Spilling the tea on tea taxes

One cold December night in 1773, a small group of North American colonists dumped 342 crates of British tea into the Boston Harbor to protest tax policies related to tea. The 250th anniversary of what we now call the Boston Tea Party got us wondering how people today feel about tea, tea taxes, and the Boston Tea Party itself. So, we commissioned Censuswide to survey businesses, tea merchants, and consumers in both the United Kingdom and the United States to find out.

Key takeaways from the survey:

83% of U.S. tea merchants believe tax complexity is out of control in the U.S.

68% of U.K. business leaders believe tax complexity is out of control in the U.S.

82% of U.S. tea merchants feel anxious about staying on top of their tax obligations

77% of U.K. tea merchants feel anxious about staying on top of their tax obligations

90% of U.S. tea merchants would use automation or AI to reduce sales tax complexity

85% of U.K. tea merchants are looking to invest in technologies, like automation or AI, to ease the burden of complexity when it comes to tax and cross-border tax compliance

Grab yourself a cuppa and settle down to learn more.

Why was the Boston Tea Party important?

More than two-thirds (68%) of surveyed U.S. consumers agree the Boston Tea Party is “one of the most important moments in U.S. history.” Just 37% of surveyed U.K. consumers said the same.

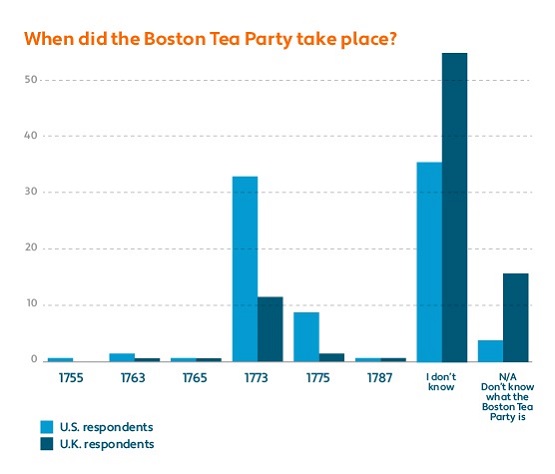

Only one-third (33%) of U.S. consumers and 12% of U.K. consumers surveyed were able to say the Boston Tea Party took place in 1773. Moreover, 37% of U.K. and U.S. consumer respondents combined said they don’t know the purpose of the Tea Act of 1773, which played a significant role in the events leading up to the Boston Tea Party.

If you’re a bit rusty on your history, the Tea Act of 1773 reduced the tax on imported British tea, giving British merchants an unfair advantage over non-British tea sellers. Adding insult to injury, Boston’s pro-British Loyalist governor required colonial merchants to pay the duties on the tea.

Following the Boston Tea Party, the British Parliament punitively banned the loading or unloading of ships in Boston Harbor. It also protected royal officials in Massachusetts and empowered royal governors to find housing for British soldiers throughout the colonies. With Britain’s grip on the colonies seeming to tighten, 12 of the 13 colonies sent delegates to the First Continental Congress in 1774. The Revolutionary War kicked off in April 1775.

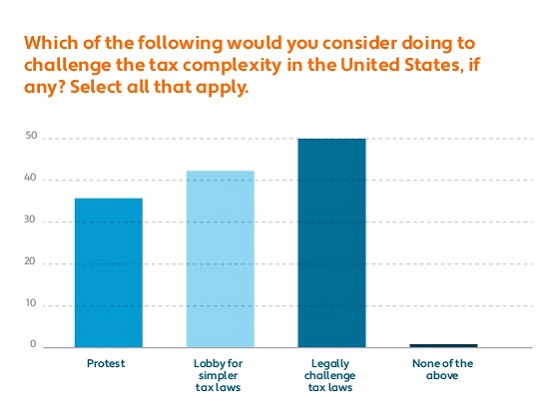

Returning to 2023, 88% of U.S. tea merchants surveyed said they feel inspired by the Boston Tea Party and 91% said they would consider protesting against the level of complexity of sales tax on tea. More specifically, 36% would consider protesting, 42% would consider lobbying for simpler tax laws, and 50% would consider legally challenging tax laws.

For their part, 88% of U.K. business leaders would urge the government to consider ways to reduce sales tax complexity for businesses.

Sales taxes in the United States are complex — and they may even be more complex than many U.K. and U.S. businesses realize.

Tea merchants underestimate the complexity of U.S. tea taxes

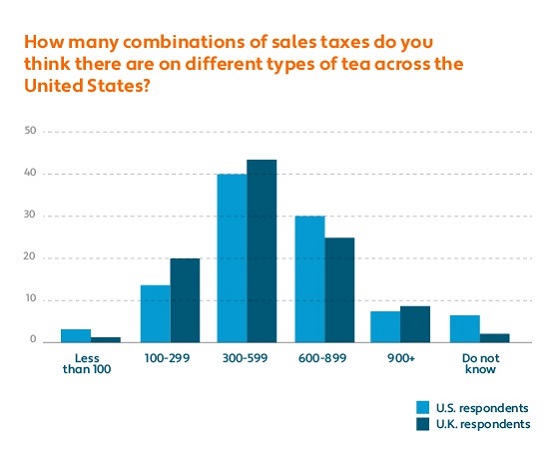

Most U.K. tea merchants surveyed underestimate the number of tax regulations that relate to tea in the U.S. Only 9% of respondents think there are 900 or more types of tax regulations related to tea in the U.S., which is how many there are. The majority (64%) of U.K. tax merchants surveyed think there are less than 600 types of tax regulations, while 25% think there are between 600 and 899 types of tax regulations.

