What our data has to say about COVID-19’s impact on consumer spending in April

We’ve been monitoring spending changes that have taken place since most of the world’s population went under stay-at-home orders, starting mid-March. In March, our customers’ data showed us the most in-demand products and services were those that could be digitally sourced to help consumers navigate their new normal at home, with industries supporting home activities like exercise and learning seeing a 100% increase or more in transactions. For a full recap of our customers’ data from March, we’ve put together a full report of our findings here.

When we first conducted this analysis, we looked at the usage of our tax calculation systems for the last two weeks of March after stay-at-home orders went into effect and compared it to usage prior to COVID-19 (the average of the last two weeks in January and February). After calculating the percent change between those two data sets for each Avalara customer, we identified two cohorts of customers categorized by industry grouping:

- Customers with the highest increase in traffic

- Customers with the highest decrease in traffic

To measure the ongoing impact, we added usage from the last two weeks of April to our initial analysis.

This analysis only includes customers that were active during all reported periods. Some data points may have changed based on active Avalara customer accounts when compared to earlier reports.

When we compared the change in usage between March and April, some findings were consistent over the two months. For example, consumer spending for boats and boating accessories continued to increase in April — up 86% in March from pre-COVID-19 and up 261% in April from pre-COVID-19. At a high level, our customers’ April data showed a continued increase in spending on products and services that can be digitally sourced to help consumers navigate their new normal at home, with industries like exercise and home improvement supplies experiencing 100% increases or more in customer traffic when compared to transaction rates prior to COVID-19.

Key takeaways and insights

Consumer spending on at-home resources and entertainment continue to rise in April when compared to pre-COVID-19 data

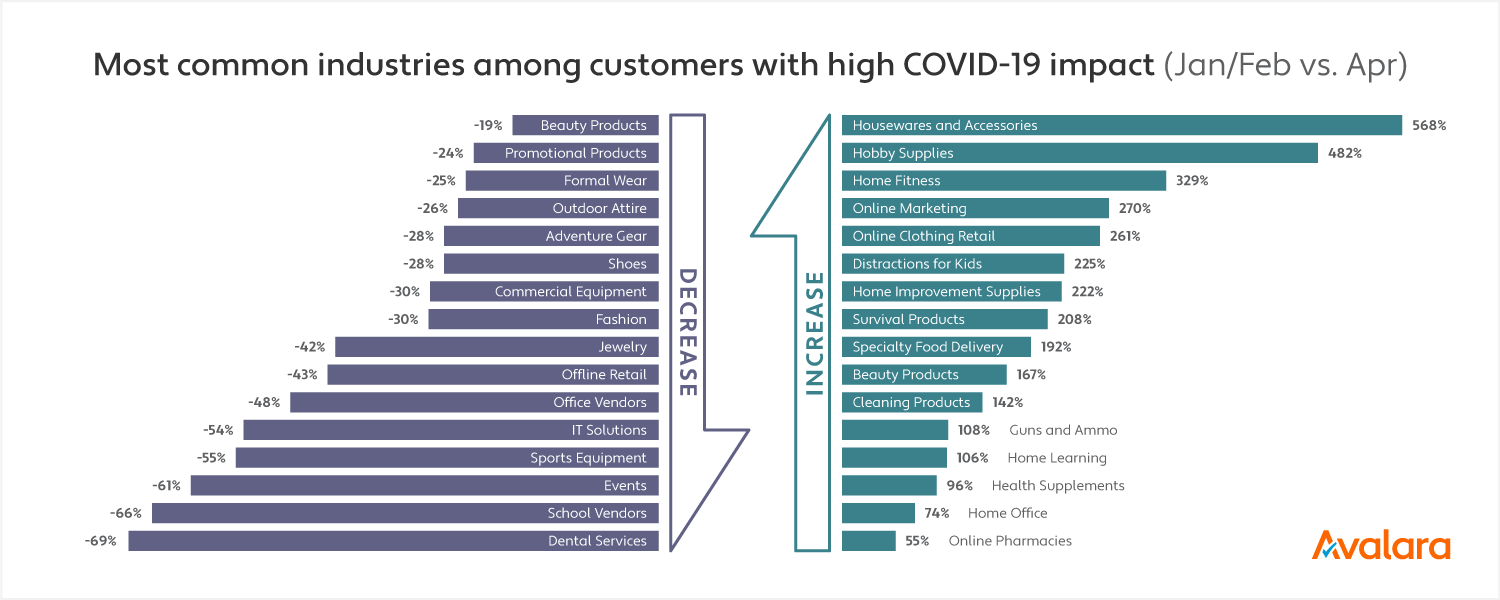

All data points in the next three sections represent the average percentage of change in transaction rates of the studied customers by cohorts in April 2020 when compared to pre-COVID-19 grouped by industry.

