The state of online sales tax five years after the Wayfair decision

It’s been five years since South Dakota v. Wayfair, Inc., the groundbreaking United States Supreme Court decision that freed states to tax online sales. As we mark the fifth anniversary of the Wayfair ruling, many businesses still find online sales tax requirements challenging to navigate, according to a new survey of 1,000 U.S. and U.K. businesses.

Key takeaways from the survey:

72% of respondents think online sales tax laws are complex and confusing

40% of respondents say economic nexus laws have increased the cost of managing tax requirements

72% of respondents have invested in technology to help with the calculation and reporting of online sales tax requirements

First, it’s worth reviewing

- What did the South Dakota v. Wayfair decision do?

- What is economic nexus?

- What is a marketplace facilitator law?

If you’re familiar with the Wayfair case as well as economic nexus and marketplace facilitator laws, you can jump right to the survey results.

What did the South Dakota v. Wayfair decision do?

On June 21, 2018, the South Dakota v. Wayfair decision overturned a physical presence rule that prevented states from taxing sales by out-of-state sellers.

Prior to the Wayfair case, states could require a business to register then collect and remit sales tax only if the business had a physical presence in the state. In repealing the physical presence requirement, the Wayfair decision enabled states to tax remote sales — sales by businesses with no physical presence in the state.

It’s important to note that physical presence continues to establish nexus, the connection that allows a state to impose a tax obligation on a business. The Wayfair ruling simply allowed states to enforce economic nexus as well.

What is economic nexus?

Economic nexus is an economic connection between a business and a state that allows the state to tax a business with no physical tie to the state.

Every state with a general sales tax enacted an economic nexus law in the wake of the Wayfair case. Specific requirements vary from state to state, but all economic nexus laws provide an exception for businesses with sales into the state under a certain threshold, such as $100,000 in sales or 200 separate transactions in the state in the current or previous calendar year.

Economic nexus thresholds are subject to change, like all sales tax laws. For example, South Dakota and Louisiana are eliminating their transaction threshold in favor of a sales-only threshold in 2023, as several other states have already done. State-specific threshold information is available in our state-by-state guide to economic nexus laws.

Once a remote seller establishes economic nexus with a state, that seller must register then collect and remit sales tax on all taxable sales in that state. Some states require businesses to register as soon as they cross the economic nexus threshold, as in before the next transaction. Other states give businesses more time to prepare.

Because each state’s economic nexus laws are unique, it can be hard for businesses to stay on top of where they’ve triggered a sales tax obligation. Yet the stakes for overlooking nexus are high. If you’re found to have nexus with a state where you’re not registered for sales tax, you could be held liable for back taxes, penalties, and interest.

What is a marketplace facilitator law?

Marketplace facilitator laws make the marketplace facilitator (e.g., Amazon, eBay, Etsy) responsible for collecting and remitting sales tax for all transactions made through the platform. As a result, marketplace sellers (aka, third-party sellers) generally aren’t liable for the tax due on marketplace sales.

However, some states require marketplace sellers to register and file sales tax returns even if they only sell through marketplaces that collect and remit sales tax for them. Furthermore, since most marketplace facilitator laws apply only to marketplaces that have nexus with the state, emerging or small marketplaces may not collect sales tax on behalf of third-party sellers.

It’s therefore essential for marketplace sellers to understand what each marketplace does — or doesn’t — do for them.

Wayfair sales tax survey results

The primary objective of the 2023 Wayfair sales tax survey was to identify and understand the level of awareness and impact of the Wayfair decision among U.S. businesses and U.K. businesses that sell into the United States. To that end, the research sought to:

Determine how confident businesses are in their understanding of economic nexus and marketplace facilitator laws

Gauge how Wayfair-related laws have changed the way businesses operate

Measure how many businesses have invested in technology to help with online sales tax compliance

Censuswide gathered information from 1,000 decision-makers (18 years and older) from U.S. and U.K. retailers/businesses that sold goods in the U.S. between May 12 and May 22, 2023. The market research consultancy then compiled results for all businesses and broke down findings based on business size (small, midsize, and large) and location (U.S. vs. U.K.).

The Wayfair sales tax survey results suggest that:

Most businesses understand their online sales tax obligations — and most find them “complex and confusing”

Most businesses are spending more time and/or money on compliance because of economic nexus and marketplace facilitator laws

Most businesses are changing the way they do business because of economic nexus and marketplace facilitator laws

Technology is helping many businesses manage online sales tax requirements

Business location matters when it comes to online sales tax compliance

U.S. businesses and U.K. businesses respond to online sales tax laws in slightly different ways

More U.K. than U.S. businesses have invested in technology to help with online sales tax

Business size matters when it comes to online sales tax compliance

Online sales tax requirements are hitting midsize businesses hard

Midsize businesses are most likely to have invested in technology to help with online sales tax requirements

Most businesses understand their online sales tax obligations — and most find them “complex and confusing”

