Wayfair aftershocks persist with marketplace laws

The number of businesses impacted by internet sales tax and marketplace facilitator laws is up, many businesses believe they’ve done what it takes to be 100% compliant, and more businesses are turning to technology to improve compliance. That’s all according to a recent survey of U.S. retailers.

Four years ago this month, the Supreme Court of the United States rocked the world of retail with its ruling on South Dakota v. Wayfair, Inc. (June 21, 2018). The decision allowed states to tax remote sales — those made by businesses with no physical presence in the state. Before the Wayfair ruling, a state could require a business to collect and remit sales tax only if the business had a physical presence in the state.

Wayfair was huge. Every state with a general sales tax now has an economic nexus law that bases a sales tax obligation on a remote seller’s sales volume in the state (e.g., Idaho’s threshold is $100,000 in sales in the current or previous calendar year). Every state with a general sales tax now also has a marketplace facilitator law that shifts the obligation to collect and remit sales tax from the individual seller to the platform facilitating the sale.

We here at Avalara know about economic nexus and marketplace facilitator laws because it’s our job to ensure our customers get sales tax right. But what about the average business professional? To gauge the awareness and impact of Wayfair and marketplace facilitator laws, we asked NetReflector/Potentiate to survey hundreds of U.S.-based businesses of varying sizes. This was the sixth and final wave of the survey.

Key findings:

- Awareness and impact of Wayfair have never been greater for all businesses

- Awareness and impact of marketplace facilitator laws have dropped among small businesses

- Awareness and impact of marketplace facilitator laws have increased among large businesses

- Fewer businesses believe they’ve done all it takes to be compliant

- More businesses are using automation to assist with sales tax compliance

Let’s take a closer look.

Awareness and impact of Wayfair have never been greater

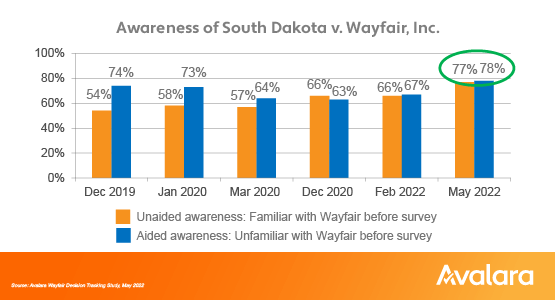

Among all respondents, awareness of the Wayfair decision is at its highest level since the survey started in December 2019.

Wayfair awareness is particularly high among very small businesses (84% for unaided awareness, 87% for aided awareness) and the largest businesses (87% for unaided awareness, 85% for aided awareness). Among small-to-midsize companies, awareness remained consistent with prior survey periods (around 69%).

Matt Crawford, general manager of Shipping at BigCommerce, an Avalara technology partner, found the level of awareness among small businesses to be at odds with what he’s seeing in the market. “It’s interesting that most small businesses say they’re familiar with these laws,” he says, “because in my experience, it appears these businesses are at most risk because they may not understand the full scope of complexity associated with Wayfair.”

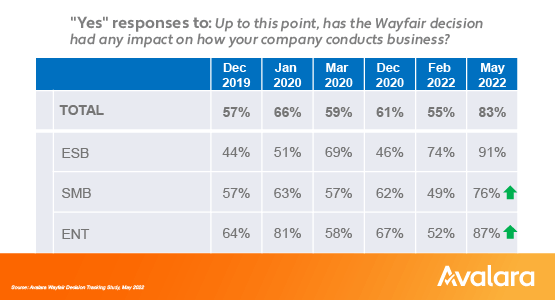

Businesses of all sizes are also feeling the effects of Wayfair more than ever. In May 2022, a whopping 83% of all respondents said Wayfair has had an impact on how their company conducts business. That’s the highest percentage yet.

