CFOs: Talent shortage is propelling AI adoption

Short-staffed businesses in any industry basically have three options: Ask existing employees to work more hours, cut back on services, or invest in technology to improve the efficiency of the current workforce. Many chief financial officers facing staffing challenges now favor leaning into artificial intelligence (AI), according to new research from Avalara.

We surveyed approximately 300 CFOs in the United States and United Kingdom to get their take on talent availability, economic conditions, and AI. The survey findings suggest CFOs on both sides of the Atlantic are concerned about the economy and facing talent shortages. Many plan to use AI to drive efficiency, profitability, and productivity. Read on for details.

Fewer people are entering the accounting profession

An exodus of retiring accountants, pandemic-related fallouts (the “Great Resignation”), and declining numbers of accounting graduates have created a perfect storm for the accounting field. Almost 75% of the CPA workforce hit the retirement age in 2020, and younger accountants are leaving the profession in droves.. There’s a need for new talent, but the number of CPA candidates sitting for the Uniform CPA Examination in 2022 was the lowest in 17 years.

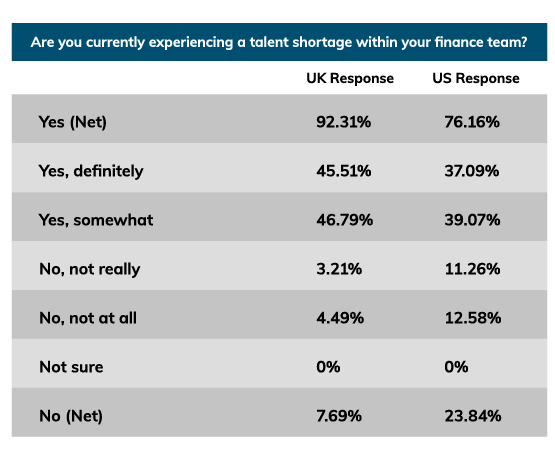

CFOs surveyed by Avalara are certainly feeling the effects of retirements, departures, and the sluggish pipeline. Asked if their finance teams are currently experiencing a talent shortage, 84% of U.K. and U.S. respondents said yes. Diving deeper:

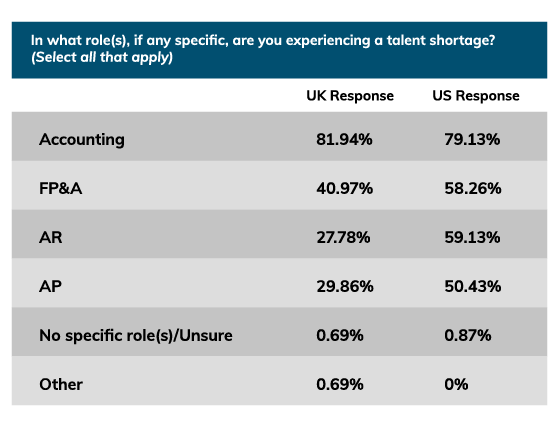

- 81% report a talent shortage in accounting roles

- 49% report a talent shortage in Financial Planning and Analysis (FP&A)

- 42% report a talent shortage in Accounts Receivable (AR)

- 39% report a talent shortage in Accounts Payable (AP)

CFOs in the U.K. expressed a more dire outlook than their U.S. counterparts.

Interestingly, although greater numbers of respondents in the U.K. reported overall talent shortages, more U.S. than U.K. CFOs are experiencing talent shortages in FP&A, AR, and AP. The need for accounting professionals is roughly the same in both geographic areas.