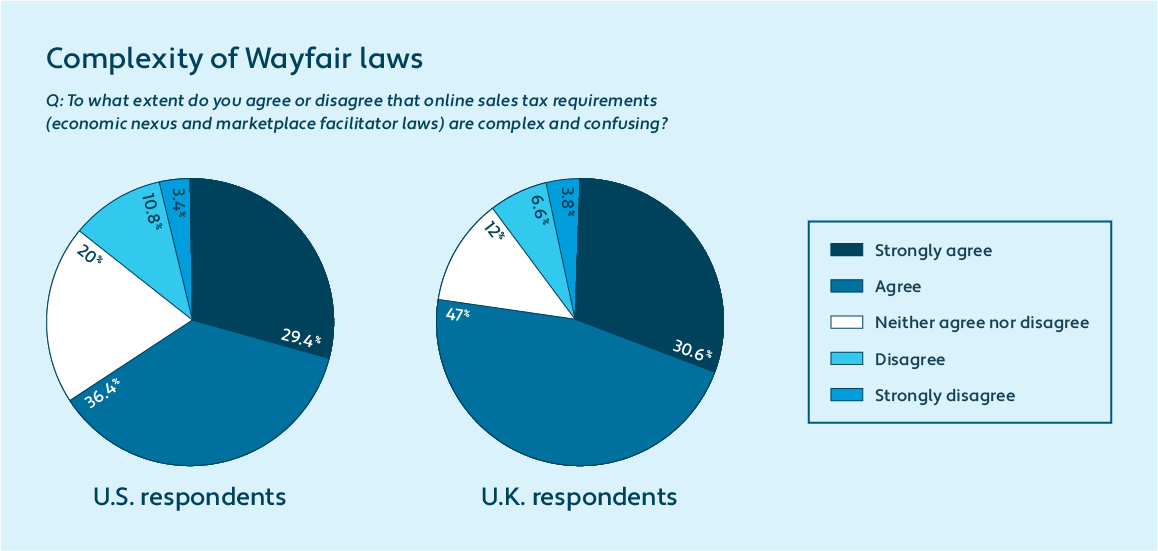

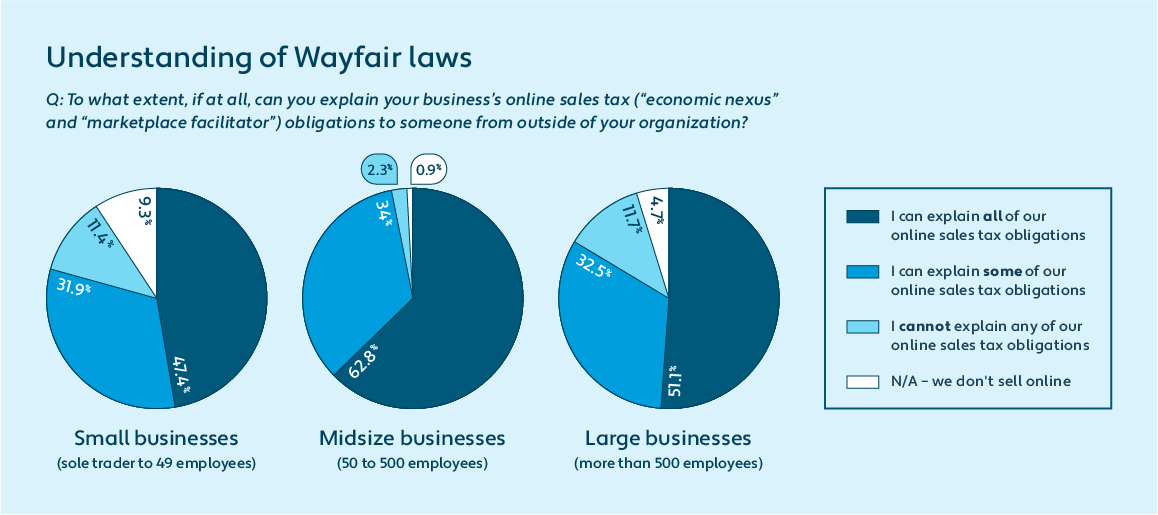

About 55% of all respondents said they can explain all their online sales tax obligations to someone outside their organization. Another 33% said they can explain some of their sales tax obligations. Nevertheless, more than 71% of respondents “agree” or “strongly agree” that online sales tax requirements are “complex and confusing.”

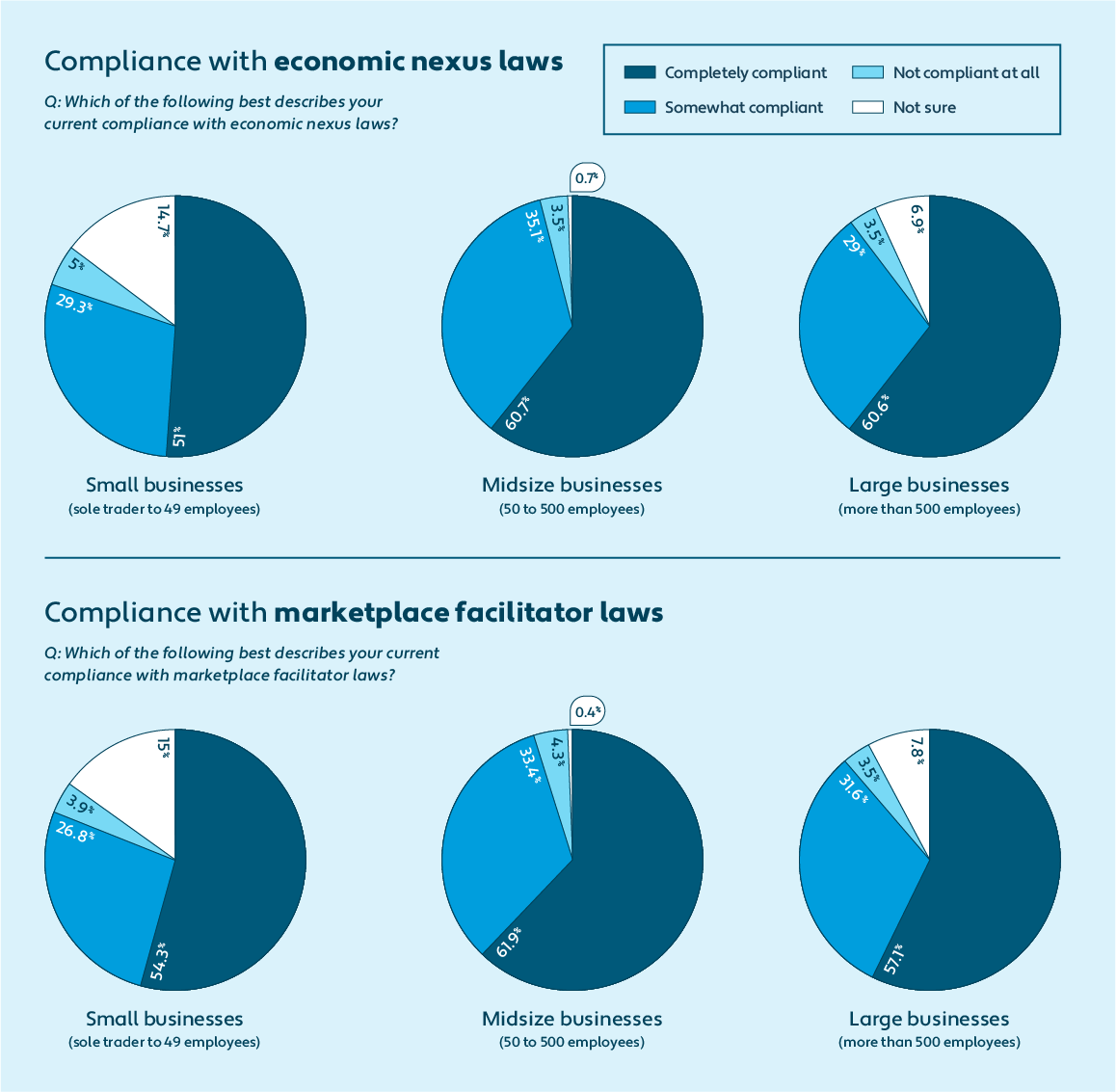

Interestingly, 58% of businesses surveyed report being “completely compliant” with both economic nexus and marketplace facilitator laws, and about 32% report they are “somewhat compliant.” Approximately 10% of respondents either weren’t sure or said they were “not compliant at all.”

