Australia to remove nuisance tariffs, simplify international trade

Are there any tariffs that aren’t a nuisance?

Merriam-Webster defines “nuisance” as “one that is annoying, unpleasant, or obnoxious.” If that sounds like a tariff to you, you’re not alone. The Australian Government has identified approximately 500 nuisance tariffs and slated them for elimination effective July 1, 2024.

In Australia, the debate over tariffs has intensified in recent years, with the government facing pressure to reduce or eliminate them. The Australian Chamber of Commerce and Industry (ACCI), which represents more than 70 national industry associations and businesses of all sizes from all sectors of the economy, has been urging the government to remove nuisance tariffs, calling them “a highly inefficient form of taxation and industry policy.”

The Australian Government takes a similar stance. It says abolishing these tariffs will “boost productivity, reduce compliance costs for businesses, and ease the cost of living for Australian families by over $120 million over the next four years.” (All monetary values in this blog post are in Australian dollars.)

Eliminating tariffs can save time and money

Tariffs add significant time and cost to the import process. Importers must declare the value of their goods, pay the appropriate tariffs, and provide documentation proving that the goods meet Australian standards. This can be a time-consuming and expensive process, particularly for small businesses.

Removing tariffs would eliminate these costs and delays, allowing businesses to import goods more quickly and efficiently. This would free up time and resources that could be better spent on other business activities, such as research and development or marketing.

And businesses aren’t the only ones who’d benefit, as the government spends between $11 million and $20 million administering this complex tariff system. Given that and the millions of dollars businesses spend on compliance, it’s estimated the true cost of nuisance tariffs ranges from 59 cents to $1.57 for every dollar collected, according to the Australian Government Productivity Commission.

All this leads to higher consumer prices for imports, to the tune of roughly $1.5 billion, collectively.

Australia shows nuisance tariffs the door

On March 11, 2024, the Australian Government announced its intention to abolish “around 500 nuisance tariffs” starting July 1, 2024. A consultation note published by the Australian Treasury lists the Harmonized System (HS) codes that will likely be affected.

According to the government, removing these tariffs will simplify Australia’s trade system, benefitting both businesses and consumers by:

- Boosting productivity

- Reducing compliance costs and time

- Easing the cost of living for Australian families

In short, this is a big deal. It will be “the biggest unilateral tariff reform in two decades,” says the Australian Treasury, abolishing 14% of Australia’s total tariffs.

What products will qualify for the 0% tariff?

A variety of “household necessities” are expected to qualify for the 0% tariff. These include but certainly aren’t limited to:

- Clothing and footwear

- Dishwashers and refrigerators

- Tools

- Toothbrushes

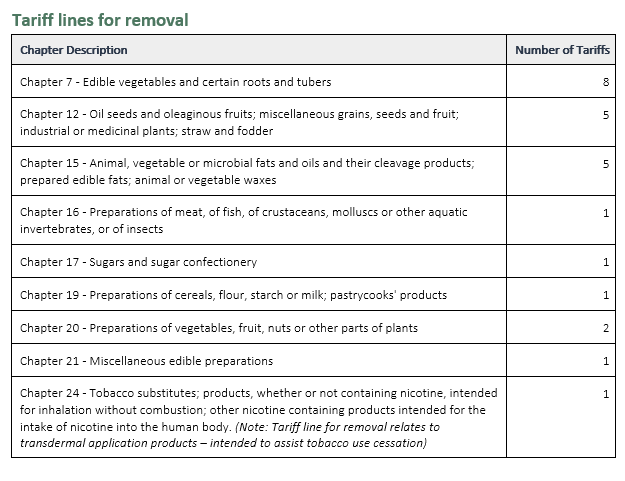

The consultation note published in March provides a high-level description of the “tariff lines for removal” and the number of affected tariffs in each chapter. To give you an idea of the diversity of potentially affected products, here’s a snapshot of the (incomplete) list:

Incomplete list of tariff lines slated for removal.

The consultation note also provides a list of hundreds of HS codes, each one of which corresponds to one of the affected chapters. Products found in Chapter 7 have an HS code starting with a “7”; products found in Chapter 12 have an HS code starting with a “12,” and so on.

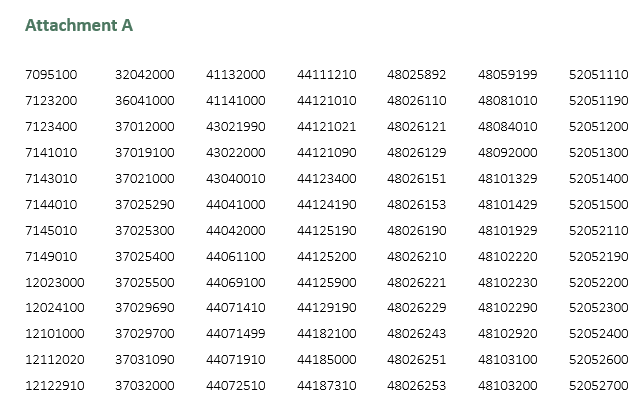

Here’s a snapshot of some of the affected HS codes:

Incomplete list of HS codes that will be affected by the tariff removal.

