What is the pink tax?

In 2016, a New York City pharmacy put up signs announcing that all female customers could shop tax free, while all male customers were subject to a 7% man tax. It was done to raise awareness about gender pricing discrimination, also known as the pink tax.

But what exactly is the so-called pink tax? Is it really a tax? Read our pink tax FAQ for the answers to these and other questions.

Pink tax FAQ

What is the pink tax?

Most broadly, the pink tax describes gender inequality in various forms, including the gender pay gap.

More specifically, the pink tax refers to gender-based price discrimination: the fact that some products and services designed for women or girls may cost more than similar products and services designed for men or boys.

Is the pink tax a real tax?

The pink tax isn’t a traditional “tax,” but a number of studies have concluded the pink tax is real.

“Examples of gender-based price disparities for goods and services have been documented throughout the economy,” noted a December 2016 report by the Joint Economic Committee of the United States Congress. “This phenomenon may not constitute intentional gender discrimination. Yet the frequency with which female consumers find themselves paying higher prices for gender-specific goods and services effectively becomes a tax on being a woman.”

Evidence the pink tax exists

A 1992 investigation of price discrimination against women conducted by the New York City Department of Consumer Affairs (DCA) concluded that women paid more for men at dry cleaners, hair salons, launderers, and used car dealers. Then, in 1994, California’s Assembly Office of Research found that 64% of stores in five major cities charged more to launder a women’s white cotton shirt than a man’s white cotton shirt, and that women in California paid on average $5 more for a haircut than men.

Roughly two decades later, in 2011, researchers at the University of Central Florida reported that 85 out of 100 surveyed hair salons charged an average of 54% more for a basic women’s haircut than a basic men’s haircut.

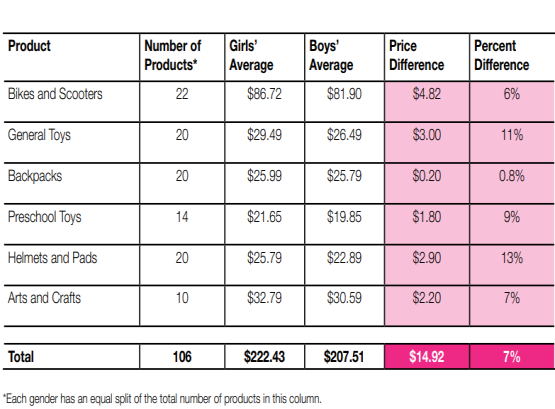

And in 2015, after reviewing nearly 400 pairs of products sold by New York City retailers, the New York City DCA concluded women’s products “were priced higher” than similar products for men. DCA found that 42% of women’s products were priced higher than similar men’s products. By contrast, men’s products had a higher price tag 18% of the time.

Evidence the pink tax may not exist

In 2018, the U.S. Government Accountability Office (GAO) examined prices for 10 categories of personal care products geared to women and men. After controlling for size and other factors that could lead to price discrepancies, GAO found women paid more than men for the following five products:

- Body deodorant

- Body spray

- Designer perfume

- Shaving cream

- Underarm deodorant

However, the following products for men cost more than similar products for women:

- Nondisposable razors

- Shaving gel

There was no discernible gendered price for the following:

- Disposable razors

- Disposable razor blades

- Mass-market perfumes

Ultimately, GAO couldn’t definitively conclude there was a pink tax — or that there wasn’t. “GAO found that the target gender for a product is a significant factor contributing to price differences identified, but GAO did not have sufficient information to determine the extent to which these gender-related price differences were due to gender bias as opposed to other factors, such as different advertising costs.”

Is a tampon tax a pink tax?

“Pink tax” is sometimes used to describe “tampon tax,” which is actually a sales and use tax on tampons and other feminine hygiene products. According to the Congressional Joint Economic Committee, the sales tax on feminine hygiene products is an example of “gender-based pricing.”

Though a number of states now exempt tampons and similar products from sales and use tax, sales tax applies to menstrual products in about 27 states. States looking to eliminate the sales tax on feminine products in 2023 include Hawaii, North Carolina, South Carolina, Texas, and Wisconsin.

In the meantime, some businesses are trying to offset the tampon tax and sales tax on other gendered products by lowering their retail sale price. In October 2022, CVS announced it was reducing the price of CVS-brand period products by 25% in all U.S. stores, and absorbing the sales tax on these products (i.e., paying it themselves) in 12 states: Arkansas, Georgia, Hawaii, Louisiana, Missouri, South Carolina, Tennessee, Texas, Utah, Virginia, Wisconsin, and West Virginia.

Is import tax the true pink tax?

If there is a true tax on gendered items, it’s likely import tax (aka, customs duty or tariffs). In 2015, the Mosbacher Institute for Trade, Economics, and Public Policy at Texas A&M University found that clothing companies pay higher import taxes on certain women’s apparel than on similar men’s apparel.