Most businesses are spending more time and/or money on compliance because of economic nexus and marketplace facilitator laws

According to the survey, economic nexus and marketplace facilitator laws are impacting business decisions — but not always in the same way.

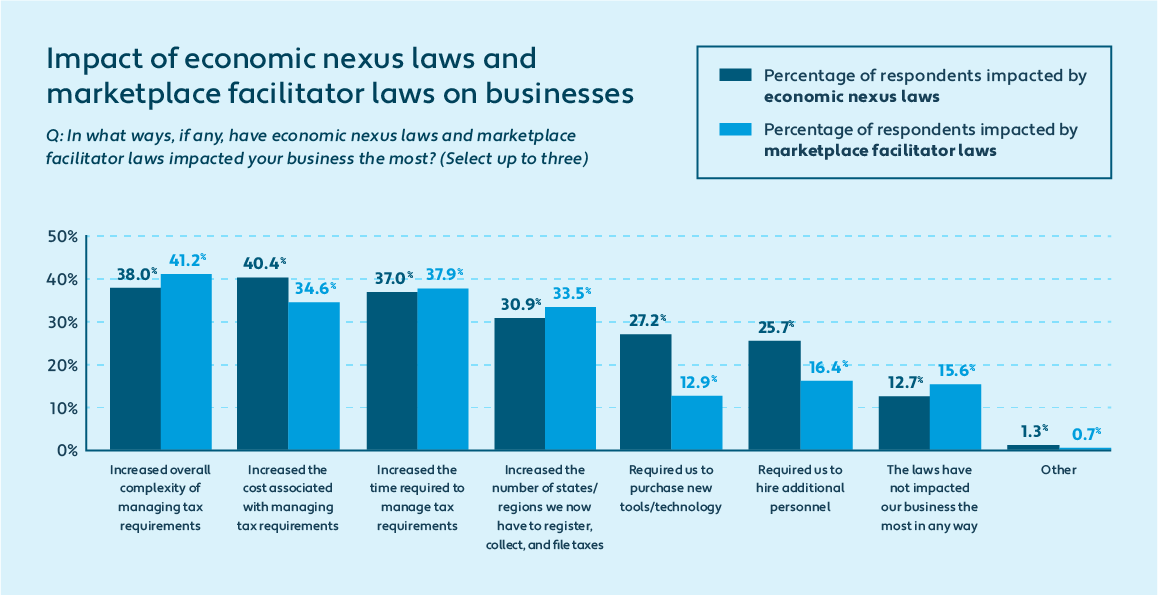

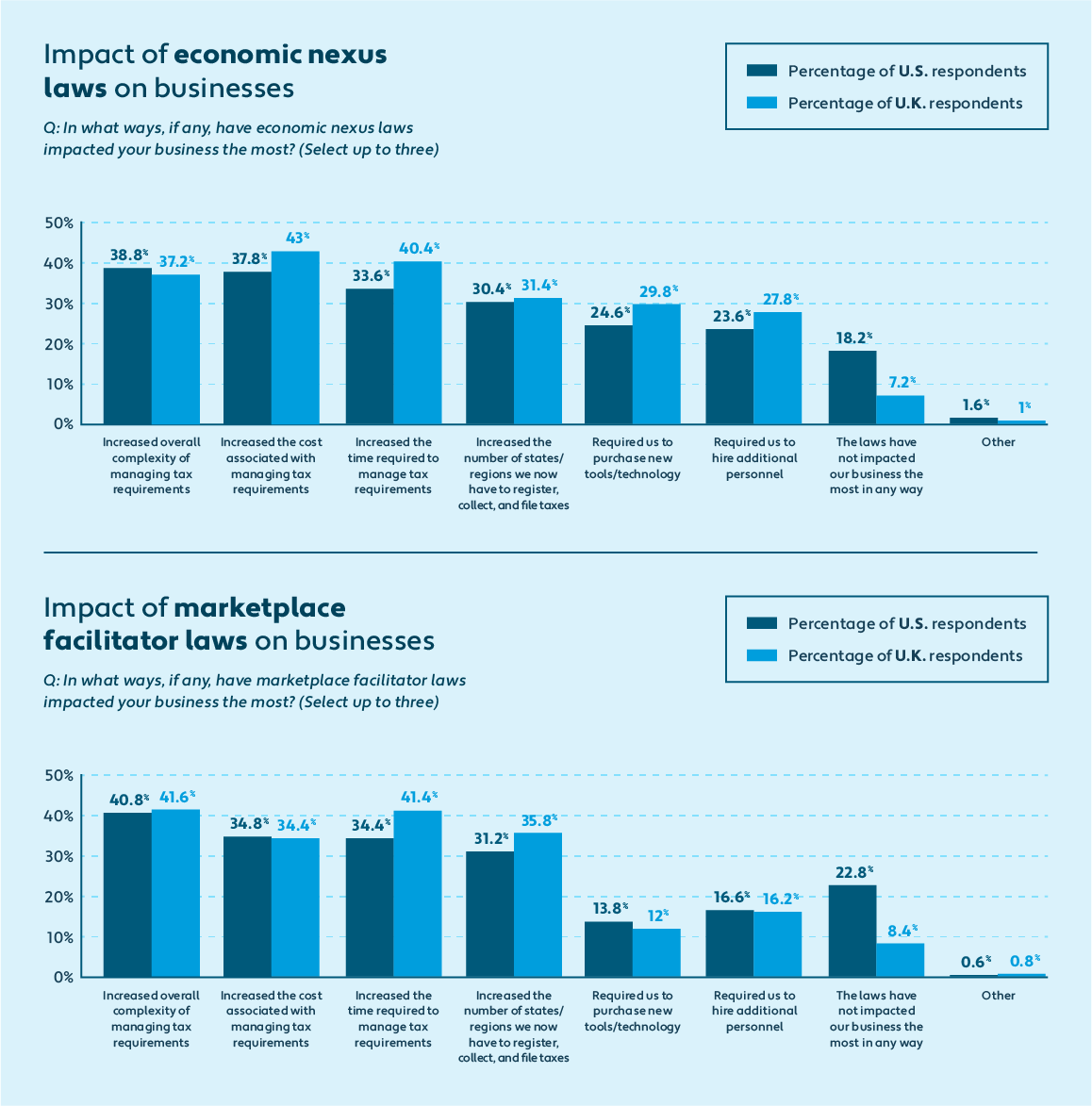

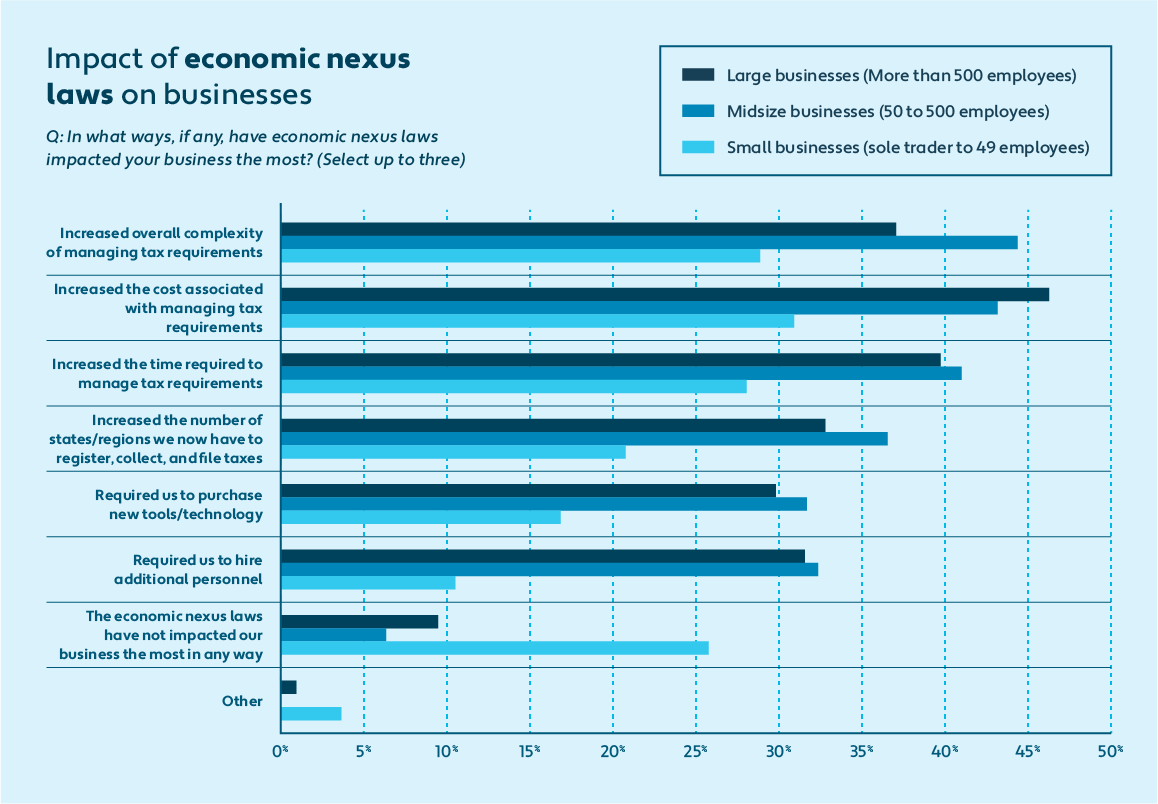

Economic nexus laws have increased the cost of sales tax compliance as well as the time needed for respondents to manage sales tax compliance. Slightly more than a