Can your business spend less on sales tax compliance?

Every day, sales tax compliance gives someone somewhere a headache. Sometimes it’s mild and clears quickly after a bit of research. Sometimes it lasts for days. And sometimes it lingers around the edges like a migraine coming on: You sense it, dread it, and do everything you can to stave it off.

The headache can be caused by the simplest things, a question in need of an answer, a form in need of filing. A mom-and-pop market in Vermont decides to stock a new type of beverage and needs to know whether the drink is subject to Vermont’s sales and use tax. Some beverages are sales tax exempt in Vermont, but as of July 1, 2015, “beverages that contain natural or artificial sweeteners” are taxed. Will determining the taxability of their new product be as easy as scanning its ingredients? Perhaps, perhaps not. More likely, the retailers will have to spend some time browsing the Vermont Department of Taxes website.

Still, that’s a mild headache in the world of sales tax. No ibuprofen needed. It’s the envy of a business like The Vitamin Shoppe, which offers more than 25,000 SKUs in more than 700 stores across the United States. State taxability rules regarding dietary and digestive products vary widely from state to state, and like the Vermont soda tax, often hinge on ingredients. According to sales tax manager Diana Rancy, “It has taken me three days to research and categorize just 100 items. Can you imagine how long it would take me to do more than 20,000?”

Patrick Gillespie had an inkling when employed by the Washington State Department of Revenue back in 2010. He built a database of every kind of candy sold in the state and was at 6,000 and counting when interviewed by National Public Radio that May. Although exempt from Washington sales tax today, candy was taxable June 1, 2010, through December 1, 2010 — unless it contained flour. Thus, the database: Gillespie had to read the ingredients of every kind of candy sold in the state to determine whether it was taxable or exempt.

Needless to say, it takes time and resources to get sales and use tax right. Exactly how much time and how many heads depends on the size and industry of your company. The methods used to manage sales tax also play a key role.

Always interested in this topic, Avalara asked NetReflector/Potentiate to find out the true cost of sales tax compliance for companies of differing sizes across several industries. Potentiate surveyed hundreds of companies in the United States to suss out the methods, staffing requirements, and expenses associated with managing sales and use tax compliance manually (i.e., without an automated sales tax solution).

The survey gathered information about each company’s sales. It identified the scope of a company’s sales tax compliance activity, such as the number of returns filed and filing frequency. And it asked how many people and hours each participant devoted to sales tax, along with hourly wages or rates. Finally, Potentiate inquired about audits.

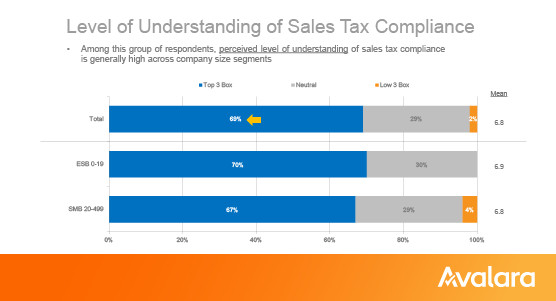

Key findings are described below. What stands out is that a company’s size and industry tend to dictate how many resources it devotes to sales and use tax compliance. Furthermore, although survey respondents are generally confident they’re compliant, evidence suggests some may not be.

Size matters

Typically, the larger the company, the more heads, time, and money it spends on sales tax.

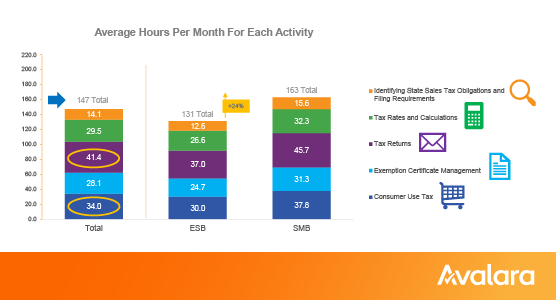

In the “vast majority” of emerging small businesses (ESB) surveyed, three or fewer employees with a mean hourly wage of $83 typically work on sales tax. Each month they devote a combined 131 hours to compliance activities, so ESBs generally spend $11,968 per month on sales and use tax compliance.

Small and midsize businesses (SMB) generally have two to five employees working on sales tax, with a mean hourly wage of $98. Since they spend a combined 163 hours on sales tax compliance, SMBs typically spend $17,672 monthly on sales tax management.

