Avalara Commerce Monitor — Looking at COVID-19’s impacts one year later

On March 13, 2020, the U.S. declared the COVID-19 pandemic a national emergency. At the same time, grocery stores flooded with people stocking up amid the unknown as the virus spread across the country. In the months following, industries and businesses of all types and sizes reckoned with changes to business operations, changes in consumer habits, and impacts on the supply chain.

Early on, many brick-and-mortar businesses moved their operations online as stay-at-home orders and mandated closures swept the nation. Later in the year, as the number of COVID-19 cases continued to fluctuate, retailers had to rethink the traditional look of the holiday season. Instead of long lines on Black Friday, the holiday shopping season began as early as October 13 with Amazon Prime Day and was carried out predominantly online over the last three months of the year.

We analyzed all of these changes and more through the Avalara Commerce Monitor, which uses analysis from the Avalara index tracking system to monitor segments of the United States economy across the manufacturing, retail, and services industries.

The Avalara Commerce Monitor is designed to derive insights and trends for the U.S. economy across each industry vertical based on indexed cohorts of Avalara customers. The indices are representative of the U.S. with equal distribution across four key U.S. Census regions: Northeast, Midwest, South, and West. The Avalara Commerce Monitor will deliver quarterly updates with insights from prior months to highlight trends in consumer spending and economic performance. You can read the full Avalara Commerce Monitor report here.

COVID-19 trends in the U.S. economy

This edition of the Avalara Commerce Monitor reveals pandemic-influenced trends in our transaction data from March 2020 to February 2021 across manufacturing, retail, and services sectors.

From ecommerce acceleration to changes in consumer confidence — the Avalara Commerce Monitor uncovered five trends fueled by the pandemic that will continue to impact the economy for the foreseeable future.

Rapid acceleration of ecommerce adoption

Perhaps one of the biggest and most impactful trends driven by the pandemic has been the acceleration of ecommerce adoption. When life at home began, the shift to ecommerce immediately followed as mandated closures prevented traditional in-store shopping and safer-at-home orders encouraged more people to stay home.

Over the past year, we’ve seen a drastic increase in sales for businesses suited for social distancing and life at home. For instance, analysis of the transaction data of five home fitness businesses shows their sales grew by 25% in April 2020 compared to the same month in 2019 as more people transitioned to working out at home when many gyms were required to close.

