Introducing the Avalara Commerce Monitor

2020 has had an impact on business and commerce that’s likely to last for years to come. Due to the pandemic, consumer spending and business operations have been anything but normal. At Avalara, we’ve been monitoring trends and keeping track of changes across industries through the lens of our customers’ transactions. Throughout the year we’ve seen the acceleration of ecommerce, widespread adoption of at-home subscriptions, and much more. As a result, we’ve created the Avalara Commerce Monitor — analysis from the Avalara index tracking system that monitors segments of the United States economy across the manufacturing, retail, and services industries.

The Avalara Commerce Monitor is designed to derive insights and trends for the U.S. economy across each industry vertical based on indexed cohorts of Avalara customers. The indices are representative of the U.S. with equal distribution across four key U.S. Census regions: Northeast, Midwest, South, and West. The Avalara Commerce Monitor will deliver quarterly updates with insights from prior months to highlight trends in consumer spending and economic performance. You can read the first Avalara Commerce Monitor report here.

Key findings

The first edition of the Avalara Commerce Monitor found that the pandemic has had significant impacts across manufacturing, retail, and services sectors. Key findings include:

Manufacturing

Manufacturing sales rebounded after May as the industry adapted to COVID-19 protocol and states began reopening. After hitting a low on the Avalara Commerce Monitor Manufacturing Index in April (82), manufacturing total sales reached a year-to-date peak in September (118). The uptick in sales in September signals the start of an earlier than usual holiday season that kicked off in October. As retailers prepared for the season, manufacturing sales reached their highest levels.

Of all three indices, manufacturing has also proved the most resilient throughout the pandemic, experiencing the least volatility and percent of change.

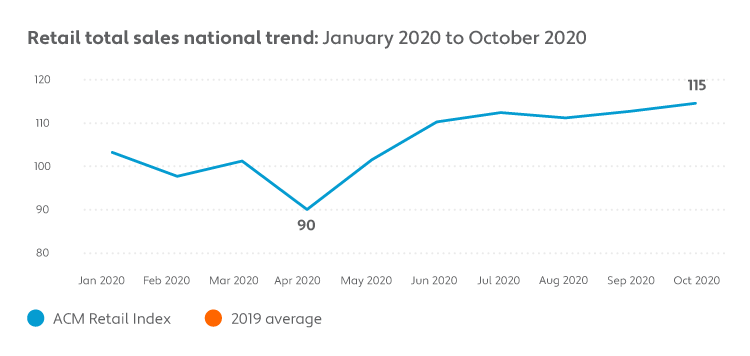

Retail

Total retail sales dropped early in the pandemic but have steadily recovered throughout the year, reaching the highest levels in October (115). The spike in retail total sales in October can be attributed to the start of the holiday shopping season, which kicked off more than a month early as retailers worked to ease the burden on their ecommerce systems and supply chains by spreading out the season over a longer period of time.

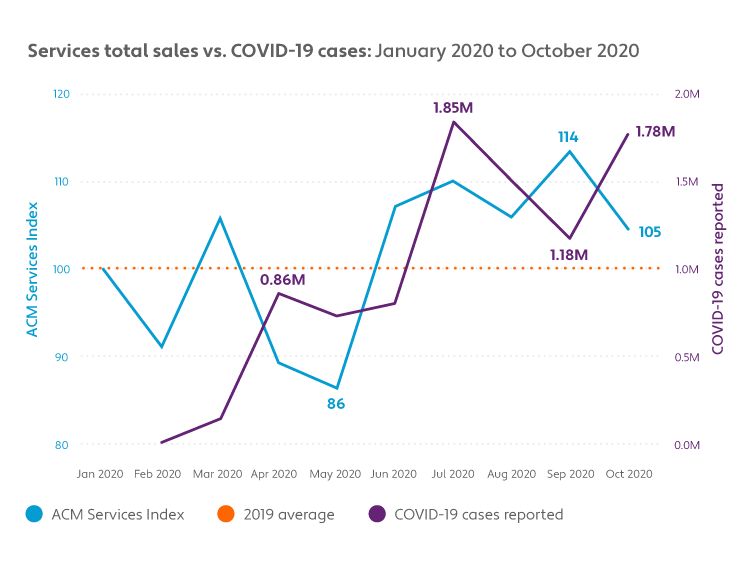

Services

The services industry has felt the ongoing impact of the COVID-19 pandemic. Total sales in the services sector have risen and fallen multiple times throughout the year. The peaks and valleys of services sales can be mapped to coincide with changes in the number of COVID-19 cases in the U.S.

*Source: United States; World Health Organization; U.S. Department of Commerce; January 22 to October 31, 2020.

Avalara serves businesses across the U.S. and around the world. Additional resources to help businesses understand and navigate the new normal can be found on our COVID-19 resources hub.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.