U.S. tea merchants also tend to underestimate the complexity of tea taxes. When asked how many combinations of sales taxes there are on different types of tea across the United States, 56% responded that there are less than 600, while 30% said between 600 and 899. Only 8% correctly answered that there are more than 900 combinations of sales taxes on different types of tea across the U.S.

Most tea merchants have faced fines or penalties for noncompliance

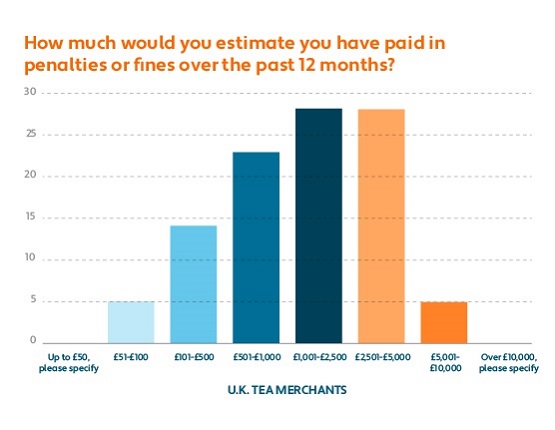

Interestingly, while 71% of the U.K. tea merchants surveyed “feel confident and up to date about the current sales tax rates on the items I sell to the U.S.,” 83% of U.K. tea merchants that export tea to the U.S. have faced fines or penalties due to unintentional noncompliance with U.S. sales tax obligations. Nearly half (49%) have faced fines/penalties more than once. These fines/penalties range from £51 to £10,000 (roughly $64 to $12,600).

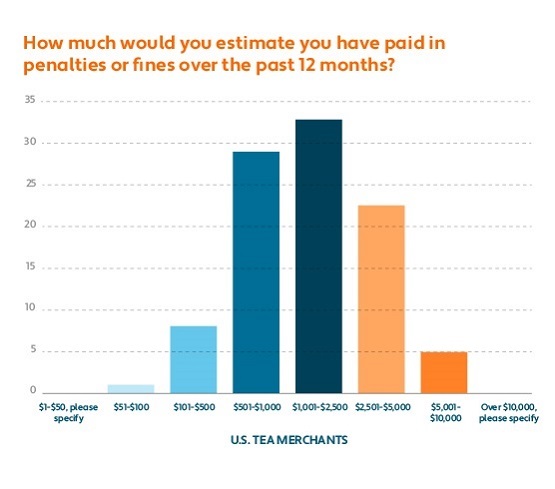

The survey found a similar discrepancy among U.S. tea merchants. Of those surveyed, 74% “feel confident and up to date about the current sales tax rates on the items I sell.” Yet 76% of U.S. tea merchants have faced fines or penalties due to unintentional noncompliance with sales tax obligations, and 60% have faced fines or penalties more than once. Though some of the respondents paid less than $500 in fines/penalties, and some up to $10,000, the fines/penalties for most respondents range between $501 and $5,000.

Tax compliance takes time

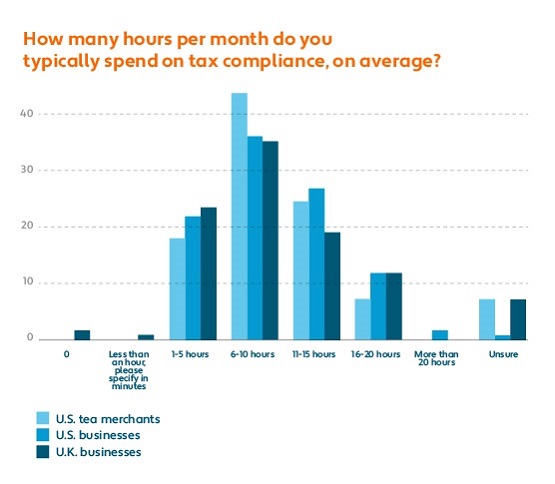

If businesses in both countries have been penalized for noncompliance with sales tax in the United States, it’s not for lack of effort. Most of the businesses surveyed typically spend 6–10 hours on tax compliance each month. Some spend more time, and some less.

Tax compliance is an anxiety-provoking burden for tea merchants

Given the time they devote to compliance and the fines/penalties they’ve paid for unintentional noncompliance, it’s no wonder many tea merchants on both sides of the Atlantic identify tax compliance as a burden and are anxious about it.

