Survey reveals state of finance during COVID-19

It’s been more than three months since the World Health Organization declared COVID-19 a global pandemic. Since then, governments and communities have joined together to “flatten the curve” by closing buildings, limiting social interaction, and increasing testing. Likewise, companies and organizations have had to spring into action to support their employees, customers, suppliers, and investors throughout the crisis. As companies and organizations put measures in place to mitigate the impact of the pandemic and communicate their COVID-19 response to customers, employees, partners, and key stakeholders, their CFOs and finance teams play an integral role in the stabilization of businesses, while preparing their organizations for the future.

Survey examines the impact of COVID-19 on the finance profession

To determine the extent of COVID-19’s impact on finance professionals and understand how their priorities have changed in the wake of the pandemic, Avalara partnered with Zuora to survey hundreds of finance professionals in the United States and abroad. Survey respondents range from entry level to CFO (individual contributor, management, upper management, executive, controller, CFO, etc.).

The survey sought to:

- Measure the impact of COVID-19 on businesses and business performance

- Understand how finance teams are responding to COVID-19

- Gauge the impact of technology in mitigating COVID-19

- Analyze the impact on revenue from customer payment delays and cancellations

Sign up to receive the full State of Finance Amid COVID-19 report when it’s published.

Survey results

Level of concern about COVID-19

All respondents were asked about their level of concern regarding the overall impact of COVID-19 on their organization, including employee health, financial decline, and supply chain disruptions. 91% of respondents were “somewhat” or “very” concerned.

Concern by business impact

The level of concern about specific business impacts varied across respondents. Unsurprisingly, decreased revenue and profit was the top concern among respondents.

- Decreased revenue/profit — 49%

- Decreased customer acquisition/retention — 21%

- Staffing changes (layoffs, paid leave, etc.) — 13%

- Supply chain disruptions — 9%

- Cost containment — 4%

- Loss of employee productivity — 4%

Concerns of a second wave of COVID-19

When asked about the level of concern about the forewarnings of a recurrence or second wave of COVID-19, 90% of respondents noted they’re “somewhat” or “very” concerned.

Cost-cutting measures in response to COVID-19

When asked if their company had to make any cuts or changes to expenditures as a result of COVID-19 impacts, responses varied across employee/personnel, marketing/sales, and technology expenses. Respondents were asked to select all that apply.

- Marketing/Sales expenses — 59%

- Employee/Personnel expenses — 49%

- Technology expenses — 31%

- Not applicable/I don’t know — 21%

- Other — 11%

Similarly, when asked about financial relief measures, the majority of businesses have taken advantage of business support loans and tax relief measures. Specifically:

- Business support loans — 43%

- Tax or duty relief (deferments, delays, penalty/interest waivers) — 36%

- Jobs retention scheme — 23%

- Utility fee waivers — 5%

- Not applicable/I don’t know — 25%

- Other — 6%

Respondents were asked to select all that apply.

Priority finance functions amid COVID-19

Those surveyed were asked how their priorities shifted in the wake of COVID-19. Respondents were prompted to select the top three functions that increased in priority for them. The top three responses overall included:

- Managing cash flows — 57%

- Collections and payments — 48%

- Forecasting and metrics — 45%

Other top responses included billing and invoices (23%), headcount planning (15%), and revenue protection and sales promotions (14%).

Respondents were asked to choose the top three functions that have become a priority during COVID-19. They were asked to choose from the following list: audits, billing and invoicing, business intelligence, closing the books, collection and payments from customers, financial reporting, forecasting and metrics reporting, headcount planning, managing cash flows, pricing and packaging strategies, product line profitability analysis, quotes and orders, revenue protection and sales promotions, revenue recognition, securing credit, supply chain management, tax compliance and other regulatory requirements, and other.

Interestingly, respondents noted that the same finance functions that have become a priority during COVID-19 have also become a priority to automate or migrate to the cloud. The top three functions included:

- Billing and invoicing — 33%

- Collection and payments — 28%

- Forecasting and metrics reporting — 28%

Impact of finance technology solutions

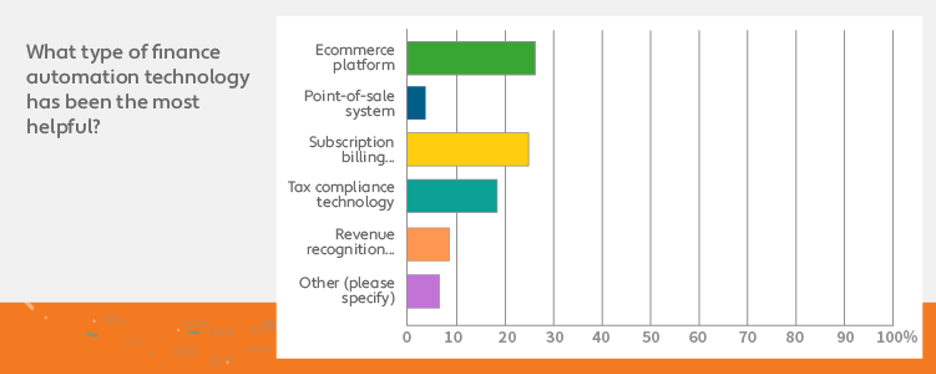

To understand how tools and technology are being leveraged throughout the pandemic and the resulting impact, respondents were asked to discuss how technology is helping and what types of solutions have been the most effective.

Of those surveyed, 47% noted that finance automation technology (ecommerce platforms, point-of-sale systems, tax compliance software, subscription billing software, etc.) has helped their business handle the financial changes that came with COVID-19.