When we compared our customer data from April with spending trends in January and February, we saw trends consistent with the industries that saw significant growth in March.

- Housewares and Accessories. The rate of transactions for housewares and accessory products increased by 568% in April when compared to January and February.

- Hobby Supplies. The rate of transactions of hobby supplies, like arts and crafts, collectible car parts, and drones, rose by 482% in April in comparison to January and February.

- Home Fitness. The rate of transactions for home fitness products and services increased by 329% in April in comparison to January and February.

Spending on in-person services continued to see the greatest rate of decline when compared to pre-pandemic data

While consumer spending with “nonessential” businesses began to shift upward in April when compared to March, our customers’ data showed that spending on in-person products and services continued to decrease in April when compared to January and February.

- In-Person Services. The rate of transactions for in-person services, like tanning and beauty salons, home healthcare services, and photo portraits, decreased by 83% in April in comparison to January and February.

- Security. The rate of transactions for security products, including safes, gates, and home security systems, decreased by 72% in April in comparison to January and February. With more people staying home, they’re spending less on security-related services.

Our customers’ data also showed a continued decline in the rate of transactions for in-person business spending. Industries like events, office vendors, and commercial equipment all continued to see a decrease in the rate of transactions in April when compared to January and February.

We then looked closely at changes in our customer data in April when compared to pre-COVID-19 data.

Consumer spending on at-home resources started to decline for products without significant recurring costs

All data points in the next three sections represent the average percentage of change in transaction rates of the studied customers in March and April 2020 when compared to pre-COVID-19 grouped by industry.

Comparing April usage to pre-COVID-19 helped us confirm the trends we saw in March were not a flash in the pan. Having confirmed the ongoing impact for customers with the largest increases and decreases in traffic during the pandemic, we also looked at how traffic for those same customers trended from March into April for more granular insights.

When comparing our customers’ data in April to pre-COVID-19, we found consumer spending for many of the industries that saw an increase in March continued to grow, but the rate of growth slowed significantly. Many products consumers ramped up spending on at the onset of the pandemic, like home office supplies and guns and ammunition, have minimal recurring costs once purchased and set up.

Consumer spending on at-home products that can be used on an ongoing basis continued to increase in April

Despite a slowdown in consumer spending across some products used for time spent at home, many industries saw continued growth in April. Products that help people fill added free time at home, like home improvement supplies, home fitness, distractions for kids, and special food delivery, saw a high rate of continued growth in April.

Unlike at-home products that are purchased once and require minimal recurring costs, some industries lend themselves to extended time at home. These purchases include those that help people stay busy, cater to having to eat more at home, and subscription services.

We all know dogs are loving having their humans at home with them more during this time, but evidently, they’re also using this time to enjoy a few extra treats and meals. Purchases for pet food surged in April, up 204% from pre-COVID-19 data.

Consumer spending on outdoor-related products began to rebound in April

As summertime approaches, our customer data showed that consumer spending on products commonly used outdoors began to recover in April. After seeing a stark decline in purchases during March, the rate of decline in product purchases for outdoor attire, adventure gear, and sunglasses slowed in April when compared to pre-COVID-19 data.

- Outdoor attire. The rate of transactions for outdoor attire, like bathing suits, hats, and sundresses, declined by 26% in April in comparison to pre-COVID-19 data. However, the decline in consumer spending for these products improved by 42% from March.

- Adventure gear. The rate of transactions for adventure gear, like car racks, rain jackets, and backpacks, declined by 28% in April in comparison to pre-COVID-19 data. However, the decline in consumer spending for these products improved by 18% from March.

- Sunglasses. The rate of transactions for sunglasses declined by 47% in April in comparison to pre-COVID-19 data. However, the decline in consumer spending for these products improved by 14% from March.

