What is product taxability and why does it matter?

If you sell goods or services, you need to know whether, where, and to what extent those goods and services are subject to sales tax. And while product taxability might seem straightforward at a glance, there’s actually more to it than “taxable” or “exempt.”

This post aims to unravel product taxability complexity by getting down to brass tacks:

- What is sales tax?

- What goods and services are taxed in the US?

- What sales tax rate should you charge?

- What goods and services are exempt from US sales tax?

- Product taxability pitfalls

- Who needs to collect and remit sales tax on goods and services?

What is sales tax?

Sales tax is a consumption tax on the sale of certain goods and services, but not all goods and services. There’s no federal or national sales tax in the United States, like Europe’s value-added tax (VAT) or Canada’s goods and services tax (GST). Instead, the states — and in some states, the local governments — levy and administer sales tax. Close to 40 states have local sales taxes in addition to the state sales tax.

That’s one of the reasons determining goods and services tax can be a bear. Only five states have no general sales tax: New Hampshire, Oregon, Montana, Alaska, and Delaware (sometimes called the NOMAD states because of their initials). There’s a general sales and use tax in every other state in the country, plus Puerto Rico and Washington, D.C., and Alaska allows sales and use tax at the local level.

Though there are some overarching themes with sales tax, specific requirements vary from jurisdiction to jurisdiction. That makes compliance challenging for companies doing business in multiple sales tax states.

What goods and services are taxed in the US?

Unfortunately, there’s no one-size-fits-all answer here. But generally, states tend to tax retail sales of most tangible personal property. And very generally, states tend to exempt many services, especially services that have nothing to do with tangible goods.

That’s the 40,000-foot view. The closer you get, the more nuances you’ll find.

Taxable sales of goods

Tangible personal property is typically presumed to be taxable unless specifically exempt by law. Consequently, most retail sales of goods are subject to state and applicable local sales tax in most states.

Yet there are many exceptions to that rule. For instance, food for home consumption is taxed at a reduced rate in some states (e.g., Alabama and Arkansas) yet fully exempt in others (e.g., Ohio and Texas). Candy and soda, which seem like food, are subject to higher sales tax rates in certain parts of the country.

Depending on the jurisdiction, food or other products may be subject to applicable local sales taxes but exempt from the state sales tax, or exempt from local sales tax but taxed at the state level. Thus, clothing and footwear priced $110 or less is generally exempt from New York state sales tax, while clothing and footwear at a higher price point is subject to New York state sales tax. Local sales tax may or may not apply to the clothing and footwear that qualifies for New York’s state sales tax exemption.

The taxability of digital goods can be even more nuanced. Some states tax certain digital goods the way their physical counterparts are taxed, and others have separate tax rules for digital goods. Thus, bound books and electronic books are both subject to sales tax in Washington, while bound books are taxed in California but ebooks are not.

Taxable sales of services

Hawaii and New Mexico tax all but a few select services, and more than 100 services are subject to sales tax in South Dakota and West Virginia. In these four states, services are generally presumed taxable unless specifically exempted by law.

Far fewer services are taxable in California, Colorado, and Massachusetts, where services are generally presumed exempt unless specifically taxed. Most other states tax fewer services than Hawaii, New Mexico, South Dakota, and West Virginia, but more services than California, Colorado, and Massachusetts.

As with products, there’s a lot more to the taxability of services. Read more about sales tax on services for details.

What sales tax rate should you charge?

Sales tax rates are governed by sales tax sourcing rules.

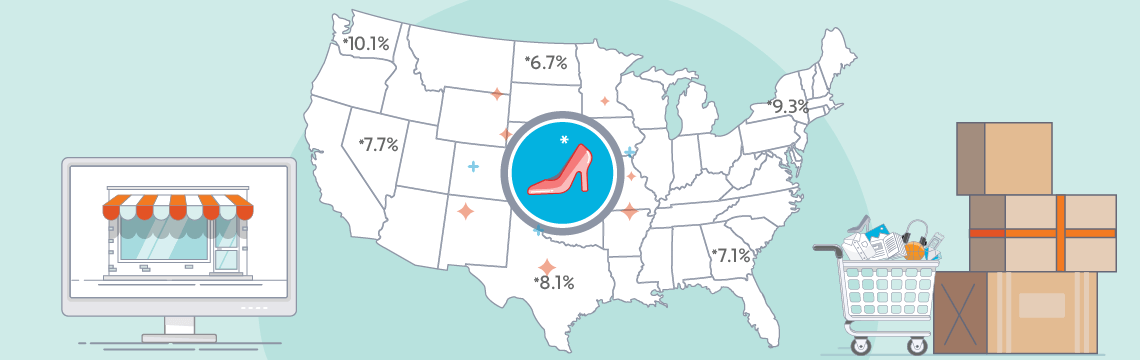

Most states use destination sourcing for both interstate and intrastate transactions, so the sales tax rate is based on the location where the consumer took possession of the goods. For goods, this can be the location of a retail store or the delivery address. For services, it’s typically the location where the consumer received the service.