quarter of all businesses surveyed have purchased new tools/technology and/or hired additional personnel to help handle sales tax compliance as a result of economic nexus laws.

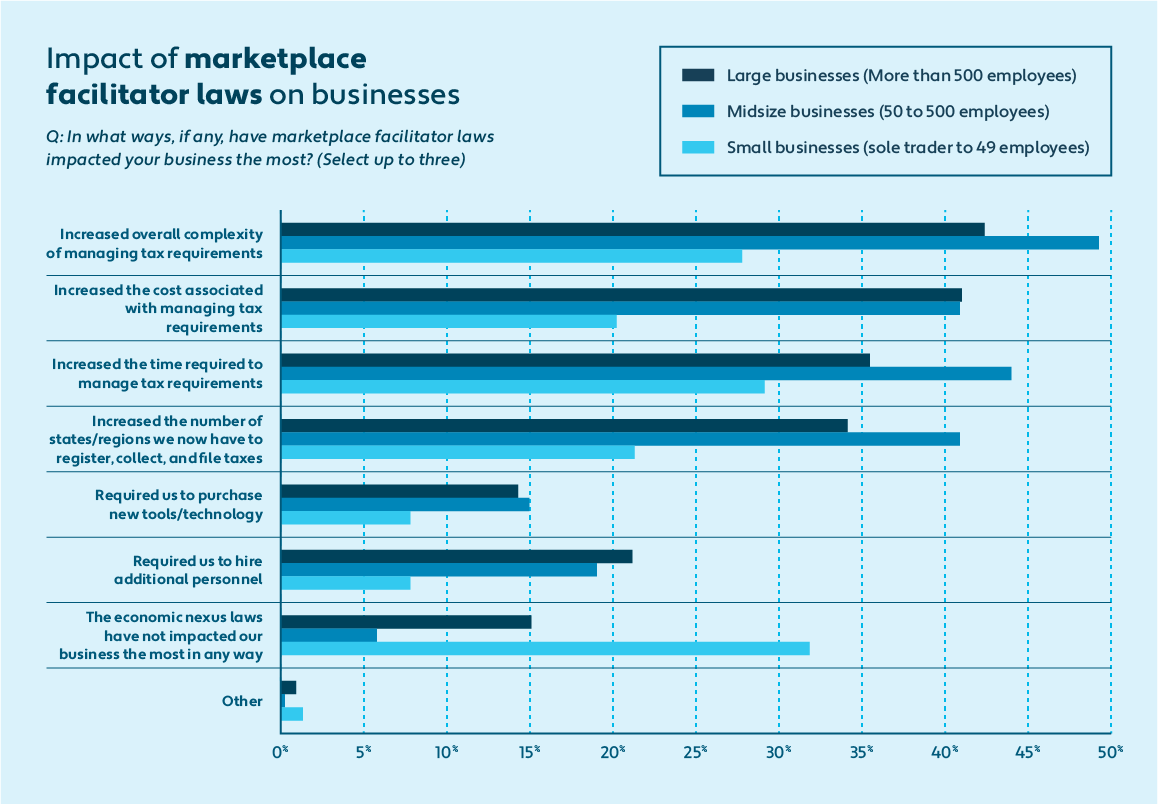

The situation is similar but different with respect to marketplace facilitator laws. More businesses report an increase in overall complexity of managing tax requirements as a result of marketplace facilitator laws, though slightly fewer (34% as opposed to 40%) say marketplace facilitator laws have caused the cost of compliance to increase.

