What is sales tax? Definition and examples

You’ve probably paid plenty of sales taxes in your lifetime, but paying sales tax as a consumer is different from dealing with sales tax as a business. Once on the other side of the counter, you may find yourself wondering exactly what sales tax is.

So.

What is a sales tax?

A sales tax is a tax on consumption, the exchange, sale, or transfer of goods or services. It’s generally added to the sales price of retail sales, collected by the retailer at checkout, and paid by the consumer.

The United States has no federal sales tax or national sales tax. Instead, sales tax is levied and administered by state and/or local governments (i.e., cities, counties, and special districts).

Which states charge sales tax?

There’s a general sales tax in 45 states, the District of Columbia, and the territory of Puerto Rico. Most of those states have local sales taxes in addition to the state sales tax. However, there are no local sales taxes in Connecticut, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Jersey, Rhode Island, or Washington, D.C.

That leaves five states with no sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware (sometimes called the NOMAD states after their initials). Alaska stands out because more than 100 local governments in Alaska levy a local sales tax. And although the NOMAD states don’t have a general, statewide sales tax, they do tax certain transactions.

All told, there are more than 12,000 sales and use tax jurisdictions nationwide, many of them overlapping. Sales tax sourcing rules govern which jurisdiction’s rates apply.

The vast number of sales and use tax jurisdictions in the United States is one reason sales tax compliance can be so challenging for businesses. Sales and use tax rates are also subject to change, and there can be different rates for different products.

Adding to the complexity, some products and services are fully exempt from sales and use tax by law. And some normally taxable transactions are exempt because of the circumstances; in this case, businesses must validate the exemption with an exemption certificate.

How does sales tax work?

Sales tax is based on a percentage of the sales price, a percentage that varies from jurisdiction to jurisdiction.

For example, the total sales tax rate in Alameda, California, is currently 10.75%. The California Department of Tax and Fee Administration (CDTFA) breaks that rate down:

- Base state sales tax rate, 6%

- Mandatory (statewide) local rate, 1.25%

- Alameda County Children’s Health and Child Care Transactions and Use Tax, 0.5%

- Alameda County Essential Health Care Services Transactions and Use Tax, 0.5%

- Alameda County Transactions and Use Tax, 0.5%

- Alameda County Transportation Commission Transactions and Use Tax, 0.5%

- Alameda County Transportation Commission 2022, 0.5%

- Bay Area Rapid Transit District, 0.5%

- City of Alameda Transactions and Use Tax, 0.5%

If a resident of Alameda purchases a $100 sweater from a registered retailer and has it delivered to their house, the retailer would add the 10.75% sales tax to the sales price, for a total of $110.75 ($100 plus the 10.75% tax). The retailer is responsible for reporting and remitting the 10.75% to the California Department of Tax and Fee Administration. In some states, the local portion of the tax must be remitted directly to the appropriate local taxing authority.

