The multi-tax challenge of managing excise tax and sales tax

Overview

It seems so simple on the surface: A customer fills up on gas, purchases some “fuel” for the road—a pack of cigarettes, a bottle of water—swipes a credit card and then heads down the highway. Behind the scenes, however, the systems processing this transaction are going into overdrive as they sort out the numerous tax rules, rates and requirements surrounding this one seemingly straightforward transfer of goods. When a purchase involves both excise tax and sales tax, it’s in fact anything but simple.

The multi-tax challenge

Fuel distributors pay excise tax. Retailers collect and remit sales tax. But what happens when a company has to include excise and sales tax on a single invoice? Suddenly an already-challenging equation becomes a profoundly complicated process.

Fuel tax analysts accustomed to calculating excise taxes based on volume must also determine sales tax percentages based on final purchase prices. Even more confusing: In many jurisdictions, those sales taxes must be calculated after excise tax has been determined and added to the invoice—a process often referred to as “tax on tax” or “gross receipts tax.” This puts an extra burden on the tax calculation process since excise and sales taxes can’t be calculated independently. And if alternative fuels like ethanol or biodiesel are involved, additional determinations must be made. After identifying where the fuel is in the supply chain for excise tax calculation purposes, tax analysts may need to assess how it will be used by the customer to determine sales tax in some states.

Yet for all its complications, mastering the multi-tax challenge is critical for any business whose day-to-day operations involve filing both excise tax and sales tax. Understanding the nuances that differentiate these two very different types of taxes is critical to achieving compliance.

Four critical multi-tax challenges

When incorporating excise and sales taxes into a single invoice, a number of unique scenarios might surface. This is particularly true in the fuel industry, where distributors are impacted by regulations that change frequently. These shifts are sometimes significant and impact the type of tax due according to where along the supply chain the transaction took place. Changes in tax regulations are also handled differently by each tax jurisdiction.

Challenge #1: Product determination

How can a franchise or chain know precisely when a product is subject to both excise and sales taxes, as opposed to one or the other? Unless someone at the company has time to memorize the rules and requirements for 70,000+ taxing jurisdictions, it can’t. Each state, federal and local governing body takes its own approach to applying sales and excise tax. While these jurisdictions may overlap in fuel transfers and transactions, their tax laws rarely do.

For example*: A company that sells lubricants in Alabama, Mississippi or Texas is currently required to charge excise tax in addition to sales tax—but not when those same products are sold in the nearby states of Arkansas and Louisiana. In some states, companies must be ready to apply different requirements to the same product depending on how it’s altered or refined. In California, for instance, pure biofuels are subject only to excise tax...until they’re blended with fossil fuels. Then both excise tax and sales tax must be applied.

Challenge #2: Sales tax base calculations

In addition to varying product determinations, states have different rules on which excise tax components are included in the sales tax base. In some states, excise taxes must be rolled into the product price first so that sales tax can then be calculated as a “tax on tax.” Other states require all excise taxes and fees at both the federal and state levels to be tallied individually. Thus, the same excisable product transaction can undergo wildly different calculations depending on the jurisdiction.

For example*: In Illinois, several excise taxes and fees must be added to a transaction of undyed diesel before the sales tax is calculated: federal excise tax, the Federal Oil Spill Tax, the Illinois State Environmental Impact Fee and the State Underground Storage Tank Tax. If the same transaction takes place in California, those same federal fees will apply—only this time the tax engine must also be programmed to add the state AB32 Fee to cover costs brought about by the state’s 2006 assembly bill aimed at reducing greenhouse gas emissions.