Most businesses are changing the way they do business because of economic nexus and marketplace facilitator laws

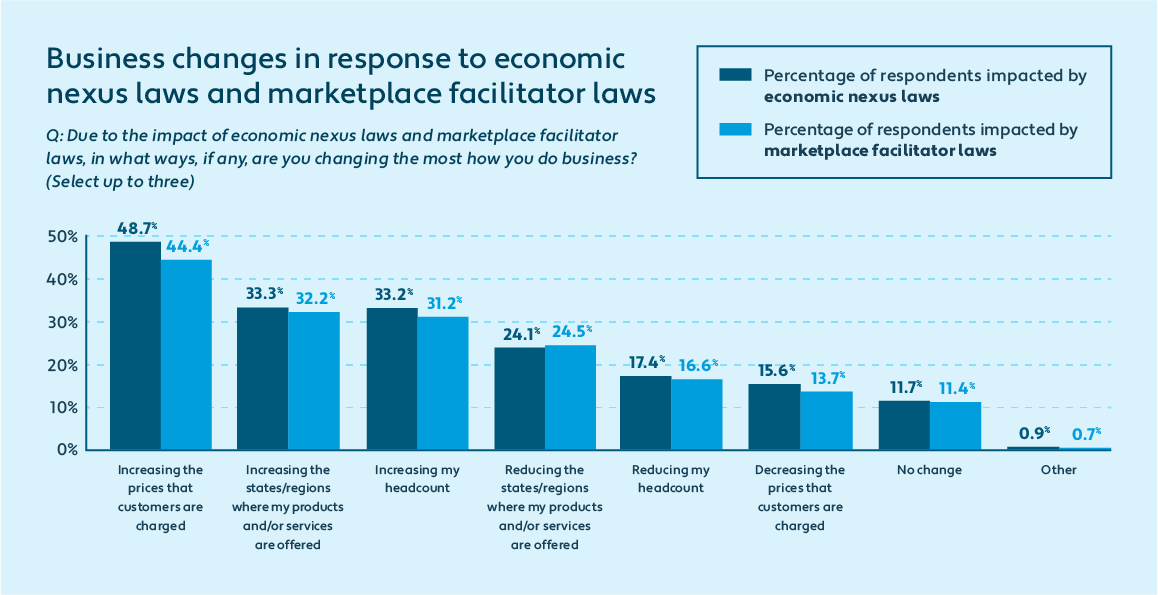

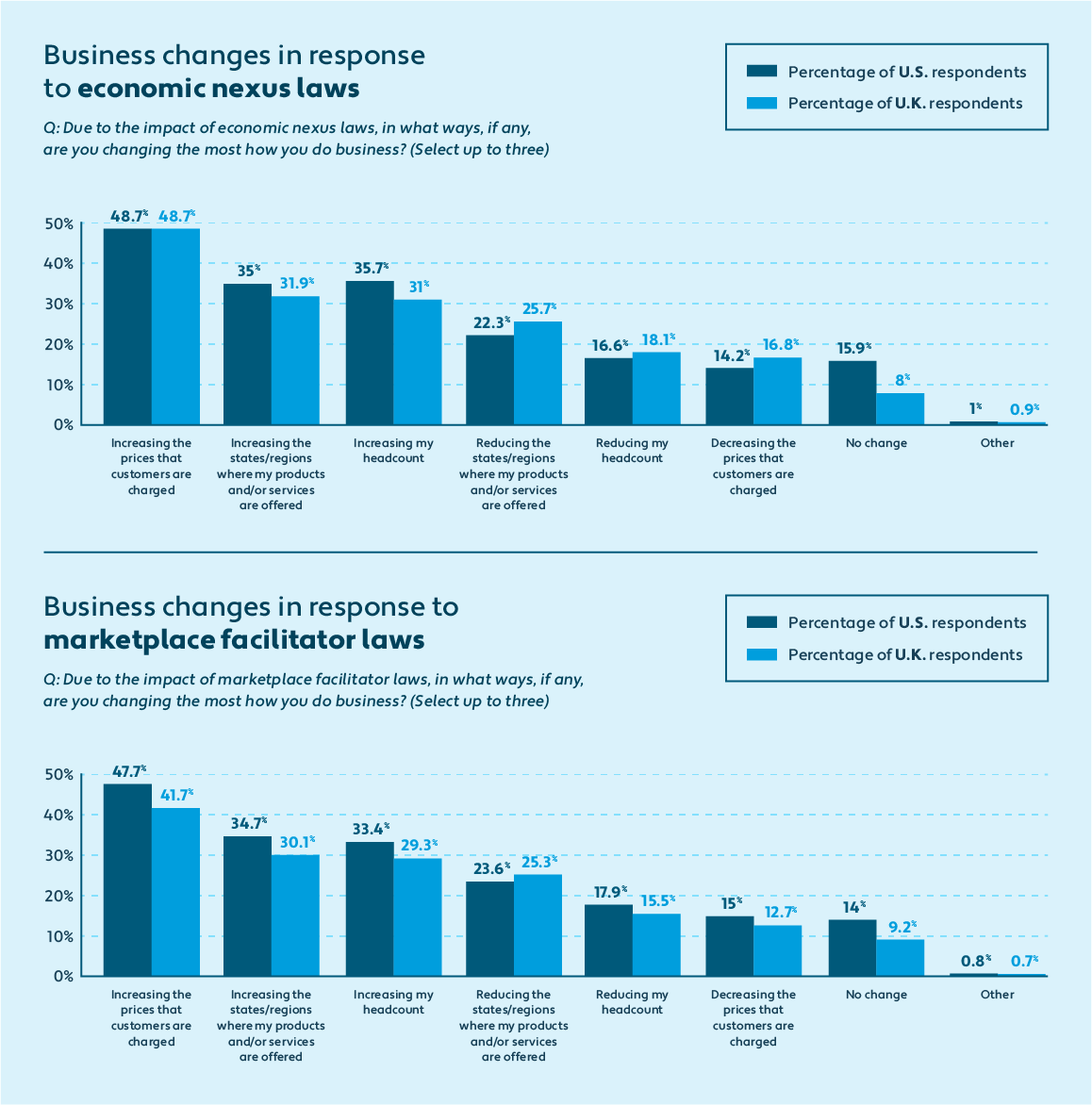

There are other effects as well. Businesses report changing consumer prices, expanding or contracting the number of states or regions where they offer their products or services, and increasing or decreasing their headcount in response to economic nexus. Interestingly, businesses often respond to similar circumstances in opposing ways.

As with economic nexus, more businesses report increasing consumer prices, increasing states where they sell, and increasing headcount because of marketplace facilitator laws (though some have cut back on where they sell, reduced headcount, and decreased consumer prices).

