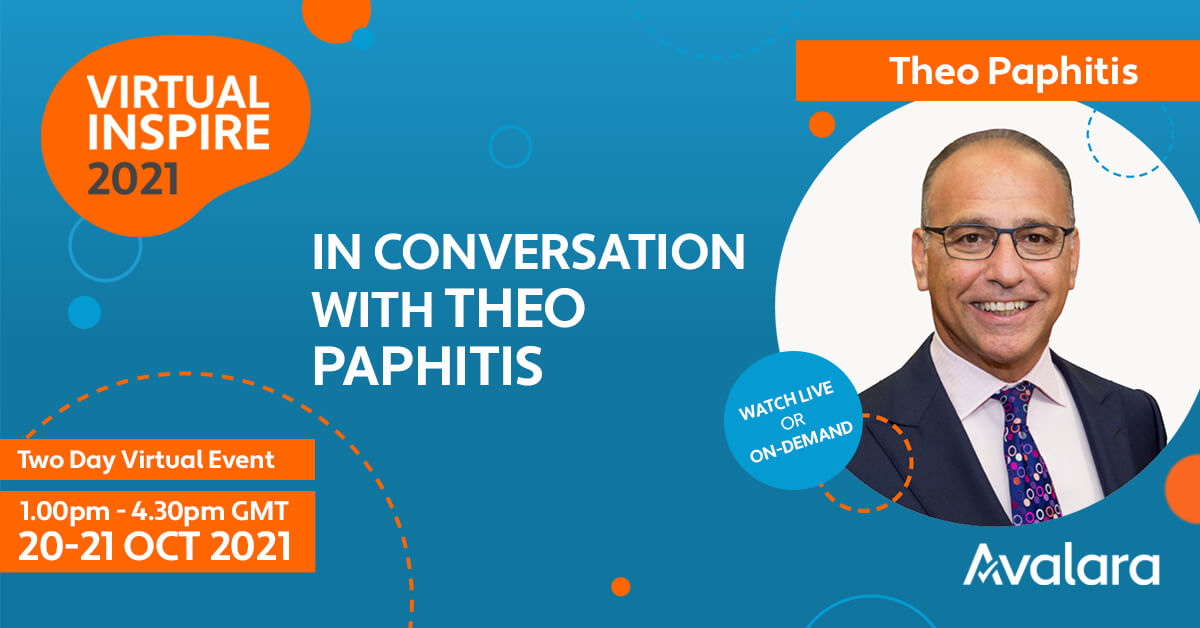

Dragon’s Den star and retail magnate Theo Paphitis headlines Inspire 2021

Oct 18, 2021 | Avalara

This year has been like no other. Who better to learn from how to successfully adapt to this change, than self-proclaimed shopkeeper and multimillionaire high-street retail magnate, Theo Paphitis....Continued