Will fulfillment house battles continue in 2022?

Many wineries rely on third-party logistic centers known as fulfillment houses to store and package wine then transfer it to common carriers for final shipment. Yet despite their widespread use in direct-to-consumer (DTC) shipping, most states don’t currently have specific rules for fulfillment houses. That could change in 2022 as states continue to step up DTC enforcement efforts and face pressure from special interest groups.

“Fulfillment houses are commonly misunderstood in the alcohol shipping world,” says Jeff Carroll, general manager of Beverage Alcohol at Avalara. Because of that, DTC shipping came dangerously close to a halt in Tennessee and Louisiana after those two states sought to ban the use of fulfillment houses last year (more details below).

Whether fulfillment houses should be regulated is a topic of heated debate. Some entities consider fulfillment houses to be logistics providers more similar to the United Parcel Service (UPS) than to alcohol producers or sellers. Others think they should be subject to the same licensing and reporting requirements alcohol producers, sellers, or shippers have because they store, package, and ship alcohol, and because regulatory agencies want to have full visibility into the alcohol packages sent into their state

It’s complicated. To make it less so, states need to understand what fulfillment houses are and what they do.

What are fulfillment houses and what do they do?

Fulfillment houses help wineries — and, increasingly, beer and spirits producers — store products and prepare them for shipment. They play a critical role because many alcohol producers lack storage space or the resources required to ship orders to consumers nationwide. Although it can be difficult to classify all businesses of a certain kind under one standard definition, the description below applies to most businesses operating in the beverage alcohol space today.

Fulfillment houses are not beverage alcohol producers; they don’t make wine, beer, or spirits. Though they contract with wineries and other producers to move their products to consumers, they’re not retailers; they don’t make sales. And though they package wine and transfer it to common carriers, they are not themselves a common carrier. They’re in a unique position, one many state lawmakers and policymakers commonly don’t fully understand.

What should states require of fulfillment houses?

Once states understand the role of fulfillment houses, they need to decide if and how to regulate them. We’ve seen states take several different approaches, but these are the general categories:

Do nothing (but require licensees to comply with all rules)

Require the reporting of tracking numbers

Authorize certain fulfillment houses to make direct shipments

Create a unique license for fulfillment houses

Require fulfillment houses to file reports with the state

Do nothing

Lots of states don’t regulate fulfillment houses today and could choose this option tomorrow. Yet in 2022, we expect more of these states to turn the spotlight on fulfillment houses and perhaps choose one of the following options.

Require the reporting of tracking numbers

Some states require both winery DTC shippers and common carriers to report tracking numbers. DTC licensees in Texas must report the name of the common carrier and the unique common carrier tracking number for each shipment, and there are similar requirements in Alabama, Iowa, Missouri, New Hampshire, and South Dakota.

State ABCs use the tracking numbers reported by the direct shipper licensee to cross-reference against the reports submitted by the common carriers to ensure proper tax collection and to identify non-compliant shipments.

Authorize certain fulfillment houses to make direct shipments

Kentucky recently updated state regulations to specifically authorize the use of certain fulfillment houses, though it didn’t create a new fulfillment house license.

This option gives states more authority to enforce compliant shipments than they’d have if they didn’t track or regulate fulfillment houses at all. However, it doesn’t force states to establish additional licensing or reporting requirements.

Create a unique license for fulfillment houses

This isn’t new: North Dakota has had a logistics shippers license for fulfillment houses since 2013, and today there are 39 logistics shipper licensees in the state. Alcohol logistic shippers don’t pay North Dakota excise or sales taxes — that’s the responsibility of the licensed direct shipper — but they must file a monthly Schedule L report.