The beginning of summer wasn’t great news for all industries. In fact, the rate of transactions for home learning solutions slowed by 180% in April when compared to March. However, the rate of transactions in April were still up in comparison to pre-COVID-19 data.

Consumers and businesses appear to spend more on “nonessential” businesses in April

While many vendors that were deemed “nonessential” or otherwise closed due to stay-at-home orders took a major hit in March, our customers’ data showed that consumer and business spending on a range of products and services began to rebound in April. From promotional products to offline retail, an uptick can be found at points throughout the offline business supply chain.

- Offline retail. The rate of transactions for offline retail purchases still trended down by 8% in April in comparison to pre-COVID-19 data. However, the decline in consumer spending for these products recovered by 58% from March.

- Promotional products. The rate of transactions for promotional products, including branded merchandise, such as pens, mugs, and T-shirts, decreased by 24% in April compared to pre-COVID-19 data. However, the decline in consumer spending for these products recovered by 39% from March.

- Formal wear. The rate of transactions for formal wear decreased by 25% in April when compared to pre-COVID-19 data but rebounded by 40% from March.

The increase in transactions for primarily in-person or “nonessential” businesses was exclusive to the comparisons between March and April. April traffic for these “nonessential” businesses is still down 24–69% compared to pre-COVID-19 levels, but compared to March, recovery has begun.

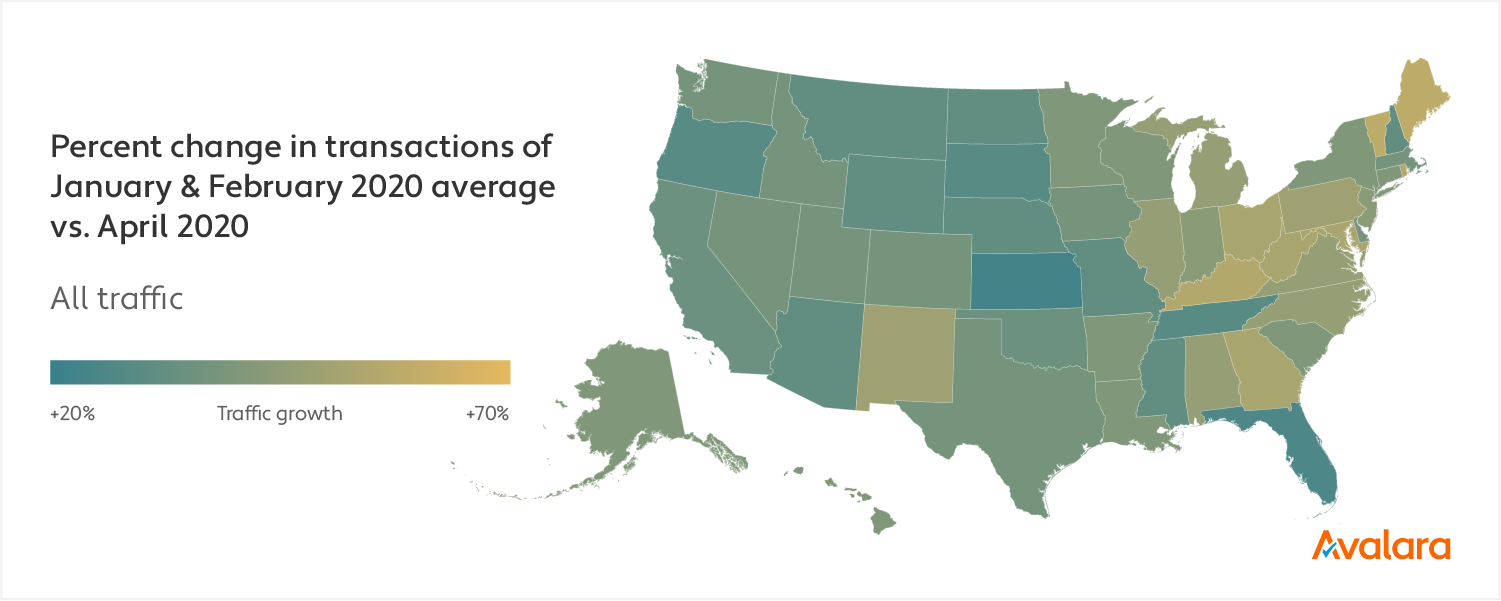

State-by-state consumer spending changes pre-COVID-19 to April

When looking at data prior to the pandemic compared to April, our team found that April numbers were significantly higher than in January and February despite stay-at-home orders and other restrictions that were in place during the month. However, all 50 states and the District of Columbia saw an increase in the rate of transactions in April when compared to pre-COVID-19 data.

