State-by-state physical presence nexus laws

Guide sections

If you sell into states where you don't collect sales tax, you need to be aware of physical presence nexus laws.

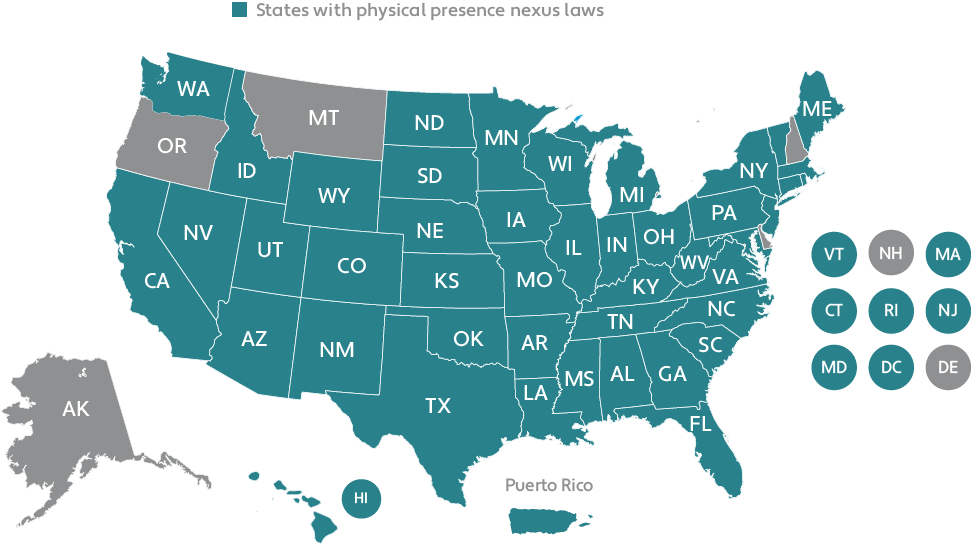

Map of physical presence nexus

The standard for establishing a nexus obligation to register, collect, and remit with a tax jurisdiction was historically based on physical presence within a jurisdiction. The most common form of physical presence in a state is a brick-and-mortar location or storefront, but may also include physical presence through employee activities, payroll, property, performance of services, or trade show attendance. With the United States Supreme Court ruling in 2018, the buzz around nexus has been all about economic activity and remote sellers, though it’s important for all businesses to not forget about physical presence. Any activity a state considers related to physical presence still establishes nexus and results in the requirement to register, collect, and remit sales tax to the appropriate tax jurisdiction. Not fulfilling this obligation results in non-compliance.

Let’s review how states define and enforce physical presence nexus. For more information or assistance in determining your sales tax registration, collection, and remittance requirements, contact Avalara Professional Services

Although we hope you’ll find the information helpful, this guide does not offer a substitute for professional legal or tax advice. If you have questions about your tax liability or concerns about compliance, please consult your qualified legal, tax, or accounting professional. This information was compiled in May 2019. Because states constantly update and amend their sales and use tax laws, see each state’s tax authority website for the most up-to-date and comprehensive information.

Reduce tax risk

Increase the accuracy of your tax compliance with our cloud-based tax engine and tax research services.

Alabama

Summary:

Businesses are required to register with the Alabama Department of Revenue and to charge, collect, and remit the appropriate sales tax to state and local authorities when they have a physical presence in the state, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Alabama.

Alaska

Summary:

Alaska doesn’t have a state sales tax, but local sales and use tax is permitted and is in effect in multiple jurisdictions.

Arizona

Summary:

Businesses are required to register with the Arizona Department of Revenue and to charge, collect, and remit the appropriate tax. In lieu of a sales tax, Arizona imposes transaction privilege tax (TPT) — a tax on income or proceeds derived from engaging in a taxable business within the state. Businesses that have a physical presence in Arizona, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a TPT collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Arizona in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Having an employee present in Arizona for more than two days per year establishes nexus.

Arkansas

Summary:

Businesses are required to register with the Arkansas Department of Finance and Administration and to charge, collect, and remit the appropriate tax when they have a physical presence in Arkansas, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Arkansas.

