Retailers still grappling with fallout from Wayfair and marketplace facilitator laws

The United States Supreme Court decision in South Dakota v. Wayfair, Inc. set off an avalanche of economic nexus and marketplace facilitator laws. More than two years later, retailers of all sizes are still grappling with the debris.

Washington D.C., parts of Alaska, and 43 states require out-of-state sellers with no physical presence in the state to collect and remit sales tax via economic nexus laws. In all but one of those states, marketplace facilitators are responsible for collecting and remitting tax on behalf of third-party sellers. By the end of 2021, all 45 states with a general sales tax will likely have economic nexus and marketplace facilitator laws on the books.

Survey gauges impact of economic nexus and marketplace facilitator laws

To understand how the Wayfair decision, economic nexus, and marketplace facilitator laws are impacting businesses, Avalara commissioned NetReflector/Potentiate to survey hundreds of U.S.-based B2B businesses of varying sizes: ESBs (extremely small businesses, with fewer than 20 employees), SMBs (small to medium-sized businesses, with 20–40 employees), and UMM/ENTs (medium and large enterprises, with 500 or more employees). The survey:

- Gauges the impact of Wayfair on attitudes and behaviors

- Measures awareness, perceptions, and differences across companies of different sizes

- Monitors results over time

- Seeks to understand challenges created by economic nexus and marketplace facilitator laws

There were four fielding dates from December 2019 to December 2020. The first three waves focused on awareness and the impact of Wayfair and marketplace facilitator laws but didn’t mention “nexus” by name. In the fourth wave, respondents were asked specifically about their familiarity with “nexus,” “economic nexus,” and “physical nexus.”

Key findings

Overall, businesses are more aware of Wayfair and more affected by remote sales tax and marketplace collection requirements than previously.

This should come as no surprise. The sudden and extreme onset of COVID-19 forced businesses to move many activities online and accelerated the global shift toward ecommerce: The U.S. experienced 10 years’ worth of ecommerce adoption in just three months.

There were growing pains. Businesses of all types faced surprising supply chain issues due to shifting consumer habits, like the reduced demand for commercial (aka, large) toilet paper rolls and increased demand for home-use (aka, small) toilet paper rolls. Shelves, both virtual and in brick-and-mortar stores, emptied with alarming speed.

Main Street stores long reliant on foot traffic quickly built online stores. And many direct-to-consumer retailers found it necessary to expand into marketplaces: From July 2019 to July 2020, the number of businesses selling through Walmart’s marketplace more than doubled.

Marketplaces appeal to consumers because they offer one-stop shopping, numerous brands, and product reviews. For retailers, they can help raise brand awareness and grow sales. Marketplaces can also take over many tasks that may otherwise be overwhelming for retailers, such as order fulfillment, returns processing, even tax collection.

The pandemic has accelerated ecommerce and marketplace adoption. This, in turn, is creating new opportunities for businesses, allowing many to survive and even thrive. Yet it also exposes them to heightened tax risk because of economic nexus and marketplace facilitator laws. Read on to learn more.

How much do retailers know about Wayfair and marketplace facilitator laws?

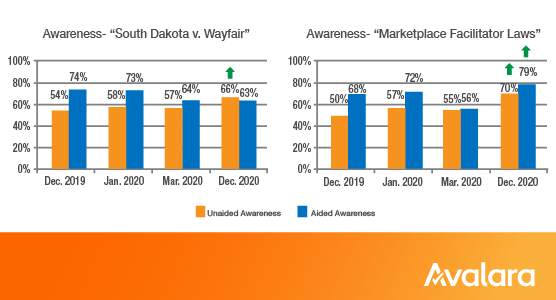

Aided versus unaided awareness of Wayfair and marketplace laws

Participants were asked whether they’d heard of the Wayfair decision and marketplace facilitator laws, and whether they understood the tax implications of the two. Respondents with “unaided awareness” had heard of them. Respondents with “aided awareness” understood their tax implications.

For the most part, both aided and unaided awareness grew between March 2020 and December 2020:

- Unaided awareness of South Dakota v. Wayfair, Inc. grew by 9%

- Aided awareness of South Dakota v. Wayfair, Inc. dropped by 1%

- Unaided awareness of marketplace facilitator laws grew by 15%

- Aided awareness of marketplace facilitator laws grew by 23%

Unaided awareness on the rise

Among the smallest sellers, unaided awareness of the Wayfair decision nearly doubled during the past year. Just 29% of ESBs surveyed had heard of Wayfair in December 2019, while 59% of respondents were aware of it in December 2020. Still, ESBs continue to be less aware of the Wayfair decision than their larger counterparts.

Unaided awareness of marketplace facilitator laws grew across all subgroups from December 2019 to December 2020:

- From 30% to 68% for ESBs

- From 56% to 71% for SMBs

- From 58% to 70% for UMM/ENTs

Aided awareness of Wayfair lags among ESBs

Interestingly, although aided awareness of the Wayfair decision increased overall, it declined for the nation’s smallest sellers. In December 2019, 54% of ESBs surveyed said they understood the tax implications Wayfair; only 37% surveyed in December 2020 could say the same. By contrast, aided awareness of Wayfair has consistently exceeded 70% among SMBs and UMM/ENTs.

While aided awareness of marketplace facilitator laws was relatively consistent across all subgroups in December 2020, ESBs experienced tremendous growth in this area. In December 2019, 54% of ESBs surveyed said they understood the tax implications of marketplace facilitator laws. By December 2020, that number had jumped to 79%.

How much have Wayfair and marketplace facilitator laws affected retailers?

