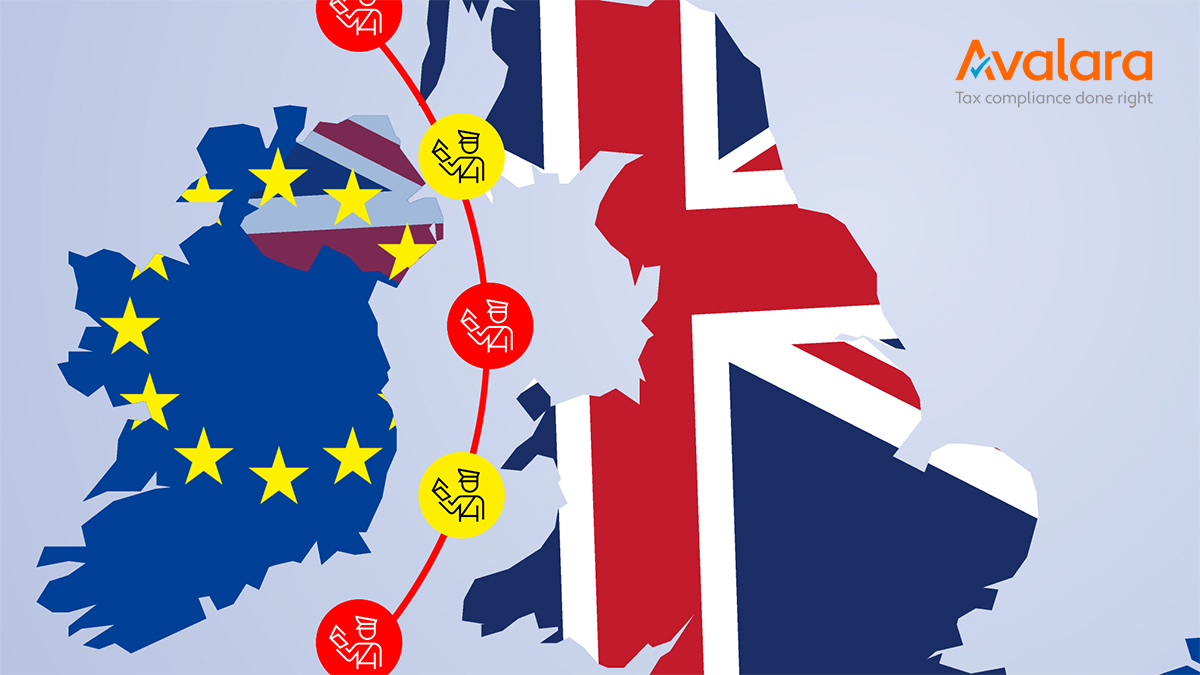

UK clarifies Brexit Northern Ireland ‘XI’ VAT number

Nov 22, 2020 | Richard Asquith

The UK’s HMRC has issued fresh guidance on VAT transactions between Northern Ireland (NI), the EU and the UK excluding NI (Great Britain or GB). This address identifying the correct VAT reporting of t...Continued