Supply chains had to play catch-up

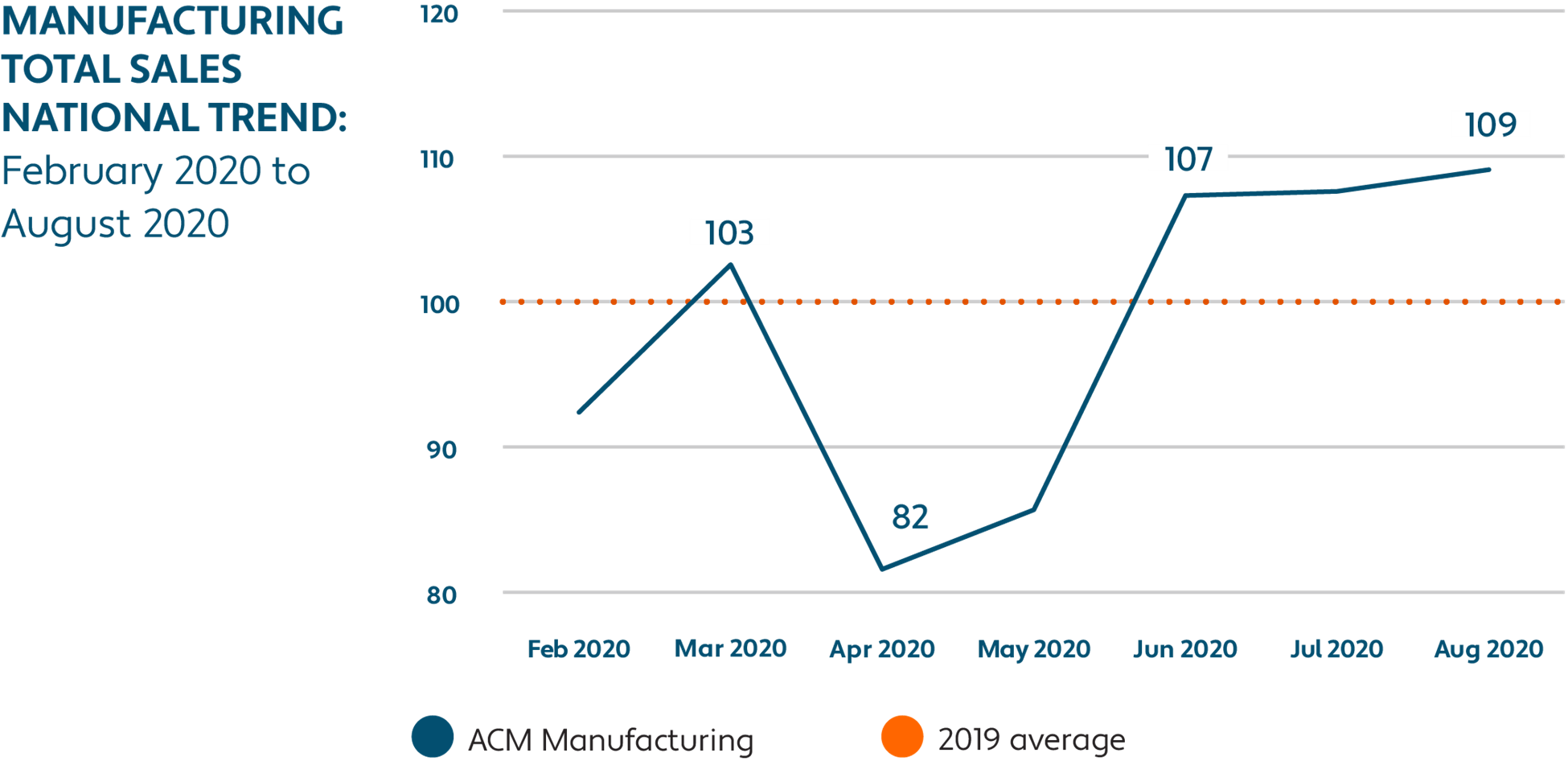

At the beginning of 2020, experts warned of “supply shocks” due to disruptions to the availability of goods coming out of China as the coronavirus spread across the country. The Avalara Manufacturing Index monitored these impacts, including the demand shock felt in March and April.

At that time, the Avalara Manufacturing Index dropped more than 20 points between March and April 2020 as supplies were wiped out. Fortunately, as consumers settled into life at home and restrictions began to ease in early summer, manufacturers were able to ramp up production — leading to a steady climb in the Avalara Manufacturing Index through August.

