Marketplaces required to collect sales tax for sellers in Wisconsin

Update 10.14.2019: The collection requirement for marketplaces takes effect January 1, 2020, not October 1, 2019, as previously reported.

Wisconsin already requires certain out-of-state sellers to collect and remit sales tax. Starting January 1, 2020, certain marketplace providers will be required to collect and remit the tax due on third-party sales.

Economic nexus in Wisconsin

Sellers with no physical presence in Wisconsin (remote sellers) have been required to collect and remit Wisconsin sales tax since October 1, 2018, if they have more than $100,000 in gross revenue from Wisconsin sales or at least 200 separate transactions in the state in the current or preceding calendar year.

Sales of products and services, both taxable and exempt, should be included in the threshold count.

Basing a sales tax collection obligation solely on economic activity is known as economic nexus. States won the right to enforce economic nexus when the Supreme Court of the United States ruled in favor of the state in South Dakota v. Wayfair, Inc. (June 21, 2018). Prior to that decision, states could only tax sales by businesses with a physical presence in the state. (The ruling did not change physical presence sales tax nexus.)

Marketplace sales tax collection requirement

Under Act 10, marketplace providers or facilitators must collect tax on all sales made through the site.

The new law makes marketplace providers liable for “the tax imposed … on the entire sales price charged to the purchaser, including any amount charged by the marketplace provider for facilitating the sale, from the sale, license, lease or rental of tangible personal property, or items, property, or goods … or services … .” Marketplace providers must inform third-party sellers that the marketplace is collecting and remitting sales tax on their behalf.

The state will hold marketplace providers liable for failure to properly collect and remit sales tax unless it relied on incorrect information received from the marketplace seller. In that case, the state may audit the marketplace seller.

Marketplace sellers registered with the Wisconsin Department of Revenue may claim a deduction for sales on which tax was collected by a marketplace provider.

Waivers

Marketplace providers that only facilitate sales of taxable goods and services on behalf of marketplace sellers that operate under a hotel, motel, or restaurant brand name shared by the provider and seller may apply for a waiver to relieve them from collecting and remitting tax on these sales.

Additionally, the Department of Revenue may grant a waiver to other marketplace providers that can demonstrate marketplace sellers have “a history of reliably collecting and remitting to the department the tax” due. More details are provided in the text of the act.

New law, old policy

According to a Wisconsin Department of Revenue web page dated March 28, 2014, sellers using distribution facilities in Wisconsin are liable for Wisconsin tax on their sales, even if they’re “located outside Wisconsin and do not have their own business location or employees in Wisconsin.”

However, a department web page dated May 2, 2016, states, “An online marketplace seller [engaged in business in Wisconsin] that sells taxable products owned by a third-party seller on its website may be liable for Wisconsin sales or use tax on its Wisconsin sales.” The page explains that “the third-party seller may also be liable for the tax, but this does not relieve the online marketplace seller of its liability to remit the tax.”

The department then notes an exception to the rule: The definition of “retailer” was amended effective July 14, 2015, “to allow an online marketplace to make sales … on behalf of third-party sellers, without becoming liable for tax on such sales if the online marketplace or one of its affiliates operates a distribution facility.” This exception doesn’t apply when a customer takes possession of taxable products “at a location (i.e., storefront) operated by the marketplace or one of its affiliates.”

Act 10 of 2019 repeals the provision that excludes a person or its affiliates from the definition of “retailer” when all the following conditions apply:

- The person or its affiliates make taxable sales in Wisconsin

- The person or its affiliates operate a distribution facility

- The person or its affiliates sell taxable products on behalf of a third-party seller

- The third-party seller owns the taxable products and is named the seller

- Customers cannot take possession of purchases at a location operated by the person or its affiliates

The department provides more information about remote sellers, marketplace sellers, marketplace providers, and sales tax on the Remote Sellers Common Questions page. As of this writing, that page has not been updated to account for Act 10.

It’s hard to keep up with changing remote sales tax requirements. Avalara’s new sales tax laws by state resource page can help.