Technology is helping many businesses manage online sales tax requirements

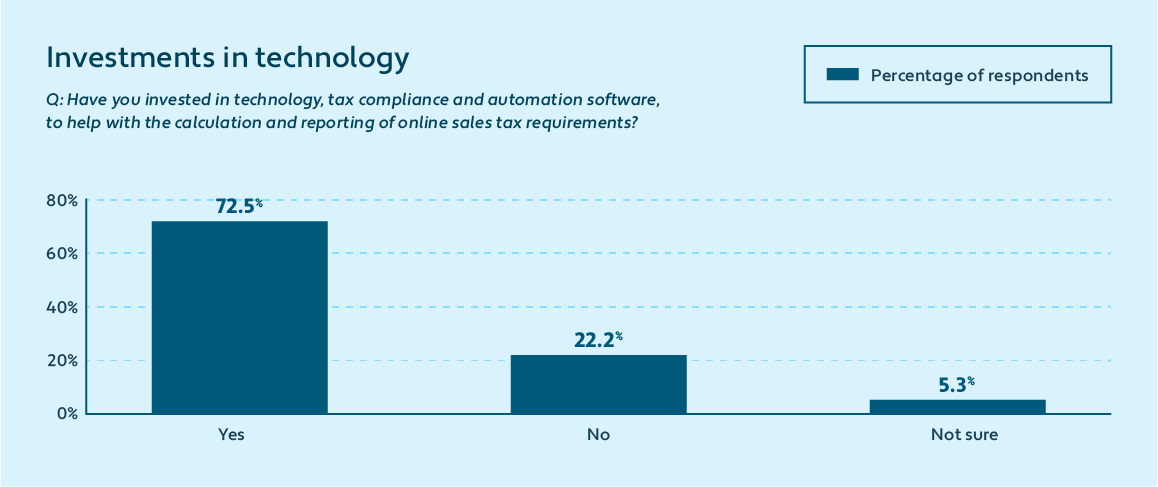

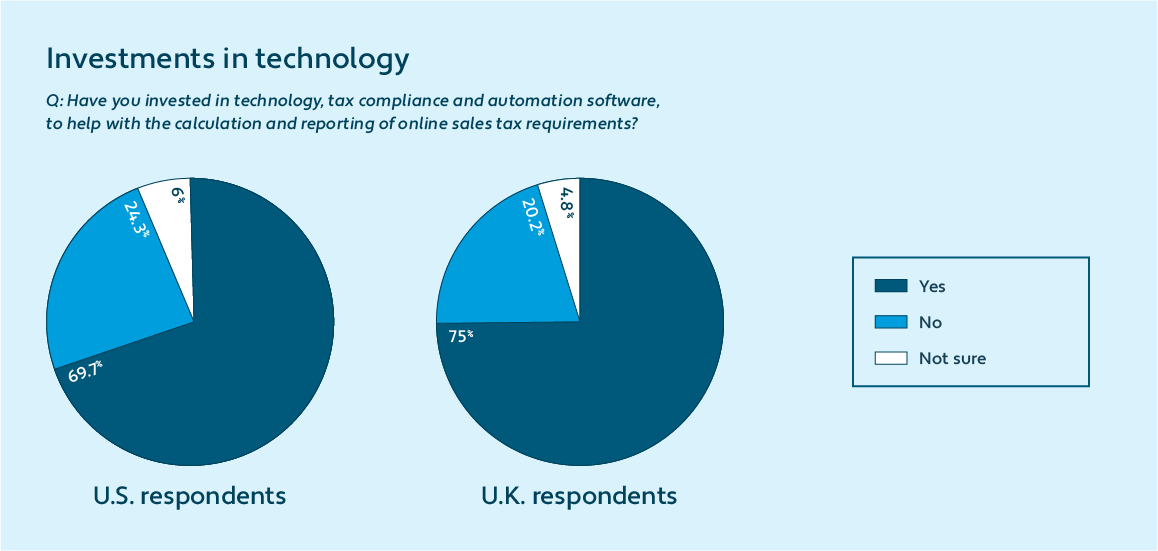

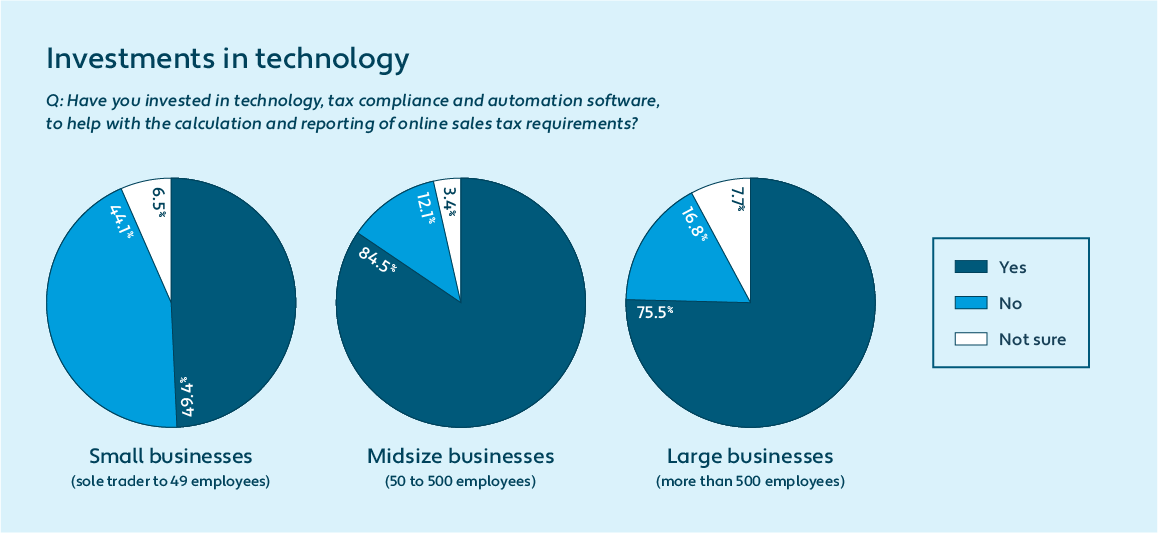

A whopping 72% of all businesses surveyed have invested in technology, tax compliance and automation software, to help with the calculation and reporting of online sales tax requirements. Only 22% said they haven’t turned to technology for help. Another 5% weren’t sure.