California

Summary:

Businesses are required to register with the California State Board of Equalization (BOE) and to charge, collect and remit the appropriate tax when they have a physical presence in California, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in California in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in California establishes nexus. You may be liable for collecting and remitting California use tax on orders taken or sales made during California conventions or trade shows. There are some exceptions listed here.

Colorado

Summary:

Businesses are required to register with the Colorado Department of Revenue and to charge, collect and remit the appropriate tax when they have a physical presence in Colorado, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Colorado in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in Colorado. You may be liable for collecting and remitting Colorado use tax on orders taken or sales made during Colorado conventions or trade shows, even if only in the state for trade show activity for one day.

Connecticut

Summary:

Businesses are required to register with the Connecticut Department of Revenue Services (DRS) and to charge, collect and remit the appropriate tax when they have a physical presence in Connecticut, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Connecticut in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Connecticut.

Delaware

Summary:

Delaware doesn't impose a state sales tax, but it does have an annual business license requirement and it imposes a gross receipts tax on the seller of goods or provider of services. Sales of tangible personal property are also subject to a retail or wholesaler license and gross receipts tax.

Any person or entity with nexus in Delaware is required to obtain a Delaware business license from the Delaware Division of Revenue. The division provides a nexus questionnaire to help business taxpayers determine if they have nexus. See the nexus questionnaire.

Florida

Summary:

Businesses are required to register with the Florida Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Florida, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Florida in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in Florida. You may be liable for collecting and remitting Florida sales or use tax on orders taken or sales made during Florida conventions or trade shows. There are some exceptions listed here.

Georgia

Summary:

Businesses are required to register with the Georgia Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Georgia, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Georgia in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Even when nexus is not otherwise established, out-of-state vendors must apply sales tax to any orders taken or sales made during convention or trade show activities.

Hawaii

Summary:

Businesses are required to register with the Hawaii Department of Taxation and to charge, collect, and remit the appropriate tax when they have a physical presence in Hawaii, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state. Instead of sales tax, Hawaii imposes on individuals and businesses a general excise tax (GET) on the gross receipts or gross income derived from their business activities in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Businesses attending conventions or trade shows in Hawaii may be required to register, and to collect and remit Hawaii GET on orders taken or sales made during Hawaii conventions or trade shows.

Idaho

Summary:

Businesses are required to register with the Idaho State Tax Commission and to charge, collect, and remit the appropriate tax when they have a physical presence in Idaho, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Idaho.

Illinois

Summary:

Businesses are required to register with the Illinois Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Illinois, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state. Illinois sales tax is comprised of Retailers’ Occupation Tax and Service Occupation Tax.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Illinois in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in Illinois. You may be liable for collecting and remitting Illinois use tax on orders taken or sales made during Illinois conventions or trade shows. There are some exceptions listed here.

Indiana

Summary:

Businesses are required to register with the Indiana Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Indiana, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Maintaining a warehouse or storing property for sale in the state establishes nexus. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Indiana in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Displaying merchandise at local trade fairs and exhibitions in Indiana.

Iowa

Summary:

Businesses are required to register with the Iowa Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Iowa, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Maintaining a warehouse or storing property for sale in the state establishes nexus.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Iowa.

Kansas

Summary:

Businesses are required to register with the Kansas Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Kansas, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Kansas in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Kansas

Kentucky

Summary:

Businesses are required to register with the Kentucky Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Kentucky, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the commonwealth.

Inventory in the state:

Storing property for sale in the commonwealth. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Kentucky in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in Kentucky for the purpose of taking orders or making sales may establish nexus in Kentucky.

Louisiana

Summary:

Businesses are required to register with the Louisiana Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Louisiana, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

You may be liable for collecting and remitting Louisiana use tax on orders taken or sales made at Louisiana conventions, events, or trade shows.

Maine

Summary:

Businesses are required to register with Maine Revenue Services and to charge, collect, and remit the appropriate tax when they have a physical presence in Maine, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Maine. However, the following activities do not establish nexus in Maine:

- Attending conventions, seminars, or trade shows in Maine (and not soliciting or making sales)

- Holding a meeting of a corporate board of directors or shareholders, or holding a company retreat or recreational event in Maine

- Maintaining a bank account or banking relationship in Maine

- Using a vendor in Maine for printing

See HP 1279, 2019 for more details.