Avalara Free Tax Guides

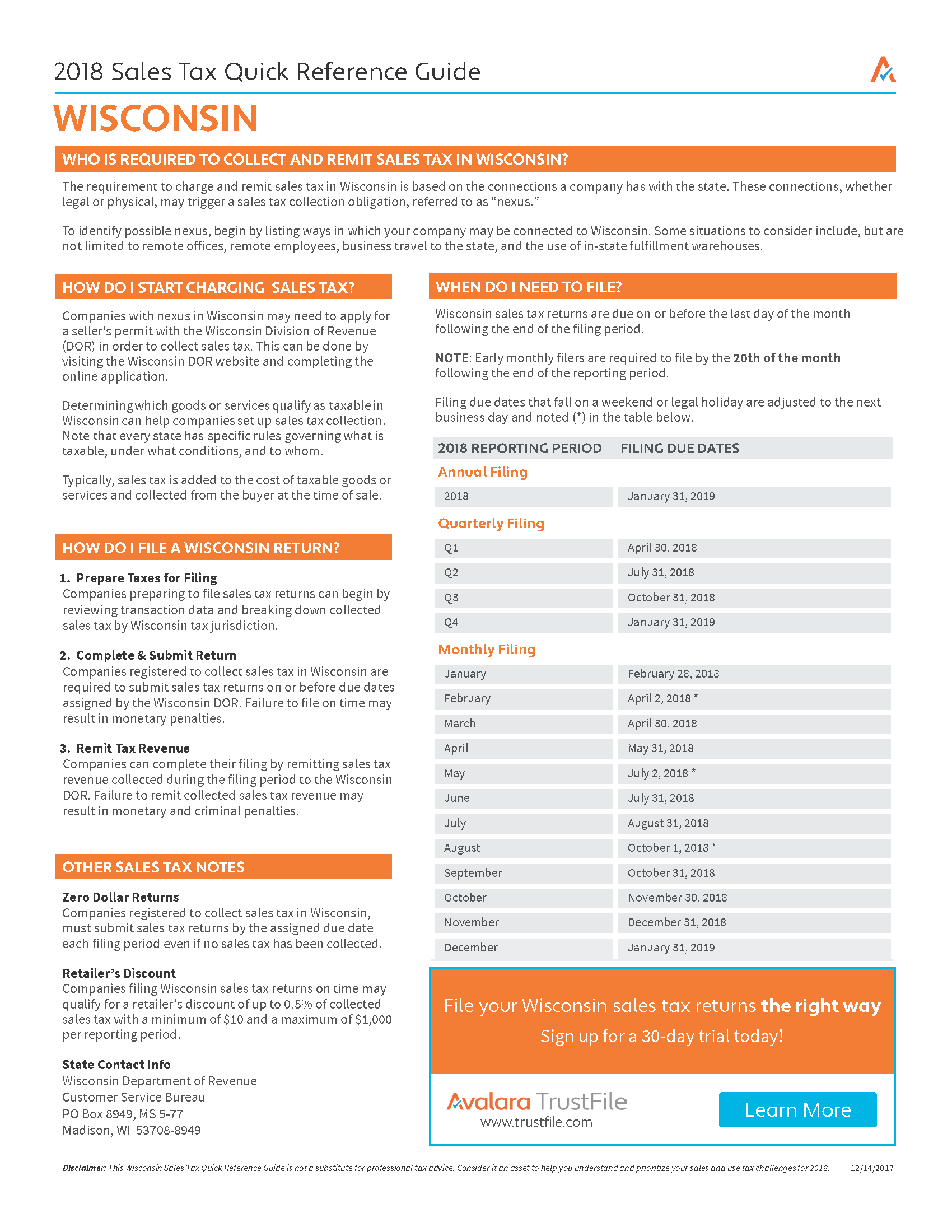

Wisconsin Sales Tax Reference Sheet

A handy reference for businesses filing Wisconsin sales tax returns.

Download a Free Copy

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.