Impact of marketplace facilitator laws growing

The impact of Wayfair on companies remained relatively consistent over the past year: 57% of overall respondents said they were impacted in December 2019, and 61% said they were impacted in December 2020. During that same period, the impact of marketplace facilitator laws grew. In December 2019, 45% of companies surveyed said marketplace laws were impacting their business; in December 2020, 57% said they felt their impact. Understanding of Wayfair and marketplace facilitator laws is now on par.

Wayfair and marketplace laws trigger new collection requirements

As in the previous waves, approximately half of survey respondents are collecting and filing sales tax in more states as a result of South Dakota v. Wayfair, Inc. Similarly, 50% of respondents find sales tax calculation and filing to be more complex, and 47% are spending more time managing tax calculation and filing. Forty percent of respondents say they need to hire more people because of Wayfair, and 38% feel their risk of noncompliance has grown.

Of companies surveyed in December 2020, 40% said they were currently collecting and filing taxes in more states than previously because of marketplace laws. Similarly, marketplace laws compelled 42% of companies surveyed to register in more states, and 43% to spend more time managing tax collection and remittance.

Across the board, fewer businesses reported being 100% compliant with marketplace facilitator laws in December 2020 than previously. And only 31% of ESBs surveyed believe they’re 100% compliant with marketplace facilitator laws (down from 47% in December 2019.

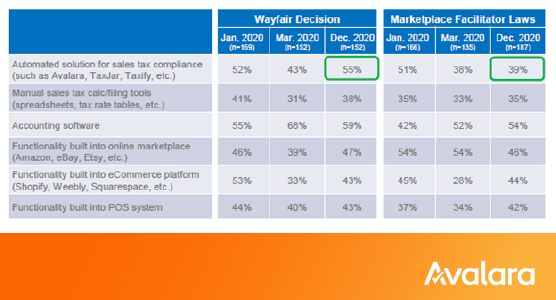

Sales tax automation solutions easing burden of economic nexus

In December 2020, 55% of survey respondents said they were using an automated solution to manage new compliance obligations triggered by South Dakota v. Wayfair, Inc. Automated solutions had been adopted by 52% of respondents by January 2020, and 43% by March 2020.

Only 39% of the December 2020 respondents were using sales tax software to help with marketplace facilitator laws. That could be because marketplace facilitators, not third-party sellers, bear the brunt of the compliance burden.

Survey dives deeper in December 2020

The December 2020 survey posed more questions than earlier waves, including:

- Has the number of states you are selling into changed in the past year?

- Are you familiar with the term “nexus” as it relates to sales tax compliance?

- Are you familiar with the difference between “physical nexus” and “economic nexus” and the tax implications of each?

While 39% reported no change, 42% of businesses surveyed said they currently sell into more states than previously. The larger the business, the more likely that was to be true: 56% of UMM/ENTs had expanded their economic nexus footprint, as compared to 8% of ESBs.

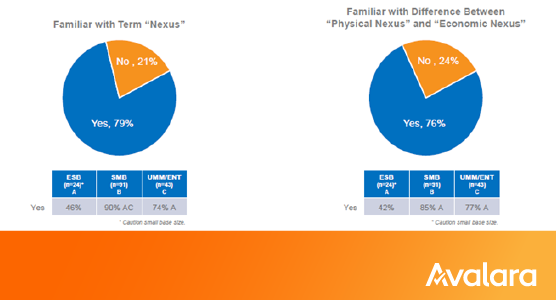

SMBs know nexus

Of businesses surveyed in December 2020, 79% said they’re familiar with the term “nexus,” and 76% understand the difference between economic nexus and physical nexus. Small and mid-sized businesses were most aware:

- 90% of SMBs said they knew about nexus (versus 46% of ESBs and 74% of enterprise companies)

- 85% of SMBs said they understood the distinction between economic and physical nexus (versus 42% of ESBs and 77% of UMM/ENTs)

Companies turn to consultants for help

More of the companies surveyed rely on third parties to determine or review their sales tax obligations than not: Between 70% and 78% of SMBs and UMM/ENTs.

By contrast, only about a third of the smallest companies surveyed are using consultants to determine or ensure their sales tax obligations.

Marketplace facilitator laws shoulder some — but not all — of the sales tax burden

Of marketplace sellers surveyed, 34% said they plan to de-register in states where marketplace facilitators collect on their behalf, while 58% plan to remain registered. The breakdown is interesting: only 10% of ESBs plan to de-register, as compared to 40% of SMBs, and 41% of UMM/ENTs.

The more you sell online, the more your risk grows

As retailers of all sizes continue to contend with the effects of economic nexus and marketplace facilitator laws, they’re facing an existential challenge: COVID-19.

Ecommerce has been a lifeline throughout the pandemic. Yet the more you sell online, the more likely you are to develop nexus and an obligation to collect sales tax in other states.

Companies of all sizes are becoming more aware of economic nexus and marketplace facilitator laws, and many are collecting and filing in more states because of them. Yet fewer than half believe they’re fully compliant with remote sales tax laws, and more than a third are concerned they’re not compliant.

Avalara helps businesses worldwide register where they have tax liabilities, streamline tax collection and remittance, manage exempt sales, and more. Visit us at avalara.com to learn more.

Survey methodology

The survey gathered information from approximately 250 extremely small businesses (ESB), small to medium-sized businesses (SMB), and medium and large enterprises (UMM/ENT):

- 26% = ESB (fewer than 20 employees)

- 50% = SMB (20–40 employees)

- 24% = UMM/ENT (500 or more employees)

All participants make retail sales and collect and remit sales tax in at least one state outside of their home state.

Fielding dates:

- Wave 1: December 19–24, 2019

- Wave 2: January 29–February 7, 2020

- Wave 3: March 27–April 17, 2020

- Wave 4: November 11–December 10, 2020

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.