Alcohol Marketplaces 2.0 Part 3: Follow the money

Only businesses holding a license to sell alcohol at retail can sell alcohol to consumers. That simple fact complicates matters for unlicensed entities such as online marketplaces, delivery apps, and delivery services that would like to create or enhance platforms to facilitate alcohol sales. Marketplace platform providers, alcohol licensees, and alcohol and tax regulatory agencies all have different goals and concerns when it comes to the sale of beverage alcohol products.

In this Alcohol Marketplaces blog series, Rebecca Stamey-White, partner at Hinman & Carmichael LLP, and Jeff Carroll, general manager of Avalara for Beverage Alcohol, will explore the multiple issues surrounding alcohol marketplaces and propose a compliance framework to meet the goals and concerns of the different stakeholders.

Disclaimer: This post may constitute attorney advertising and is not intended to provide or be relied on as legal advice. Perform independent legal research and consult your lawyer.

What is the “flow of funds” for an alcohol transaction involving TPPs?

In our previous posts, we covered the history of alcohol agency policy for unlicensed third-party providers (TPPs), the basic requirements of these marketplaces, and how recently enacted marketplace facilitator laws have complicated matters. In this post, we’ll follow the money and discuss the all-important “flow of funds,” which is shorthand for how the money flows from the consumer to the various parties involved with the transaction. As we’ve discussed in previous posts in this series, selling alcohol is an activity that requires a license, which means the licensee must maintain control over product selection, pricing decisions, and, as we'll discuss here in detail, the flow of funds. A TPP could exert too much control and be charged with “selling alcohol without a license” if it controlled the flow of funds (as we often hear TPPs propose) by collecting the money from the sale of alcohol, retaining its service fee, and directing the remainder of the funds to the alcohol licensee in perhaps monthly disbursements. Only the licensee can exert this kind of control over the flow of funds.

What does a typical flow of funds look like?

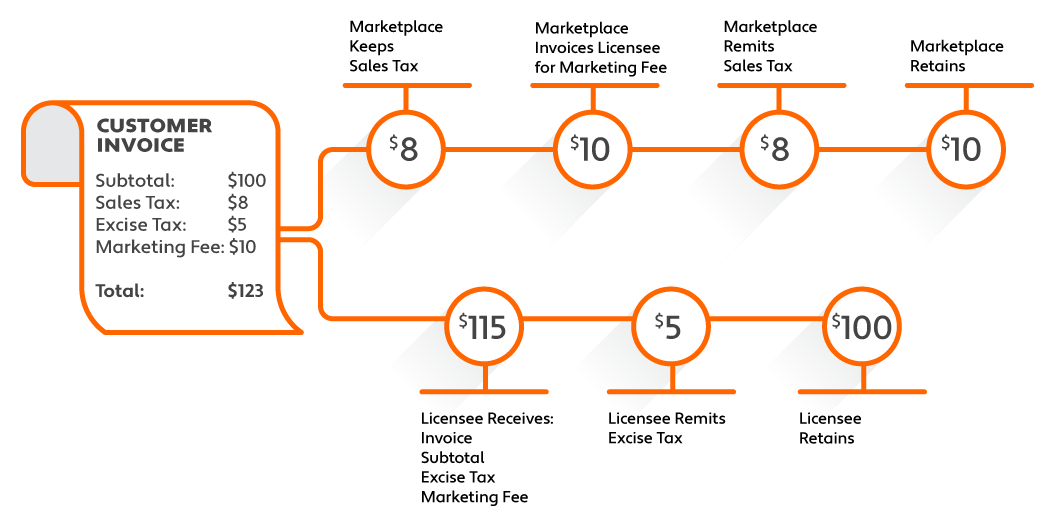

After our last post on marketplace facilitator law requirements, we thought it would be helpful to show what a compliant transaction flow might look like. It’s more complicated now that sales tax needs to be paid by the marketplace.

The entire invoice amount ($123) is charged to the consumer and immediately moves into the control of the licensee, with one exception. Per California’s new guidance, the marketplace can keep the sales tax portion if they’re registered to collect and remit sales tax and send the balance ($115) directly to the licensee. Note, as we mentioned in our last post, marketplace laws vary. We’re using California’s requirements in this example; other states may have different flow of funds requirements for taxes.

The marketplace invoices the seller for their prearranged marketing fee ($10). Note that some states have guidelines and safe harbor for the marketing fee structure and may have issues with percentage-based calculations.

When taxes are due, the marketplace remits the sales tax ($8) and the licensee remits the excise tax ($5). In some states, the licensee may have to report the sales tax that was collected and remitted by the marketplace. The licensee would not have to also pay sales tax, but would be required to include the invoice total as gross receipts before backing it out as exempt.

