- Sign up and configure: Choose from various configurable options that support the tax rates and rules for your properties.

- Select delivery preferences: Schedule your content delivery format and set up your notification preferences.

- Export tax content: Access and receive regularly updated lodging tax content via SFTP or API file delivery.

- Upload tax content: Easily download or upload lodging tax content into the system of your choosing.

Increase the accuracy of offline tax calculations

Avalara helps lodging businesses succeed by providing expertly researched and regularly updated tax content for the hospitality industry.

Let’s solve your tax compliance challenges together

Fill out this short form to connect with an Avalara tax solution specialist.

You can expect the following once you submit:

- We’ll review your business needs.

- One of our specialists will contact you to discuss tailored solutions.

- You’ll get insights into how Avalara can help streamline your compliance.

Connect with us now — we’re excited to speak with you! Already a customer? Get technical support.

BENEFITS

Simplify offline tax calculations for lodging

Increase efficiency

Reduce labor-intensive tasks and support the efficient use of business resources by replacing manual compliance processes with automation.

Decrease risk

Increase the accuracy and uniformity of tax calculations across locations while avoiding errors that can result in costly penalties.

Expand your calculation options

Get lodging tax content for offline or hybrid tax calculations.

Access industry-specific content

Leverage relevant and deeply researched lodging tax content to help maintain compliance.

Be independent from internet connectivity

Eliminate the need for consistent internet access to help ensure continuous compliance and customer satisfaction.

Outpace tax changes

Stay ahead of constantly evolving lodging tax rate and rule changes.

How it works

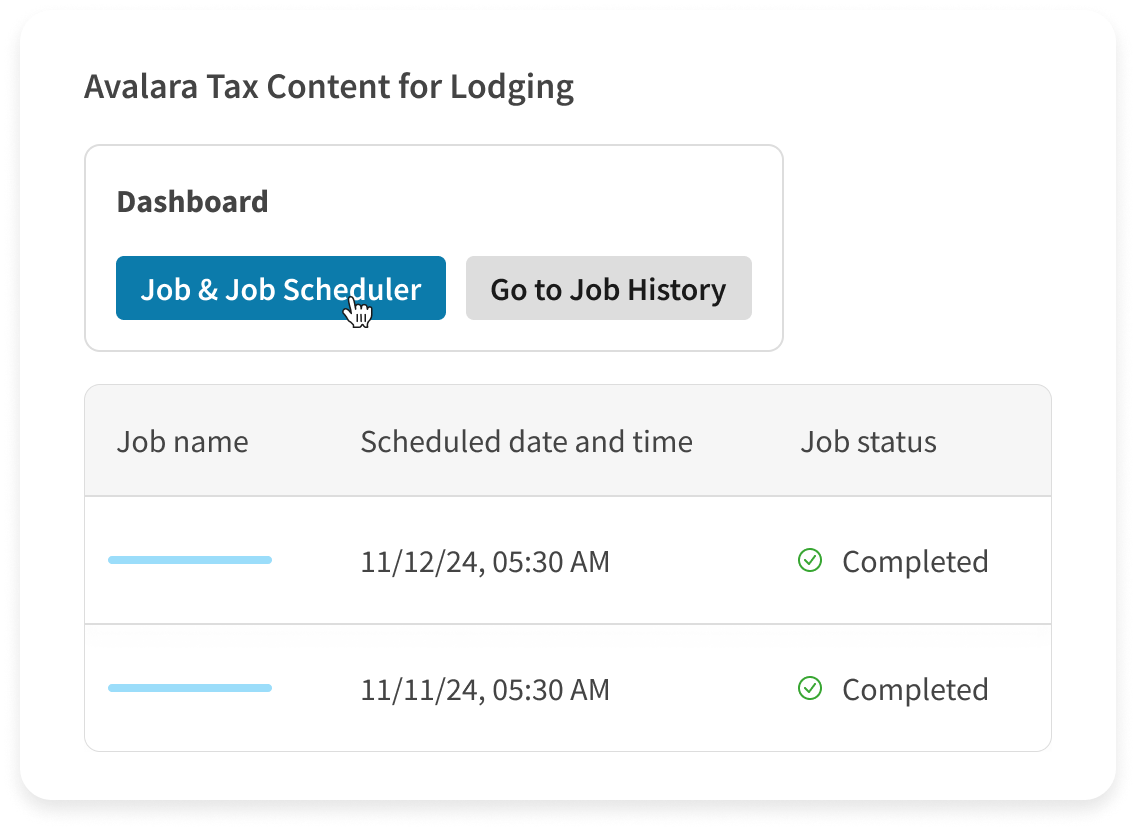

Avalara Tax Content for Lodging

Optimize productivity with Avalara Tax Content for Lodging

Related products

Avalara AvaTax for Hospitality

Ideal for online travel agencies and larger hospitality businesses. AvaTax for Hospitality helps deliver instant, location-specific tax calculations.

Avalara Returns for Hospitality

Manage returns preparation, filing, and remittance through a centralized online portal for easy compliance management and high transparency.

Dive deeper

Learn more about lodging tax obligations, requirements, trends, and more.

EXPLORE

Frequently asked questions

What methods do lodging and hospitality companies typically use to calculate taxes?

Lodging and hospitality companies rely on one of three tax calculation processes: offline, online, or hybrid.

Can Avalara Tax Content for Lodging (ATC for Lodging) be used with AvaTax for Hospitality?

Absolutely, they work together seamlessly to help ensure there are no gaps in tax calculations or compliance. Users can reap the benefits of AvaTax for Hospitality’s live calculations while continuing operation in offline mode with ATC for Lodging when needed.

Does ATC for Lodging support international tax calculations?

No, ATC for Lodging currently only supports tax calculations in all 50 U.S. states.

Can ATC for Lodging be customized for specific business needs?

Yes, ATC for Lodging offers configurable options that allow you to tailor tax rates and rules based on your properties.

Connect with Avalara

Learn how Avalara simplifies tax compliance for lodging and hospitality businesses.