2019; they’re now taxed at either 7.5 percent or 5 percent (depending on the venue). The 7.5 percent admissions tax rate will drop to 5 percent starting July 1, 2020, while admissions taxed at 5 percent will become exempt.

Higher tax on Lyft and Uber. The per-ride fee on transportation network companies increased from 25 cents to 30 cents on July 1, 2019.

Tax break for crumbling foundations. Sales of principal residences with crumbling foundations are exempt from the real estate conveyance tax as of July 1, 2019.

Plastic bag tax. Businesses are required to charge a 10-cent fee for every single-use plastic bag provided at checkout starting August 1, 2019. Hopefully this will encourage consumers to bring their own bags, because single-use plastic bags will be banned at checkout come July 1, 2021.

Higher tax rate on digital goods and services. Categorized as computer and data processing services, digital goods and services are currently subject to a 1 percent sales and use tax rate. As of October 1, 2019, the full Connecticut state sales tax rate of 6.35 percent will apply.

Higher taxes on prepared meals and beverages. Meals and beverages sold by a caterer, eating establishment, or grocery store are subject to an extra 1 percent tax starting October 1, 2019, for a total rate of 7.35 percent.

Increased taxes on alcohol sales. The tax on sales of alcoholic beverages (except beer) will jump by 10 percent starting October 1, 2019. That same date, alcoholic beverage tax on beer sold to-go by craft breweries will drop by 50 percent. Starting January 1, 2020, only the first 15 barrels served a year at a craft brewery taproom will be exempt.

New tax on e-cigarettes and vaping products. A 40-cent per milliliter tax on vaping products takes effect October 1, 2019, as does a 10-percent tax on the wholesale price of vaping “juice.”

Tax collection requirement for home rental marketplaces. Connecticut already requires many marketplace facilitators to collect and remit tax on sales made through the marketplace. Starting October 1, 2019, home rental marketplaces will have to collect occupancy taxes on behalf of their hosts.

Additional product taxability changes will take effect at the start of the new year. Effective January 1, 2020, sales of the following (currently exempt) will be subject to Connecticut sales tax:

- Dry cleaning and laundry, with the exception of coin-operated laundry

- Interior design services

- Metered and other previously exempt parking (will this include parking at federal, local, and state parks?)

- Safety apparel

More details about these and other tax changes are available in Public Act 19-117 and from the Connecticut Department of Revenue Services.

Sales tax software helps businesses of all sizes manage sales tax compliance in all states. Learn more.

Avalara Free Tax Guides

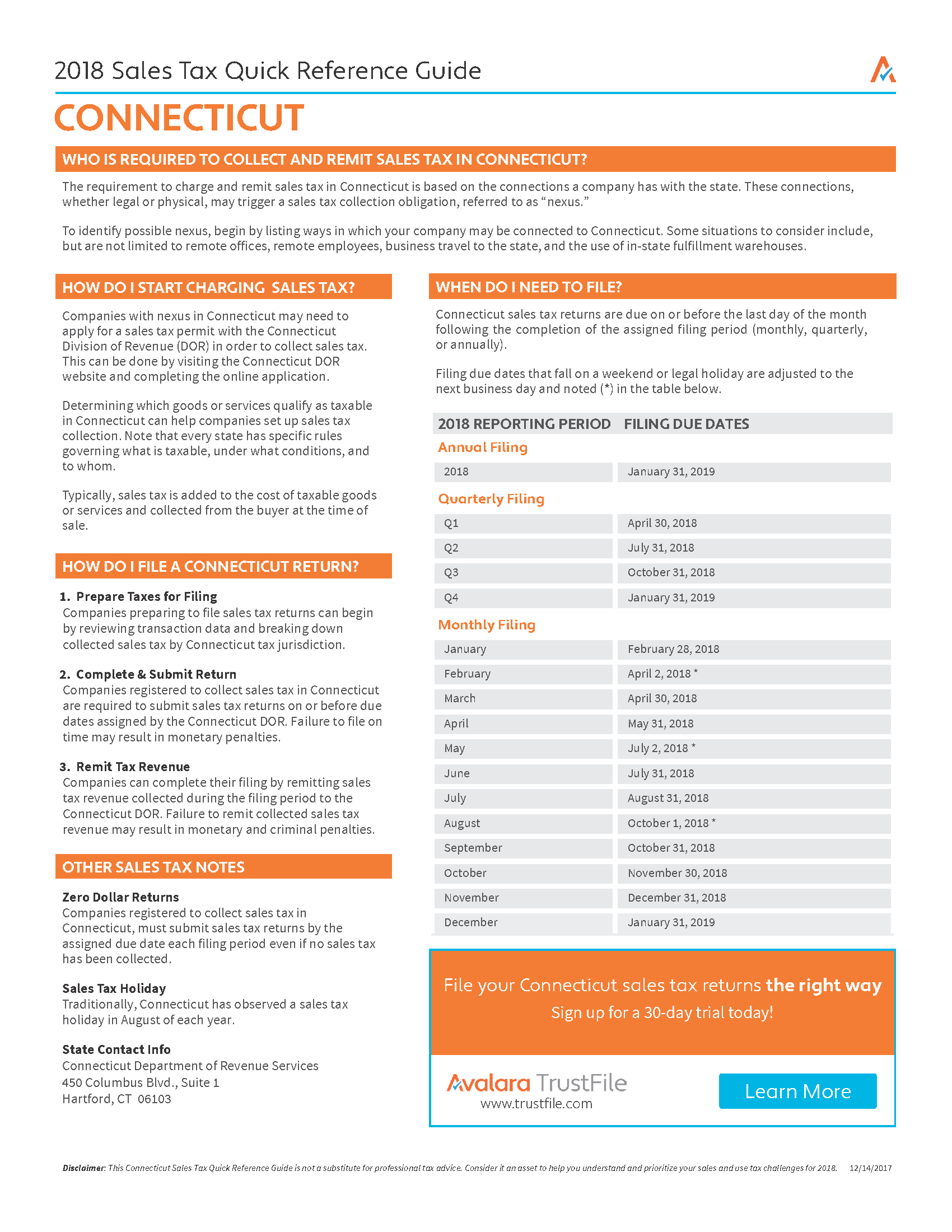

Connecticut Sales Tax Reference Sheet

A handy reference for businesses filing Connecticut sales tax returns.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.