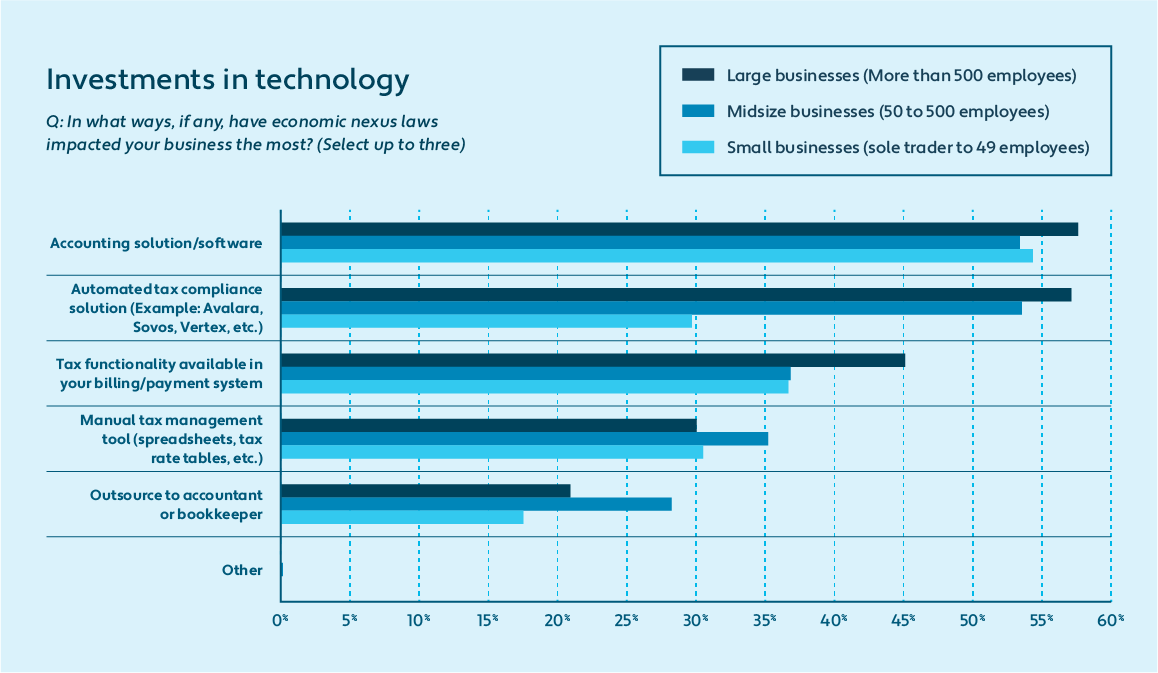

Among businesses that have invested in tools or technology to comply with economic nexus and marketplace facilitator laws:

55% have implemented accounting solutions

51% are using automated tax compliance solutions (e.g., Avalara, Sovos, Vertex)

40% are using tax functionality available in their billing or payment system tools

About 33% of respondents report using manual compliance tools like spreadsheets and tax rate tables, while 24% have outsourced sales tax compliance activities to an accountant or bookkeeper. Many respondents rely on more than one tool; survey respondents could select up to three solutions.

Business location matters when it comes to online sales tax compliance

U.S. businesses and U.K. businesses respond to online sales tax laws in slightly different ways

More U.K. than U.S. businesses report an understanding of Wayfair laws. While the same percentage (55%) said “I can explain all of our online sales tax obligations,” only 27% of U.S. businesses said “I can explain some of our online sales tax obligations,” compared to 40% of U.K. businesses.

Likewise, more U.K. businesses than U.S. businesses either “strongly agree” or “agree” that online sales tax requirements are complex and confusing.

U.K. businesses are slightly more likely than U.S. businesses to report spending more time and money managing tax requirements as a result of economic nexus and marketplace facilitator laws. Surprisingly, to me at least, more U.S. businesses said economic nexus and marketplace facilitator laws “have not impacted our business” in any way.

There are also slight differences in how U.S. and U.K. respondents have changed their business in response to economic nexus and marketplace facilitator laws. U.S. businesses were more likely to increase headcount; U.K. businesses were more likely to reduce the states or regions where they make sales.

About 89% of U.S. and U.K. businesses alike reported increasing consumer prices in response to economic nexus laws, while marketplace facilitator laws compelled more U.S. businesses (48%) than U.K. businesses (42%) to increase consumer prices.

More U.K. than U.S. businesses have invested in technology to help with online sales tax

Businesses on both sides of the Atlantic are using technology, tax compliance and automation software, to calculate and report online sales tax. However, slightly more U.K. businesses than U.S. businesses report investing in technology to manage online sales tax requirements.

Nearly a quarter (24%) of U.S. businesses haven’t invested in tax technology to help with the calculation and reporting of online sales tax requirements; 20% of U.K. businesses are in the same boat.

Business size matters when it comes to online sales tax compliance

In addition to highlighting broad trends across all businesses, the survey examined the impact of economic nexus and marketplace facilitator laws on small, midsize, and large businesses respectively.

Censuswide defines business sizes as follows:

- Small business: Sole trader to 49 employees

- Midsize business: 50–500 employees

- Large business: More than 500 employees

Online sales tax requirements are hitting midsize businesses hard

Midsize businesses seem to have a better understanding of their online sales tax obligations (economic nexus and marketplace facilitator laws) than small businesses or large businesses.

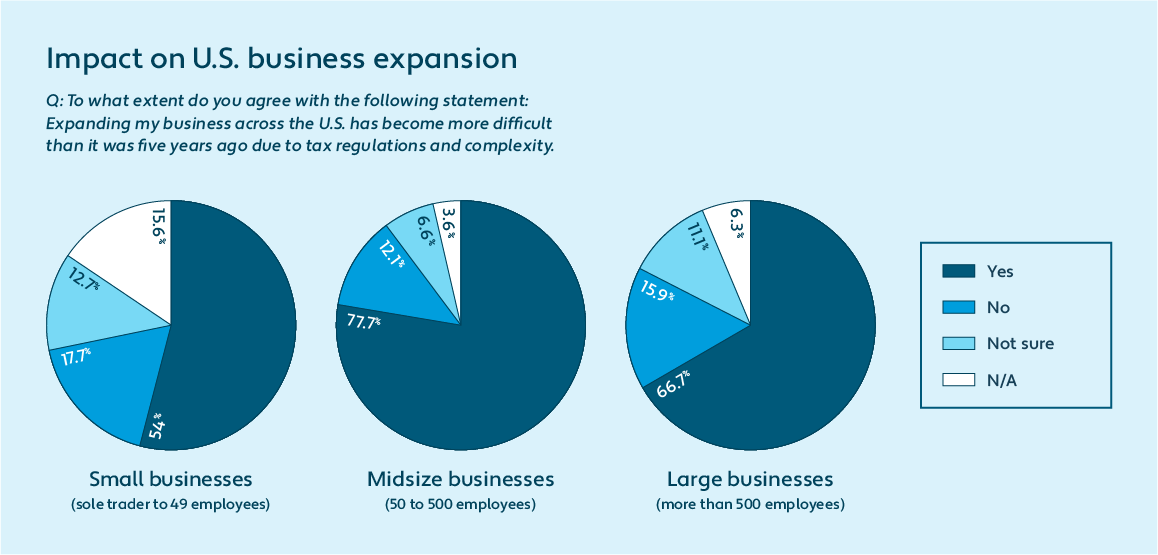

But understanding doesn’t translate to ease of compliance. More than 77% of U.S. midsize businesses say expanding across the U.S. has become more difficult in the five years since the Wayfair case. That’s about 20% more than U.S. small business respondents, and roughly 10% more than large business respondents.