Crawford believes the increased impact is a direct result of aggressive enforcement and omnichannel commerce, among other factors. “It makes complete sense that more businesses are feeling the impact of Wayfair. We’re seeing more states being aggressive in how they collect taxes, as well as the breadth and depth of what products and services are taxable,” he says. “On top of regulatory pressures, merchants are selling through new channels and using third-party logistics to serve customers — all of which creates more tax complexity. The impact is large and growing each day.”

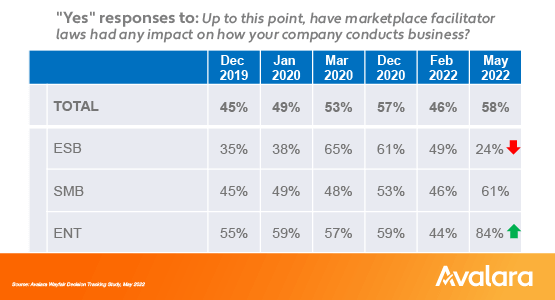

Awareness and impact of marketplace facilitator laws have dropped among small businesses

Interestingly, overall awareness of marketplace facilitator laws has dropped. In fact, aided awareness is at an all-time low. This despite the fact that marketplace facilitator laws have never been more complex.

The smallest businesses experienced the sharpest declines in awareness since the last survey wave (February 2022). Small businesses with unaided awareness of marketplace facilitator laws fell by 25% while those with aided awareness fell by 29%.

Liz Armbruester, senior vice president of Global Compliance Operations at Avalara, attributes the decline in awareness of marketplace laws to the lack of clarity around who’s impacted by them:

“As omnichannel commerce has grown, the number of businesses aware of and using marketplaces has increased. One would think that as the usage of marketplaces increases among businesses, the awareness of marketplace tax laws would as well. However, what this data is showing us is that the sheer amount of complexity tied to marketplace facilitator laws is making more businesses unsure of what the laws are and how they apply. The complexity surrounding these laws will only continue to grow, so it’s likely we’ll see that businesses and marketplaces will continue to be less aware of how these laws impact them.”

Likewise, the percentage of very small businesses that report being impacted by marketplace facilitator laws has never been lower.

Scott Peterson, vice president of Government Relations at Avalara, suspects this could be because many small businesses are marketplace sellers whose taxes are handled by marketplace facilitators. “Most marketplace sellers shouldn’t be aware of these laws,” says Peterson. “It’s not their business.”

In fact, Peterson thinks over time, businesses may forget why they’re collecting tax or why their marketplace is collecting tax for them. The terms “Wayfair” and “marketplace facilitator law” may disappear from our lexicon. “Businesses will just know someone has to collect and remit tax because online sales are taxable.”

He has a point. Most of us don’t think about the court rulings or laws that give us tax obligations; we simply pay the taxes we’re supposed to pay. (Unless we don’t, but that’s another issue.)

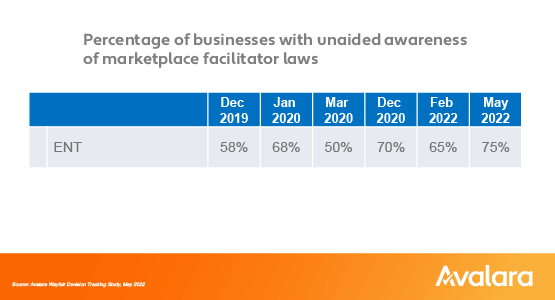

Awareness and impact of marketplace facilitator laws have increased among large businesses

Large businesses are more aware of marketplace facilitator laws and their impact on sales tax today than in the past.

Furthermore, the percentage of large businesses that say their business has been impacted by marketplace facilitator laws has never been higher, at 84%. That’s a considerable jump over previous survey periods.

What explains the discrepancy between small and large businesses? It could be because marketplace facilitator laws eliminate the burden of collection for marketplace sellers, many of which are small businesses. Out of sight, out of mind.

By contrast, large businesses are more likely to have tax experts advising them on their responsibilities vis-à-vis economic nexus and marketplace facilitator laws. Large businesses are also more likely than very small businesses to be marketplace operators themselves.