After the multiple money movements come to rest, the seller nets $100 and the marketplace nets $10.

How have alcohol regulators responded to the “flow of funds” issue?

Candidly, most states haven’t given specific direction on the flow of funds issue, perhaps because most business models operating in this space have already incorporated the flow of funds guidance from the more restrictive states into their models. We summarize some of the existing flow of funds guidances below:

The District of Columbia Alcoholic Beverage Control Board issued an advisory opinion in 2014 (Order No. 2014-314) that prohibits a TPP to “charge or process the customer’s credit cards or directly collect or receive funds from the customer.” Instead, the “sales transaction should occur directly between the customer and the retailer with the licensee thereafter, through a separate written agreement, paying the third party provider for the services rendered.” Only the licensee may actually process the customer’s payment information and complete the transaction to prevent the TPP from “selling” alcoholic beverages, meaning TPPs couldn’t run the credit card, even if the funds flowed into an account controlled by the licensee.

The New York State Liquor Authority addressed the TPP flow of funds issue in its 2013 declaratory ruling (2013-01006A). It determined TPPs could not unlawfully avail themselves of a New York alcohol license by taking a substantial portion of the sale and controlling how consumer funds are disbursed, even when credit card funds were “contractually agreed upon to be processed by a third party financial institution, forwarded to an escrow account opened in the name of the licensed seller, and subsequently distributed to the entities in the chain of distribution according to strict escrow instructions – thereby leaving no discretion or control whatsoever in the hands of the licensed seller.” Essentially, if the licensee’s role is entirely passive, and there are no indications the retailer actually exerts any control over the transaction, an automated solution won’t pass regulatory muster.

The Texas Alcoholic Beverage Commission adopted the California Industry Advisory language in its own 2013 Marketing Practices Advisory on Wine Shipping and Third Party Advertisers/Payment Processing Services (MPA056), permitting a TPP to process the order and payment as long as the permit holder approves the order and controls the funds.

The California Department of Alcoholic Beverage Control’s Third Party Providers Industry Advisory makes it clear in no uncertain terms that “the full amount collected [from a sale of alcohol] must be handled in a manner that gives the licensee control over the ultimate distribution of funds."

According to the advisory, a TPP can:

“Act as an agent for the licensee in the collection of funds (such as receiving credit card information and securing payment authorization)” and

“[P]ass all funds collected from the consumer to the licensee conducting the sale, and that licensee should thereafter pay the Third Party Provider for services rendered.”

A TPP cannot:

“independently collect the funds, retain its fee, and pass the balance on to the licensee.”A TPP cannot:

But, the TPP and the licensee can:

“utilize an escrow account, or similar instrument, that disburses the funds upon the instructions of the licensee.”

As such:

“a Third Party Provider may accept consumer credit card information, debit the card, deposit the funds in an account under the licensee’s ultimate control, and, upon the licensee’s acceptance of the order and direction to the account holder, receive a fee from the account.”

“[s]uch collection, acceptance, and disbursement of funds will often times be accomplished solely through computer-generated means.”

What qualifies as an “escrow account, or similar instrument” that is “under the licensee’s ultimate control”?

This is the tricky part and where we’ve seen little enforcement or guidance from the alcohol regulators. Early marketplace models learned quickly that traditional escrow accounts were unwieldy for these kinds of transactions because a new escrow had to be set up for each licensee. Escrow accounts are generally used for larger transactions with monthly payments (e.g., home payments), or to guarantee potential payments to unknown creditors (e.g., retail liquor license transfers).

While there are a variety of approaches to try to meet the TPP guidance regarding flow of funds, many marketplaces turned to FBO (for the benefit of) accounts, which permit a TPP to create sub-accounts that hold funds for the benefit of each licensee selling through the platform. A variety of payment processing platforms have emerged more recently to accommodate online marketplace needs. We won’t make specific recommendations or critiques here, but recommend TPPs and licensees do their own due diligence to ensure these provider accounts actually give the licensee control over the flow of funds. To the authors’ knowledge, none of these payment platforms have explicitly been approved by alcohol regulators. It’s best to ask the hard questions of the payment providers and banks providing account services to see if the licensee retains control over the transaction.

Have tax or compliance questions? Contact Avalara's Beverage Alcohol team.

Have legal or compliance questions? Contact Hinman & Carmichael LLP.

The 4 steps to age verification for direct shippers

Make sure you’re following the rules when it comes to selling to customers 21 and over.

Economic nexus in the beverage alcohol industry: Learn how state laws create tax collection obligations for your business

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.