Rates don’t always change based on gender, but they can because gender is one way governments and customs officials distinguish the millions of products that cross international borders every day. In fact, the Mosbacher Institute determined that 86% of U.S. apparel imports and 79% of U.S. footwear imports in 2014 were gender-classified by the United States International Trade Commission. And gender-based discrepancies on import taxes persist today.

For example, women’s or girls’ shirts knitted or crocheted from manmade fibers and containing 23% or more of wool or fine animal hair (HTS 61062010) are subject to a 14.9% import tax. By contrast, men’s or boys’ shirts made in the same way of the same materials (HTS 61052010) are subject to a 13.6% import tax.

The difference in import tax rates can be even more extreme, as evidenced here:

- 0.9% — Duty rate for men’s or boys’ shirts containing 70% or more by weight of silk or silk waste (HTS 61059040)

- 14.9% — Duty rate for women’s or girls’ shirts containing 70% or more by weight of silk or silk waste (HTS 61062010)

(You can search the Harmonized Tariff Schedule for duty rates using the HTS codes provided above. Learn more about HTS codes.)

The Mossbacher Institute would like to see Congress address the gender import tax disparity, perhaps by banning “tariff differentials on products that are gender-classified, but otherwise identical.”

Is the pink tax legal?

There’s currently no federal law prohibiting gender-based price discrimination. The 2021 Pink Tax Repeal Act sought to outlaw gender-based taxes, but the bill garnered little attention and wasn’t enacted. Similar bills introduced in the past have also died.

However, at least two states and several local jurisdictions have prohibited so-called pink taxes — and their counterpart, blue taxes.

Which states have banned the pink tax?

Both California and New York have enacted laws that prohibit gender-based price discrepancies.

California bans gender-based price discrimination

California’s Gender Tax Repeal Act of 1995 prohibits businesses of any kind from discriminating, with respect to the price charged for services of similar or like kind, against a person because of the person’s gender. However, it allows businesses to set different prices “based specifically upon the amount of time, difficulty, or cost of providing the services.”

Because it applied to services but not to products marketed to women, the 1995 law left the gender-based pricing ban undone. In 2022, the California Assembly rectified that oversight with the enactment of AB-1287. As of January 1, 2023, California businesses are prohibited from charging a different price for any two goods that are substantially similar, “if those goods are priced differently based on the gender of the individuals for whom the goods are marketed and intended.”

Like its predecessor, the 2022 California law doesn’t prohibit price differences that are based specifically upon:

- The amount of time it took to manufacture those goods

- The cost incurred in manufacturing those goods

- The difficulty in manufacturing those goods

- The labor used in manufacturing those goods

- The materials used in manufacturing those goods

- Any other gender-neutral reason for charging a different price for those goods.

New York state bans gender-based price discrimination

New York City prohibited retail establishments from discriminatory pricing based on gender in 1998. It also granted DCA the authority to issue fines to businesses found violating the law. You can still file a complaint about NYC retail service establishments that charge men and women different prices for the same service.

New York state officially banned gender-based pricing for substantially similar products or services effective September 30, 2020. As in California, New York state doesn’t prohibit price differences in goods or services that are based on the amount of time or difficulty it took to manufacture the goods/services, the cost incurred in manufacturing the goods or offering the services, and similar considerations.

Miami-Dade County, Florida, bans gender-based price discrimination

Though price discrepancies based solely on gender haven’t been outlawed by the state of Florida, they’re illegal in Florida’s Miami-Dade County. The county’s gender price discrimination ordinance applies to both goods and services and to sales by individuals as well as businesses.

As seems to be the norm in such cases, price disparities for comparable products are legal under certain circumstances, such as if products for one gender cost more to produce or obtain than products for another gender.

What states could ban the pink tax in 2024?

At the start of the 2024 legislative session, many states introduced bills seeking to prohibit gender-based pricing, gender discrimination, pink taxes, and so forth. These include Kentucky, Missouri, and South Carolina.

Learn more about the states looking to get rid of pink taxes in 2024.

What’s the future of the pink tax?

Your guess is as good as ours.

Congress could ban gender-based price discrepancies, as could more state and local governments. Yet bans may not be effective if it costs businesses more to manufacture or import certain gendered products. Indeed, the pink tax is already outlawed in some parts of this country, and it seems to still exist.

The pink tax could evolve to become nonbinary. After all, as GAO discovered, some products geared toward men cost more than comparable products geared toward women. Furthermore, a growing number of consumers that purchase products subject to the so-called pink tax may not identify as female.

Whatever happens, Avalara Tax Desk will let you know.

This post was updated for 2024. It first published in May 2023.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.