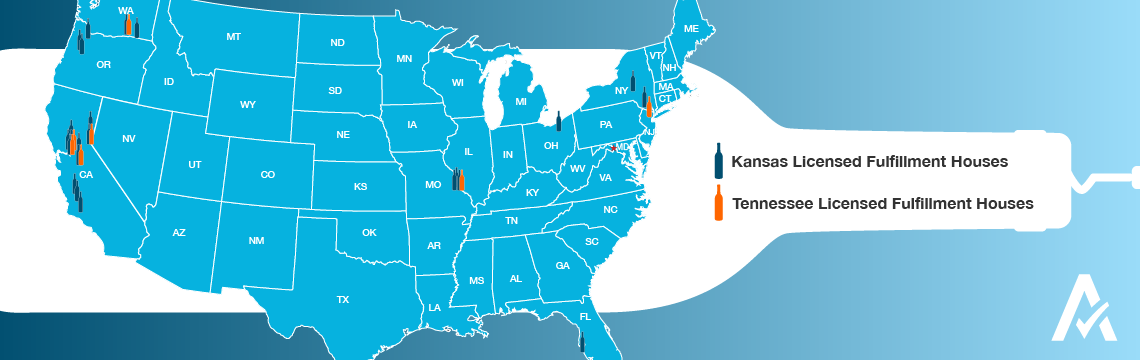

Alabama, Kansas, and Tennessee all created new fulfillment house licenses in 2021, and other states may do the same in 2022. Kansas has already issued 38 fulfillment house licenses. The largest fulfillment houses hold multiple licenses (Wine Direct has five, Wineshipping.com has 15) for the different warehouses they own or operate around the country.

Require fulfillment houses to file reports with the state

Finally, states could require fulfillment houses to file reports without imposing a licensing mandate. That’s the tactic Illinois, New Hampshire, Ohio, and Virginia have taken.

Illinois allows wineries to ship wine through an unlicensed third-party provider like a fulfillment house. The holder of the Winery Shipper’s License is responsible for ensuring Illinois licensing and tax requirements are met, and each fulfillment house or third-party provider must file an annual report with the Illinois Liquor Control Commission.

In New Hampshire, direct shippers must include the name and address of any fulfillment houses they use on their monthly report. Fulfillment houses must also file reports; those that don’t will be treated as unauthorized shippers.

Wineries holding an S-2 permit may use fulfillment warehouses to ship to consumers in Ohio as of September 30, 2021, thanks to the enactment of House Bill 110. Fulfillment houses are required to register and report all shipments to the division, though Ohio hasn’t created a special fulfillment house license.

Virginia permits direct shippers to ship wine or authorized beer through “an approved fulfillment warehouse,” meaning one that’s appropriately licensed in the state where it’s located. Fulfillment warehouses must secure written approval from the Virginia Alcoholic Beverage Control Authority ABC for each winery they represent, and maintain records and file reports as required by the Virginia Alcoholic Beverage Control Act. Wholesale wine and beer licensees are prohibited from acquiring or holding any financial interest in any fulfillment house licensee.

Louisiana and Tennessee: A cautionary tale

Tennessee came close to banning the use of fulfillment houses with the enactment of House Bill 742. Opponents of DTC shipping that were pressuring state lawmakers to outlaw fulfillment houses almost succeeded. It was only after the wine industry clarified the important role fulfillment houses play that the bill was changed to authorize their use.

What happened in Tennessee is public record. There’s been significantly less publicity about the events that transpired in Louisiana late last year, when the Louisiana Office of Alcohol and Tobacco Control (ATC) issued cease-and-desist orders to fulfillment houses shipping into the Pelican State.

Though Louisiana law requires a license to produce, sell, or ship beverage alcohol, it doesn’t currently regulate the use of fulfillment houses — so fulfillment houses can perhaps be forgiven for not obtaining a license to operate in Louisiana.

After learning about the cease-and-desist orders, wine industry representatives pledged to work with Louisiana and fulfillment houses on this issue, and the ATC agreed to hold the cease and desist orders in abeyance. Louisiana’s now looking at creating fulfillment house reporting requirements similar to those in effect in Illinois, meaning it would set filing requirements but not specific licensing requirements.

Learn about other forces shaping beverage alcohol tax compliance in 2022.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.