Survey and Senate hearing find small businesses are not immune to impacts of the Wayfair decision

Most small businesses are aware of the United States Supreme Court ruling in South Dakota v. Wayfair, Inc. (June 21, 2018) and its impact on sales tax compliance. Many also believe they’ve done all it takes to comply with sales tax requirements resulting from the Wayfair decision. That’s according to a recent survey of businesses conducted by NetReflector/Potentiate at the request of Avalara.

It’s an optimistic assessment given that during a recent Senate Committee on Finance hearing examining the impact of Wayfair on small businesses, witnesses explained just how complicated and costly sales tax compliance has become in the wake of Wayfair.

The Senate Finance Committee hearing and the sixth (and final) wave of the NetReflector/Potentiate survey took place on the eve of Wayfair’s fourth anniversary. Both underscore how the Wayfair ruling and subsequent economic nexus and marketplace facilitator laws have transformed the sales tax landscape.

Survey finds small businesses are feeling the effects of Wayfair

According to the May 2022 fielding by NetReflector/Potentiate, 84% of respondents with fewer than 20 employees said they were familiar with the U.S. Supreme Court ruling in South Dakota v. Wayfair, Inc. prior to the survey.

Small businesses have more than a passing familiarity with Wayfair. During the last three waves of the survey, respondents were asked whether they were familiar with the term “nexus” as it relates to sales tax compliance. Back in December 2020, only 40% of small businesses said they were familiar with the term. A full 100% of small businesses said the same in February 2022, as did 91% in May 2022.

Nexus is the connection that enables a state to require a business to register for sales tax. Before the Wayfair decision, nexus was based almost exclusively on physical presence in a state. Wayfair overturned the physical presence rule, paving the way for states to base sales tax obligation on economic activity (economic nexus).

Thus, respondents were also asked about “physical nexus” and “economic nexus” and the implications of each. Here, too, awareness has increased dramatically. Only 42% of respondents in December 2020 said they were familiar with the differences between physical nexus and economic nexus. In February and May 2022, respectively, 84% and 85% of small businesses claimed to understand the difference between physical nexus and economic nexus.

Businesses probably should know about these terms, since physical and economic nexus are fundamental to understanding the impacts of Wayfair and subsequent remote sales tax requirements.

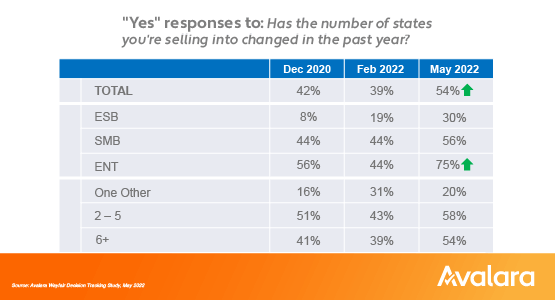

The number of small businesses registered to collect and remit sales tax in at least one other state is also on the rise. During the May 2022 wave, 30% of small business respondents said they now collect and file taxes in more states as a result of Wayfair. That’s the highest percentage since this question was first asked in December 2020.

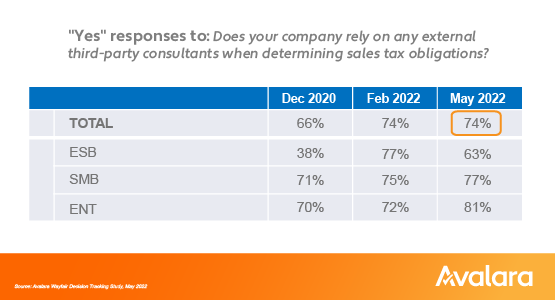

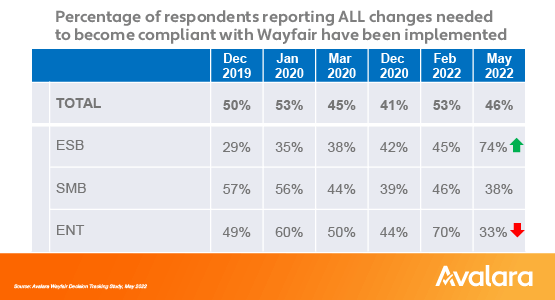

Interestingly, 74% of small businesses surveyed during the May 2022 wave said they’ve done all it takes to comply with sales tax requirements resulting from the Wayfair decision, even though 37% of small businesses didn’t use third-party consultants to help determine their sales tax obligations. More small businesses — 61% — said they invested in a third-party review/analysis of their sales tax obligations to ensure they’re in compliance.

This suggests small businesses may not know exactly what their compliance obligations are, or whether they’re meeting them. Matt Crawford, general manager of Shipping at BigCommerce, an Avalara technology partner, finds that to be true. “In my experience,” he said, “it appears these businesses are most at risk because they may not understand the full scope of complexity associated with Wayfair.”

Midsize and larger businesses are more likely to hire consultants and third-party reviewers than their smaller counterparts. Perhaps not surprisingly, large businesses are also less sure they’re doing all it takes to be in compliance.

The NetReflector/Potentiate survey offers some interesting insights. More emerged from the June 14 hearing on the impact of Wayfair on small businesses.

Wayfair hearing highlights cost and burden of remote sales tax

The Senate Committee on Finance invited five witnesses to address the impact of the Wayfair decision and remote sales tax.

