Sales tax compliance — it’s all about where and what you sell

When it comes to sales tax, the devil is certainly in the details … and the ingredients, the temperature, tangibility, classification, and location. The minutiae with which sales tax is determined can be quite maddening. To maintain compliance and avoid fines and other penalties, merchants must research the sales tax laws for every product they sell in every location. This is especially critical for smaller vendors who can’t weather financial setbacks as well as the big guys.

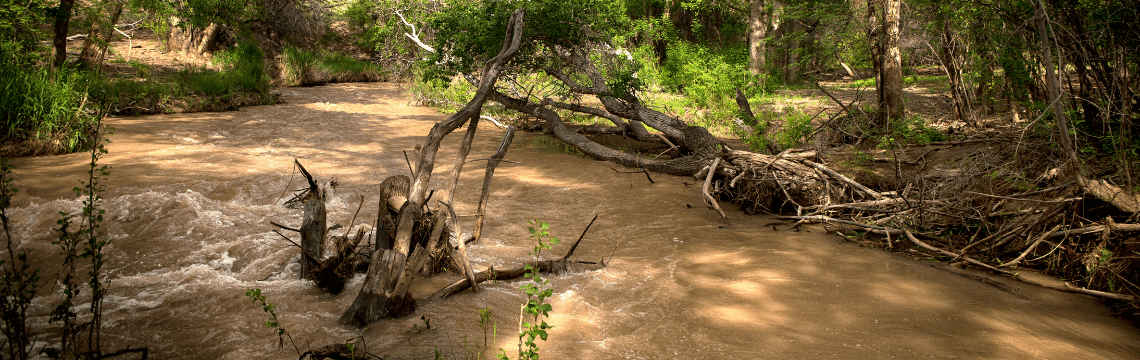

Let’s look at some authentic samples to draw a clearer picture of just how muddy tax waters can get.

Sales tax smorgasbord

Food and beverage taxes are particularly vexing and convoluted.

Some states tax food, others don’t. Too bad that’s where the simplicity ends. States vary on what they consider food, and the tax designations get excruciatingly specific from there.

Ten states broadly consider candy the equivalent of food for tax purposes. Some 20 states don’t regard candy as food and tax it differently. Then you have 24 states that belong to the Streamlined Sales and Use Tax Agreement that feel an edible product is not candy if it contains flour. Buy a bag of yummy Swedish Fish in Illinois, and you won't pay tax, but a Twix bar will set you back an additional 6.5%.

For some food, location is more than just what state or city the food is sold, but sometimes in what venue it is sold or where it will be consumed. If you buy fresh fruit from a vending machine in California, you’re dinged at 33% tax, but purchase it from a market and it’s tax-free. In New York, if you eat a bagel on-premises, it’s taxed; take it home for tomorrow’s breakfast, it’s not. Also, you will pay an 8-cent tax if the bagel is sliced, no tax if it’s whole.

Then you have states that tax based on a food’s temperature. Some keep it simple. Hot prepared food is taxed; cold food is not taxed. States like California like to get into the fine grounds of taxation as with coffee: In the Golden State, hot coffee is considered a hot prepared food, which is generally taxed. But if you purchase just hot coffee, it’s exempt; if you add cold prepared food to your order, the entire purchase amount is now taxable — though both are exempt when sold separately — not confusing at all.

If the tax fits…

Clothing is another product that wears many different styles of tax. Again, some states tax clothing, some don’t. Many states impose exceptions and variations to the general rule. Four states exempt all clothing sales, but these states also don’t hold any general sales tax:

- Delaware

- Montana

- New Hampshire

- Oregon

Then we have states that like to mix-and-match: Massachusetts exempts clothing and footwear sales if the individual item has a price tag under $175 — except athletic or protective clothing, that’s taxed. Many states do tax accessories and athletic or protective clothing. But in New York, along with apparel priced under $110, you’ll also get exemptions for athletic equipment, protective devices, costumes, rented formal wear, and items used to make or repair taxable clothing. However, not all local jurisdictions follow the state tax exemptions.

Tax pits

Many states steer clear of taxing necessities such as food and prescription medications. Most people — though you may know exceptions — classify deodorant and antiperspirant as a necessity. But some states tax it, some don’t, based on the ingredients and even the intended use.

In Texas, for instance, if an item bears a “drug facts” panel indicating it is an over-the-counter drug (OTC), the state exempts it. So, one brand of the under-arm product can be taxed, and another is not, even though they contain very similar ingredients.

But then New York exempts medicated dandruff shampoo, but not antiperspirants and deodorants. New Jersey also exempts OTC drugs … except for “any grooming and hygiene product” [their emphasis].

Intangible taxes

Digital products are tough to tax. Only now are many states getting specific tax laws on the books for digital products. Some just can’t keep up with technology and attempt to squeeze new technology into old tax law. Even the definition of “digital products” can get a bit dodgy, but generally speaking, they are classified as follows: digital audio files, digital books, and digital images and videos.

Some states that don’t tax intangible products also don’t tax digital products — you can’t put a song in your pocket. Others feel that because you can see a movie it’s tangible.

States that have joined the Streamlined Sales and Use Tax Agreement ascribe to consistent definitions of digital products, but not the taxation of those products. Still, many states don’t declare product definitions or their taxability.

Taxed today, gone tomorrow

This is just a smattering of the wild world of tax variations. So much depends on what you sell, where you sell it, in what form you sell it, and all sorts of other maddening minutiae. And it can all change with a politician’s pen.

Just one missed tax on one product could lead to a devastating tally of back taxes. And then there are the audits. Once a small business gets on an auditor’s radar, the more likely the company will remain there for further scrutiny down the road.

As a small business, it’s imperative to stay abreast of ever-changing sales and use tax laws in every location you operate for every product.

Automation is a great way to keep the auditors at bay and minimize your legwork when calculating sales tax. Check out the helpful automation software at Avalara.

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.