DTC Shipping 101: A survival guide for the beverage alcohol industry

Learn the basics of direct-to-consumer shipping for wineries, breweries, and distilleries.

Additional resources

Direct-to-consumer shipping is a fast-growing business for wineries and other sellers in the beverage alcohol industry. Whether you’re just getting started or want to make sure you’re not missing a step, this is a handy reference guide for today’s DTC best practices.

Today’s consumers are living in the golden age of convenience, whether by simple desire or true necessity. Groceries, household goods, electronics, almost anything can be purchased and delivered at the click of a button. It’s likely only a matter of time — and some key state legislation — before alcohol is delivered everywhere as seamlessly.

Wineries, with their popular wine clubs and online wine shops, have been at the forefront of this growth. Breweries and distilleries currently face more legal restrictions than wineries, but the direct-to-consumer (DTC) market is expected to grow substantially as laws evolve.

This whitepaper breaks down the basics beverage alcohol sellers need to know to not only get started, but also remain compliant.

You’ll learn:

- Who can legally sell and ship alcohol directly to consumers

- A quick history of the legislative complexity surrounding shipping in the beverage alcohol industry

- The essential best practices every DTC seller needs to know to remain compliant

Who can legally sell alcohol directly to consumers?

To be licensed as a DTC seller in the beverage alcohol industry you must meet certain requirements. Unlike consumer goods, alcoholic beverages are more complicated to sell online. The shipping rules are different and there are strict compliance regulations to consider.

As a DTC seller, for example, you must:

- Use a common carrier (FedEx or UPS) for delivery

- Have the appropriate state’s direct-shipping license

- Pay tax in the destination state

So, which types of beverage alcohol businesses are legally able to sell DTC?

Wineries

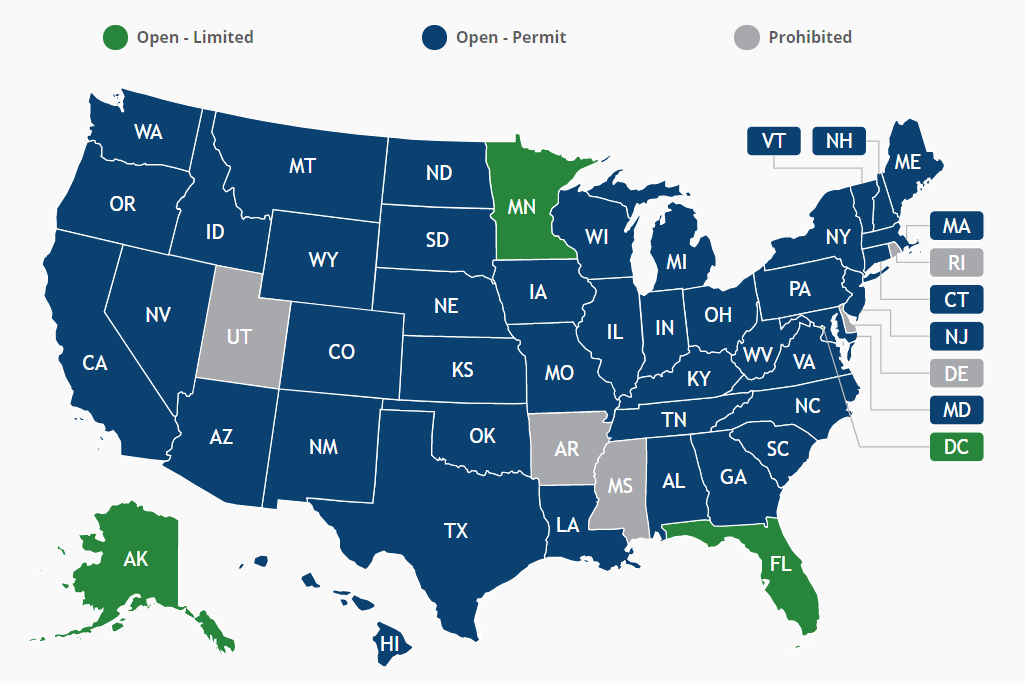

As the most established part of the DTC beverage alcohol market, wineries are able to ship directly to 47 out of 50 states, plus the District of Columbia. Wineries cannot ship directly to consumers in Mississippi, and Utah. Arkansas, Delaware, and Rhode Island allow on-site shipments, but not off-site shipments, according to Wine Institute.

Off-site shipments are made on behalf of a customer who places an order via phone, fax, club subscription, or internet. On-site shipments refer to sales that occur when a customer was physically present at a tasting room.

Breweries

For the most part, state beverage alcohol laws do not support much direct-to-consumer shipping of beer. The laws generally allow only licensed wholesalers to distribute beer, and only licensed retailers to sell to consumers. However, 10 states — plus the District of Columbia — have rules in place to allow breweries to sell directly to their residents: Alaska, Kentucky, Nebraska, New Hampshire, North Dakota, Ohio, Oregon1, Vermont, and Virginia.

Distilleries

Traditionally, distilleries have had to sell their alcohol to distributors who sell it to retailers, through three-tier distribution (producer – wholesale distributor – retailer). However, seven states — Alaska, Arizona, Kentucky, Nebraska, New Hampshire, and North Dakota — and the District of Columbia allow DTC shipment of spirits.

Cideries

Depending on the state, hard cider may be classified like wine or beer, or have its own unique classification.

Retailers

The success of wineries in courts and state legislatures continues to drive retailers to work for the same rights to sell direct-to-consumer across state lines. So far, success is limited. Wine retailers can currently ship to 14 states plus the District of Columbia with the proper licensure.