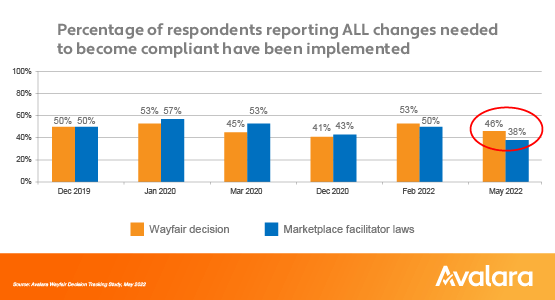

Fewer businesses believe they’ve done all it takes to be compliant

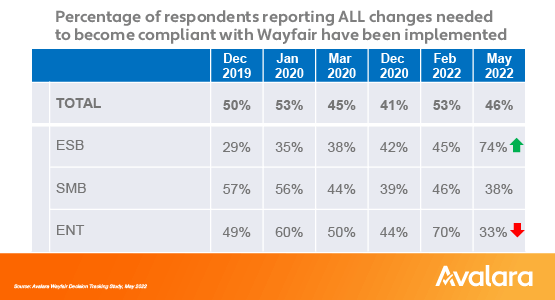

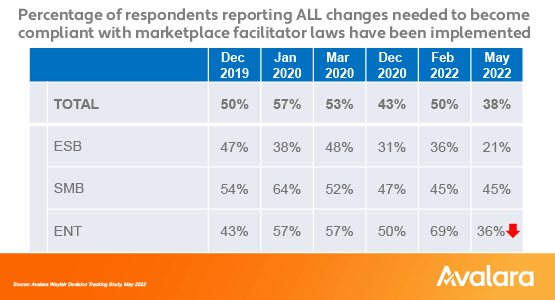

Interestingly, although awareness of Wayfair is up among businesses of all sizes, and awareness of marketplace laws has increased among large businesses, the percentage of respondents who believe they’ve implemented all changes needed to be in compliance with Wayfair-related legislation and marketplace facilitator laws has dropped since February.

Believing they’ve done what it takes to comply with marketplace laws is at an all-time low.

Breaking the data down by company size provides additional insights.

While the percentage of small businesses that believe they’ve done what’s required to be 100% compliant with the Wayfair decision has never been higher, the percentage of large businesses that believe the same has never been lower.

Armbruester believes this delta boils down to a simple premise: You don’t know what you don’t know. “It’s likely that many of the small businesses that believe they’re 100% compliant with remote seller laws are using a solution or working with a consultant to offload their tax burden,” says Armbruester. “While using these tools and resources is exactly what small businesses should be doing for tax, it’s important to note that tax is never a 100% hands-off business function.”

Armbruester also notes that the delta in confidence we’re seeing between small and large businesses is likely due to the fact that “larger companies have the teams and experts in place to keep a close eye on the changes to their tax obligations.”

The percentage of small and large businesses unconvinced they’ve done what it takes to comply with marketplace facilitator laws has also dropped. In fact, it’s never been lower. Perhaps due to their heightened awareness of these laws, large businesses have experienced the steepest decline.

More businesses are turning to technology to improve compliance

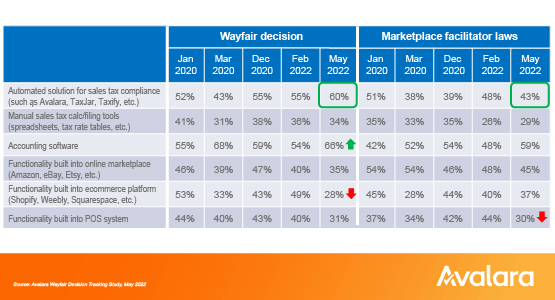

The percentage of businesses using an automated solution like Avalara to help them comply with Wayfair-related laws has never been higher, at 60%. This surprises Scott Peterson, who thought it would have taken much longer to get here. He wonders how much of the shift to automation was driven by the pandemic and remote working conditions.

