Uber splashes into alcohol delivery

Shortly after Uber’s plan to acquire alcohol delivery service Drizly hit the press on February 2, online wine marketplace and wine app Vivino announced it had raised $155 million in its fourth round of funding. These two announcements signal tectonic shifts in the alcohol ecommerce industry, and shine a light on the potentially potent mix of alcohol and tax regulations, alcohol license requirements, and marketplace intricacies.

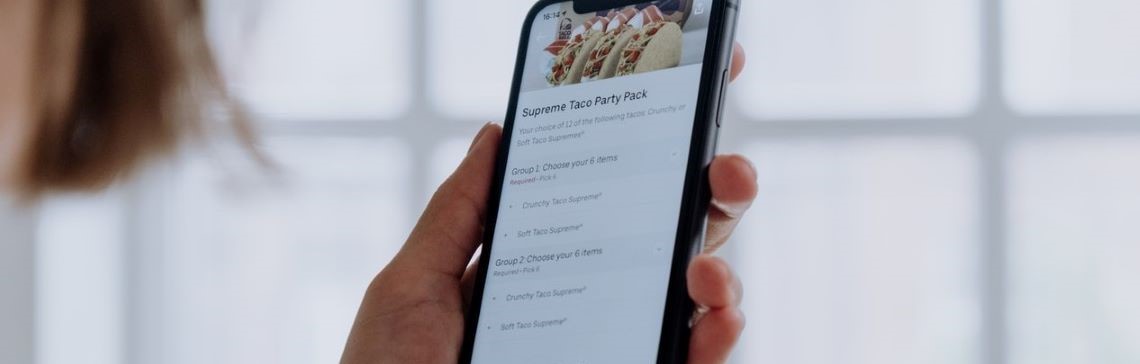

Both Uber and Drizly have felt the effects of COVID-19. While Uber’s ridership dropped dramatically due to stay-at-home orders and travel restrictions, its Uber Eats food delivery service surged. After many states limited in-person dining and drinking but relaxed restrictions on alcohol delivery, Drizly’s business more than doubled. For the two companies to join forces is a “marketplace fit,” according to TechCrunch.

Vivino’s sales also increased as a result of the pandemic. The company experienced record growth in 2020, with a 157% year-over-year increase in April’s sales alone. This is in step with the industry as a whole, which saw sales spike as consumers adjusted to life with COVID-19. Although online alcohol sales overall have dropped from their spring 2020 peak, they remain higher than pre-pandemic sales.

Clearly, there’s room to grow in this space. For online alcohol marketplaces to do so, they need to successfully navigate the intersecting requirements of marketplace facilitator laws and the beverage alcohol industry.

What is a marketplace?

Marketplaces have been around since the origin of trade; the internet merely changed their scope and reach.

Online marketplaces emerged around 1994. As with physical marketplaces, they provide a place for multiple independent third-party merchants (marketplace sellers) to sell their goods. This allows marketplace sellers to reach a wider market than they would on their own, and consumers to browse and compare products more easily.

Marketplace facilitators like Amazon and Etsy — also called marketplace providers or online marketplaces (OMPs) — provide the platform, collect money from consumers, and transfer it to sellers. Most also offer a variety of services to facilitate sales for marketplace sellers, such as expedited shipping and simplified returns processes. They may also make direct sales of their own products.

In most states, marketplace facilitators also must now collect and remit the sales tax due on all sales made through the platform, including third-party sales.

Marketplace facilitator laws

Of the 45 states with a general sales tax (plus Washington, D.C., and parts of Alaska), all but three require marketplace facilitators to collect and remit sales tax on behalf of their third-party sellers. The holdouts — Florida, Kansas, and Missouri — will likely soon follow suit.

In a sense, marketplace facilitator laws represent a departure from states’ long-standing practice of requiring sellers to collect and remit sales tax. Online marketplaces are the platform provider, not the actual seller (except in the case of their direct sales). Their physical counterpart would be the owner of the bazaar or mall: They provide the place for individual sellers to set up their stores and charge a fee for doing so, but they aren’t necessarily a seller themselves.

Yet most states now treat most marketplaces as the seller, from a sales tax perspective. This is in part due to fallout from the U.S. Supreme Court’s game-changing decision in South Dakota v. Wayfair, Inc. (June 2018), which essentially granted states the authority to require remote retailers to register with the tax authorities then collect and remit sales tax. Prior to the decision, states were largely limited to taxing sales by businesses with a physical presence in the state.

The economic nexus laws enacted in the wake of the Wayfair decision base a sales tax obligation on economic activity alone, thus allowing states to tax remote sales. But most states provide a safe harbor for the smallest sellers, requiring them to collect only after their annual sales in the state exceed $100,000, 100 transactions, or another threshold.

Many marketplace sellers don’t meet states’ economic nexus thresholds and therefore aren’t required to register and collect sales tax. Marketplace facilitator laws allow the states to capture revenue from those sales by passing the sales tax obligation from the seller to the facilitator. In fact, they generally hold that the marketplace facilitator “is considered the seller and the retailer for each sale facilitated through its marketplace,” as California’s marketplace facilitator law explains.