Each aspect of sales tax compliance requires more time of SMBs than it does for ESBs. Every month, SMBs devote 3 additional hours to identifying sales tax obligations and filing requirements, 5.7 more hours to tax rates and calculations, 6.6 more hours to exemption certificate management, 7.8 more hours to consumer use tax, and a whopping 8.7 additional hours on tax returns.

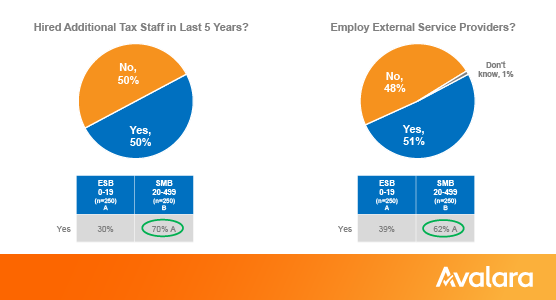

In addition to putting more employees toward sales tax, SMBs tend to have hired more staff to help with tax compliance when compared to their smaller counterparts. They’re also more likely to employ external service providers.

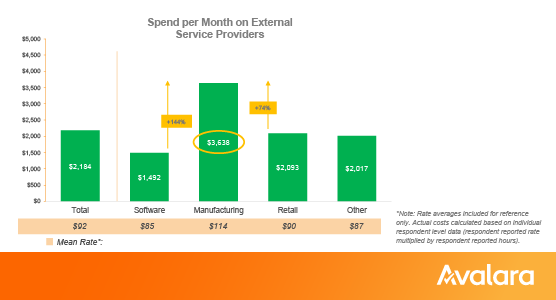

Considering hours spent and cost per hour, SMBs allot 40% more to service providers than ESBs allocate each month: $2,455 versus $1,748. This is on top of money spent on internal staff.

Industry matters

As with size, a company’s industry greatly influences the amount of time and money needed for sales tax compliance. To get a clearer idea of how, Potentiate gathered information from businesses in numerous industries. Three are identified by name: manufacturers, retailers, and software companies.

Findings show retailers and manufacturers spend more on sales tax than software companies spend, with retail spending by far the most. Each month:

- Retailers spend an average of 209 hours and $24,032 on sales tax compliance

- Manufacturers spend an average of 149 hours and $14,256 on sales tax compliance

- Software companies spend an average of 121 hours and $11,113 on sales tax compliance

Software companies also spend less ($1,492) on external service providers than companies in other industries spend. Manufacturers tend to bring in the most external help: They generally spend $3,638 each month on service providers, while retailers spend $2,093.

Are businesses registered for sales tax as required?

Participants were asked to quantify sales in states where they weren’t registered to collect and remit sales tax. The results suggest SMBs are more likely to be out of compliance than ESBs, no matter their industry.

To be clear, not all businesses have an obligation to register for sales tax in all states where they sell. Whether they do is determined by nexus, a connection between the business and the taxing jurisdiction. Having a physical presence in a state is one of the most common ways to create nexus, but an out-of-state business with no physical presence can establish nexus solely through its sales activity in a state. This is known as economic nexus.

All economic nexus laws provide an exception for companies whose sales are below the state’s economic nexus threshold, which varies from state to state. For example, the threshold in California is $500,000 in total combined sales of tangible personal property for delivery in California (including exempt sales) during the preceding or current calendar year. The threshold in Kentucky is much lower, at 200 transactions or $100,000 in gross receipts from sales of tangible personal property or digital property in the state (including exempt sales) during the preceding or current calendar year.

According to the survey, 78% of ESBs sold less than $50,000 in states where they weren’t registered for sales tax, which is well beneath all state economic nexus thresholds. Yet 80% of SMBs sold between $50,000 and $3 million in states where they weren’t registered, and the mean was $678,000. Thus, many of the SMBs surveyed could have economic nexus — and a registration requirement — in states where they aren’t registered, even if all their sales are exempt. That said, respondents were generally confident they were aware of and complying with all applicable taxes related to their business.

The survey couldn’t — and didn’t intend to — discover whether respondents were compliant or noncompliant. Yet it’s safe to assume at least some of the companies surveyed should be registered for sales tax in at least one state where they currently aren’t.

An audit would uncover noncompliant activity, and participants were asked about their audit experiences.

How painful and expensive are audits?

According to the survey, 14% of all participants experienced a sales tax audit during the past five years. Most audits (79%) were completed within three weeks, though a small percentage dragged on for five months or more.

It took employees an average of 35 hours to oversee and respond to an audit. Employees in 3% of the companies devoted more than 100 hours to the audit, while employees in 7% of the companies spent 10 or fewer hours on the audit.