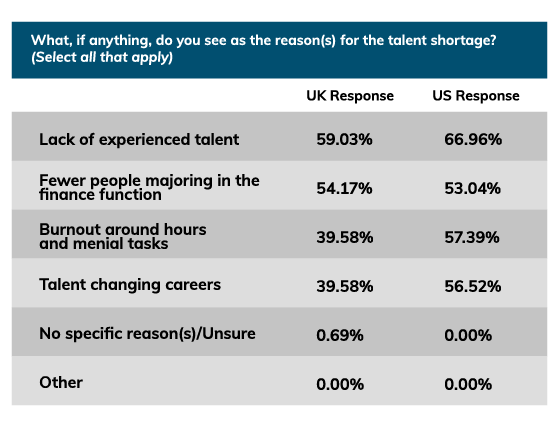

When asked to explain the reason(s) for the talent shortage in their finance team, 63% of U.K. and U.S. respondents said there’s a lack of experienced talent. Like other industry watchers, CFOs are finding:

- Fewer people are majoring in the finance function (54% of respondents)

- Talented people are changing careers (47% of respondents)

- There’s burnout around hours and menial tasks (47% of respondents)

Country-specific survey results suggest U.S. CFOs are finding it harder than their peers in the U.K. to find experienced talent. They’re also seeing more burnout and career changes. As for whether fewer people are majoring in finance, the transatlantic data is about the same.

AI will drive efficiency, productivity, and profitability

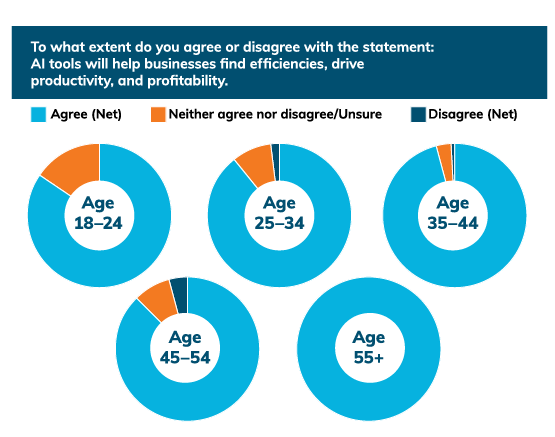

With fewer people available to complete essential tasks, CFOs are turning to AI. Just over 92% of CFOs surveyed on both sides of the Atlantic agree that AI tools will help businesses find efficiencies and drive productivity and profitability. This is true for polled CFOs of all ages, though particularly for those age 55+.

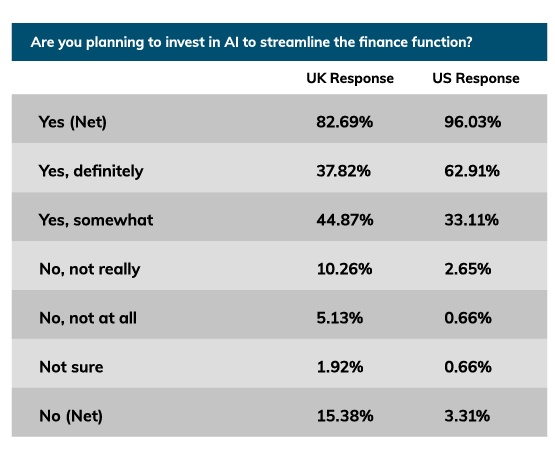

Given how many of the surveyed CFOs agree that AI tools will help their businesses moving forward, it stands to reason that 89% of the polled CFOs plan to invest in AI. Yet here, again, it’s interesting to parse the geographic differences. The survey found that CFOs based in the U.S. are more likely to be planning to invest in AI to streamline the finance function than CFOs in the U.K. And 15% of the CFOs surveyed in the U.K. are not planning to invest in AI, compared to 3.31% of CFOs surveyed in the U.S.