And so, marketplace facilitators must collect the sales tax due on third-party sales.

Why are alcohol marketplaces unique?

Just about every industry has an online marketplace today: automobiles, books, hotels, music, shoes … If you can name it, there’s probably an ecommerce marketplace for it. Beverage alcohol marketplaces are uniquely complex because of the convergence of marketplace facilitator laws and beverage alcohol laws.

Although the Prohibition era in the United States ended in 1933 with ratification of the 21st Amendment, its legacy lingers. Alcoholic beverages remain among the most highly regulated products in the U.S., though cannabis is gaining ground.

The legislative complexity surrounding the beverage alcohol industry is astounding. Overarching federal regulations work in conjunction with varying state laws governing the production, distribution, and sale of alcohol in each state. Alcohol sellers that fail to register and maintain state beverage alcohol licenses as required risk revocation of their state license, and perhaps consequences at the federal level as well.

Every alcohol seller is required to register with the following agencies:

- The Federal Alcohol and Tobacco Tax and Trade Bureau (TTB)

- State tax authorities (e.g., the department of revenue)

- State alcohol beverage control departments

Businesses interested in making direct-to-consumer (DTC) shipments of alcohol must jump over even more hurdles. In addition to the requirements listed above, every DTC beverage alcohol seller must:

- Have the appropriate direct-shipping license in all states where they sell

- Pay tax in the destination state

- Use a common carrier (e.g., FedEx or UPS) for delivery

Selling alcohol without the appropriate licenses is strictly prohibited.

So, if a marketplace is considered the seller, or at least to have “the duties of a seller,” as Texas law states, must it also be the licensee for the alcohol sales it facilitates? There’s no simple answer, and it may be something each state needs to figure out for itself.

Who should collect the tax on marketplace alcohol sales?

A brief look at California sheds light on this complex situation.

After California’s marketplace facilitator law took effect in October 2019, the California Department of Alcoholic Beverage Control (ABC) “received a number of inquiries concerning the interaction of California’s Marketplace Facilitator law and the prohibitions against non-licensees exercising license privileges, including financial control of the alcohol sales transaction.”

The ABC had long held that only licensees could sell alcoholic beverages and “exercise license privileges,” such as “controlling all aspects of the sales transaction, from ordering to the receipt of funds to delivery.” That helps explain why online alcohol marketplaces and online alcohol delivery services typically don’t control all aspects of the sale — they merely provide the platform where sellers and consumers can connect. The holder of the license fulfills the order.

But if the marketplace doesn’t control the sale, how can it collect and remit the sales tax? The ABC acknowledged the state’s marketplace facilitator law “appears to conflict with the Department’s position that only the licensee may be the ‘seller’ of the alcoholic beverages.”

Although California’s marketplace facilitator law doesn’t provide an exception for alcoholic beverages, the ABC decided in July 2020 that deeming a marketplace facilitator the “seller of record” for the purpose of collecting and remitting sales tax wasn’t in conflict with the requirement “that only licensees may be the seller of alcoholic beverages.”

It’s enough to make the head spin, like a hangover. In reviewing the whole matter, the ABC uncovered other aspects of the relationship between marketplace facilitators and licensed sellers that raised some red flags. It suggests businesses, unlicensed alcohol marketplaces and licensed sellers alike, “familiarize themselves with the Department’s prior advice.”

Other states may also end up reevaluating the intersection of marketplace facilitator and alcohol laws.

Indeed, alcohol laws nationwide are in flux. COVID-19 has compelled numerous states to relax some long-standing restrictions on deliveries of wine, beer, and even cocktails. In many parts of the country, it’s now possible to get a margarita with your fajitas or a bottle of Singha with your pad thai, even if the delivery driver is a gig worker and not an employee.

Age must be verified

Of course, this has caused some hiccups. For example, several platforms have been called out for not verifying a purchaser’s age or simply leaving deliveries on doorsteps. Regulators take that very seriously.

Relaxed regulations resulting from the pandemic have created tremendous opportunities for businesses like Uber Eats, Drizly, and Vivino. Growing pains are to be expected, and they’re exacerbated when laws seem to have conflicting requirements (like who’s responsible for obtaining alcohol licenses and collecting the tax due). States seem unsure about how to regulate this new industry, especially during this unprecedented time, and they’re wrestling with how to proceed.

The tip of the iceberg. For an in-depth analysis of the changing landscape and impacts to the tax and regulatory requirements of beverage alcohol marketplaces, be sure to keep up with our new blog series. Alcohol Marketplaces 2.0 is co-authored by Jeff Carroll, Avalara for Beverage Alcohol General Manager and Rebecca Stamey White, Partner at Hinman & Carmichael LLP.

The first post is now available: Alcohol Marketplaces 2.0 Part 1: Solicitation of sales by unlicensed third-party providers.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.