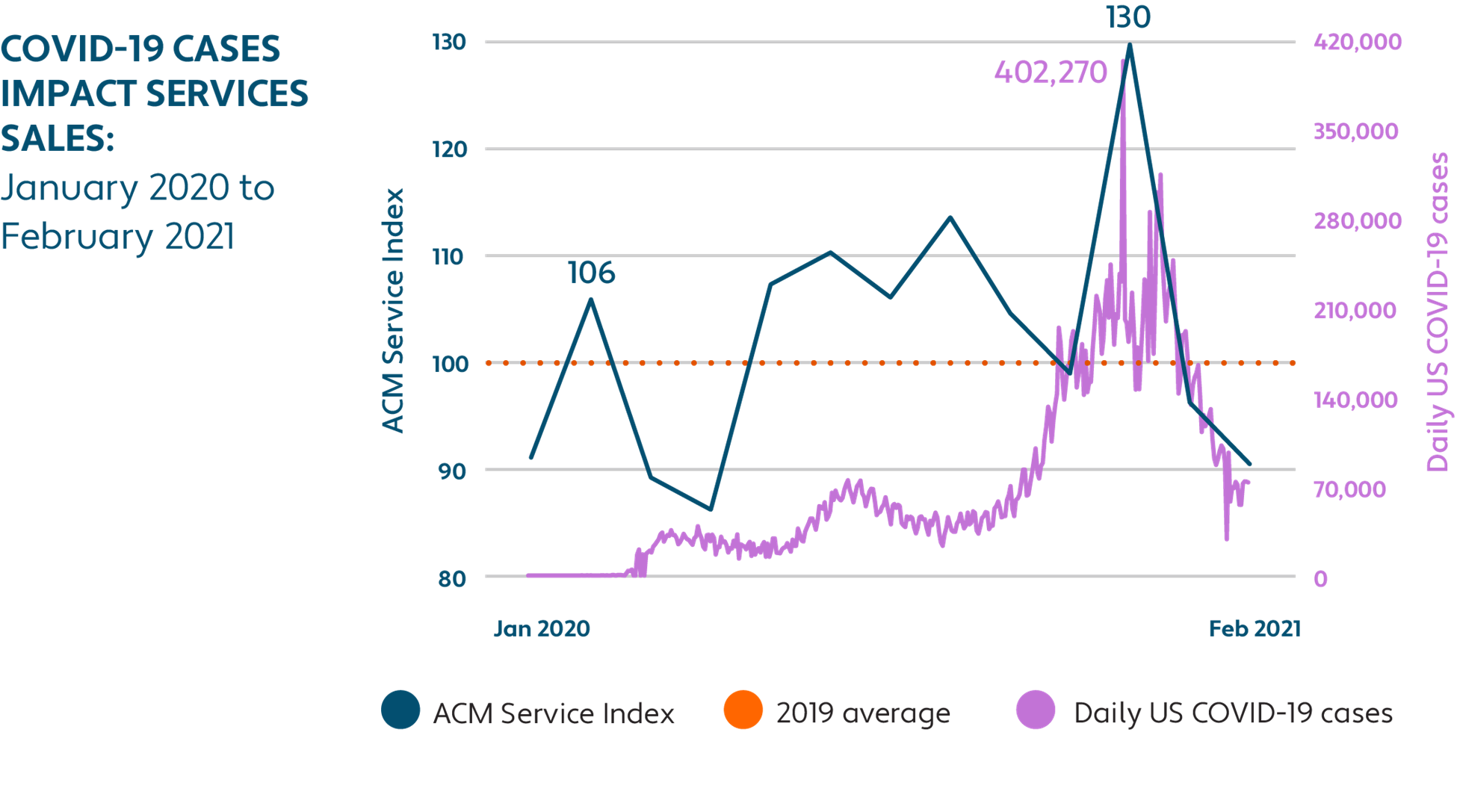

COVID-19 cases impact consumer confidence

In many instances, when COVID-19 cases rose nationwide, retail and services sales saw an associated drop the following month. The Avalara Retail and Services Indices found that for three of the four largest month-over-month increases in COVID-19 cases, a drop-off in total services sales occurred in the following month.

Source: https://www.statista.com/statistics/1102816/coronavirus-covid19-cases-number-us-americans-by-day/

The Avalara Retail Index also saw a similar correlation between consumer confidence and total retail sales. When comparing the Avalara Retail Index to the Consumer Confidence Index, total retail sales mapped closely with changes in consumer confidence levels.