The top three types of finance automation technology respondents have found to be the most helpful included:

- Ecommerce platforms — 36%

- Subscription billing software — 25%

- Tax compliance technology — 18%

Impact of customer delays and cancellations

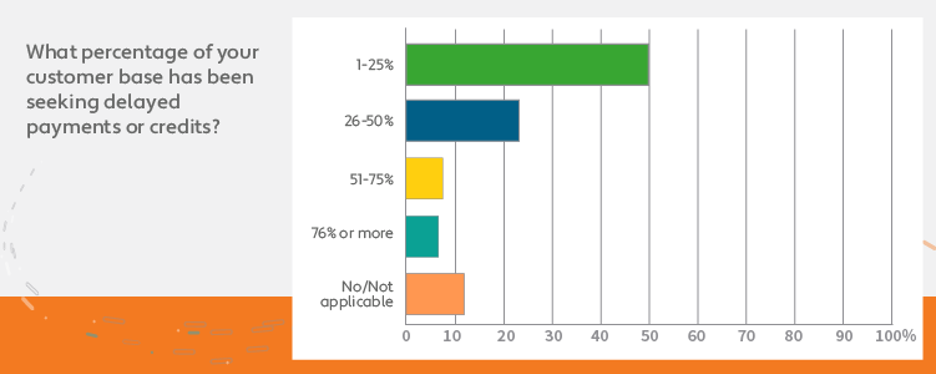

Of those surveyed, 60% responded that their customers have sought delayed payments and/or credits for their services during the pandemic.

When asked what percentage of customers requested delayed payments and/or credits, the majority of respondents said that less than a quarter of their customers have made those requests.

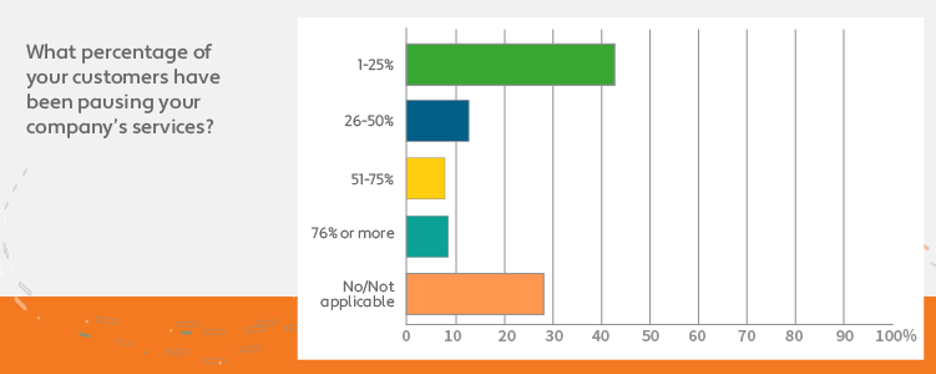

Responses were similar when asked what percentage of customers have paused services during this time.

Impact of delayed payments, credits, and/or cancellations on revenue

According to survey results, 70% of respondents said their revenue has been impacted in some way due to delayed customer payments, credits, and/or cancellations.

- My revenue has been impacted significantly — 29%

- My revenue has been slightly impacted — 41%

- My revenue has remained unaffected — 18%

- Not applicable — 12%

Key takeaways

Finance automation technology has helped during the pandemic

The survey found that nearly half of respondents (47%) found finance automation technologies to be very helpful in handling the changes that came along with the pandemic. When asked which types of finance automation technology have been the most helpful, the top three responses were ecommerce platforms (36%), subscription billing software (25%), and tax compliance technology (18%).

Interestingly, while many respondents have seen the value of technology during this time, 32% also stated that their companies have had to make cuts to technology expenses as a result of the economic impact of COVID-19. Further, while tax compliance technology was among the top technologies that have helped finance professionals during this time, only 7% of respondents said that tax compliance has been a priority for them since the onset of COVID-19.

Cash flow is critical to COVID-19 response

A major takeaway from the survey is that companies are focusing heavily on maintaining an incoming flow of cash. Respondents were asked to select the top three finance functions that have increased in priority for them during COVID-19 and 57% cited managing cash flows as a top priority for their teams. Similarly, when asked about their company’s current level of cash flow, the majority of respondents (64%) noted they’ve seen a reduction in cash flow at their companies.

As companies work to respond to the immediate challenge posed by the pandemic, there’s a strict focus on understanding the risks to their business, while protecting their employees and continuing to serve customers. As the survey results show, finance teams are focusing heavily on the influx of cash into their business to support their company’s rapid response to the pandemic.

Another key takeaway is that finance teams are focusing heavily on customer retention and payment collections.

Customer retention is having an increased impact on revenue

Seventy percent of respondents noted that delayed customer payments, credits, and cancellations have impacted their revenue in some way. Unsurprisingly, 48% of respondents also said that collections and payments from customers have become a top priority during COVID-19. As businesses work to manage cash flow during the pandemic, finance teams are putting added emphasis on collecting customer payments and managing other disruptions, like cancellations.

While most respondents said that delays in customer payments and cancellations are having an impact on revenue, most companies are only seeing a small portion of customers pause services or seek delayed payments or credits. Half of the respondents said that 1–25% of their customer base has seen delayed payments or credits, while 43% of respondents cited the same percentage for customers pausing services. Despite a small portion of customers changing their service levels or spend with companies, the majority of finance professionals are seeing an impact on their overall revenue.

Methodology

Respondents were Avalara and/or Zuora customers who held finance-related job titles at the time of surveying. Data was gathered from approximately 400 different respondents for roughly one month from May 4, 2020, to June 5, 2020.

Avalara serves businesses across the United States and around the world. Additional resources for businesses to help understand and navigate the tax implications of the COVID-19 pandemic can be found at our COVID-19 tax news and resources hub.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.