According to the survey, 66% of businesses now use accounting software to assist with compliance issues stemming from the Wayfair decision. Fewer businesses are relying on functionality built into their ecommerce platforms (28%) or functionality built into point-of-sale POS systems (31%) for Wayfair-related sales tax issues.

Fewer businesses are using technology to comply with marketplace facilitator laws. Only 43% of survey respondents said they use an automated sales tax solution like Avalara for marketplace facilitator compliance issues, and only 59% of respondents said they use accounting software. The percentage of businesses relying on functionality built in their POS systems to comply with marketplace facilitator laws is at an all-time low, at 30%.

Matt Crawford believes the number of businesses manually managing sales tax is dwindling as complexity grows. He notes that automation is becoming the logical choice for more businesses. “Brands that use Avalara don’t have to worry when a rate changes or when they trigger a new obligation because it’s taken care of,” he says.

Liz Armbruester looked at this data with a cautionary eye, noting that while it’s great more businesses are recognizing the value of technology to manage tax compliance, not all technology is created equal. “If a business is using a solution that only handles tax calculation, how are they effectively managing the rest of the compliance life cycle? Understanding nexus obligations, registrations, returns, tax-exempt sales, and more all impact how compliant a business is, so automation that streamlines that entire journey is necessary to help businesses reach a greater level of compliance.”

The move toward automation may be because more people are selling into more states through more channels than ever before. “Omnichannel selling allows businesses to sell more fluidly to more customers,” notes Armbruester. “But selling to more customers creates more tax complexity for businesses.”

Marketplace facilitator laws have never been more complex

It’s worth noting that marketplace facilitator laws are becoming increasingly complex for sellers and marketplaces alike.

For example, some states require third-party sellers to register and file sales tax returns, even if they have no physical presence in the state and only sell through a registered marketplace. Connecticut is one such state, Hawaii another.

Selling through a marketplace can also expose a seller to physical nexus — a physical connection sufficient enough to establish a sales tax obligation. Most states hold that inventory in a marketplace fulfillment center establishes physical nexus for the seller. And some states, including California, Pennsylvania, and Washington, are aggressively pursuing marketplace sellers for back taxes based on such inventory, including back income taxes.

Expanding requirements for facilitators

Requirements for marketplace facilitators are changing so rapidly that it’s virtually impossible for marketplaces to keep up with how these laws impact them.

For example, a growing number of states are starting to require marketplace platform providers to do more to stop sales of stolen goods. California is one of several states looking to make marketplace facilitators verify the identity of third-party sellers.

Arkansas already requires online marketplaces to have more oversight of high-volume sellers and provide more information to consumers, and Oklahoma just enacted a similar law. “State retailer associations are pushing this type of legislation,” says Scott Peterson. They believe marketplaces are the prime method for retail thieves to dispose of their ill-gotten gain.” More than a dozen states are considering similar action.

Marketplace facilitators are also increasingly responsible for collecting and remitting business and occupation (B&O) tax, franchise tax, or a variety of fees: California, North Carolina, and Texas are among the states that have expanded collection requirements for marketplaces.

This is just the tip of the iceberg; underneath the surface, corporate income tax obligations are looming.

Peterson notes that California, New York, and a number of other states are working to extend corporate income tax to remote sellers. If they’re successful, this burden could fall on marketplace facilitators.

Legislation recently enacted in Oklahoma (Senate Bill 1339) expands a marketplace facilitator’s tax collection obligation “to any other taxes administered by the Tax Commission.” Peterson believes Oklahoma could use this law to require a marketplace to collect corporate income tax on behalf of their sellers.

On top of all this, marketplace facilitator laws specific to certain industries are also becoming more complex.

Food and beverage marketplaces

The exponential growth of delivery and takeout sales triggered by COVID-19 has complicated tax compliance for both individual sellers (aka, restaurants) and third-party delivery apps (e.g., DoorDash, Grubhub, and Uber Eats).