A complicated history of diverse shipping legislation

When the 21st Amendment passed and ended Prohibition in 1933, states were granted the power to enact their own laws regarding the production, distribution, and sale of alcohol.

Fast-forward to the 2005 Granholm v. Heald case in which the United States Supreme Court ruled that states must treat in-state and out-of-state businesses evenhandedly. This caused most states to go back to the legislature and adopt or update DTC laws, creating additional complexity for DTC sellers.

Tennessee Wine & Spirits Retailers Association v. Thomas was another potential landmark decision. In its 2019 ruling, the Supreme Court struck down Tennessee’s requirement that liquor store owners must be state residents for at least two years, thereby initiating more complicated changes for beverage alcohol sellers. Close observers predict this ruling will lead to the expansion of direct shipping by retailers.

It’s clear that state and federal laws are still evolving, and those changes impact DTC sellers. Each state has different rules so it’s critical that you not only keep up with them when changes happen, but also explicitly understand the rules and comply with them individually.

You can find detailed rules for each state on Wine Institute’s Compliance Rules website.

Best practices for DTC shippers to remain compliant

Regardless of what type of beverage alcohol business you are in, there are some fundamental best practices everyone should follow when shipping direct-to-consumer. Doing so will help ensure that if (or when) an auditor comes calling, you have everything you need firmly in place to make the process move as quickly and painlessly as possible.

Maintain licenses on federal and state levels

Alcoholic beverages are some of the most regulated products in the United States. Failure to properly register and maintain state beverage alcohol licenses can result in revocation of licensure in the state, and potential action at the federal level.

To be compliant, your business is required to register with:

- The Federal Alcohol and Tobacco Tax and Trade Bureau (TTB)

- State Departments of Revenue (DOR)

- State Alcohol Beverage Control departments (ABC).

Every state has its own licensing requirements and shipping laws, so it’s important to check state websites regularly to understand the impact of any changes. Below are some industry overviews — with wineries having by far the most comprehensive information on shipping by state — for your reference.

Stay on top of federal and state tax requirements

In addition to regulatory compliance requirements, sellers are responsible for paying applicable federal, state, or local taxes on sales of beverage alcohol when shipping DTC. These might include several types of tax:

- Sales tax: Consumers pay on the sale of certain goods; sellers file on their sales tax return

- Markup tax: Consumers pay a specific, percentage-based tax on the retail value of alcohol sales; sellers file on a separate return

- Excise tax: Shippers are charged by the unit (e.g., gallon of wine) and the cost is factored into the price of the goods sold to the consumer

When making DTC shipments to a state, it’s as if the sale took place within that state, with the rules applied at what’s called the “destination-level.” And these local tax rates and exception rules can vary dramatically by jurisdiction.

DTC shippers must understand the different kinds of taxes that apply in the states to which they ship. Automating compliance processes with software can help you easily determine the tax rate you’ll need to charge your customers and which forms you’ll need to fill out (and when) for tax payments and applicable returns, especially as your complexity grows as your DTC business expands into multiple states.

Build in an age verification process

As a seller, you’re responsible for ensuring that shipments are only made to consumers who are over 21 years of age. Even though many states don’t explicitly require age verification online — at least not yet — here’s how to set your business up for compliance.

- Websites should include a way to have potential customers affirm they are over age 21 — the legal drinking age in the U.S. — before they visit the site

- Several states require your business to use a third-party age verification provider or store a copy of a government-issued ID for each purchaser

- A few states require you to report the date of birth of the purchaser and/or recipient by collecting that information at the point of sale

Take steps to prepare for potential audits

As the DTC channel continues to grow, expect more states to step up efforts to enforce interstate compliance, much like the Texas Alcoholic Beverage Commission (TABC) did in 2019. There are a few steps every DTC seller should take to help ensure they’re always prepared if an audit comes their way.

- Maintain thorough and accurate records. In addition to the last five years of federal and state tax returns, be sure to save critical records.

- Purchase records (equipment, supplies)

- Tax payment records (federal and state)

- Certificate of Label Approvals (COLAs)

- Production records

- Product registration records (federal and state)

- Be aware of changing rules. To avoid fines, having licenses revoked, or felony charges, stay on top of changing compliance requirements.

- Sign up for legal notifications from local government offices

- Automate notifications of deadlines for paying federal and state taxes

- Help manage all compliance requirements with software

- Bake in compliance. Always keep compliance top of mind to avoid any potential hiccups with federal or state regulators.

- Currently, FedEx and UPS are the only approved national carriers for wine shipments

- Ensure your shipment is compliant before you ship it — make sure it’s legal before it’s picked up by the common carrier

- As you ship to more states, compliance complexity increases; in general, wineries staff according to their volume — greater than 10 states typically requires outsourcing to manage constantly changing reporting, licensing, and tax requirements

The bottom line

As the beverage alcohol industry continues to catch up to its direct-to-consumer counterparts like ecommerce sellers, retail brands, and even Amazon in this expanding channel, the complicated nature of beverage alcohol compliance will remain an ongoing challenge.

Fortunately, businesses competing in this rapidly changing space have options for much-needed support, including dedicated software platforms, experienced industry consultants, and specialized advocacy organizations.

With software designed specifically for suppliers, distributors, and retailers in the beverage alcohol industry, Avalara for Beverage Alcohol is dedicated to simplifying tax and regulatory compliance with easy-to-use software and helpful service. We help you spend less time worrying about tax payments, license filings, and state and federal regulations — so you can spend more time growing your business.

Beverage alcohol tax, licensing, and other regulatory compliance rules change frequently. Although we hope you'll find this information helpful, this paper is for informational purposes only and does not provide legal or tax advice.

1 OR rev stat § 471.282 (2015)