James R. McTigue Jr., director of Tax Policy and Administration for the Government Accountability Office (GAO) said sales tax accounts for roughly a third of state revenue. To date, sales tax collections from remote sellers have exceeded GAO’s 2017 projections.

McTigue said businesses devote a lot of time to discovering and understanding their compliance obligations, in part because effective dates, small seller exceptions, exemptions, and other requirements vary from state to state. For many businesses, purchasing or developing sales tax software is now “essential” for multistate tax collection, and an added cost of doing business. GAO’s written testimony provides additional information.

Craig Johnson, executive director of the Streamlined Sales Tax Governing Board (aka, SST), said the Wayfair decision has brought about “significant changes” for sellers nationwide. He explained how SST strives to reduce the burden of compliance for businesses — something the Supreme Court noted in its opinion. Among other simplification measures, the 24 SST member states provide a central, electronic registration system; simplified administration of exemptions, remittances, and returns; uniform sourcing rules; and uniform state and local tax bases. Member states also provide taxability matrices to help businesses gauge which transactions are subject to sales tax.

Johnson said the SST program is helping thousands of businesses with compliance. More than 18,000 active sellers have registered through SST and more than 100 businesses sign on each month. More details can be found in his written testimony.

Diane L. Yetter, president and founder of the Sales Tax Institute, also addressed the committee. The Sales Tax Institute provides sales tax consultation, education, and resources for businesses worldwide and Yetter is a “proponent of rules that promote equity.” She also believes states should make every effort to reduce complexity for businesses.

Yetter focused on three main points:

Economic nexus has made it harder for some businesses, especially those businesses based in non-sales tax states, for whom sales tax is a novelty. Marketplace facilitator laws have helped reduce the compliance burden for small marketplace sellers. Some states, like Texas, have also taken steps to reduce the burden of local tax collections by instituting a uniform statewide rate for remote sellers.

Compliance burdens exist for all businesses, even marketplace sellers; for example, inventory can give out-of-state sellers a physical presence in a state, resulting in a significant retroactive tax burden. Compliance is particularly challenging in home-rule states, where local governments can self-administer local taxes.

Congress could help reduce the burden on businesses by focusing on fostering uniformity across states while protecting state sovereignty. Congress should encourage participation in SST, especially among the largest states.

See Yetter’s written testimony for additional insights.

Representatives from two small businesses also spoke: John Hennessey, president and CEO of Littleton Coin Company, Inc., and Michelle Huie, founder and CEO of VIM & VIGR Compression Legwear. Both businesses are based in states with no sales tax, so Hennessey and Huie have had a crash course in sales tax compliance since Wayfair.

Neither Hennessey nor Huie proposed eliminating remote sales tax requirements. As Huie wrote in her statement, “I am not here to challenge the payment of sales tax. It’s a major revenue stream for states and the shift to online commerce has changed the dynamics that don’t work for pre-existing regulations. I am here to ask to simplify the process for ecommerce businesses.”

Pain points for Hennessey and Huie include:

Having to register with departments of revenue in multiple states

Remitting to different states at different times

Researching and determining nexus

Finding information about sales tax rates, rules, and regulations

Identifying different exemptions

Expanding tax obligations beyond sales tax (e.g., franchise tax, income tax)

The cost of doing business has increased for both Hennessey and Huie since Wayfair; although sales tax is paid by customers, collecting and remitting it comes at a price.

VIM & VIGR spends close to $50,000 per year in out-of-pocket technology costs and labor to comply with sales tax legislation. Littleton Coin Company spent $225,000 in 2018 on legal and tax experts and software developers to become compliant by 2019, and it now pays approximately $50,000 on compliance activities yearly. The company also spends roughly $40,000 annually, out of pocket, on various business and occupation (B&O), commercial activity, and franchise tax obligations. A looming issue for Littleton Coin Company is a request to remit California income tax.

More than one senator asked Hennessey and Huie to identify how Congress could help reduce the burden of compliance. Their suggestions include requiring:

A centralized clearing house for registration and returns

A centralized system for audits (e.g., one audit for all states each year)

Protection from retroactive tax obligations

A single unified rate per state

Uniform product definitions within states and across states

Uniform product exemptions across states

Hennessey also asked that any new tax requirements be phased in, so businesses would have time to prepare. His company is currently scrambling to comply with Colorado’s new retail delivery fee; announced in May, it takes effect July 1.

Since a common theme from the witnesses was the need to minimize the burden of compliance, especially for small businesses, Johnson was quick to point out that SST was created to do just that. And Huie agreed that SST reduces the burden in participating states. But as Yetter noted, some of the most populous states in the country, including California, Florida, New York, do not participate in SST.

Avalara VP of Government Relations Scott Peterson attended the hearing. He noted that three of the witnesses commented on the complexity created by differing economic nexus thresholds, which surprised him; he thought their comments would be more random.

Of course, economic nexus laws do make compliance more diificult for businesses. “The old physical presence rule created unusual outcomes,” Peterson said, “but the concept was fairly easy to understand and uniform state to state. The economic nexus threshold is the one thing the states could have done uniformly, but they didn't.”

Learn more about Wayfair and sales tax nexus at the Avalara resource center.

Updated at 9:45 a.m.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.