To identify individual products that are slated to be duty free in and after July 1, 2024, each HS code must be cross-referenced with Schedule 3 of the Current Tariff Classification. It’s a time-consuming, somewhat tedious task.

Fortunately, the Australian Government also provides a nuisance tariff list in spreadsheet form for consultation. From this we can easily ascertain that products up for duty-free status include:

- 7095100: Mushrooms of the genus Agaricus, fresh or chilled

- 63011000: Electric blankets

- 84672100: Drills of all kinds

- 96081000: Ballpoint pens

- 96190010: Sanitary towels (pads) and tampons, napkins (diapers) napkin liners, and similar articles of any material, specifically:

- Goods, of paper pulp, paper, cellulose wadding or webs of cellulose fibers or of textile wadding, as follows:

- (a) incontinence pads, whether or not having an adhesive strip;

- (b) pants or napkins for adults

Why is Australia getting rid of these tariffs?

The Australian Government has determined the tariffs on these products are a nuisance to Australian businesses. Remember the definition of “nuisance” from above? Simply put, these tariffs are “annoying, unpleasant, or obnoxious.”

Furthermore, “these tariffs do nothing to protect Australian businesses,” says the Australian Treasury, “because they apply to goods that often arrive under a concessional rate.”

Australia’s Tariff Concession System waives applicable duties for products not known to be produced by an Australian manufacturer. Currently, approximately 15,000 goods qualify for Tariff Concession Orders (TCO) and can therefore be imported into the country duty free.

Since tariffs would otherwise apply to these products, qualifying for and documenting TCO status becomes a compliance burden. Importers must apply for TCO status and meet all requirements. As the Australian Government observes, “Businesses spend time and money proving their imports are eligible for existing tariff preferences and concessions.”

And proving eligibility is essential. Per the Australian Border Force, “If you fail to meet all the requirements outlined in the form your application may be delayed or rejected.” Penalties may apply if goods do not precisely match the TCO description and/or its classification.

So, eliminating tariffs on products that qualify for a concession should simplify Australia’s trade system and remove compliance burdens for Australian firms.

It could also “ease the cost of living for Australian families” by more than $120 million, collectively, over the next four years, according to the Government, perhaps anticipating that businesses will lower the cost of affected products.

Feminine hygiene products to be duty free as well as exempt from GST

Removing the tariffs on menstrual and sanitary items will also align tariff policy settings with changes made to Australia’s Goods and Services Tax, or GST. Australia eliminated the GST on feminine hygiene products effective January 1, 2019. Making these products duty free could potentially put “downward pressure” on their prices, according to the Australian Treasury, making them more affordable. Time will tell.

What happens next?

The Australian Government invited interested parties to submit input on the list of nuisance tariffs selected for removal. The consultation period concluded April 1, 2024, but the Australian Treasury has yet to publish a finalized list of tariffs slated for removal. We’ll update this blog post once it has.

If your business manages tariffs on its own, you’ll need to make the necessary changes to your systems once the final list of affected HS codes is announced.

How can businesses prepare for tariff reform?

Stay informed: The first step for businesses is to stay informed about the latest developments in the tariff reform process. Regularly check the Australian Treasury’s website for updates or the Avalara Tax Desk for the final list of tariffs to be removed. Additionally, consider subscribing to Avalara newsletters and following relevant social media accounts to stay updated on any changes.

Assess the impact: Once the final list of affected HS codes is announced, businesses should assess the potential impact of the tariff reform on their operations. This includes identifying which products will be affected, the extent of the tariff reduction, and the potential cost savings.

Update systems: If your business manages tariffs on its own, you’ll need to make the necessary changes to your systems once the final list of affected HS codes is announced. This may involve updating software, modifying internal processes, and training staff on the new tariff rates.

Partner with experts: For businesses that use Avalara for cross-border calculation and compliance, rest assured that we’ll update our duties calculation in advance of July 1, 2024. This means you can focus on your core business operations while we handle the complexities of the tariff reform.

Plan for the future: The tariff reform presents an opportunity for businesses to reevaluate their supply chain strategies and explore new markets. Consider diversifying your product offerings, expanding into new regions, and leveraging the cost savings from the tariff reduction to invest in growth initiatives.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.