Approximately eight states have origin sourcing rules for tangible goods, meaning the sales tax rate is based on the location where the sale originated (e.g., where the order was taken or from where the goods were shipped). Four of those states use origin sourcing for services as well.

California and Texas use a mix of destination and origin sourcing.

What goods and services are exempt from US sales tax?

Here again, there’s no simple answer.

Many states provide a sales tax exemption for at least certain tangible goods, which may include but are not limited to:

- Food for home consumption

- Machinery and equipment

- Prescription medications

- Textbooks for college courses

In recent years, numerous states have carved out new sales tax exemptions for diapers, tampons, and similar products that historically have been taxable. Pink taxes, as the taxes on these products are sometimes called, seem to be falling out of favor.

Services are more likely to be sales tax exempt in most jurisdictions. Commonly exempt services may include:

- Admissions

- Healthcare services

- Personal services

- Professional services

- Security services

A host of other products, including digital goods and services, qualify for sales tax exemptions in select jurisdictions. Additionally, approximately 20 states have tax-free weekends or longer sales tax holidays. During these events, a variety of products are temporarily exempt from sales tax.

As you see, product taxability is complicated.

Product taxability pitfalls

There are a lot of pitfalls when it comes to sales tax. Here are some of them.

Product taxability rules are subject to change.

If you understand how and where the goods and services you sell are taxed today, remember the rules can change tomorrow. Sometimes taxability changes are announced well in advance of the effective date, but sometimes they’re sprung on you.

South Carolina enacted a sales tax exemption for tampons and other feminine hygiene products on May 13, 2024. The exemption took effect immediately. And while Colorado enacted the first-in-nation retail delivery fee in 2021, which was a very big deal, the Colorado Department of Revenue didn’t provide any guidelines for it until May 2022 — less than two months before the fee took effect July 1, 2024.

Goods and services are taxable in some jurisdictions but exempt in others.

As noted above, some states tax food for home consumption, some don’t. Some tax clothing and digital products, some don’t. The same is true for a host of other goods and services.

Taxability rules are statewide in most states, so if a transaction is subject to the state sales tax, it’s also subject to local taxes. Or not, if the sale is exempt. However, that’s not necessarily the case in home-rule states such as Alabama, Colorado, and Louisiana, where local governments have the authority to administer and levy local sales taxes.

For example, Denver provided a sales tax exemption for feminine hygiene products on July 1, 2019, and an exemption for diapers and adult incontinence products on October 1, 2022. Yet those products remained subject to Colorado’s state sales tax until January 1, 2023, when they became exempt from state sales tax too.

Bundling can make an otherwise exempt transaction taxable.

When both taxable and nontaxable sales are bundled together and sold as one, like a gift basket, it’s common for states to require the seller to apply sales tax to the entire charge. Alternatively, a state may give the retailer the option of collecting and remitting tax only for the taxable portion of the bundle. The Wisconsin Department of Revenue describes when that is and isn’t allowed and how to go about it.

When a bundled transaction includes a taxable good and an exempt service, retailers may need to determine the “true object” of the transaction to determine how to allocate sales tax. Is the main purpose (true object) of the transaction the provision of the service or the attainment of the goods? In this case, the taxability of the true object reigns.

And in some cases, if the taxable portion of a transaction is de minimis (i.e., the sales price of the taxable products is 10% or less of the total sales price of the bundled objects), the sales price would not be subject to sales tax.

It’s important to understand how states tax sales including both exempt and taxable items. And it’s critical to remember that states have different rules.

There are exceptions to every rule.

Most states have many, many taxability rules — and many exceptions to those rules.

For instance, after sales tax was extended to sweetened beverages in Vermont, some beverages that seemed like they should be taxed were exempt, and vice versa. Although sales tax generally applies to sweetened iced teas, the clearly sweetened Starbucks bottled Frappuccino is exempt.

And sales tax holidays by nature are exceptions to the rule.

Who needs to collect and remit sales tax on goods and services?

You’re required to register with the taxing authority then collect and remit applicable sales and use taxes in states where your business has nexus.

Sales tax nexus is the connection between a business and a state that enables the state to impose a sales tax obligation on the business. It can be established through physical presence in a state, economic activity in a state (economic nexus), and certain other connections. Nexus requirements vary from state to state.

In many states, you can establish sales tax nexus even if all your sales in the state are exempt.

Compliance doesn’t end when taxability is determined

Once you determine a product is taxable you must apply the proper sales tax rate to each sale, and sales tax rates vary from jurisdiction to jurisdiction. There are approximately 1,500 different local tax jurisdictions in Texas alone, and more than 12,000 sales and use tax jurisdictions in the U.S.

Making matters more complex, sales tax rates and product taxability rules are subject to frequent change. There were 85,836 taxability updates in the U.S. and Canada in 2023, and 98,910 U.S. sales tax holiday rule updates.

Don’t let product taxability complicate sales tax compliance anymore than it has to. Automating sales tax calculation with Avalara AvaTax makes calculating product taxability faster, easier, and more accurate. Learn more about Avalara AvaTax.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.