Bigger companies audited more than smaller companies

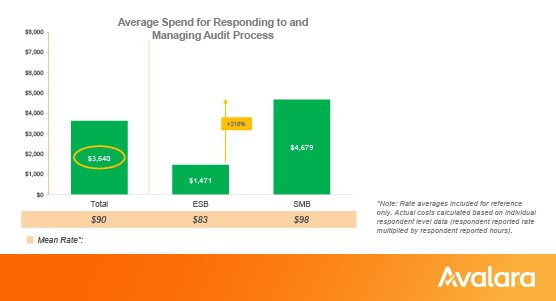

ESBs were less likely to be audited than SMBs (9% versus 19%). When ESBs were audited, they spent considerably less on overseeing the audit than their larger counterparts spent: $1,471 versus $4,679. In other words, audits were 218% more costly for SMBs than ESBs.

Manufacturers audited more than retailers and software companies

Manufacturers were more likely to be audited than retailers and software companies: 18% of manufacturers versus 10% of retailers and 4% of software companies. Manufacturers were also more likely to owe penalties after the audit, though their penalties tended to be lower than those of retailers and software companies.

The survey cautions that many of the audit-related findings, particularly for ESBs, come from “extremely small base sizes.”

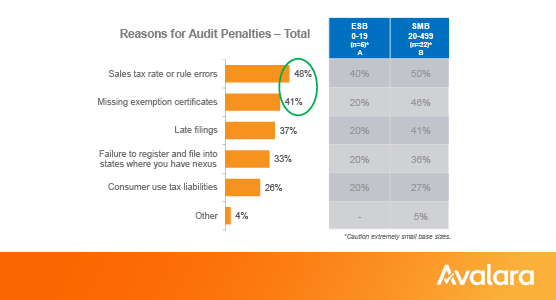

All aspects of sales tax can lead to penalties

What triggered the audit penalties? Reasons include everything from late filings to consumer use tax liabilities and failure to register in a state when required. Yet sales tax rate or rule errors and missing exemption certificates were the top two reasons.

It’s worth noting that only 21% of the businesses surveyed said they kept money aside to respond to audits. Among those that did, the amount of the reserve budget varied considerably by size. The mean reserve budget for ESBs was $9,790; the mean reserve budget for SMBs was $457,638.

Again, the survey cautions that the reasons for audit penalties came from “extremely small base sizes.”

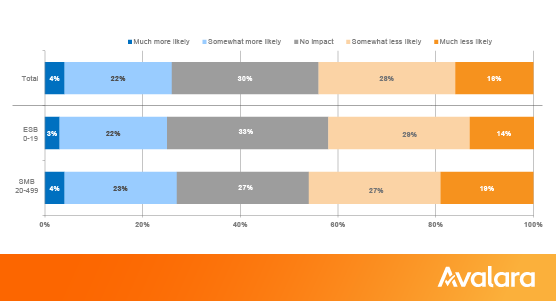

Pandemic accelerates adoption of new technologies

More than a quarter of businesses surveyed (26%) said the COVID-19 pandemic has made them more likely to purchase new technology solutions in the next 12 months.

This is in line with findings from a recent survey of accounting professionals. More than 52% of the accountants surveyed said that because of the pandemic, “keeping up with changes in online technologies” was highly important for small businesses. And 54% of them indicated their own companies could benefit from more cloud-based software, too. According to the accountants, “more automation, less handwork” is key “to remain competitive.”

Like a lot of us, many accounting professionals were forced to work remotely during the early months of the pandemic. And like a lot of us, many still are. Cloud-based technology allows information to be shared securely with colleagues and clients in disparate locations.

New technology costs, to be sure, but as the Potentiate survey reveals, many hands make manual compliance costly, too. Companies are paying for employees to manage sales tax and they’re paying for external service providers to manage sales tax. Some also pay audit penalties when employees and external service providers make mistakes, which they’re bound to do because sales tax compliance entails navigating a confusing labyrinth of sales tax rates, rules, and requirements in up to 45 states, plus Washington, D.C., and parts of Alaska.

Find out how much time you can save by automating sales tax compliance.

Survey methodology

Respondents were either the owner of a company or a key decision maker for its finance solutions. All were familiar with sales tax compliance activity at the company. None represented a company using an automated sales tax solution.

Fielding ran from January 8 to February 11, 2021, and there were 500 participants across the manufacturing, retail, software, and “other” industries:

- 250 were emerging small businesses (ESB) with fewer than 20 employees

- 250 were small and midsize businesses (SMB) with 20–499 employees

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.