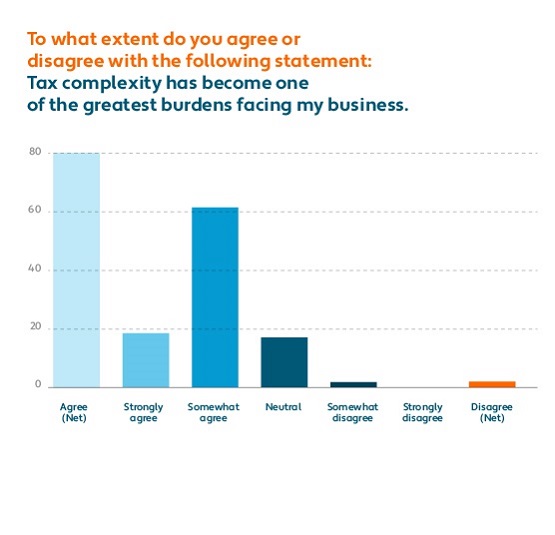

Of U.S. tea merchants surveyed, 80% say tax complexity has become one of the greatest burdens facing their business. Another 82% admit that staying on top of tax obligations makes them anxious. Perhaps not surprisingly, 83% of U.S. tea merchant respondents agree that “tax complexity in the USA is out of control.”

In today’s post-Brexit environment, 66% of U.K. tea merchants surveyed find U.S. sales tax harder to navigate than selling into Europe. Moreover, 77% of U.K. tea merchants admit that staying on top of tax obligations makes them anxious. For U.K. tea merchants that sell into the U.S., calculating sales tax rates and understanding sales tax obligations and boundaries topped the list of “main challenges” facing their business.

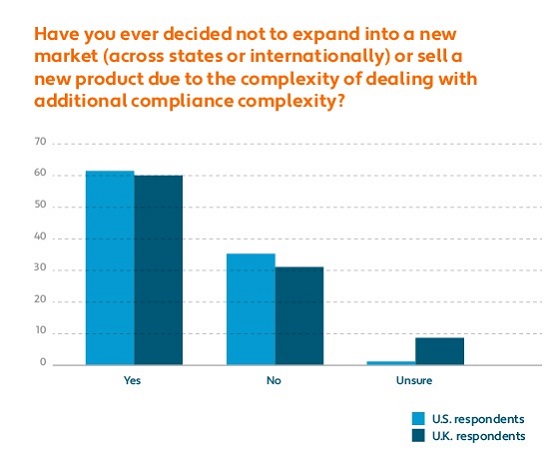

The burden of tax compliance can limit growth too. The survey found that 60% of U.K. business leaders and 62% of U.S. businesses have decided not to expand into new markets (across states or internationally) or sell a new product due to the additional tax compliance complexity it would entail.

Taxes can be a heap of trouble. Unfair tax policies contributed to the Boston Tea Party (and ultimately the Revolutionary War) 250 years ago, and complicated tax policies cause a lot of grief for merchants today. But dumping tea into a harbor probably won’t reduce the tax burden, ease anxiety, or eliminate barriers to growth in 2023.

Technology offers another way, and a majority of the businesses surveyed know it.

Automation can help ease the burden of tax compliance

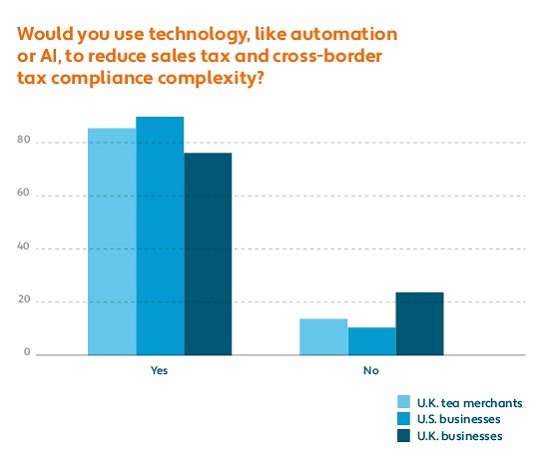

When asked if they’re looking to invest in technologies like automation or AI to ease the burden of complexity when it comes to sales tax and cross-border tax compliance, 77% of U.K. businesses and 85% of U.K. tea merchants replied, “yes,” Among U.S. businesses, 88% said the same.

Trying to deal with sales tax or cross-border tax compliance manually can be like trying to drink tea out of a chocolate teapot: Frustrating; ineffective; maddening. If you sell tea or any other taxable product into the United States or another market, automation offers a way to stay on top of tax compliance with minimal anxiety, burden, and complexity.

Think about it over a cup of tea.

Survey methodology

Surveys were conducted between November 9 and November 21, 2023. For the U.S. data, Censuswide surveyed 100 U.S. tea merchants, 301 decision-makers that deal with tax in small to medium-size businesses (up to 240 employees), and 2,000 U.S. consumers.

For the U.K. data, Censuswide surveyed 300 U.K. decision-makers in small to medium-size general businesses/retailers (up to 240 employees) who have a basic understanding of tax regulation and sell goods across the U.K. and globally. Censuswide also surveyed 102 U.K. decision-makers who say their company sells tea and sells products internationally.

Censuswide abides by and employs members of the Market Research Society, which is based on the ESOMAR principles.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.