Source: https://conference-board.org/data/consumerconfidence.cfm

Cyber Week became Cyber Months

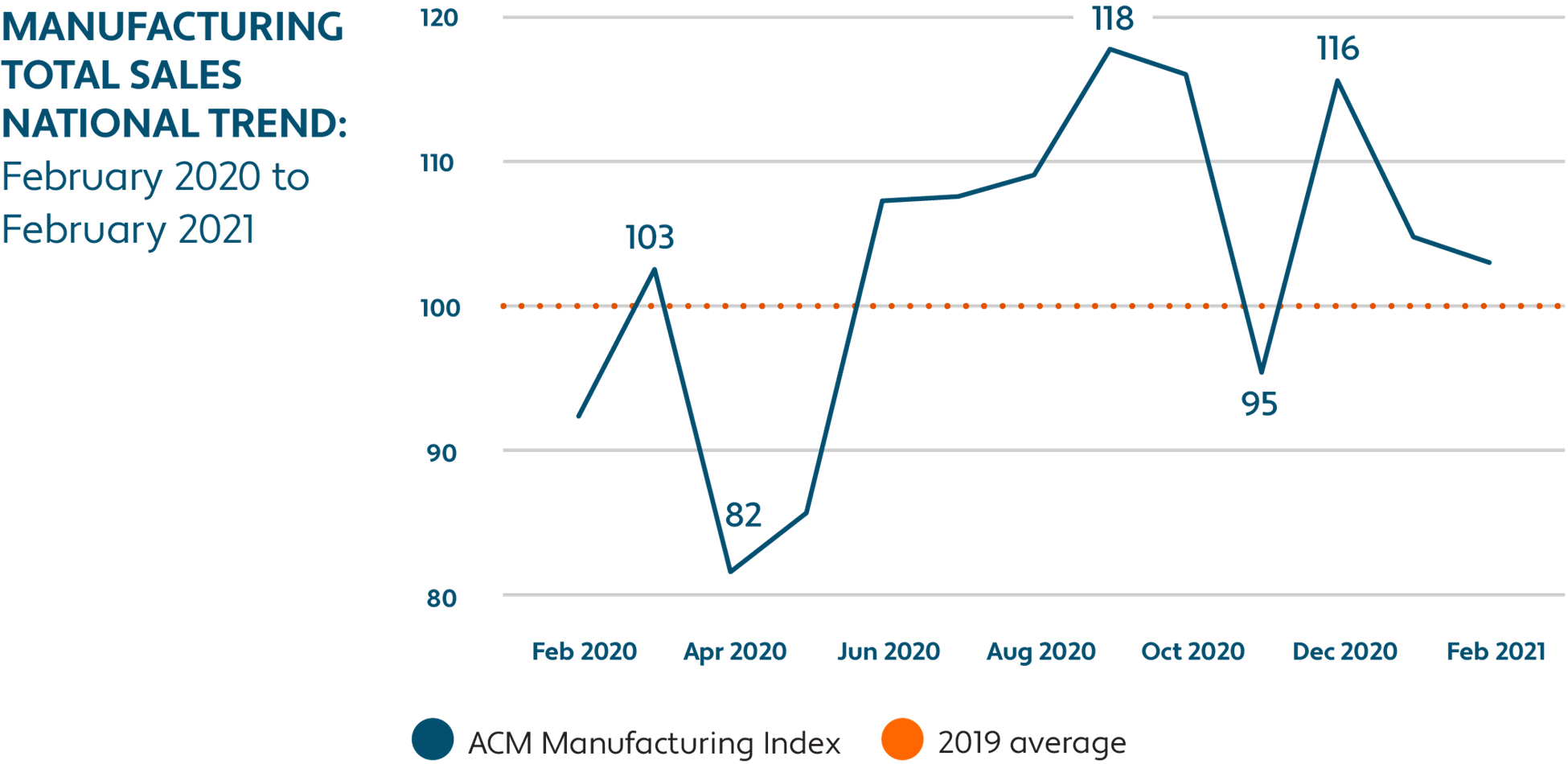

Historically, manufacturing sales increase in October as retailers prepare for the major shopping days during Cyber Week (Thanksgiving through Cyber Monday). However, in 2020, those big retail spending days looked different as the pandemic both forced and prompted changes for retailers and consumers alike.

The Avalara Manufacturing Index hit its year-to-date high in September — up 18% from the 2019 baseline. The spike in manufacturing sales in September signaled an earlier-than-usual start to the holiday season.

The manufacturing sales spike was followed by an increase in retail sales in October, which was likely the result of many strategies retailers employed to encourage customers to shop online, while also mitigating the impact on supply chains.