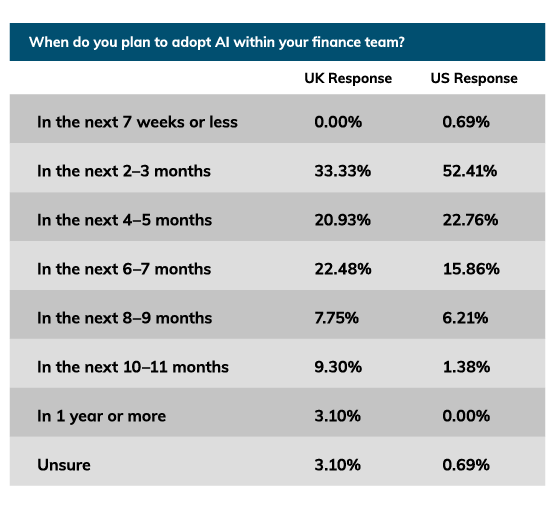

Most of the CFOs surveyed who plan to invest in AI to streamline the finance function see no reason to wait. When asked when they plan to adopt AI within their finance teams:

- <1% said in the next 7 weeks or less

- 43% said in the next 2–3 months

- 22% said in the next 4–5 months

- 19% said in the next 6–7 months

- 12% said in the next 8–11 months

Less than 1.5% will wait one year or more; fewer than 2% weren’t sure.

The transatlantic data shows that U.S.-based CFOs are planning to act a bit more quickly than their counterparts in the U.K. About 75% of polled CFOs based in the U.S. plan to adopt AI within their finance team within five months. By contrast, 54% of CFOs surveyed in the U.K. plan to do the same. Look at the responses by geographic area.

Responses were mixed as to whether CFOs will work with internal teams or outside vendors when investing in AI. However, almost 78% of U.K. and U.S. respondents are planning to rely on a third-party provider, at least in part:

- 22% plan to work with outside vendors

- 56% plan to work with internal teams and external vendors alike

Just 21% plan to work with in-house teams, and about 1.5% were unsure.

ChatGPT seen as a leading solution

Among CFOs surveyed, ChatGPT is the leading option for AI. Nearly 65% plan to invest in ChatGPT to streamline the finance function of their teams. Salesforce is the second most popular solution, with 53% naming it. Other options include Zapier (32%), Bard (29%), and Einstein (23%). Only about 21% plan to build an in-house solution to meet their needs.

Cost will likely be a consideration. According to CFO Dive, “CFOs are under increasing pressure to weigh the value of [automation and AI] technologies not only for their future potential, but as ways to help bring down costs in a rocky economic environment.”

Many CFOs are concerned about the state of the economy

Just over half (51%) of the CFOs surveyed on both sides of the Atlantic are anticipating a recession and operating in cutback mode. Fewer than 37% have shifted back to a growth mode, and only 10% are staying their current course, neither cutting back nor expanding. There weren’t significant differences between the transatlantic responses.

What do the polled CFOs consider to be reliable indicators of a recession?

- Consumer spending (76%)

- Consumer Price Index (59%)

- Producer Price Index (57%)

Whether optimistic or concerned about the state of the economy, and whether their business is growing or contracting, CFOs surveyed are generally feeling the impact of the shortage of available talent in the accounting and finance sectors. Many plan to invest in AI tools in the coming months to find efficiency, drive productivity, and bolster profitability.

Avalara understands the value AI can provide to businesses when it comes to automating tax compliance. Earlier this year, we launched the first sales tax plugin for ChatGPT that allows users to ask the platform to calculate and research sales tax rates based on their location. Avalara also leverages AI across our portfolio of tax compliance solutions to power data extraction from tax documents, assign tax and Harmonized System (HS) codes on transactions, and more. Learn more about the future of tax compliance with AI in our on-demand webinar.

Avalara’s tax compliance platform has solutions to automate the end-to-end compliance journey for CFOs and their teams. Learn more about the Avalara platform here.

Survey methodology: Research was conducted by Censuswide with 307 full-time CFOs in the U.S. and U.K. (aged 18+) between August 25, and August 31, 2023. Censuswide abides by and employs members of the Market Research Society, which is based on the ESOMAR principles and is a member of The British Polling Council.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.