This could be because more midsize businesses report being affected by economic nexus laws than their smaller or larger counterparts. More midsize businesses registered in new states as a result of economic nexus laws, according to the survey. And more midsize businesses have increased the amount of time they spend managing economic nexus requirements.

We see similar trends with marketplace facilitator laws. More midsize businesses than small or large businesses are experiencing “increased overall complexity of managing tax requirements” and “increased the time required to manage tax requirements” as a result of marketplace facilitator laws. Though when it comes to hiring more people, midsize businesses are in the middle.

In theory, marketplace facilitator laws should relieve the burden of compliance for many businesses because they make marketplaces collect and remit sales tax on behalf of their third-party sellers. And indeed, fewer small business respondents report “increased overall complexity of managing tax requirements” as a result of marketplace facilitator laws.

The survey doesn’t ask businesses to explain why or how tax compliance has become more complex. It’s possible that midsize businesses are more likely to be direct sellers as well as marketplace sellers, meaning they’d have to juggle more tax compliance balls. But there’s no way to know for certain based on the information at hand.

Midsize businesses are most likely to have invested in technology to help with online sales tax requirements

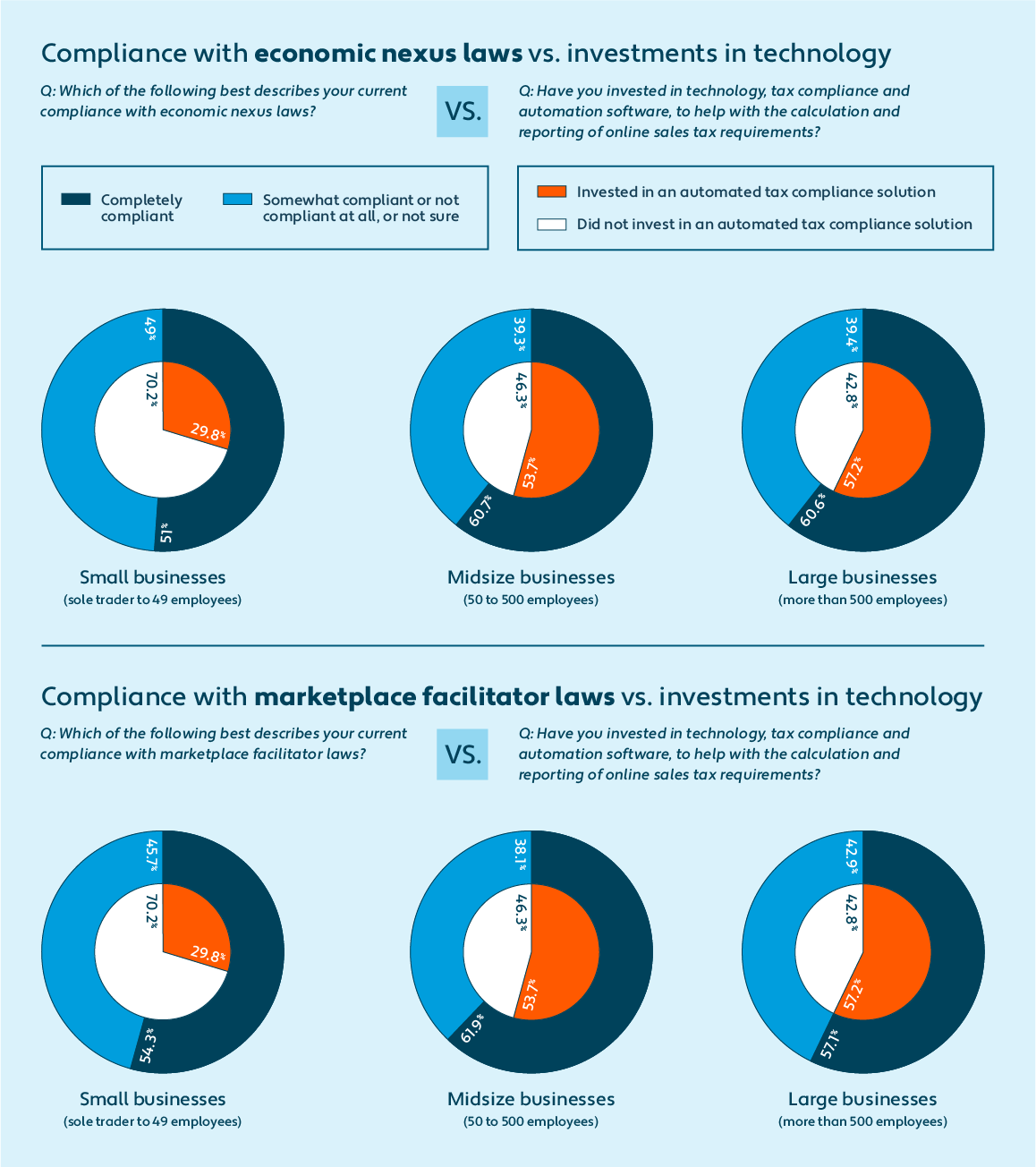

When it comes to investing in technology, tax compliance and automation software, midsize businesses have outstripped their small and large counterparts. Nearly 85% of midsize businesses report turning to technology for help with sales tax compliance, as compared to 75% of large businesses and less than 50% of small businesses.

Midsize and large businesses favor automated tax compliance solutions and accounting solution/software about equally, while accounting solution/software is the preferred choice for small businesses.

Many businesses aren’t completely sales tax compliant

At its conclusion, the survey asks participants whether they’re completely compliant with economic nexus and marketplace facilitator laws, somewhat compliant, not at all compliant, or unsure.

No more than 61% of businesses of any size believe they’re fully compliant with economic nexus laws. Even fewer businesses report being fully in compliance with marketplace facilitator laws.

Small businesses are the most uncertain about online sales tax compliance. About 15% aren’t sure whether they’re complying with economic nexus laws or marketplace facilitator laws.

So what can be done?

The more likely businesses are to use an automated tax compliance solution like Avalara, the less uncertain they are. In other words, businesses that automate sales tax compliance are more likely to report being in compliance.

Learn why you should consider automating sales tax.

If you're curious about how South Dakota v. Wayfair, Inc. has affected online sales tax compliance over the past five years, read the following:

Happy birthday, Wayfair: What a year it’s been

Wayfair turns 2, but survey shows many businesses still unaware of economic nexus

Pivotal sales tax ruling’s third anniversary marked by pandemic

Wayfair aftershocks persist with marketplace laws

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.