Flush states may exempt food from sales tax

Update November 18, 2022: To learn how the efforts described below panned out, read Three states slash sales tax on food in 2022.

Most states started 2022 with budget surpluses, and now legislatures need to figure out what to do with the extra cash. While certain federal stimulus funds come with restrictions, much of the excess state tax revenue can be put wherever lawmakers think best.

There are many options. Infrastructure can be modernized, reserves replenished, and schools funded. Money can be put toward healthcare and housing, workforce development, and more. States can provide tax relief for residents.

To that end, several states are looking to eliminate or reduce the sales tax on food.

Food for home consumption (aka, groceries) is already exempt, or taxed at a reduced rate, in most states. Calls to exempt food in the states where it’s taxed aren’t new, but 2022 could be the year they reach fruition.

States where food is subject to sales tax

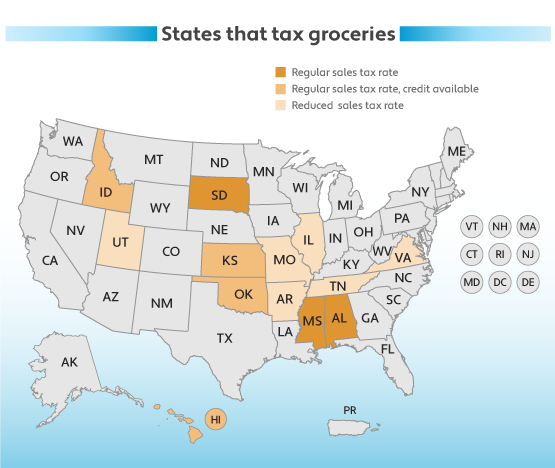

Three states tax food at the full rate: Alabama, Mississippi, and South Dakota.

Four states tax food at the full rate but offset the tax with credits or rebates for qualifying taxpayers: Hawaii, Idaho, Kansas, and Oklahoma.

Six states tax food at a reduced rate: Arkansas, Illinois, Missouri, Tennessee, Utah, and Virginia.

The remaining 37 states and the District of Columbia exempt most food for home consumption from state sales and use tax, though local taxes apply in some states (e.g., Arizona, Colorado, Georgia, Louisiana, North Carolina, and South Carolina).

Note that different tax rules may apply to certain products, such as candy and soft drinks. Some states treat these items as food and tax or exempt them accordingly. Some consider them to be different from food, and tax them when other food is exempt or tax them at a higher rate. In some states, special rates and rules also apply to food sold through vending machines.

States looking to exempt food from sales tax

Alabama, Kansas, Mississippi, Oklahoma, and Virginia have all introduced measures that would eliminate or reduce the sales tax on food for home consumption.

Alabama

House Bill 174 would exempt sales of food from state sales and use taxes as of September 1, 2022.

Senate Bill 43 and House Bill 173 would exempt sales of food from state sales and use taxes starting January 1, 2023.

None of the above would affect the local taxation of food.

Kansas

Senate Bill 339 would exempt food and food ingredients from the state sales tax, allow cities and counties to tax food and food ingredients, and discontinue the nonrefundable food sales tax credit. “Food and food ingredients” includes bottled water, candy, dietary supplements, food sold through vending machines, prepared food, and soft drinks. House Bill 2484 and House Bill 2711 are similar.

An amended version of SB 339 would allow Washburn University of Topeka to levy a local tax on food and food ingredients and make other changes not related to the taxation of food.

Senate Bill 342 would exempt food and food ingredients from the state sales tax, allow cities and counties to tax these sales, and provide a sales and use tax exemption for sales of farm products sold at farmers’ markets. It would also discontinue the nonrefundable food sales tax credit. House Bill 2487 would do the same, while House Bill 2352 would provide a sales tax exemption only for farm products sold at a farmers’ market.

House Bill 2432 seeks to reduce the state sales and use tax for food and food ingredients based on a formula, with a goal of eventually eliminating it. Once eliminated, local governments would no longer be able to tax food and food ingredients. It seems a bit complicated. House Bill 2616 would set the sales and use tax rate on food and food ingredients at 4.3% starting July 1, 2022, and aims to eliminate the tax starting October 1, 2024, provided certain benchmarks are met. It, too, is one of the more complicated proposals.

Mississippi

House Bill 952 sought to phase out the sales tax on certain foods, but died in committee on February 23, 2022. Several similar measures also died: HB 1297, SB 2187, and SB 2375.

Oklahoma

Senate Bill 1495 would exempt groceries — including bottled water, candy, food and food ingredients, and soft drinks — from the state sales tax starting November 1, 2022. Local sales taxes would continue to apply.

The first version of SB 1495 also provided an exemption for dietary supplements, but a Senate Committee substitute introduced March 2 specified that dietary supplements would not be eligible for the exemption.

Senate Bill 1473 seeks to gradually reduce the state gross receipts tax on groceries beginning January 1, 2023, so that the rate would be 1.5% starting with calendar year 2025. “Groceries” includes food and food ingredients and bottled water, but not candy, dietary supplements, or soft drinks.

Carried over from 2021, House Bill 2844 would exempt food items sold by a convenience or grocery store from the state sales tax. Candy, carbonated soft drinks, ice, and certain other food items would remain subject to “a tax levied in lieu of sales tax by other provisions of law.”

Virginia

Senate Bill 451 seeks to exempt food purchased for home consumption from the state sales tax starting January 1, 2023. Essential personal hygiene products would also be exempt under the measure.

Update, June 23, 2022: The new budget eliminates the 1.5% state sales tax on food purchased for home consumption starting January 1, 2023. Local sales tax will continue to apply.

The state sales tax exemption also applies to personal hygiene products like diapers and tampons. See the bill for more details.

States looking to exempt restaurant food

Measures introduced in Colorado and New York are a bit different from the proposals detailed above, because food for home consumption is already exempt from state sales tax in these two states. These are included because they’re related to food and sales tax.

Colorado

Colorado House Bill 1062 would expand the state sales and use tax exemption for food to include food that isn’t prepared for domestic home consumption. Think takeout food prepared by grocery stores, restaurants, and similar establishments.

New York

New York Assembly Bill 1704, the “Save our New York state restaurants act,” would authorize a state sales tax exemption for food and drink sold at restaurants and taverns — but only for a specific one-week period. Municipalities would have the option to exempt these sales from local sales tax.

We’ll let you know at the Avalara Tax Desk if any of the above proposals make it into law, as all registered retailers that sell qualifying products to consumers in affected states will need to comply with any new tax policies.

Cover photo by Canva

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.