Finance professionals address ongoing impact of COVID-19

It’s been one year since COVID-19 began its insidious spread throughout the world, transforming the way we live and do business. There have been times when restrictions on movement and activities — adopted to limit the spread of the virus — brought economic activity to a near standstill.

In June, the World Bank stated the pandemic “represents the largest economic shock the world has experienced in decades.” Its December year-in-review summary paints an equally grim picture, though it finds “a glimmer of good news” in the fact that many firms are committed to retaining staff, even if hours and wages must be reduced. Another positive: Digital technology is helping businesses worldwide survive.

A survey of finance professionals in the United States and Europe also found technology to be a boon in these difficult times.

Survey studies COVID-19’s ongoing impact on finance profession

To determine COVID-19’s impact on finance professionals and their companies, Avalara and Zuora surveyed 400 financial professionals from a range of industries in Europe and the U.S. Respondents were Avalara and/or Zuora customers with finance-related job titles, ranging from entry level to CFO and including individual contributors, management, executives, and controllers.

The initial survey was conducted May 4–June 4, 2020. It’s goal:

- Measure the impact of COVID-19 on businesses and business performance

- Determine how finance teams are responding to the pandemic

- Gauge how technology is mitigating the impact of COVID-19

- Analyze the pandemic’s impact on revenue flows

On September 16, a group of survey respondents joined other global finance professionals at a virtual roundtable examining the state of finance during COVID-19. It was hosted by Todd McElhatton, CFO of Zuora, and Mike Rinehart, vice president and corporate controller at Avalara. Liz Armbruester, senior vice president of global compliance at Avalara, moderated the discussion.

The resulting Finance Report 2020 shares information gleaned from both the survey and roundtable, so it’s both quantitative and qualitative. It reveals challenges facing financial professionals in the past year, as well as some unexpected benefits and opportunities. Finally, it highlights new trends that could last long after the pandemic is over — a day that must surely come.

Financial professionals speak honestly about the pandemic

Clearly, 2020 has been a difficult year. More than 90% of survey respondents are “very” or “somewhat” concerned about the impact of COVID-19 on their business.

Liquidity is the #1 priority

Cashflow is a main area of concern among finance professionals. Of the survey’s respondents, 60% have experienced delayed customer payments or had requests for service credits.

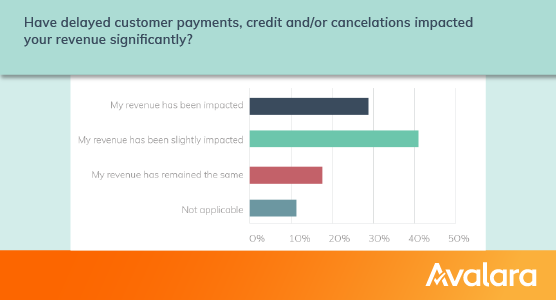

Delayed payments are hurting revenue

Revenue streams are hurting. Respondents reported that 88% of their customers have sought delayed payments or credits. And 71% of respondents had customers temporarily pausing services. Although challenging for our respondents’ businesses, roundtable participants generally favored allowing customers to pause services; customers appreciate the flexibility.

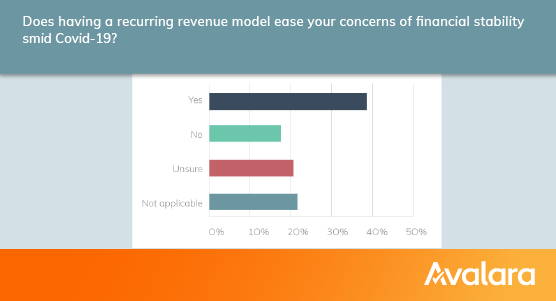

Subscriptions are saving the day

Businesses with recurring revenue streams have generally fared well despite the pandemic. In fact, a Subscribed Institute report from June 2020 found 4 out of 5 subscription companies have grown since the start of 2020. Close to 40% of survey respondents expressed that having a recurring revenue model eased their concerns over financial security.

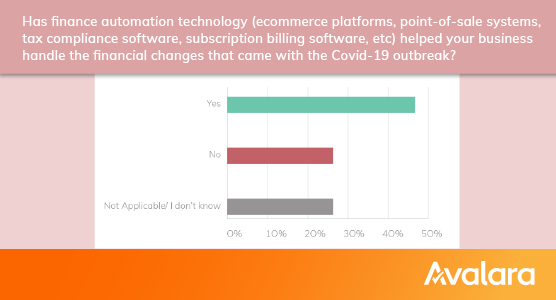

Technology is helping businesses cope

Many expense categories have suffered during the pandemic, including technology investments. That said, finance teams seem to be leaning more heavily on process automation technology. In fact, 47% of respondents believe automation has helped their business handle financial changes incurred by COVID-19.

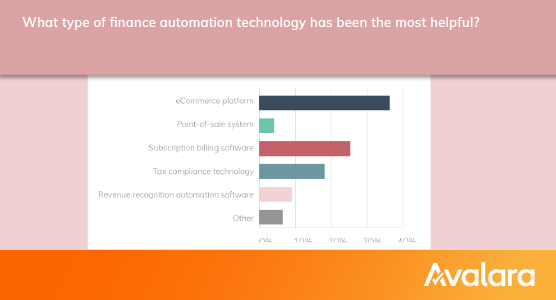

Ecommerce platforms were cited as the “most helpful” type of finance technology. This stands to reason, since in-person sales have suffered due to COVID-19 while ecommerce has grown with astounding speed: IBM’s annual U.S. Retail Index study found COVID-19 may have accelerated the shift toward ecommerce by about five years.

Subscription billing software and tax compliance technology are also being embraced by finance professionals during these challenging times. A separate survey on remote sales tax laws found nearly 4 out of 10 businesses are relying on automated sales tax software to improve compliance.

The future will hold more automation

No one knows exactly what 2021 will bring, but finance professionals plan to lean into automation technology to streamline their business. During the September roundtable, 82% of participants said they intend to increase spending on technology as the pandemic progresses.

Any solution that can help businesses improve efficiency is on the table, but 33% of survey respondents would prioritize billing and invoice automation. Another 28% of respondents think it would be helpful to automate collections and payments solutions, and 28% would move forecasting and metrics reporting to the cloud.

Get the report

The pandemic is forcing business leaders and finance professionals to examine assumptions and evaluate business systems. It’s also providing key insights into customer needs, allowing businesses to uncover new opportunities. More details are shared in the report, which is now available.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.