As Peterson notes, “Some states require the restaurant to collect and remit the tax. Some require the marketplace to collect and remit tax. And some may let the two entities work it out.” Since it’s often unclear who’s responsible for what, sales tax can easily be overcollected or undercollected.

And of course, it’s never one-size-fits-all when it comes to sales tax, says Liz Armbruester. “Every state’s law is unique even when they fit under the same category, like a marketplace facilitator law.”

The beverage alcohol industry may be the poster child for marketplace facilitator complexity.

States have struggled to establish regulatory frameworks for alcohol marketplaces and determine how marketplace facilitator laws intersect with beverage alcohol regulations. They’ve grappled with how marketplaces impact the flow of funds, and how their involvement affects age verification requirements. And that’s just the start: The impact of marketplace facilitator laws on the beverage alcohol industry continues to evolve.

Jeff Carroll, general manager of Beverage Alcohol at Avalara, explains the conflict between marketplace facilitator laws and beverage alcohol regulation: “Only licensees can sell alcohol, but states have provided guidance that marketplaces can facilitate the sale of alcohol products as long as the licensee is in full control of the transaction, including the flow of funds. However, if a marketplace is registered to collect sales tax, they must ultimately remit the sales tax portion of each transaction while the licensee would be responsible for remitting any alcohol excise taxes.”

Lodging marketplaces

Marketplace facilitator laws are also causing headaches in the lodging industry. According to Oliver Hoare, general manager of Lodging at Avalara, where there’s a marketplace facilitator law, “there is regularly a parallel bill that is specific to lodging.” Each law imposes different collection and reporting requirements on lodging marketplaces.

In Kansas, for example, marketplace facilitators must collect and remit tax on third-party lodging, but not on facilitated sales of hotel accommodations.

West Virginia requires marketplace facilitators to collect and remit hotel occupancy tax on behalf of hotels or hotel operators, but not for any facility providing fewer than three rooms in private homes, not exceeding a total of 10 days in a calendar year. Once collected, hotel occupancy tax must be remitted to local tax authorities because the state doesn’t administer hotel occupancy tax. But any sales tax collected would need to be remitted to the state.

“The expectations and conditions of these laws are changing daily, which makes it very difficult for rental property owners to understand what’s their responsibility versus the responsibility of the marketplace they may be utilizing,” says Pam Knudsen, senior director of Compliance Services at Avalara.

Marketplaces and the metaverse

Last but not least, marketplaces can expect to face mounting compliance challenges in the metaverse. “When you’re in a metaverse, you’re effectively in a marketplace,” says George Trantas, senior director of Global Marketplaces at Avalara. Like a physical marketplace, a metaverse is “an open and shared virtual world” where users can interact and conduct business — so any purchase made while in the metaverse would be made through the marketplace.

Trantas notes that marketplaces often accept a variety of currencies, from fiat (aka, money) to crypto. “Marketplaces that handle intangible digital goods like NFTs are growing the fastest. This new breed of marketplaces — led by entrepreneurs — is challenging marketplace facilitator laws due to the nature of how NFTs are interpreted.”

Survey respondents were asked whether they’d heard of the Wayfair decision and marketplace facilitator laws. Respondents familiar with Wayfair or marketplace facilitator laws and their effect on sales tax have “unaided awareness,” Respondents unfamiliar with Wayfair or marketplace laws prior to the survey have “aided awareness.”

Respondents:

- 25% had fewer than 20 employees (ESB)

- 50% had 20–499 employees (SMB)

- 25% had 500+ employees (ENT)

This is the sixth wave of the survey, which had the following fielding dates:

- Wave 1: December 19–December 24, 2019

- Wave 2: January 29–February 7, 2020

- Wave 3: March 27–April 17, 2020

- Wave 4: November 11–December 10, 2020

- Wave 5: January 26–February 10, 2022

- Wave 6: April 26–May 9, 2022

Find additional resources about the Wayfair decision, economic nexus, and marketplace facilitator laws at the Avalara resource center.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.