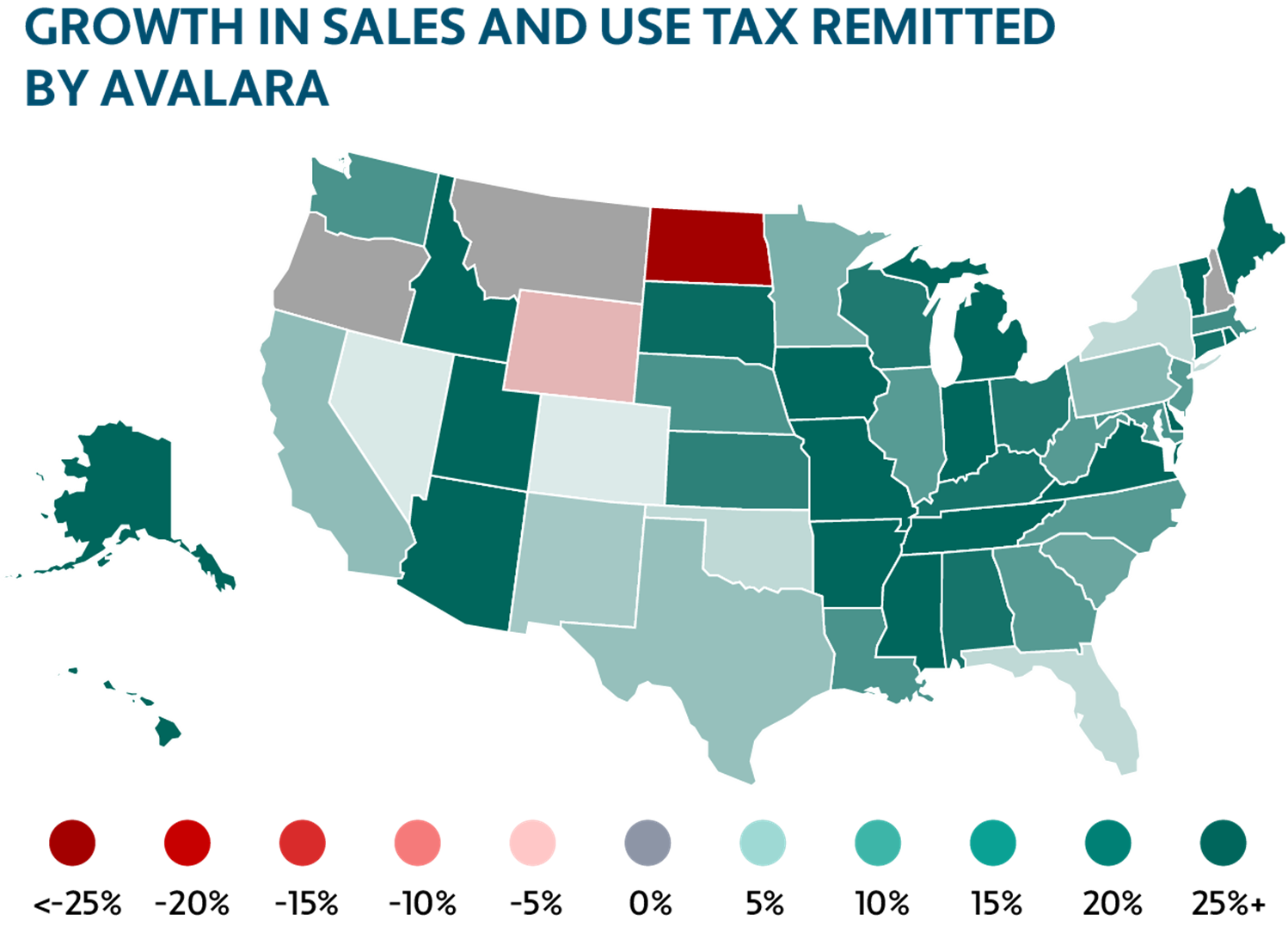

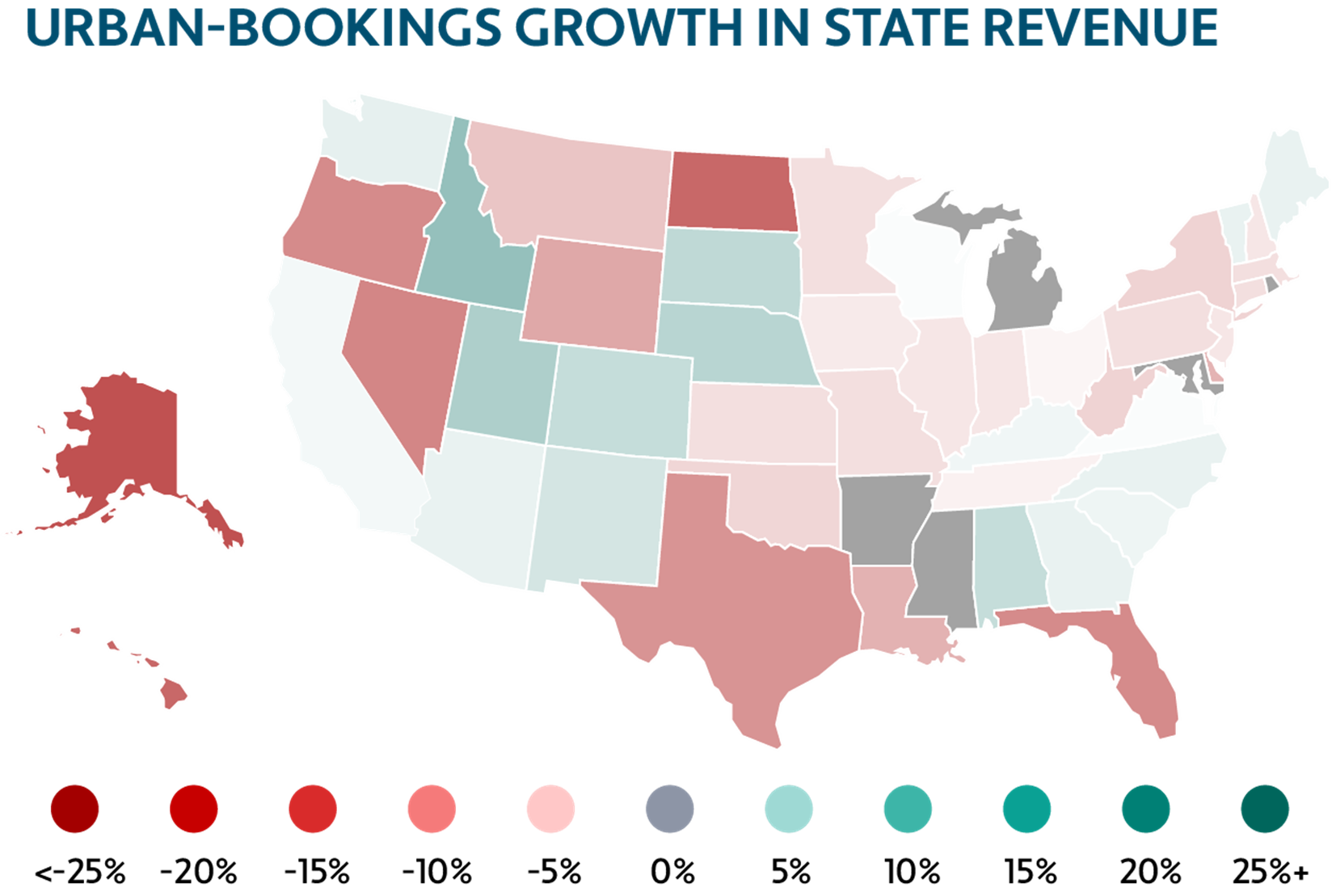

Sales tax collections helped bolster state revenues

As shutdown orders went into effect last March, most state tax collections took a nosedive, which prompted many states to issue dire outlooks on revenue.

When comparing Avalara’s sales and use tax returns data with data from the Tax Policy Center, we found a correlation between the states with the highest sales and use tax remittance and those with higher state tax revenues. Idaho saw the highest increase in state tax revenue at 10.4% and was among the top states for growth in sales and use tax remittance at 44%.