Maryland

Summary:

Businesses are required to register with the Comptroller of Maryland and to charge, collect, and remit the appropriate tax when they have a physical presence in Maryland, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Maryland in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Maryland.

Massachusetts

Summary:

Businesses are required to register with the Massachusetts Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Massachusetts, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the commonwealth.

Inventory in the state:

Storing property for sale in the commonwealth. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Massachusetts in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in Massachusetts for the purpose of taking orders or making sales may establish nexus in Massachusetts.

Michigan

Summary:

Businesses are required to register with the Michigan Department of Treasury and to charge, collect, and remit the appropriate tax when they have a physical presence in Michigan, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Michigan in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Michigan.

Minnesota

Summary:

Businesses are required to register with the Minnesota Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Minnesota, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Minnesota in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in Minnesota. You may be liable for collecting and remitting Minnesota use tax on orders taken or sales made during Minnesota conventions or trade shows. An out-of-state business establishes nexus when it conducts business activity in Minnesota at least four days during a 12-month period.

Mississippi

Summary:

Businesses are required to register with the Mississippi Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Mississippi, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Mississippi.

Missouri

Summary:

Businesses are required to register with the Missouri Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Missouri, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Missouri.

Montana

Summary:

Montana doesn't have a general sales tax, but the state allows certain Montana communities to levy resort and local option sales and use taxes, which are administered by local government agencies.

Nebraska

Summary:

Businesses are required to register with the Nebraska Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Nebraska, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Nebraska.

Nevada

Summary:

Businesses are required to register with the Nevada Department of Taxation and to charge, collect, and remit the appropriate tax when they have a physical presence in Nevada, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Nevada in a warehouse owned or operated by Amazon.

Event or trade show attendance:

You may be liable for collecting and remitting Nevada sales and use tax on orders taken or sales made during Nevada conventions, events, or trade shows. If you make sales at one or two events during a 12-month period, you’re required to declare your intent to sell taxable goods to the event promoter. The promoter will then provide you with a one-time sales tax return. Vendors are required to submit a completed return and all applicable sales tax to the promoter, who will then remit to the state. If you attend more than two events during a 12-month period, you’re required to register for a sales and use tax permit directly with the state of Nevada.

New Hampshire

Summary:

New Hampshire doesn't have a general sales tax and doesn't allow sales tax at the local level.

New Jersey

Summary:

Businesses are required to register with the New Jersey Division of Taxation and to charge, collect, and remit the appropriate tax when they have a physical presence in New Jersey, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending conventions or trade shows in New Jersey. You may be liable for collecting and remitting New Jersey use tax on retail sales of products or services made during New Jersey conventions or trade shows.

New Mexico

Summary:

Businesses are required to register with the New Mexico Department of Taxation and Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in New Mexico, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state. Instead of sales tax, New Mexico imposes a gross receipts tax.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in New Mexico.

New York

Summary:

Businesses are required to register with the New York Department of Taxation and Finance and to charge, collect, and remit the appropriate tax when they have a physical presence in New York, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending conventions or trade shows in New York. You may be liable for collecting and remitting New York use tax on orders taken or sales made during New York conventions or trade shows. If you sell taxable items at an event in New York only once a year, you’re required to collect and remit sales tax. However, mere attendance at a convention or trade show, without making sales or taking orders for taxable goods, generally doesn’t trigger sales tax nexus in New York.

North Carolina

Summary:

Businesses are required to register with the North Carolina Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in North Carolina, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in North Carolina.

North Dakota

Summary:

Businesses are required to register with the North Dakota Office of State Tax Commissioner and to charge, collect, and remit the appropriate tax when they have a physical presence in North Dakota, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in North Dakota.

Ohio

Summary:

Businesses are required to register with the Ohio Department of Taxation and to charge, collect, and remit the appropriate tax when they have a physical presence in Ohio, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Ohio in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in Ohio. You may be liable for collecting and remitting Ohio use tax on orders taken or sales made during Ohio conventions or trade shows. There are some exceptions listed here.