When looking at individual states, Vermont, Maine, and Puerto Rico saw the greatest rate of increase in April compared to pre-COVID-19 data. It’s important to note that January and February are historically slower months for consumer spending during normal circumstances.

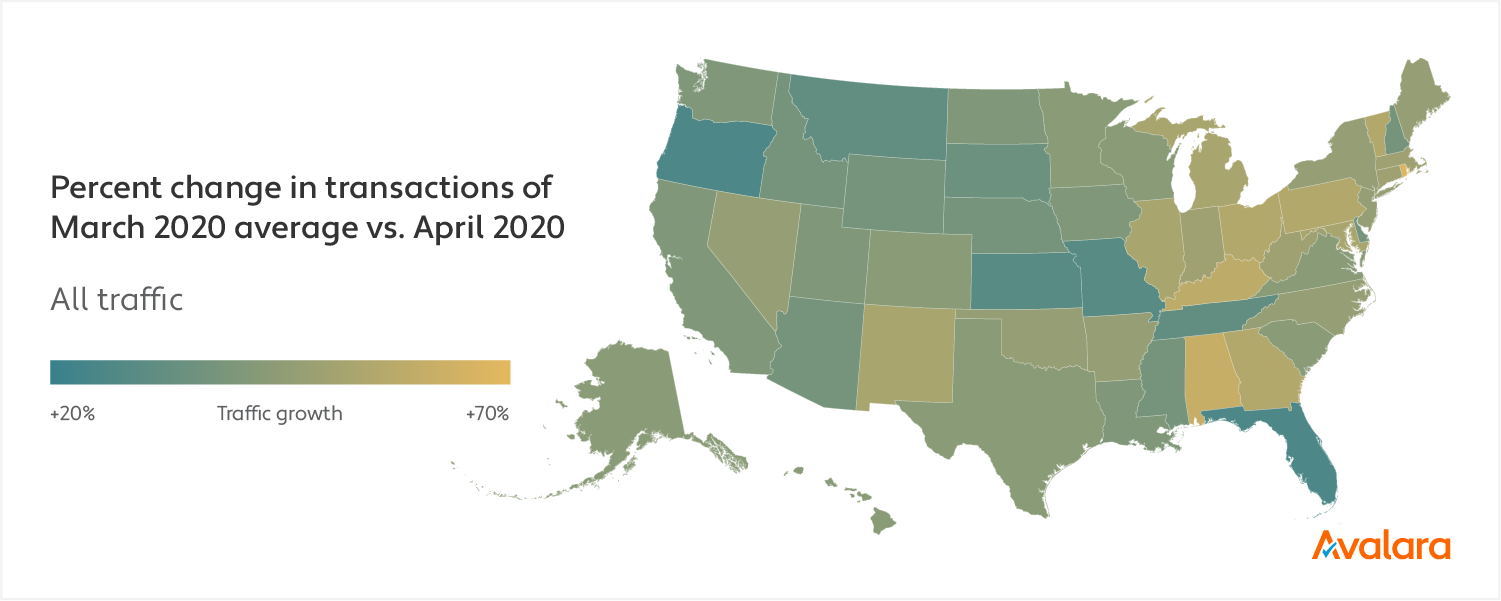

Impact on traffic by state month over month

Our team has also been following the impact of COVID-19 on consumer spending by state since the beginning of the pandemic. In March, we unsurprisingly found that the majority of states saw a decline in overall spending. However, in April, most states saw a significant increase in consumer spending, with some states seeing an average increase of 64% when compared to March. Rhode Island, Alabama, and Kentucky saw the highest increase in April and Oregon, Florida, and Kansas saw the lowest increase in spending when compared to March.

Avalara serves businesses across the United States and around the world. Additional resources for businesses to help understand and navigate this crisis can be found on our COVID-19 resources hub.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.