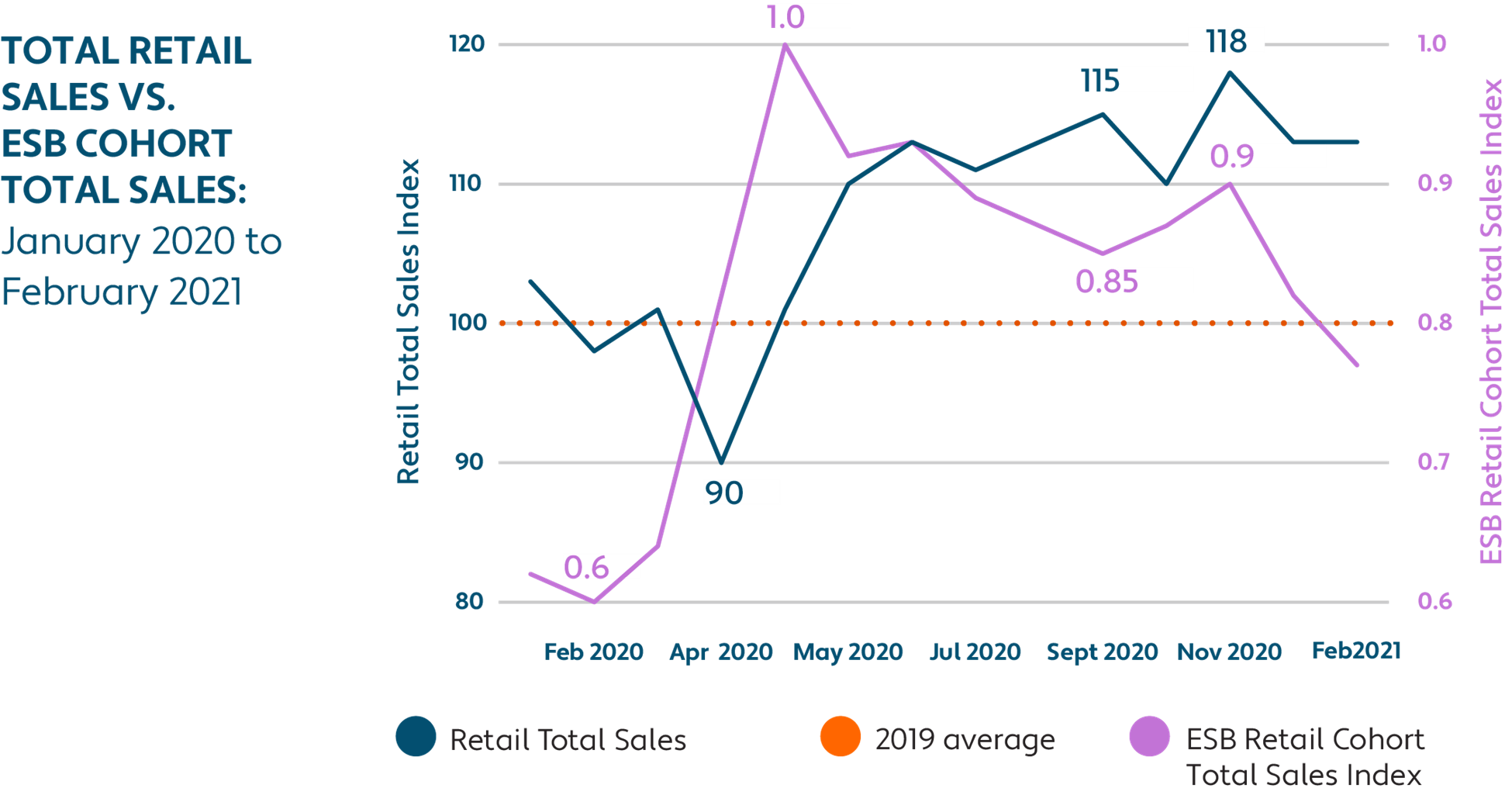

COVID-19 case study

Using Avalara Retail Index data, we took a close look at a cohort of small, online retailers — a segment of the economy that’s been overwhelmingly impacted by the pandemic. The cohort included online retailers in the outdoor and sports equipment, household goods, and wellness industries.

Despite one in five small businesses being closed at the beginning of June, the small online retailers in this cohort bounced back after the initial onset of the pandemic faster than the overall retail sector. The cohort saw growth of 35% in total sales between March and June.

Avalara helps businesses across the U.S. and around the world navigate change through tax compliance automation. Read the full Avalara Commerce Monitor report here.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.