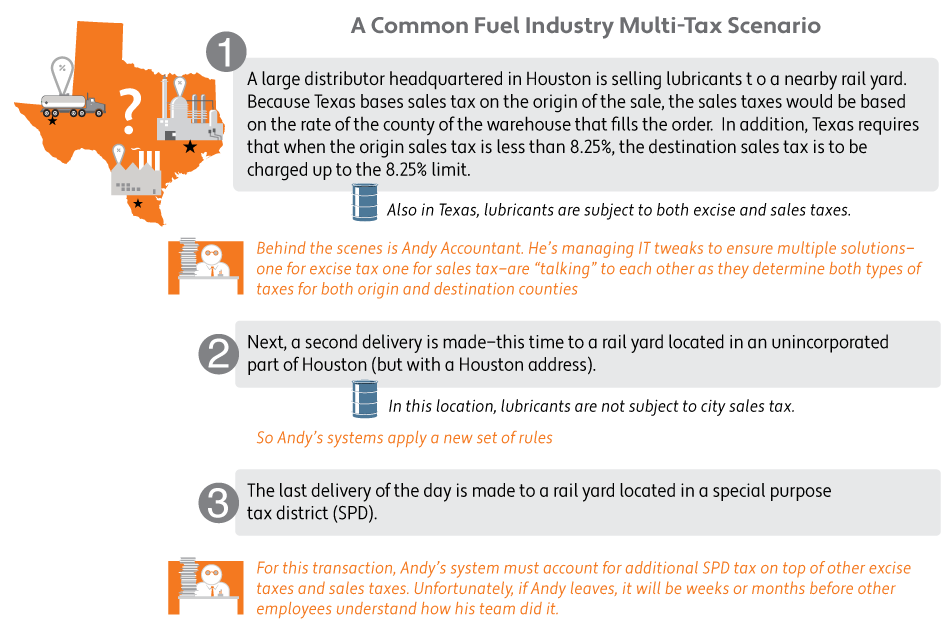

Challenge #3: Location jurisdiction determination

Where is the transaction taking place? Which jurisdiction gets to tax it? How will the combination of excise taxes and sales taxes be impacted by the location? Many tax engines are built to rely on zip codes for these determinations, which can drastically increase the risk of a wrong rate. Zip code-based street addresses don’t reveal whether a transaction is taking place in a special purpose tax district (SPD), where “extra” taxes are collected to help fund things like schools and stadiums. Addresses also can’t be used to determine when a home rule municipality is involved—an oversight that can have disastrous consequences since these entities often levy their own tax rates in lieu of state sales taxes, and can reject sales tax exemptions that are applicable elsewhere in the state.

For example*: In Colorado, dozens of home rule areas have opted out of state level tax collection filings so they can collect excise and sales taxes directly. The state also includes special purpose tax districts, which adds another layer of geographic complexity. Two addresses located across the street from one another could easily be in two completely different taxing jurisdictions with two separate sets of rules around sales tax and excise tax—and yet a tax analyst may not realize that if they are basing their calculations on the zip code alone.

Challenge #4: Sourcing sales locations

Some jurisdictions specify that sales taxes should be added to an invoice and calculated based on where an order was received. In these states, sales tax will apply any time a product order is placed at a sales office located within the state—without regard to the destination state or where the actual transaction takes place. This can make determinations and calculations especially complex for companies with multiple offices in different jurisdictions, particularly when it comes to gross receipts.

For example*: In New Mexico, gross receipts tax collections are based on the location of the office receiving the order. In addition to handling both sales tax and excise tax in the same transaction, a company with multiple sales locations in this state will also need a backend system that can first determine the sales tax rate based on each individual transaction and its office location.

* While these examples were current as of May 2016, state-specific rules and requirements can (and often do) change at a moment’s notice.

Multi-tax compliance coping strategies

To remain compliant, many companies will tailor their ERPs, which tend to be sales tax centric to include custom modules for excise tax determinations. However, because these platforms are not designed to handle this level of complexity, this can lead to costly, time-consuming coding and maintenance—and often pulls IT teams away from other responsibilities that are crucial to day-to-day operations. In these situations, the tax team generally finds itself at the mercy of IT specialists when it comes to implementing changes in rates and rules. Needless to say, this lack of efficiency can delay crucial fixes, thus increasing compliance risk.

Tax automation offers a way out of this mess

AvaTax Excise with Sales and Use fully automates the calculation of both excise and sales taxes, providing accurate determinations based on excise volumes and sales tax percentages. The system integrates directly with back office pricing processes without the need for time-consuming custom coding and ongoing maintenance. With added geo-spatial functionality, taxing jurisdictions are determined based on precise latitude-longitude pairs to accurately pinpoint which state and local authorities get to tax each transaction.

Your next steps toward multi-tax compliance

To be able to accurately calculate multiple tax types, companies must be prepared to continually determine sales tax and keep up with all of the rates and rules of excise taxes—all of which can change dramatically from jurisdiction to jurisdiction. Achieving compliance in this environment is no small feat, but it can be accomplished with the right automation tools.

With AvaTax Excise, you can:

- Identify accurate taxes for 70,000+ taxing jurisdictions

- Determine and calculate fuel excise and sales taxes for the same transaction

- Leverage address geo-location for precise local jurisdiction determination

- Eliminate the need for costly customizations to general sales tax engines

© Avalara Rev 080616

Reduce tax risk

Increase the accuracy of your tax compliance with our cloud-based tax engine and tax research services.

Contact us at: 877-780-4848