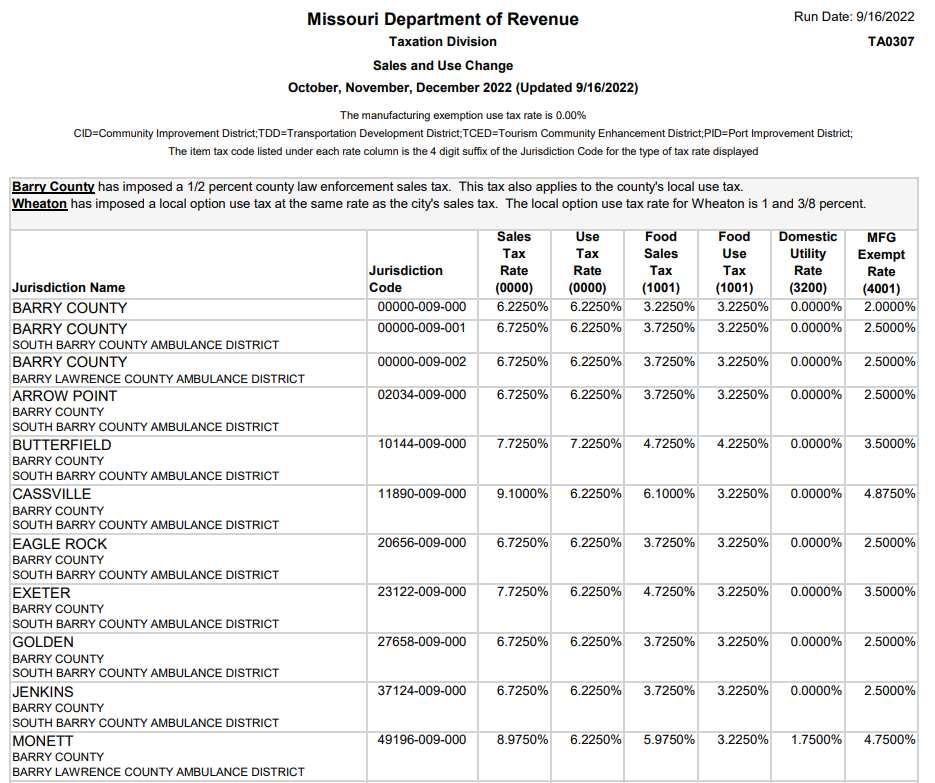

This snapshot from a sales and use tax change notice from the Missouri Department of Revenue further illustrates how complex sales and use tax can be.

Each district in Missouri has a sales tax rate and a use tax rate, which often aren’t the same. Each jurisdiction also has a sales tax rate for food and a use tax rate for food, which are also often different, a rate for domestic utilities, and a rate for manufacturing.

Note that there are three sales and use tax jurisdictions in Barry County alone. This helps explain how Missouri can have more than 2,000 distinct sales and use tax jurisdictions, and why it can be difficult for businesses to assess the proper sales tax rates for transactions in Missouri and other states. Sales tax software can help.

Types of sales tax

Though all sales tax laws are variations of the same theme, the specifics vary from state to state.

Some states tax the seller and allow the seller to pass the tax on to the buyer; this is a type of seller privilege tax. Other states tax the buyer and require the seller to act as the tax collector; this is a type of consumer tax.

Most states refer to their sales tax as a sales tax whether they have a seller privilege tax or a consumer tax. But Illinois calls sales tax by another name, and what feels like a sales tax to consumers in a couple of states isn’t actually a true sales tax:

- Arizona has a transaction privilege tax (TPT)

- Hawaii levies a general excise tax (GET)

- New Mexico levies a gross receipts tax (GRT)

Arizona’s TPT and New Mexico’s GRT are imposed on businesses for the privilege of doing business in the state. Hawaii’s GET is assessed on business activities. As with a seller privilege tax, businesses are permitted to pass the GET, GRT, and TPT on to consumers, but they’re not required to.

Who has to collect and remit sales tax?

Sales tax is always collected by a retailer, but not all businesses are required to collect sales tax. Whether you need to obtain a sales tax permit then collect and remit sales depends on something called nexus.

Nexus is a connection that creates a sales tax requirement. The most common ways for a business to establish nexus are:

- Physical presence in a state

- Economic activity in a state (economic nexus)

- Ties to affiliates in a state (affiliate nexus)

- Referrals from in-state businesses or individuals (click-through nexus)

Because economic activity, referrals, and ties to in-state affiliates can establish nexus, businesses based in other states and even other countries can develop an obligation to collect and remit sales tax in states where they make sales. Learn more about sales tax nexus.

Sales tax vs use tax

If a retailer doesn’t have nexus with a state and therefore doesn’t collect sales tax on a taxable sale, the consumer — whether a business or an individual — is generally liable for the corresponding consumer use tax.

Consumer use tax was developed to complement sales tax. It’s due when sales tax isn’t paid on a taxable transaction.

There are basically three ways to trigger a use tax obligation:

- An out-of-state retailer doesn’t have nexus and therefore doesn’t collect sales tax on items delivered into the state. In this case, the consumer must self-assess consumer use tax and remit it directly to the appropriate tax authority. States with a state income tax often include a use tax line on income tax returns. States with no income tax, like Washington, usually have a separate consumer use tax return.

- A business uses inventory purchased tax-free for resale or another purpose (e.g., incorporation into an end product). In this case, the business must self-assess consumer use tax and remit it directly to the appropriate tax authority. Sales and use tax returns generally have a line for use tax (for an example, see the California sales and use tax return).

- An individual or business purchases items in another state or country for use in their home state. Individuals must report use tax on a consumer use tax return or personal income tax return; businesses report it on their sales and use tax return.

Failure to properly assess and pay consumer use tax is one of the most common compliance mistakes made by businesses. Automating consumer use tax compliance helps reduce that risk.

To learn more about sales and use tax, check out the following resources:

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.