Oklahoma

Summary:

Businesses are required to register with the Oklahoma Tax Commission and to charge, collect, and remit the appropriate tax when they have a physical presence in Oklahoma, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Oklahoma.

Oregon

Summary:

Oregon doesn't have a general sales tax or a use/transaction tax.

Pennsylvania

Summary:

Businesses are required to register with the Pennsylvania Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Pennsylvania, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the commonwealth.

Inventory in the state:

Storing property or the property of a representative at a distribution or fulfillment center located within the commonwealth, regardless of whether the center also stores the property of third parties distributed from the same location. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Pennsylvania in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Participating in conventions or trade shows in Pennsylvania. You may be liable for collecting and remitting Pennsylvania use tax on orders taken or sales made during Pennsylvania conventions or trade shows. All businesses that make taxable sales in the commonwealth are required to register and collect sales tax. Any business that doesn’t have a permanent physical location in Pennsylvania but makes taxable sales there on an irregular basis is required to register for a transient vendor’s license.

Rhode Island

Summary:

Businesses are required to register with the Rhode Island Department of Taxation and to charge, collect, and remit the appropriate tax when they have a physical presence in Rhode Island, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Rhode Island.

South Carolina

Summary:

Businesses are required to register with the South Carolina Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in South Carolina, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in South Carolina in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in South Carolina.

South Dakota

Summary:

Businesses are required to register with the South Dakota Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in South Dakota, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in South Dakota.

Tennessee

Summary:

Businesses are required to register with the Tennessee Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Tennessee, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Tennessee a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Tennessee.

Texas

Summary:

Businesses are required to register with the Texas Comptroller of Public Accounts and to charge, collect, and remit the appropriate tax when they have a physical presence in Texas, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Texas in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending conventions or trade shows in Texas. You may be liable for collecting and remitting Texas sales and use tax on orders taken or sales made during Texas conventions or trade shows, even if you only attend one trade show in the state in a year, for one day.

Utah

Summary:

Businesses are required to register with the Utah State Tax Commission and to charge, collect, and remit the appropriate tax when they have a physical presence in Utah, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Utah.

Vermont

Summary:

Businesses are required to register with the Vermont Department of Taxes and to charge, collect, and remit the appropriate tax when they have a physical presence in Vermont, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Vermont.

Virginia

Summary:

Businesses are required to register with the Virginia Department of Taxation and to charge, collect, and remit the appropriate tax when they have a physical presence in Virginia, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the commonwealth.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Virginia in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in Virginia for the purpose of taking orders or making sales may establish nexus in Virginia.

Washington

Summary:

Businesses are required to register with the Washington Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Washington, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Washington in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Washington.

Washington, D.C.

Summary:

Businesses are required to register with the District of Columbia Office of Tax and Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in the District of Columbia, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the district.

Inventory in the state:

Storing property for sale in the district.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Washington, D.C.

West Virginia

Summary:

Businesses are required to register with the West Virginia State Tax Department and to charge, collect, and remit the appropriate tax when they have a physical presence in West Virginia, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in West Virginia.

Wisconsin

Summary:

Businesses are required to register with the Wisconsin Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Wisconsin, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Wisconsin in a warehouse owned or operated by Amazon.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Wisconsin.

Wyoming

Summary:

Businesses are required to register with the Wyoming Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Wyoming, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives trigger a sales tax collection obligation in the state.

Inventory in the state:

Storing property for sale in the state.

Event or trade show attendance:

Attending a trade show in the state for the purpose of taking orders or making sales may establish nexus in Wyoming.

Physical presence remains a key indicator of a sales tax obligation

In all states with a state sales tax, physical presence is the most straight forward way to determine if you have a sales tax obligation. While these laws aren’t evolving rapidly like economic nexus or marketplace facilitator laws, they can still serve as a key indicator of your sales tax obligation to register, collect, and remit, so you still need to be aware of how states define physical presence and the other activities that are related to physical presence. To see other sales tax laws and nexus rules by state, view our sales tax laws by state resource.