Missouri will tax remote sales starting January 1, 2023

If you sell goods to consumers in Missouri and currently are not required to collect and remit Missouri sales and use tax, your salad days may soon be over. Many out-of-state sellers will need to collect Missouri taxes starting January 1, 2023, when Missouri’s economic nexus law takes effect.

What is economic nexus?

Economic nexus is a connection between a business and a state that bases a sales and use tax obligation on sales activity in the state rather than physical presence. It’s fairly new, as states were generally limited to taxing businesses with a physical presence in the state until the U.S. Supreme Court ruling on South Dakota v. Wayfair, Inc. (June 21, 2018).

Physical presence still establishes a sales tax obligation in all states with a sales tax, but the Wayfair decision freed states to tax businesses with no physical tie to the state. Following Wayfair, one state after another enacted an economic nexus law in order to tax remote sales. Missouri was the last to do so.

Today, every state with a sales tax has an economic nexus law, and every economic nexus law provides an exception for businesses with sales in the state beneath a certain threshold. Economic nexus thresholds vary from state to state and include $500,000, $500,000 and 100 transactions, $250,000, $100,000 or 200 transactions, and $100,000. It’s a lot to track.

You can find state-specific details in this state-by-state guide to economic nexus laws.

When do out-of-state sellers need to start collecting Missouri tax?

Missouri’s economic nexus law takes effect January 1, 2023.

The state’s economic nexus threshold is $100,000 in cumulative gross receipts from taxable sales of tangible personal property delivered into Missouri during the previous or current calendar year. Senate Bill 153 specifies that sales made through a marketplace facilitator count toward the threshold. The Missouri Department of Revenue has confirmed that nontaxable wholesale sales should not be included when calculating the threshold.

This concept of a threshold is central to economic nexus. An out-of-state seller creates an obligation to start collecting Missouri tax once that seller’s sales into the state exceed $100,000. Remote vendors must determine whether they’ve reached that threshold at the close of each calendar quarter by calculating their sales in the state during the 12-month period ending on the last day of the preceding calendar quarter. If they’ve met the $100,000 threshold, they must register and start collecting applicable taxes no more than three months after the end of the preceding calendar quarter.

Per SB 153, remote vendors must collect and remit tax “for a period of not less than twelve months” once nexus has been established and continue to collect and remit the tax “for as long as the vendor is engaged in business activities within this state.”

“The Missouri Legislature should be congratulated for specifying how long economic nexus lasts,” says Scott Peterson, VP of Government Relations at Avalara. Most states don’t include that information in their economic nexus laws, so businesses don’t know how long they’re on the hook for sales tax if their sales drop below a state’s economic nexus threshold.

Registration requirements for remote sellers

Although many states expect a seller to be registered before they start collecting tax, the Missouri Department of Revenue requires businesses to be registered prior to their first return date. That means remote vendors that established economic nexus in 2022 need to register for vendor use tax before February 28, 2023.

However, the state insists remote vendors start collecting tax on their very first sale in 2023 if they reached the $100,000 threshold in 2022. This is critical.

Are there new requirements for marketplace facilitators?

Yes.

Missouri’s economic nexus law applies to marketplace facilitators, so marketplace facilitators that reach the $100,000 threshold are required to register and collect and remit applicable taxes starting January 1, 2023. Both direct and third-party sales count toward that threshold.

SB 153 also requires marketplace facilitators to collect and remit the tax due on third-party sales starting January 1, 2023. Marketplace facilitators must collect and remit for all sellers, even those already registered to do business in Missouri.

The department has told Avalara that marketplace facilitators must report their marketplace (i.e., third-party) sales separately from all other sales.

What counts as a marketplace?

Like economic nexus laws, every state’s marketplace facilitator law is unique. Some states consider online travel agencies and/or food delivery networks to be marketplaces. Some don’t.

Missouri Senate Bill 153 specifies that “marketplace facilitator” does not include entities that provide:

- Internet advertising services or product listing but don’t collect payment from the purchaser and transmit it to the seller

- Travel agency services (e.g., lodging and travel rentals)

- Third-party financial institutions appointed by a merchant or marketplace facilitator to handle various forms of payment transactions (e.g., processing credit and debit cards)

According to the Department of Revenue, lodging marketplaces should already be collecting and remitting taxes on the lodging sales they facilitate.

Should remote sellers collect and remit sales tax or use tax?

In Missouri, sales tax applies to retail sales made from a location in the state, but vendor use tax applies to sales shipped into Missouri from out of state. The department has confirmed that sales tax will continue to apply to orders shipped from within Missouri. However, vendor use tax will apply to orders shipped from outside of Missouri.

That’s a big deal for businesses that have inventory in Missouri and elsewhere. They’ll continue to collect, remit, and report sales tax on orders filled from inventory located in the state, but if they also deliver taxable goods into the state from outside the state, they’ll have to register for vendor use tax and collect, remit, and report vendor use tax on those transactions starting January 1, 2023.

This requirement is likely to be particularly burdensome for marketplace facilitators with distribution or fulfillment centers in Missouri, as well as marketplace sellers that make direct sales in addition to marketplace sales.

Sourcing sales tax vs sourcing use tax

This requirement complicates tax compliance in another way, too, because Missouri sales tax is based on the location of the seller (where the order is fulfilled), but vendor use tax is based on the delivery address.

Scott Peterson notes that this is similar to the requirement in Texas and identical to the requirement in Illinois.

Does marketplace inventory establish physical presence nexus?

The Missouri Department of Revenue has confirmed that marketplace inventory in Missouri gives a business physical presence nexus with Missouri, and that businesses with physical presence in the state should be collecting and remitting sales tax.

Thus, although marketplace facilitators have to collect and remit tax on behalf of all marketplace sellers starting January 1, 2023, marketplace sellers with inventory in Missouri can be held liable for sales tax prior to January 1, 2023 because of their physical presence in the state.

As noted above, businesses that are registered for sales tax will need to register for vendor use tax come January 1, 2023, if they ship some goods from outside of Missouri.

Sales tax rates and use tax rates are often different in Missouri

The sales tax/use tax distinction is important for another reason as well: Sales tax rates in Missouri are often different from use tax rates.

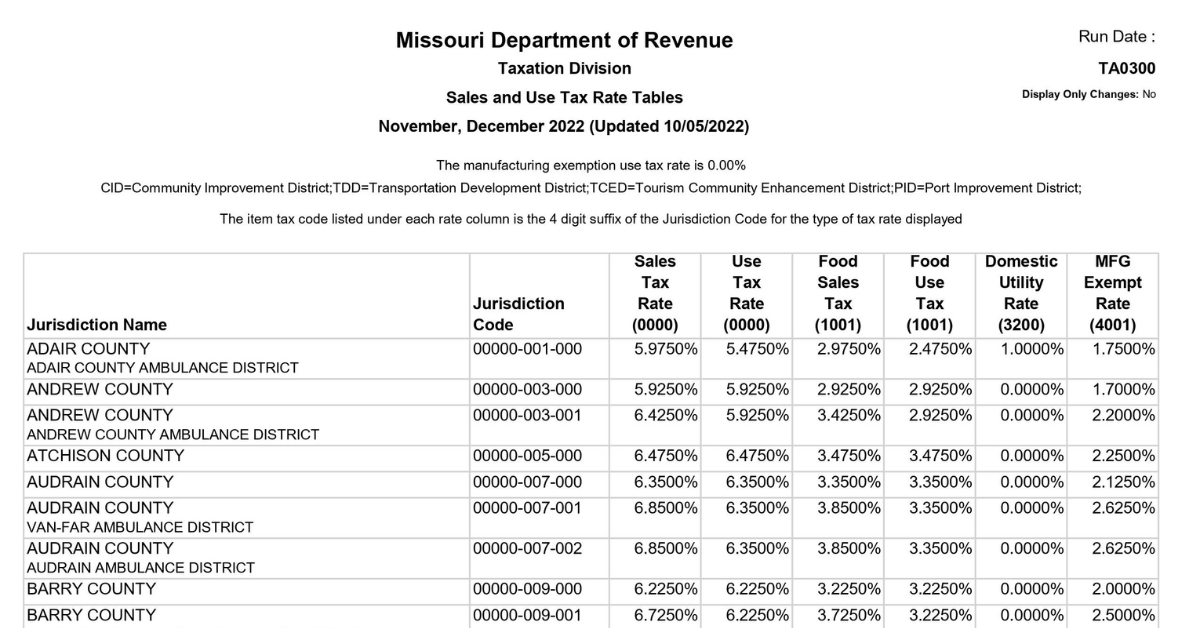

This snapshot from the department’s Sales and Use Tax Rate Tables for November, December 2022 illustrates that point.

The Missouri Department of Revenue goes into further detail in its Sales/Use Tax Facts, but note that the department hasn’t yet updated its website to account for the state’s new economic nexus and marketplace facilitator laws.

How can you know which rate to charge?

Missouri has at least 2,000 different sales and use tax jurisdictions, many of them overlapping, and rates change frequently. To help ease the burden of compliance, the Missouri Department of Revenue created a sales and use tax mapping tool that generates the total combined sales or use tax rate for locations throughout the state.

The mapping tool should help all vendors, including out-of-state vendors, charge the right rates. But for any business with more than a few Missouri transactions, finding the right rate with the mapping tool will still take a lot of work. It would be far easier for a seller to automate sales tax calculation, collection, and remittance.

SB 153 authorizes the Missouri Department of Revenue to “consult, contract, and work jointly with” the governing board of the Streamlined Sales and Use Tax Agreement (SSUTA or SST) and allow sellers to use an SST-certified service provider (CSP) like Avalara. The measure seems to authorize the department to pay for at least a portion of the CSP’s costs, as SST member states do, but the department hasn’t yet provided any information about that.

Alternatively, SB 153 allows the Missouri Department of Revenue to “consult, contract, and work with certified service providers independently.”

How should remote sellers register?

The department encourages businesses to register online through the Missouri Department of Revenue MyTax portal. Online registrations typically take three to five business days to process, while paper registrations can take up to 14 days to process.

The Department of Revenue plans to publish FAQs for remote sellers by December 1, 2022. It should also provide updated forms, such as the 2643 Registration Application, at that time.

Hopefully, the department will also provide information about local use tax requirements at that time. See the use tax section of this article for more details.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.